Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsBrand loyalty finally improves month-over-month; but will it continue?

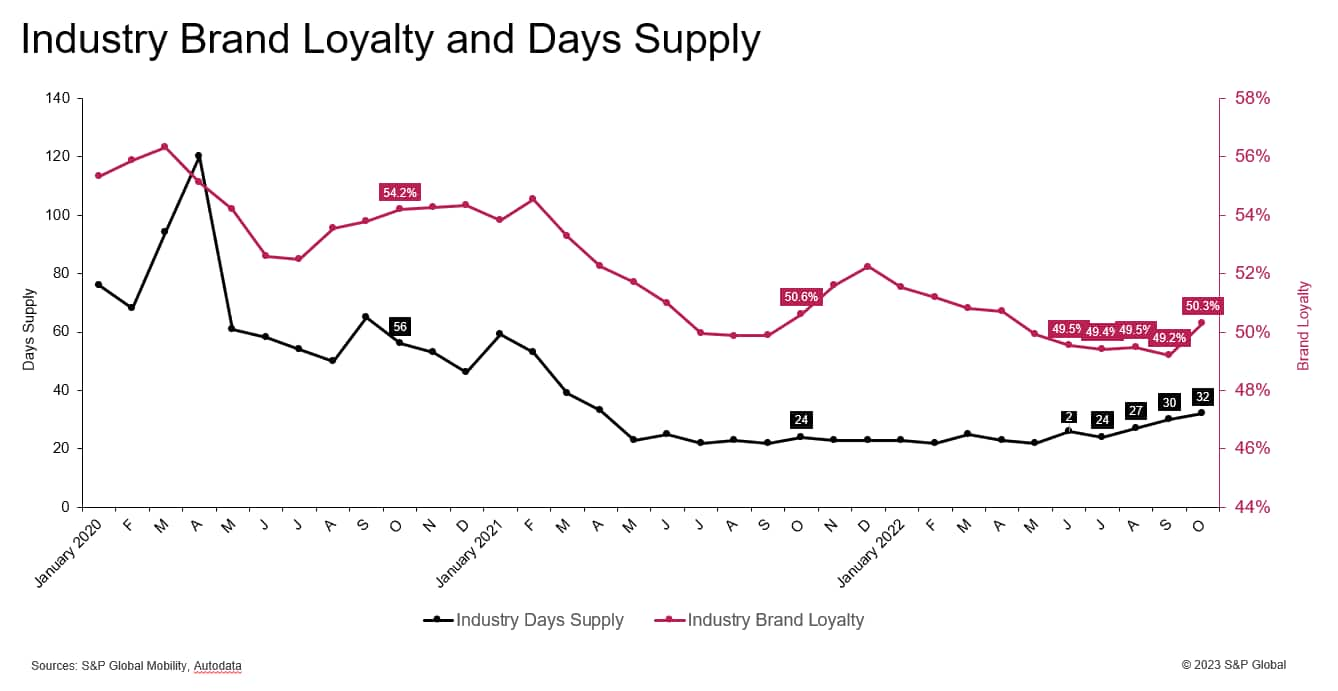

Brand loyalty in the US light vehicle market rose from 49.2% in September 2022 to 50.3% in October, the first significant increase since January (putting aside the slight improvement from July to August). October also is the first month since April in which this metric has surpassed 50%.

Looked at from a broader perspective, brand loyalty has been declining since March 2020 when it stood at 56.3%, immediately before the start of the pandemic and the start of the supply chain challenges.

Days' supply began to increase earlier than brand loyalty, rising to 26 days in June after languishing at 25 days or less since May 2021. Although this metric backtracked slightly to 24 days in July, since then it has been improving, rising to 27, 30, and 32 days in August, September, and October, respectively.

Given the strong direct correlation between brand loyalty and days' supply (.83 from January 2020 through October 2022, .88 if Covid-impacted April 2020 days' supply of 120 is removed), along with the rise in days' supply that began last summer, it is not surprising that brand loyalty has inched up.

