Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 02, 2024

Automotive marketing in the age of electrification

Whether your views on the pace of BEV adoption are optimistic or pessimistic, EVs are here, and more are on their way.

Automotive marketing is going through a transformative change. The industry's path to electrification, while bumpy, is giving consumers more vehicle options and choices than ever before.

Today, US auto shoppers have nearly 450 vehicle nameplates to consider. With the arrival of electric vehicles across every mainstream and luxury brand, and increasing demand for hybrid powertrains, there will be nearly 650 nameplates by the end of the decade — all competing for showroom space, lot space, marketing budget and most importantly, the hearts and minds of customers.

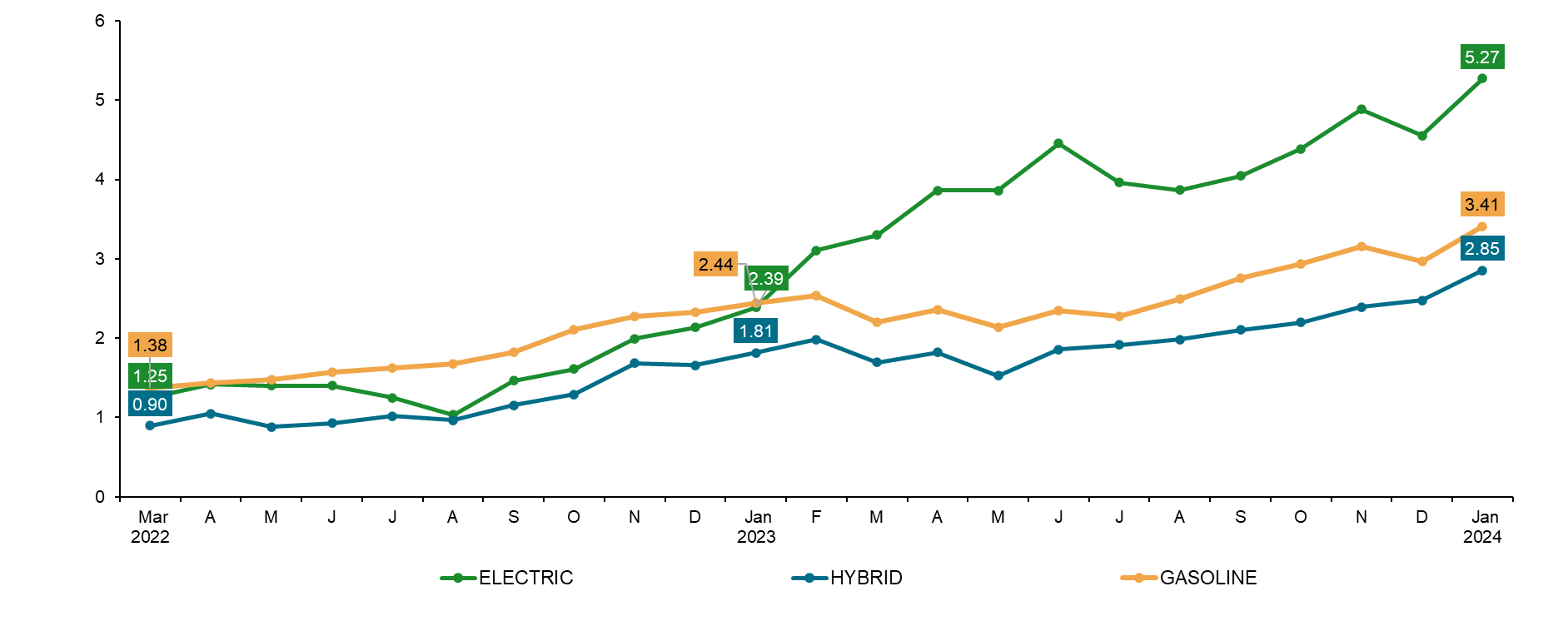

Inventory recovery driven by EV supply, leading to pivots

The industry has largely recovered from the semiconductor supply constraints and on average, dealership inventory is up 2x since January 2022. A big contributor to increased inventories, electric vehicles are occupying a growing amount of lot space. Since early 2023, EV inventories have risen more rapidly than ICE or hybrid options available. Yet sales have not kept pace and in April 2024, national EV inventory exceeded four months' supply (Figure 1).

Figure 1: Retail Advertised Inventory/Retail Registrations

Source: S&P Global Mobility Mar. 2022 - Jan. 2024

And more inventory is coming. 2024 and 2025 will see over 130 new vehicle launches — and more than half of them will be electrified. As a result, manufacturers have had to pivot, tempering EV production volume to better align with demand. S&P Global Mobility's forecast reflects an expected EV production decline of 4% in 2024 and 10% in both 2025 and 2026 respectively.

