Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsFed Rate Hikes Cascade to Auto Industry

The Fed's recent interest rate increases to curb inflation have quickly cascaded to the auto industry. The average interest rate on a new vehicle loan rose to 4.8% in May 2022, its highest rate since pre-pandemic March 2020 (5.3%). After being in the 4.0 range from last September to December, this metric quickly climbed almost a full point from December to May 2022.

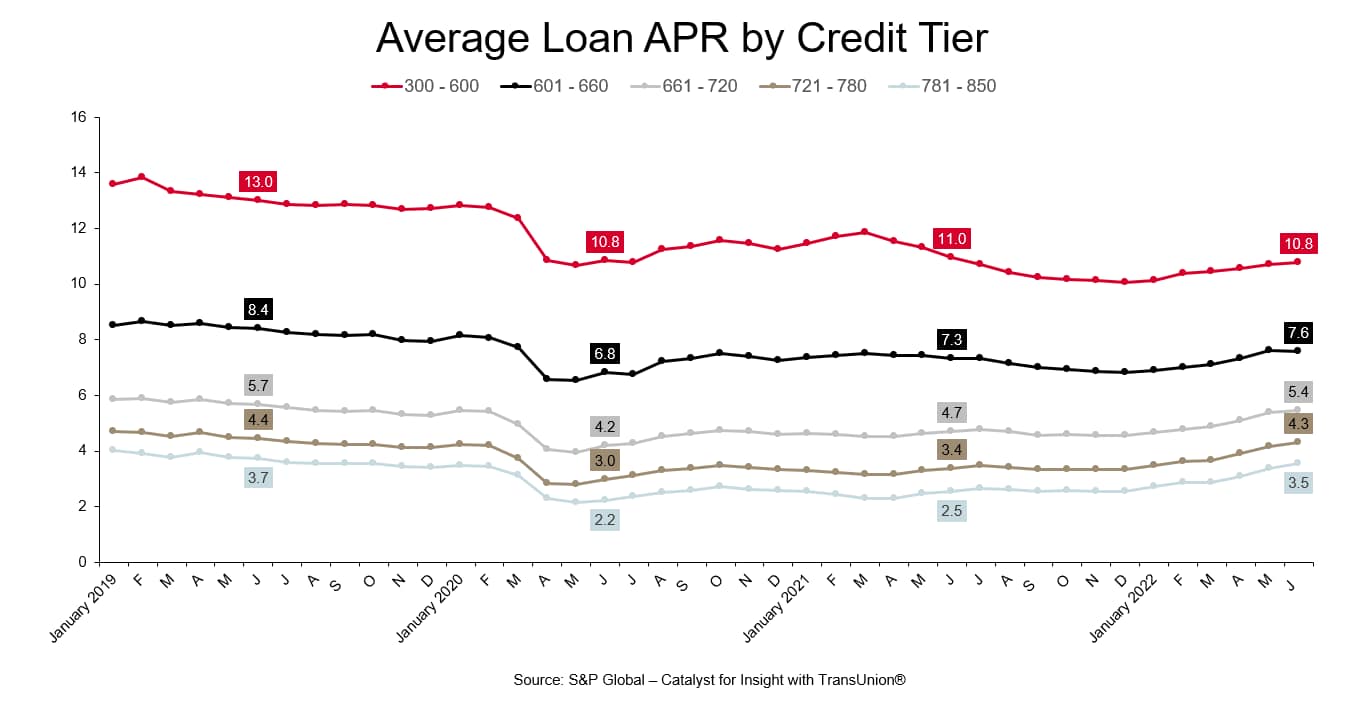

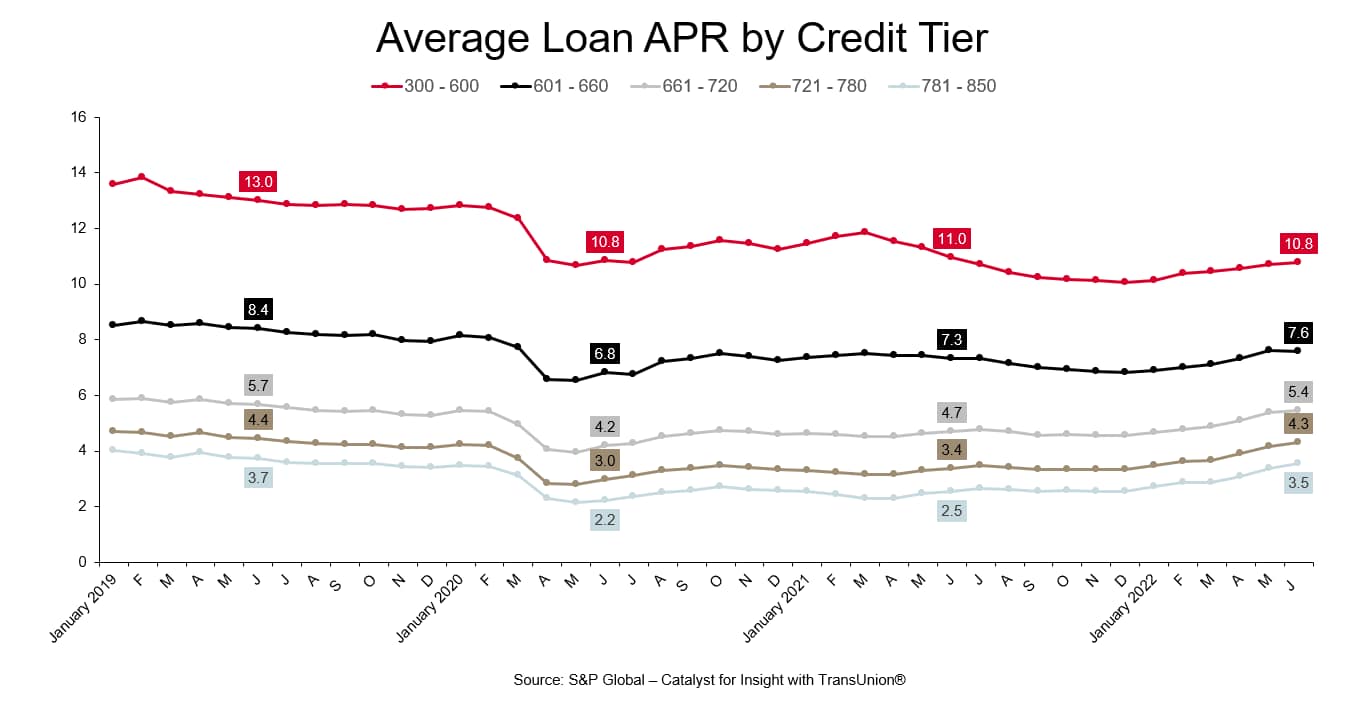

S&P Global Mobility new vehicle registration data combined with Trans Union financial data indicate not all credit score tiers have been equally impacted by the rate increases. As the chart below illustrates, the average APR has risen this past May when compared to a year ago for the upper level credit tiers, but not for the lowest tier, including credit scores between 300 and 600. While scores in this lower tier have risen in the past several months, they remain below a year ago, the only tier for which this is the case.