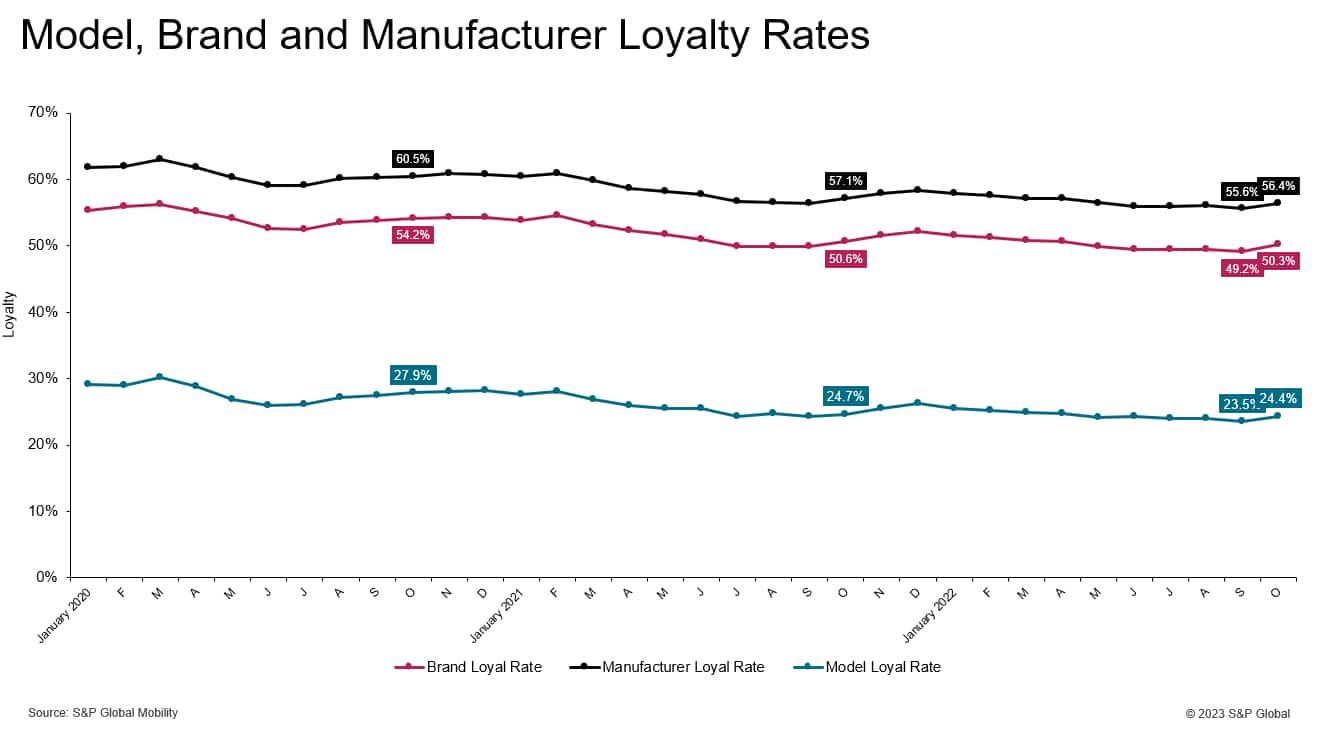

Historical model, brand, and manufacturer loyalty rates are also strongly correlated with one another; model and brand loyalties have a .99 correlation, while model and corporate loyalties have a .98 correlation. Given these relationships, it is understandable that model, brand, and corporate loyalties all rose in October (month over month) after declining in general since the beginning of 2022 (see below).

