Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 18, 2023

A revolutionary road

Electric vehicles are sweeping the markets at an astronomical pace. In 2022, more than 8 million battery electric vehicles were produced worldwide, 75% more than the previous year. In a span of only 10 years, BEVs have been transformed from being merely a rounding error in global auto production to gaining double-digit market share. The combination of cost reduction and aggressive net-zero carbon emission policies supports the continuation of this trend. S&P Global Mobility forecasts that by 2030, full electric vehicles will exceed 40% of global market share in terms of yearly production.

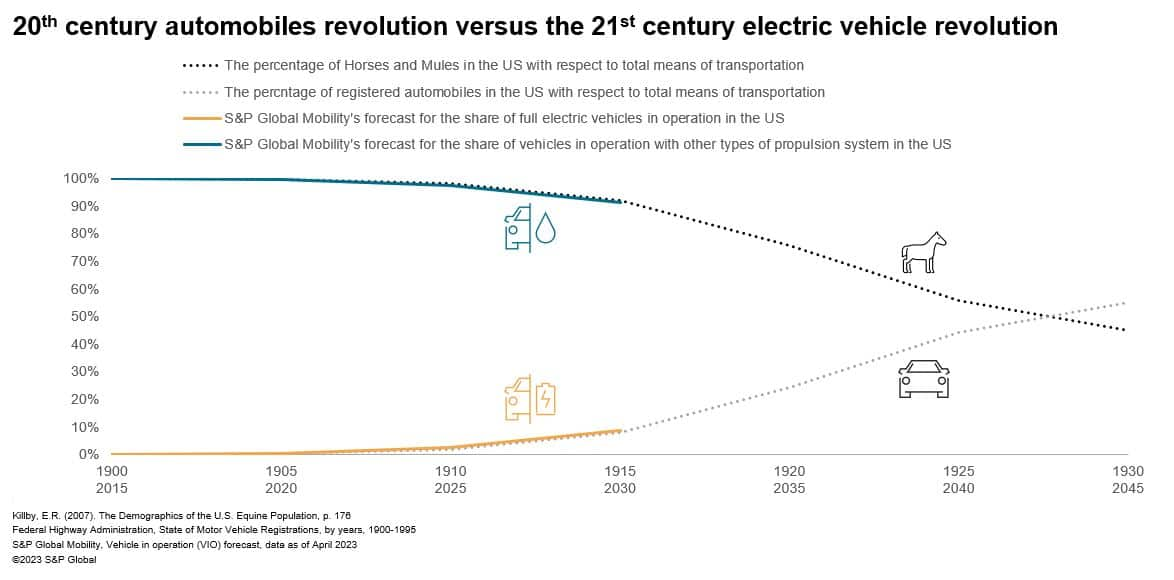

But how does this disruptive trend compare to automobiles revolution against the horses in the early 1900s? Striking results were found by combining the historical records from the US Federal Highway Administration, Equine Population, as well as the S&P Global Mobility's Vehicle-in-Operation (VIO) forecast. The progression of the market share of battery electric vehicles remarkably resembles the rise of automobiles against the horses. Both show a rise from less than 1 to 10 percentage points in less than 15 years. If this resemblance persists in the next decades, in about two decades half of the global fleet will be replaced by fully electric vehicles. The magnitude of impact of such seismic change is best described in this part of the blog post titled "The day the horse lost its job", by Brad Smith and Carol Ann: "In 1890 there were 13,800 companies in the United States in the business of building carriages pulled by horses. By 1920, only 90 such companies remained".

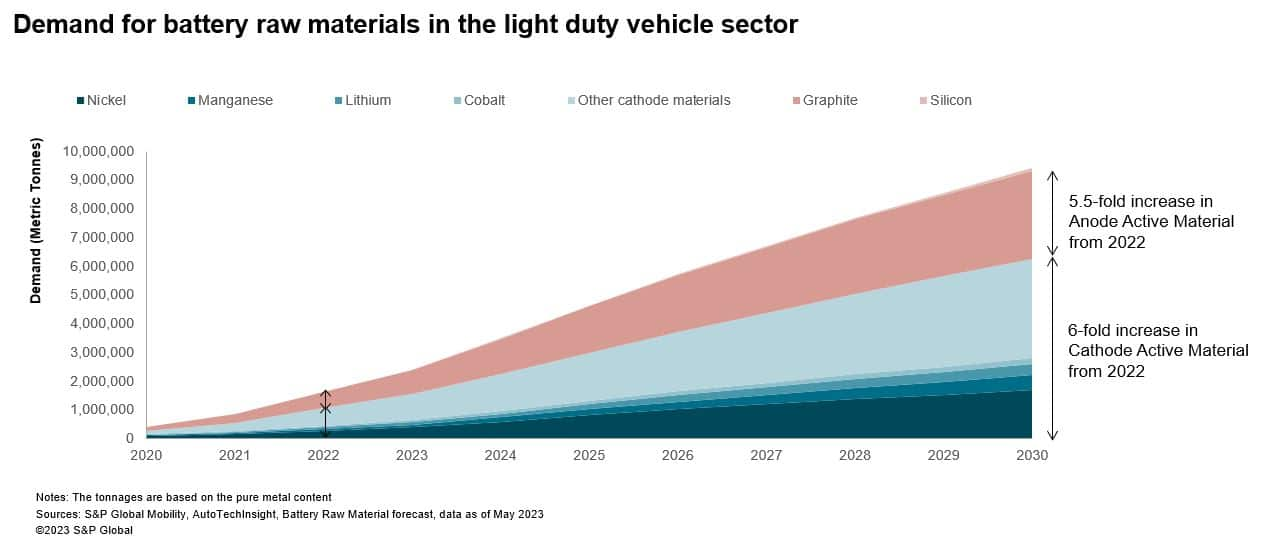

In this revolutionary environment, there are crucial questions to be answered: are there enough raw materials? Are mineral and material companies sufficiently incentivized to make investments in time to avoid shortages? How should OEMs construct their sourcing strategy to minimize risks in a shortage scenario? How do legislations such as the inflation reduction act affect the shaping of the industry?

At S&P Global, we strive to provide the intelligence needed to answer such questions. High Voltage Battery forecast, for instance, is a high-granularity database that provides intelligence regarding battery component supply chain and its technical attributes of almost all electrified vehicles up to 12 years in the future. Battery Raw Material forecast, on the other hand, tracks materials from where they are mined to cathode and anode and finally battery production.

These forecasts allow companies to stay ahead of the competition. By identifying emerging trends and technologies early on, companies can develop innovative products that meet consumer needs. This can give them a significant advantage over competitors who are slower to adapt. The clarity on the supply chains is particularly important in a volatile environment in which a single legislation or geopolitical tension has the potential to dramatically change the landscape in the industry.

References:

- https://www.wellbeingintlstudiesrepository.org/cgi/viewcontent.cgi?article=1009&context=sota_2007

- https://www.fhwa.dot.gov/ohim/summary95/mv200.pdf

- https://blogs.microsoft.com/today-in-tech/day-horse-lost-job/

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fa-revolutionary-road.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fa-revolutionary-road.html&text=A+revolutionary+road+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fa-revolutionary-road.html","enabled":true},{"name":"email","url":"?subject=A revolutionary road | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fa-revolutionary-road.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+revolutionary+road+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fa-revolutionary-road.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}