Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Dec 12, 2024

Fuel for Thought: Tariffs, Taxes, and EVs: The Road Ahead for the Global Auto Industry

Listen to the Fuel for Thought podcast

As the automotive industry prepares for the potential uncertainties of a second Trump administration, the global impact on electric vehicles (EVs), tariffs, taxes, and trade relations is profound. The president-elect's proposed policies, including tax cuts, deregulation, tariffs, and changes to EV incentives, will have ripple effects on global automotive markets, especially in North America and Europe.

How these policies unfold will shape the future of battery electric vehicle (BEV) sales and global trade dynamics.

Tax Cuts and Vehicle Affordability: A Double-Edged Sword

One of the cornerstone policies of a second Trump administration is tax cuts, including making the reductions from the Tax Cuts and Jobs Act of 2018 permanent, eliminating taxes on tipped income, overtime and social security benefits and removing the cap on state/local tax deductions. For businesses, he has pledged to reduce corporate rate from 21% currently to 15%.

While this could stimulate economic growth, disposable income, and consumer spending in the short term, the long-term effects are less certain. Higher demand, combined with potential inflationary pressure, could lead to higher borrowing costs, which would dampen vehicle affordability.

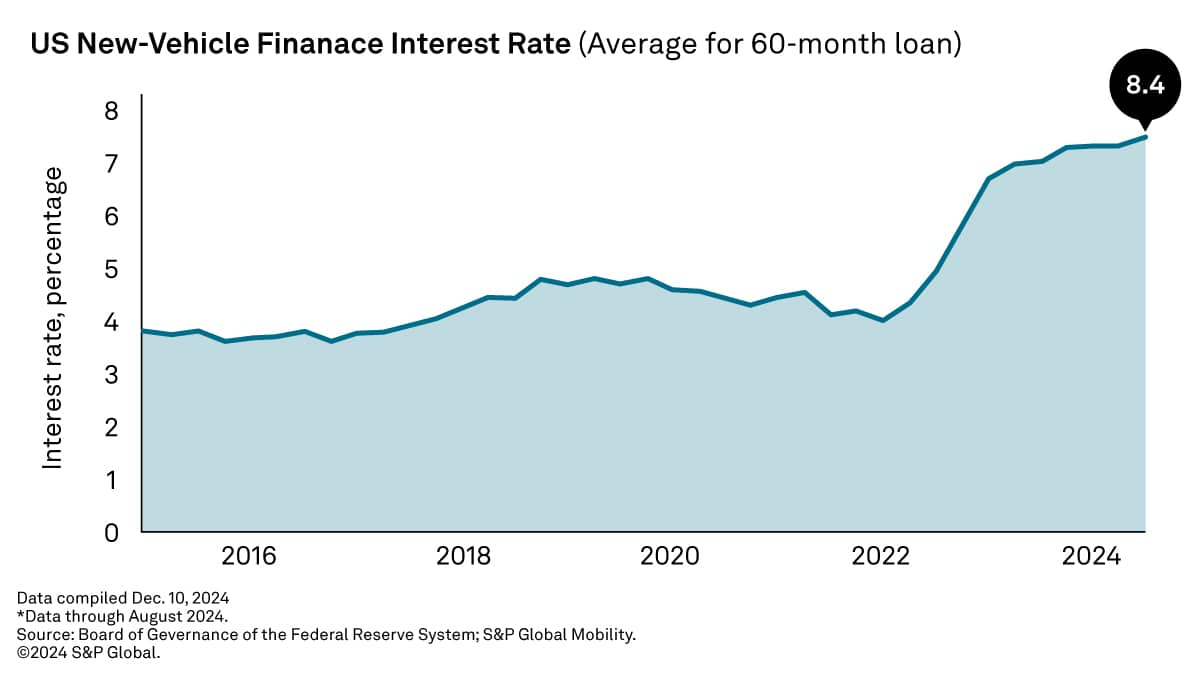

In North America, where 86% of US consumers rely on financing (lease or loan) for new vehicles, the automotive market faces a delicate balancing act. If interest rates rise as the Federal Reserve takes action to combat inflation, the cost of car loans would increase, leading to higher monthly payments. This scenario may make consumers think twice before purchasing new vehicles, including EVs, which typically carry higher upfront costs compared to traditional internal combustion engine vehicles.