Further, the range between interest rates has narrowed from pre-pandemic levels. The gap between the APR for the lowest tier customers and the highest in June 2019 was 9.3 PP, but that range has narrowed to 7.3 PP this past June.

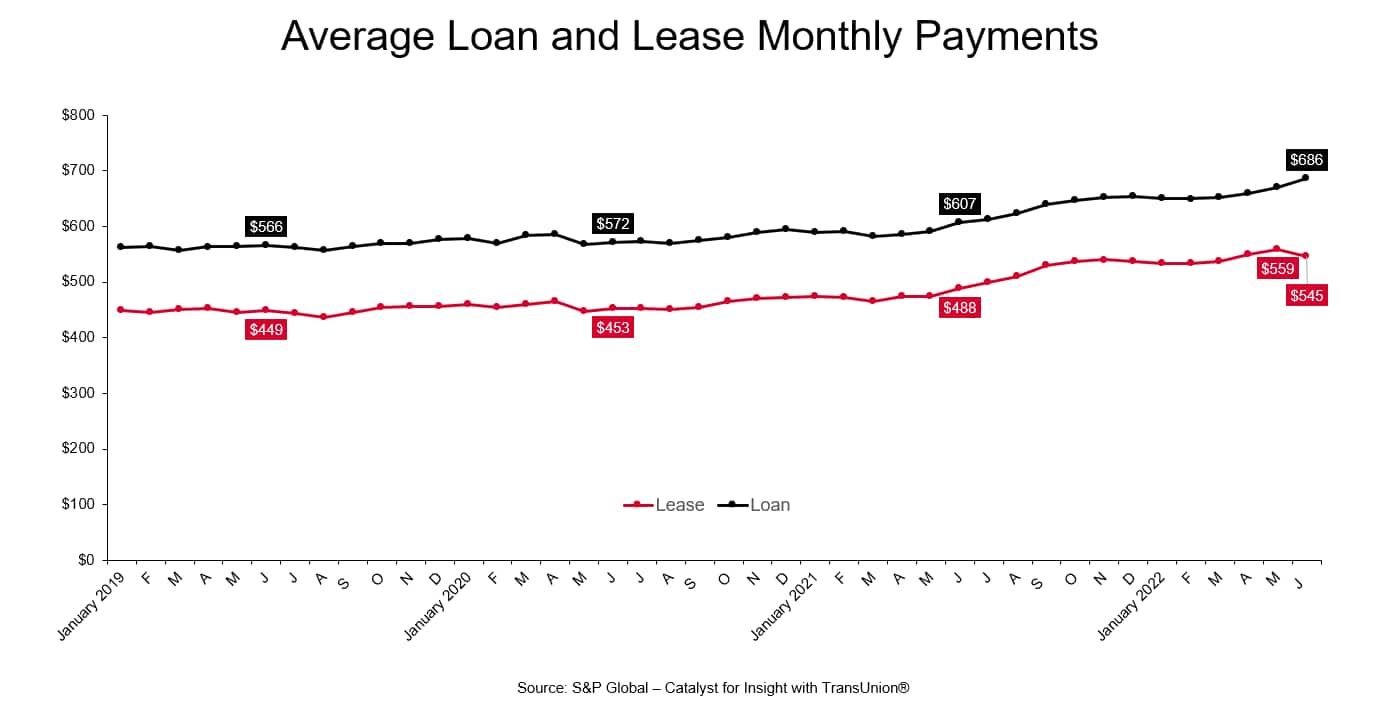

Lastly, these interest rate increases have propelled loan and lease monthly payments to four- year highs; as the chart below indicates, the average loan APR in June of $686 is the highest payment dating back to at least the start of 2019, and it is $79 a month higher than the payment a year ago. Similarly, the May 2022 lease payment of $559 is the highest in this time horizon and up $71 from June 2021. In the near time, these higher interest rates and corresponding monthly payments will curb retail demand, though natural demand is still being masked by the inventory shortages.

--------------------------------------------------------------------

This automotive insight is part of our monthly Top

10 Trends Industry Report.The Report findings

are taken from new and used registration and loyalty data.

The August report is now available. To download the report, please

click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.