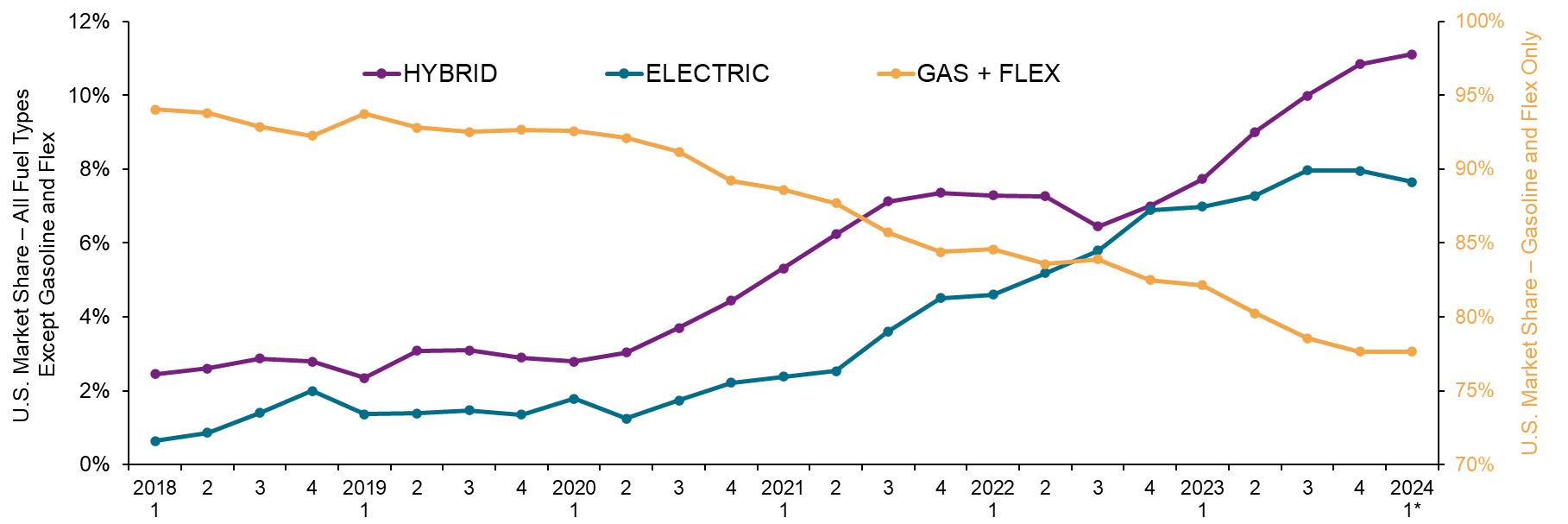

Hybrid's growing role in electrification transition

While EVs stack-up, hybrid vehicles are having a moment. According to S&P Global Mobility analysis, hybrid share of new vehicle registrations has been over 10% for seven consecutive months while EV share has topped 9% just twice in the same time span (Figure 2).

Hybrid loyalty is also at a six-year high (42%), while EV loyalty (66%) has plateaued over the last five quarters. Additionally, over 8% of EV households that return to market are migrating to a hybrid, the highest share since 2018.

Figure 2: Retail market share by fuel type

Source: S&P Global Mobility US Market share by fuel type. 2018 - Jan. 2024. *Q1 2024 includes Jan. data only

Electrified vehicle sales remain a mostly additive purchase

Electrified vehicles generally compete for household parking space, with seven-in-ten new EVs joining other vehicles in the driveway instead of replacing one. For hybrids, the split is six-in-ten as addition versus replacement while ICE vehicles have a more even split of 49% additive vs. 51% replacement.

The status of EVs as replacement vehicles will likely shift later this decade, signaling a substantial change in buying motivations as the gap between marketing spend and demand narrows.

