Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsBrand Loyalty Declines to Eight-Year Low

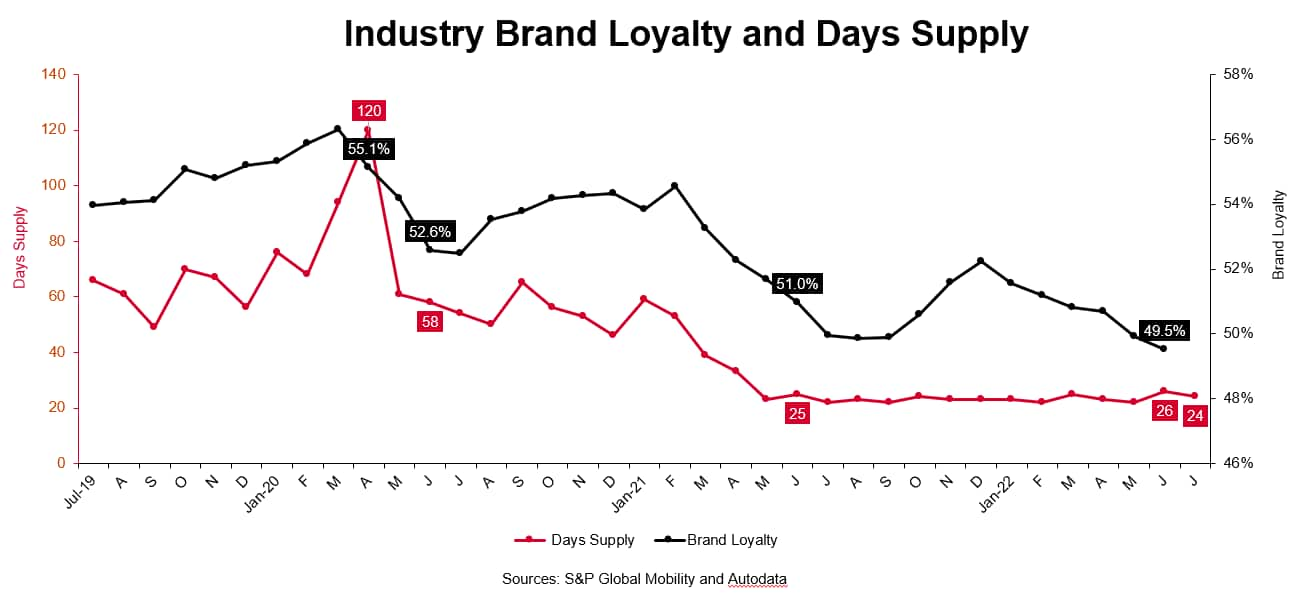

The exceptionally low inventory levels plaguing the US new vehicle industry continue to negatively impact brand loyalty. According to S&P Global Mobility loyalty data, brand loyalty dropped to just 49.5% in June, the lowest monthly result since September 2014 and the second consecutive month below 50%. For the past two months, then, consumers have been more likely to defect to another brand than to remain loyal to the brand in their garage.

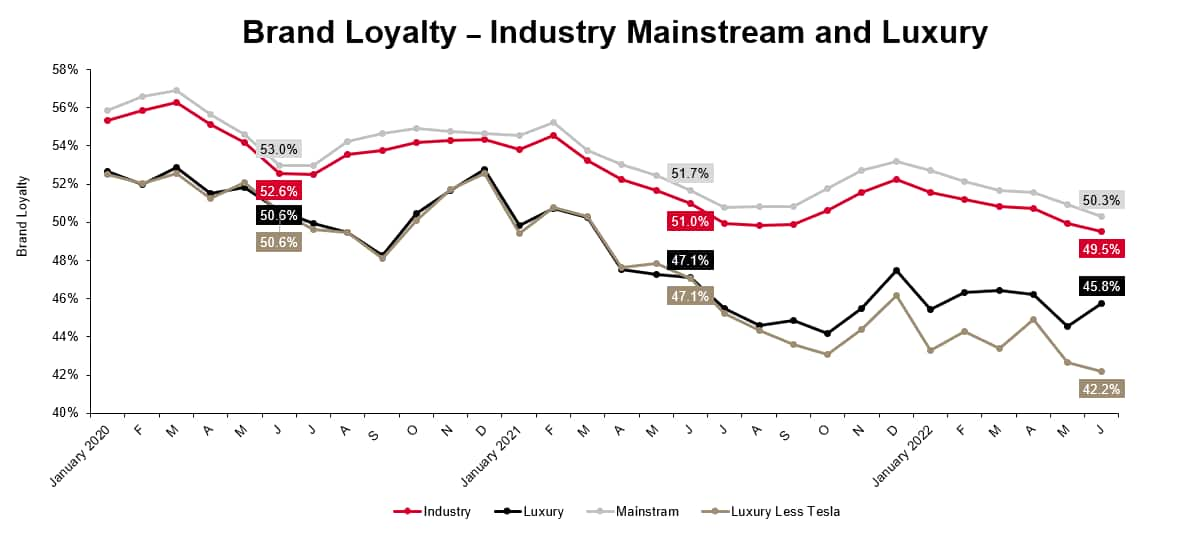

Not all brands are suffering equally. Brand loyalty for the twenty luxury brands overall has declined more than that for the nineteen mainstream brands, as illustrated on the chart below. From June 2019 to this past June, luxury brand loyalty decreased 5.9 PP while mainstream results eased 4 PP.

Brands pulling down the luxury metric include Land Rover, Infiniti, Acura, Audi, and BMW, all of which suffered double-digit three-year declines. In contrast, Maserati and Tesla enjoyed increases, led by Tesla's 13 PP climb from June 2019.

One driver of the declines for seventeen of the nineteen luxury brands is household migration to Tesla. This past June, Tesla was conquesting more than three competitive luxury households for every one household that defected, with the exception of Porsche; Tesla's conquest/defection with Porsche was 1.9, still an inflow to Tesla, albeit smaller (these results exclude the four new luxury brands, which have not been on the market for a sufficient period of time for defections to reach a natural level). Tesla conquests are defections from the other brands, which lower their brand loyalty volume and rate.

Keep yourself updated with the latest automotive insights featured on our Mobility News and Assets Community page to stay ahead of your competition.

--------------------------------------------------------------------

This automotive insight is part of our monthly Top

10 Trends Industry Report. The Report findings are taken

from new and used registration and loyalty data.

The August report is now available. To download the report, please

click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.