The Role of Tariffs: Disruptions and Trade Barriers

Trade barriers, particularly tariffs, are another potential critical aspect of the second Trump administration. Throughout his first term, Trump used tariffs as a negotiating tool in trade talks, and these measures could escalate again, especially to offset the costs of tax cuts.

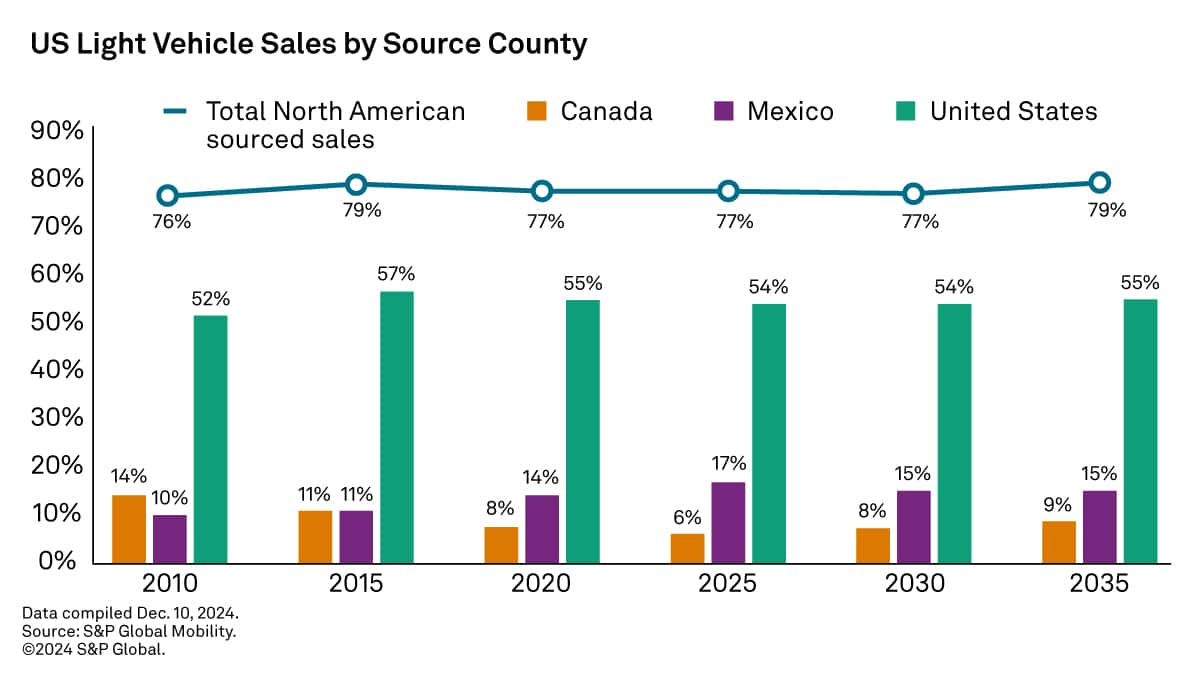

A proposed 10% tariff on imported vehicles from regions like Japan, Korea, and Europe would directly impact 16% of US vehicle sales. However, the more concerning aspect would be the potential for a 25% tariff on imports from Canada and Mexico, key trading partners under the USMCA (United States-Mexico-Canada Agreement).

Approximately one out of every four vehicles sold in the US comes directly from Canada or Mexico; those vehicles will be exposed to tariffs. Additionally, such tariffs would disrupt a highly integrated North American automotive supply chain, which relies on parts and components flowing freely between the US, Canada, and Mexico.

