Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 15, 2024

2023 by the Numbers: S&P Global Mobility Analysis of US Auto Market

S&P Global Mobility recently finalized its 2023 registration data for the US light vehicle market. As you may know, our registration data are compiled from all 50 states and require time for aggregation and analysis to ensure accuracy before publishing, hence the different reporting time from other industry sources.

We're frequently asked about the market dynamics; top models, retail volumes and share, electric and hybrid take rates, etc. As such, we're happy to share the following insights from our 2023 data analysis. Please note that each metric is addressed in two separate tables; the first one focuses on total new light vehicle registrations and the second one focuses on retail new light vehicle registrations in 2023.

We've also included a few topline observations from Tom Libby, associate director of industry analysis and loyalty from our team.

Observations:

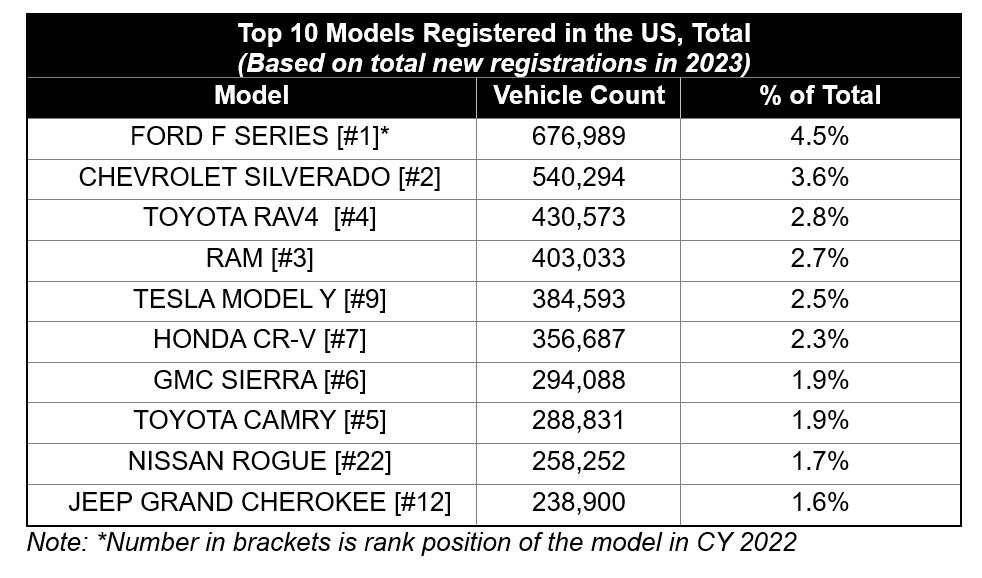

- Based on total new light vehicle registrations, eight of the top ten in 2023 were also in the top ten a year ago; the models that made the list this year, but not in 2022, are Nissan Rogue and Jeep Grand Cherokee.

- Four of the top ten models are full-size pickups.

- It is unusual to see a luxury model rank in the top ten industry-wide, given that the entire luxury market accounts for 19.6% of the market but the Tesla Model Y ranked in the top ten both last year and this year based on total new registrations, improving from #9 in 2022 to #5 in 2023.

- Only one sedan, the Toyota Camry, ranked in the top ten both this year and last; however, it ranked #8 in 2023 versus #5 a year ago.

![]()

Observations:

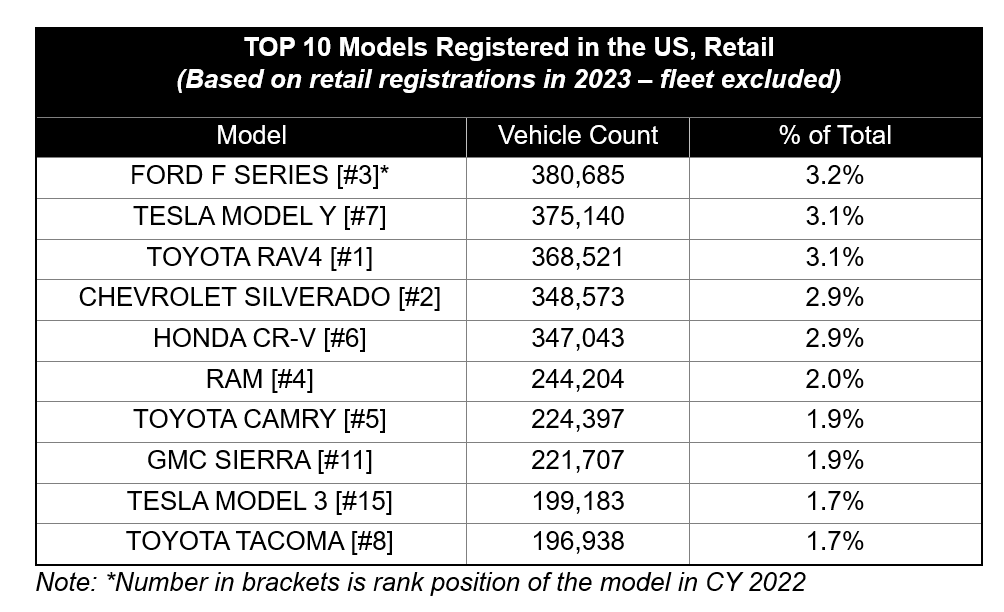

- Based on total new light vehicle registrations, eight of the top ten in 2023 were also in the top ten a year ago; the models that made the list this year, but not in 2022, are Nissan Rogue and Jeep Grand Cherokee.