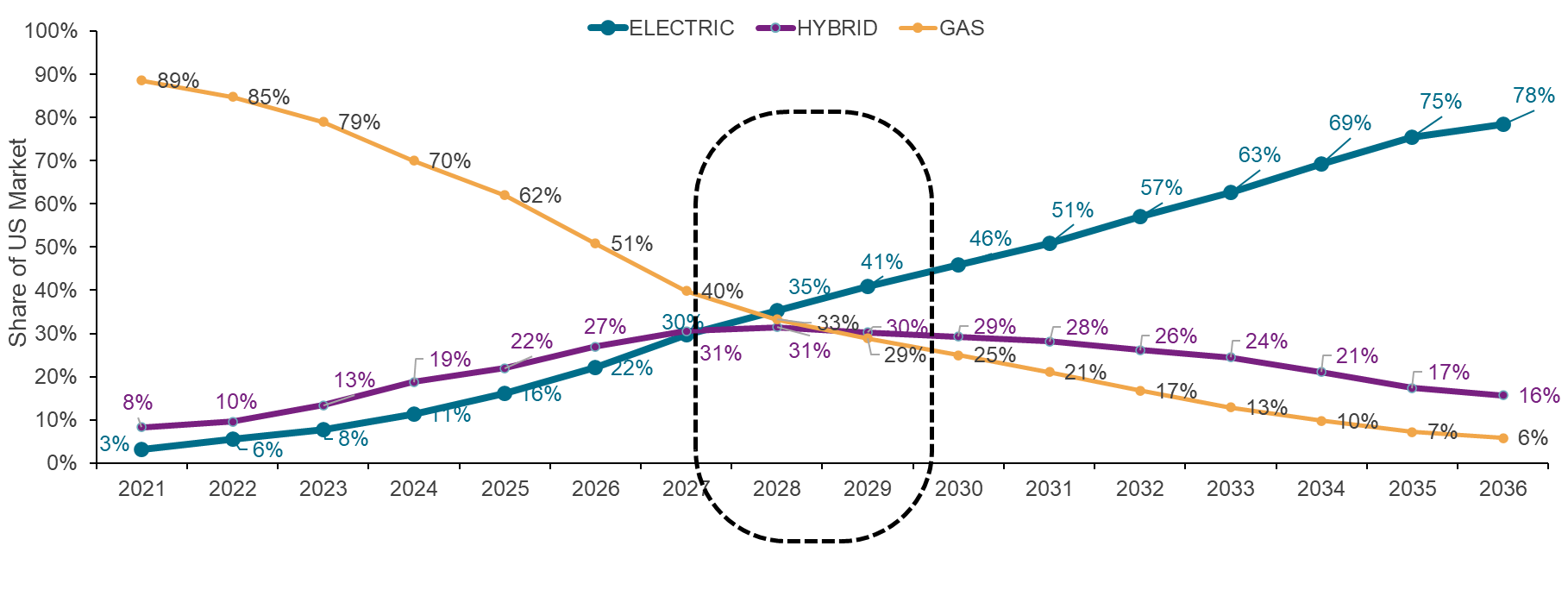

Increased model count impacts on sales and marketing

S&P Global Mobility forecasts that the three propulsion system designs — hybrid, EV and ICE — will each account for 29% to 36% market share by the end of this decade. After that, EV share is expected to grow while hybrid plateaus and then joins ICE in a continuous, but slow, decline (Figure 3).

As a result, retailers will need to develop and hone targeted messaging strategies for all of their EV, hybrid and ICE inventory.

Figure 3: Share of new vehicle registrations by fuel type

Source: S&P Global Mobility US Fuel Type Forecast as of February 2024

The increased model count is expected to cause a drop in sales-per-nameplate figures: In 2018, the average sales volume per nameplate in the US market was 49,000 units. That is expected to drop to 36,000 by 2030 before rebounding to 39,000 in 2035, according to the S&P Global Mobility light vehicle forecast (March 2024).

This is affecting production cycles, sales forecasting, supplier relationships and marketing budget allocation.

The impact to profit margins, platform economics, operating expenses, product lifecycles and go-to-market timing will cut across all aspects of the auto business — from new and used car sales, to vehicle acquisition, parts and service. Retailers and their marketers will have to be nimble and do more with less.

Auto marketers must ramp-up their messaging and audience solutions

As vehicle supply and the number of available models rise, so does competition for consumer attention. Customers expect personalization and relevant offers and prefer to handle most of the consideration and transaction process digitally. With different customer types, vehicle types and buying motivations, there is increased importance in targeted, unique and dynamic messaging.

Turning marketplace challenges into opportunity starts with your first-party data. Better personalization requires accurate, actionable data. There are three important ways marketers can develop more effective messaging, reduce waste, and improve marketing ROI:

- Employ vehicle verification. Does the consumer still have their car? Stop annoying customers with irrelevant offers and reduce wasted impressions by identifying vehicle disposers.

- Enrich customer profiles. Go beyond your customer's most recent purchase to develop a comprehensive household profile — including what other vehicles are owned, monthly payment and lease information, if they are in-market again, and if they are loyal to a segment, make or model.

- Resolve identity gaps from inaccurate data. Identification data is often incomplete. Data cleansing and hygiene reduce database management costs and improve the chances that your message is delivered to the intended customer.

Today, automotive marketers are making great strides in leveraging technology and data science to develop advanced audiences, messaging strategies and improved digital communication tools. These are going to be critical for success because marketers will have to manage more customer types, vehicle types and buying motivations. Differentiation of marketing strategies will be the key to cutting through the increased clutter and noise of the coming automotive marketplace.

Download our Electrification Impact Overview

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-marketing-electric-vehicles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-marketing-electric-vehicles.html&text=Automotive+marketing+in+the+age+of+electrification+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-marketing-electric-vehicles.html","enabled":true},{"name":"email","url":"?subject=Automotive marketing in the age of electrification | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-marketing-electric-vehicles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Automotive+marketing+in+the+age+of+electrification+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fautomotive-marketing-electric-vehicles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}