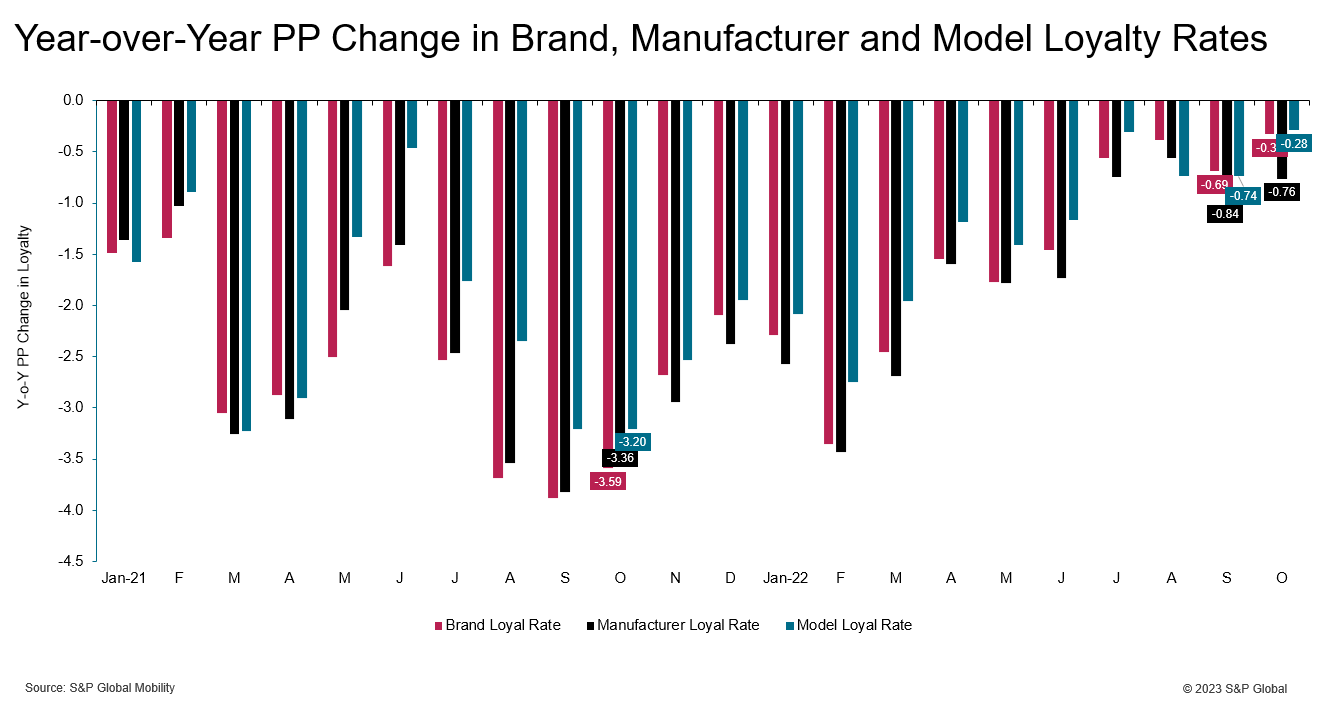

Lastly, the September-to-October brand loyalty increase is in keeping with the recent year-over-year changes in this metric. As shown below, the declines in brand loyalty had been declining from their peaks this past February and September 2021. The year-over-year declines in brand, manufacturer, and model loyalties in each of the three months from July through September 2022 all were under 1.0 percentage point; these results contrast with drops prior to this time period, back to the start of 2021, when the year-over-year declines were above 1.0 (two months with exceptions are February and June 2021 when the declines in model loyalty were .89 and .46 percentage points, respectively).

Will brand loyalty continue improving? On one hand, an ongoing increase would make sense given the recent five-month increase in days' supply. On the other hand, the just-released December inventory level of 33 days* represents a decline versus November's 34 days, suggesting that if the two metrics remain strongly correlated, brand loyalty will remain mired in the 49-51% range where it has been for the better part of two years.

*Source: Autodata

------------------------------------------------------------------------------

Top 10 Industry Trends Report

This automotive insight is part of our monthly Top 10 Industry Trends Report. The report findings are taken from new and used registration and loyalty data.

The December report is now available, incorporating November 2022 CFI and LAT data. To download the report, please click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.