With the US importing over $92 billion in automotive goods annually from these countries, a tariff increase would lead to production delays, higher manufacturing costs, and, ultimately, increased prices for consumers.

These disruptions would also extend to the broader global market. For example, tariffs could complicate the global trade environment, influencing vehicle pricing and production volumes in Europe and Asia, especially as automakers increasingly look to manage production costs and consumer affordability.

Deregulation and Its Impact on Battery Electric Vehicle Sales

A potentially more significant shift under a second Trump administration is the rollback of environmental regulations, including fuel economy standards and incentives for BEVs. Under the previous administration, aggressive fuel economy standards and the push for EV adoption were central to the automotive industry's future. However, with the expectation of relaxed regulations, automakers may face less pressure to electrify their fleets.

The National Highway Traffic Safety Administration (NHTSA) is already considering loosening fuel economy standards for model years 2027 and beyond, and the Environmental Protection Agency (EPA) is likely to revise long-term carbon dioxide (CO2) standards.

This deregulation could undermine the US market's previous trajectory toward electric vehicles. S&P Global Mobility projections for US BEV sales by 2030 have been revised downward from over 6.5 million vehicles annually to just 5 million. This would mean BEVs would account for only about 30% of the US market, far below the previously anticipated 40%.

With less regulatory pressure, automakers may slow their EV transitions, potentially stalling the momentum that had built up in the industry.

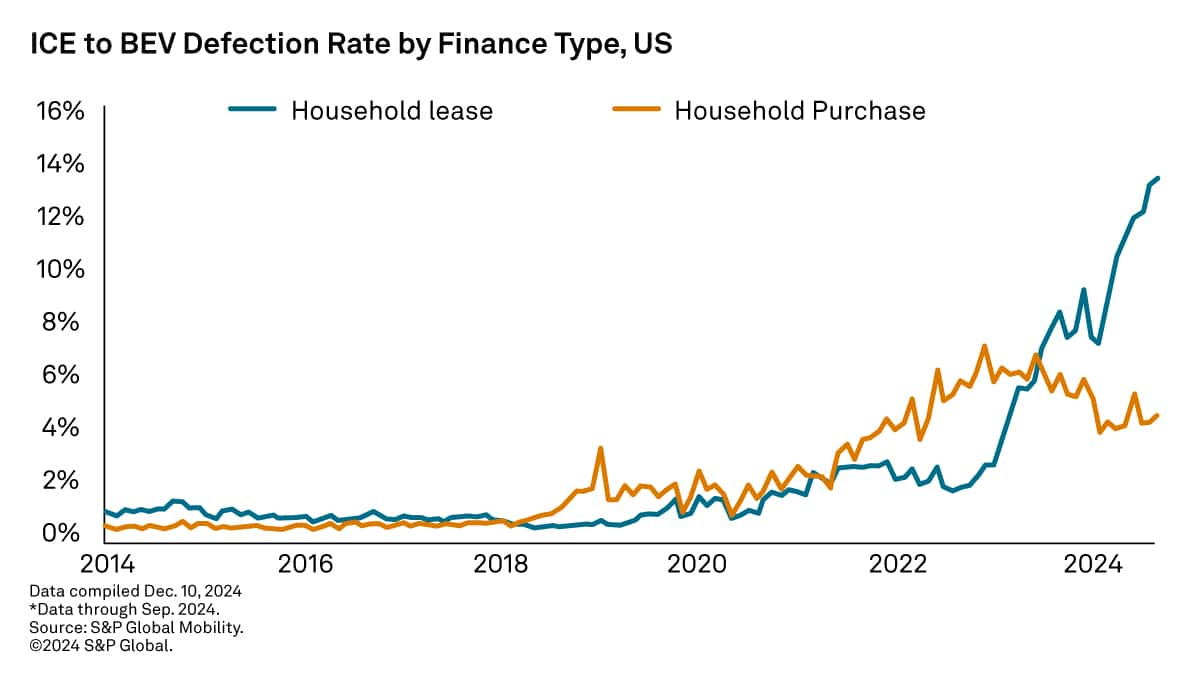

Beyond regulatory changes, the loss of consumer incentives for BEVs could significantly hinder BEV sales. One particular area of concern is the "lease loophole" in the Inflation Reduction Act, which allows consumers to lease electric vehicles at more affordable rates, even if they don't qualify for purchase tax credits.