- Four of top ten models are full-size pickups.

- It is unusual to see a luxury model rank in the top ten industry-wide, given that the entire luxury market accounts for 19.6% of the market but the Tesla Model Y ranked in the top ten both last year and this year based on total new registrations, improving from #9 in 2022 to #5 in 2023.

- Only one sedan, the Toyota Camry, ranked in the top ten both this year and last; however, it ranked #8 in 2023 versus #5 a year ago.

![]()

Observations:

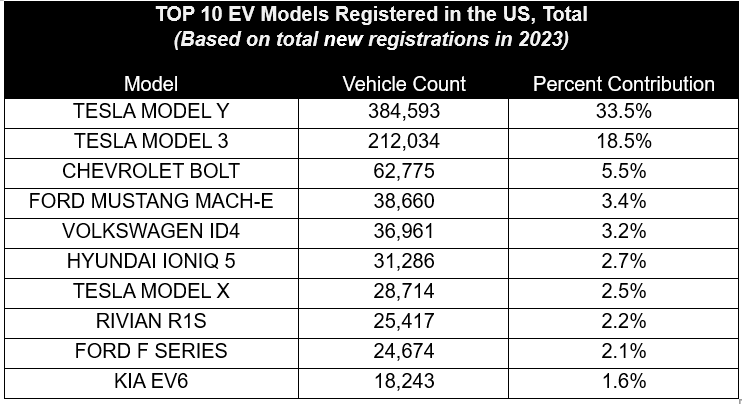

- Two Tesla models accounted for more than half of all US EV registrations in 2023.

- The top 10 EV models accounted for 75% of all new EV registrations in 2023, even though there were 83 EV models on the market.

![]()

Observations:

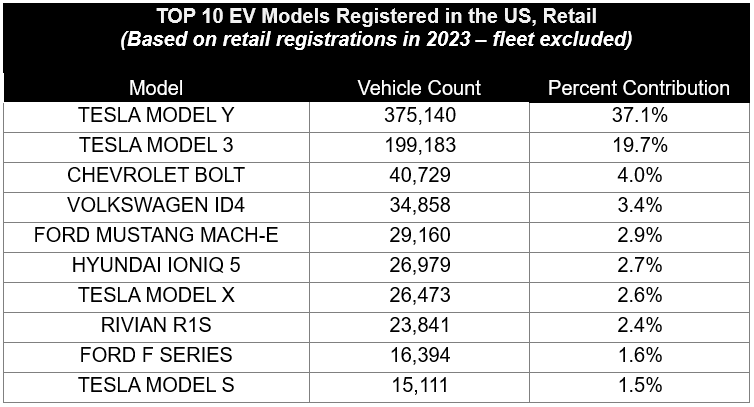

- The two high-volume Tesla models accounted for 57% of retail new EV registrations across the industry, but they only accounted for 52% of total new EV registrations.

- The two lists are similar; the only difference in models is that the Tesla Model S is on the retail list but not the total list and the Kia EV6 only appears on the total list.

- At the retail level, all four Tesla models rank in the top 10.

![]()

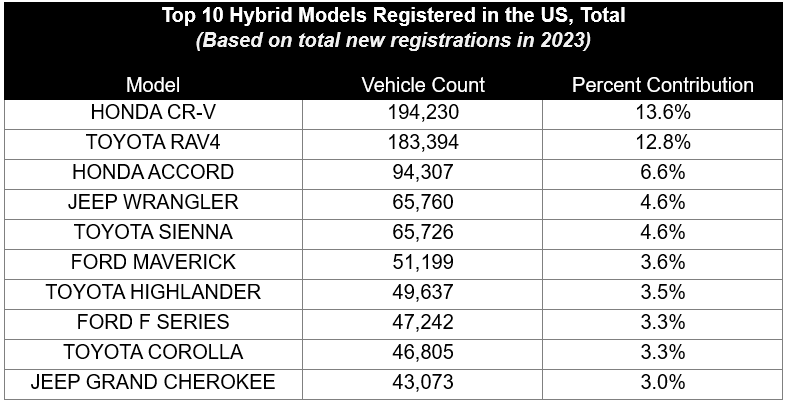

Observations:

- The two Honda hybrids account for more than one of every five hybrids registered in 2023.