If this loophole is targeted for elimination, or if overall incentives are reduced, it could make BEVs even less accessible, especially as manufacturers may not have the same incentive to drive down prices or ramp up production.

The Broader Global Impact on EVs

In addition to the impact in North America, the global outlook for BEVs will be influenced by several geopolitical and economic factors. In Europe, where the automotive market is highly dependent on export growth, the outlook is modest, with expected year-over-year growth of just 1% in 2025.

This growth is being constrained by trade issues, including Chinese vehicle tariffs, and the rising costs of subsidies for BEVs. Several European nations have already suspended BEV incentives to reduce government expenditures, which could slow the shift toward electrification.

With Europe's Big Five markets (Germany, France, the U.K., Italy, and Spain) accounting for roughly 65% of vehicle volume in the region, any dip in consumer incentives could have far-reaching effects on EV adoption.

Meanwhile, China's vehicle market is seeing an increasing shift towards domestic electric vehicle manufacturers. Western OEMs are struggling to maintain competitiveness as China-owned manufacturers focus on cost-effective new energy vehicles (NEVs).

Across the overall automotive market in China, by the end of 2024, Western automakers will account for less than 38% of total sales. This is a stark decline from over 60% prior to the COVID pandemic. The expiration of consumer incentives in late 2024 is likely to impact demand in China, but the market is expected to rebound in 2025, with a modest 4% growth forecast.

The Road Ahead: Global Uncertainty

The global automotive industry is facing a period of significant uncertainty as it navigates the implications of a second Trump administration. In North America, tax cuts, rising interest rates, and trade disruptions through tariffs will create an environment where vehicle affordability may be compromised, even as the economy shows signs of modest growth.

Meanwhile, the possible rollback of EV incentives and environmental regulations could slow the adoption of electric vehicles, undermining efforts to shift toward a more sustainable automotive future.

Across the Atlantic, Europe's automotive sector faces slow growth and potential tariff issues, while China's market is increasingly dominated by local manufacturers. As a result, global BEV sales projections have been adjusted downward, and automakers may face stiffer competition in both traditional and electric vehicle segments.

In this environment, the next few years will be critical for automakers to adapt to shifting trade policies, regulatory changes, and consumer behaviors. The automotive industry's global transition to electric vehicles is far from guaranteed, and any delays or disruptions will have ripple effects across markets worldwide.

Navigating these changes requires agility and foresight, as the industry continues to grapple with both challenges and opportunities in an ever-changing geopolitical landscape.

Need help planning for an uncertain future? Access our industry-best data and consulting services with our 2025 scenario planning workshops.

Inquire about S&P Global Mobility's scenarios workshops

Subscribe to the Fuel for Thought newsletter

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-industry-forecast-2025-tariffs-evs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-industry-forecast-2025-tariffs-evs.html&text=Fuel+for+Thought%3a+Tariffs%2c+Taxes%2c+and+EVs%3a+The+Road+Ahead+for+the+Global+Auto+Industry+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-industry-forecast-2025-tariffs-evs.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: Tariffs, Taxes, and EVs: The Road Ahead for the Global Auto Industry | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-industry-forecast-2025-tariffs-evs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+Tariffs%2c+Taxes%2c+and+EVs%3a+The+Road+Ahead+for+the+Global+Auto+Industry+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-industry-forecast-2025-tariffs-evs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}