- All ten of these models come from four brands, with two cars on the list.

- The top five models accounted for 42% of all hybrids registered last year, among 77 models on the market.

- Sienna's inclusion is noteworthy because the mid-size van category has declined substantially and accounted for only 1.6% of new retail registrations in 2023.

![]()

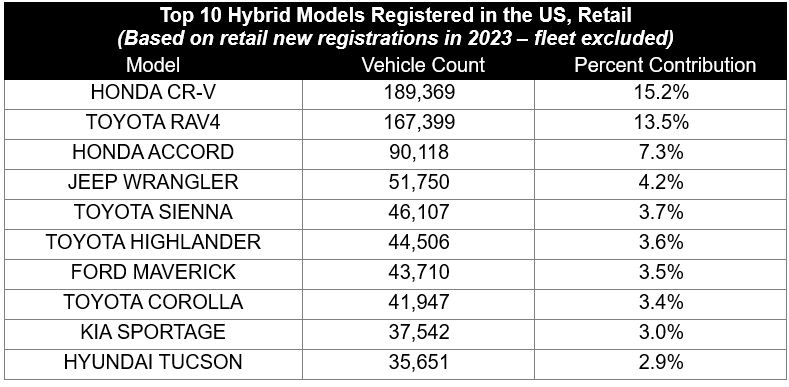

Observations:

- Similar to the total list, two cars appear on this retail list.

- Five of the hybrids on the retail list are compact utilities.

![]()

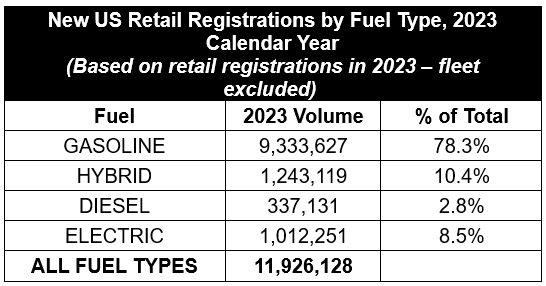

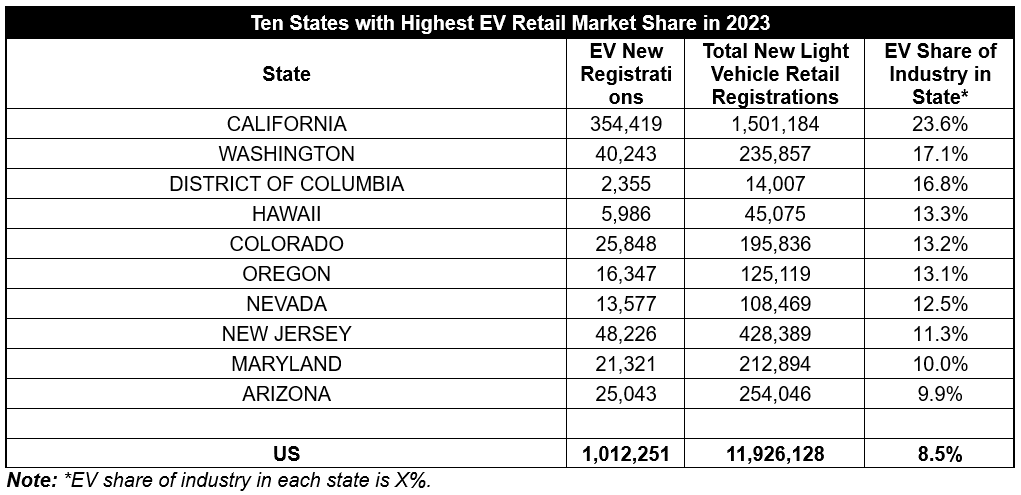

The Fuel type detail included below reflects retail registrations by fuel type at the national level and also includes a state ranking based on EV share of industry in the top 10 states.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f2023-by-the-numbers-sp-global-mobility-analysis-of-us-auto-mar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f2023-by-the-numbers-sp-global-mobility-analysis-of-us-auto-mar.html&text=2023+by+the+Numbers%3a+S%26P+Global+Mobility+Analysis+of+US+Auto+Market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f2023-by-the-numbers-sp-global-mobility-analysis-of-us-auto-mar.html","enabled":true},{"name":"email","url":"?subject=2023 by the Numbers: S&P Global Mobility Analysis of US Auto Market | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f2023-by-the-numbers-sp-global-mobility-analysis-of-us-auto-mar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2023+by+the+Numbers%3a+S%26P+Global+Mobility+Analysis+of+US+Auto+Market+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f2023-by-the-numbers-sp-global-mobility-analysis-of-us-auto-mar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}