Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 16, 2023

EV start-ups’ share of global BEV market will halve by 2034

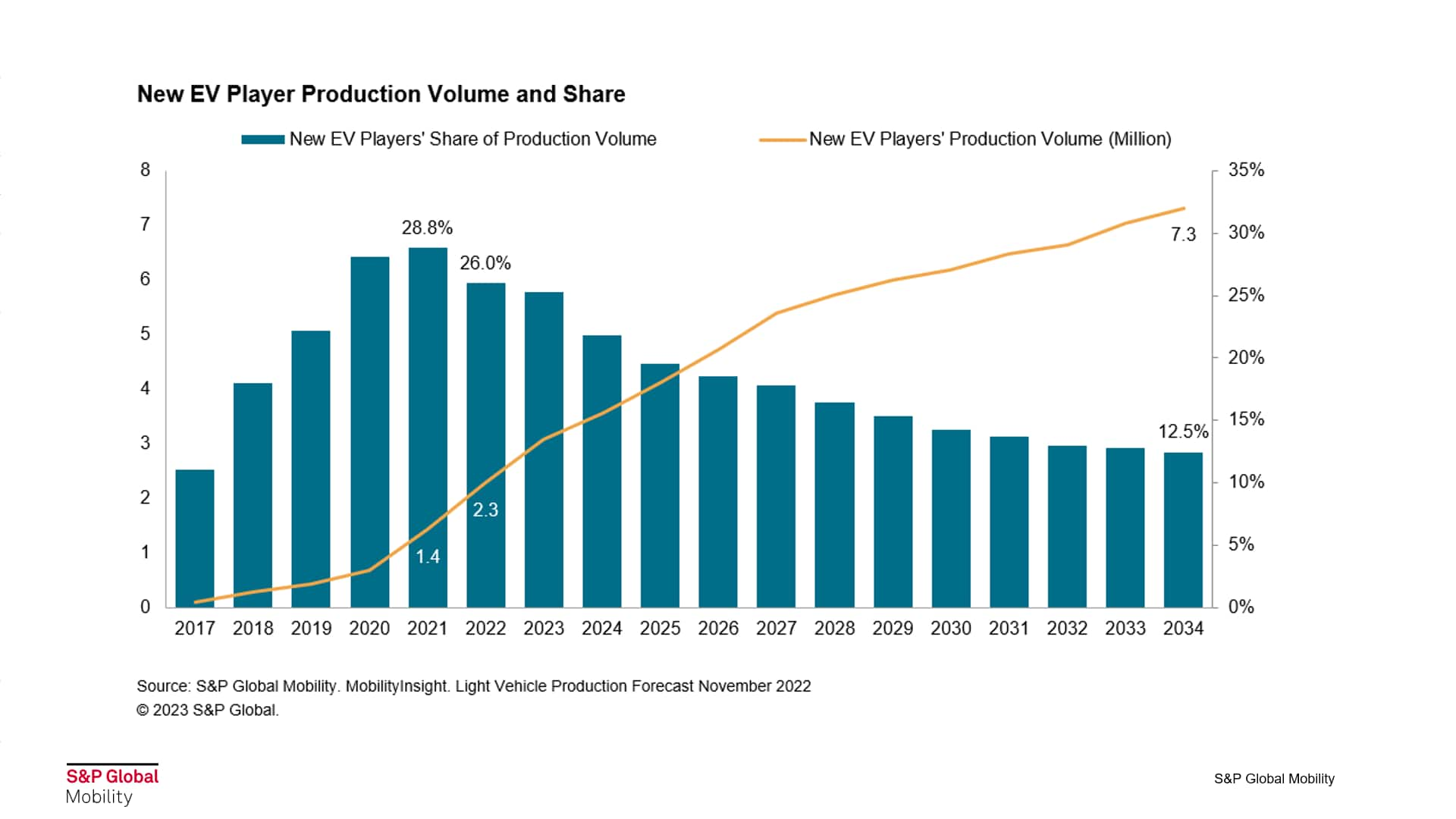

Non-traditional automakers, including Tesla, will produce 7.3 million BEVs annually by 2034 according to our forecasts. But their share of BEVs produced is already receding as legacy automakers scale up and gain share. There is no rebound expected.

In 2021, the start-ups produced 1.4 million BEVs, and their share of global BEV production peaked at 28.8%. Last year their share fell to 26%. By 2034, we believe this figure will have more than halved to 12.5%.

This is not for lack of market opportunity - BEVs in total is forecast to account for more than 50% of global light vehicle production by the mid-2030s. But even with Tesla's continued to surge into adding production, new entrants will be unable to scale at a rate that exceeds legacy OEMs' ability to convert existing capacity.

New EV player production volume will remain concentrated among a handful of the same first-movers

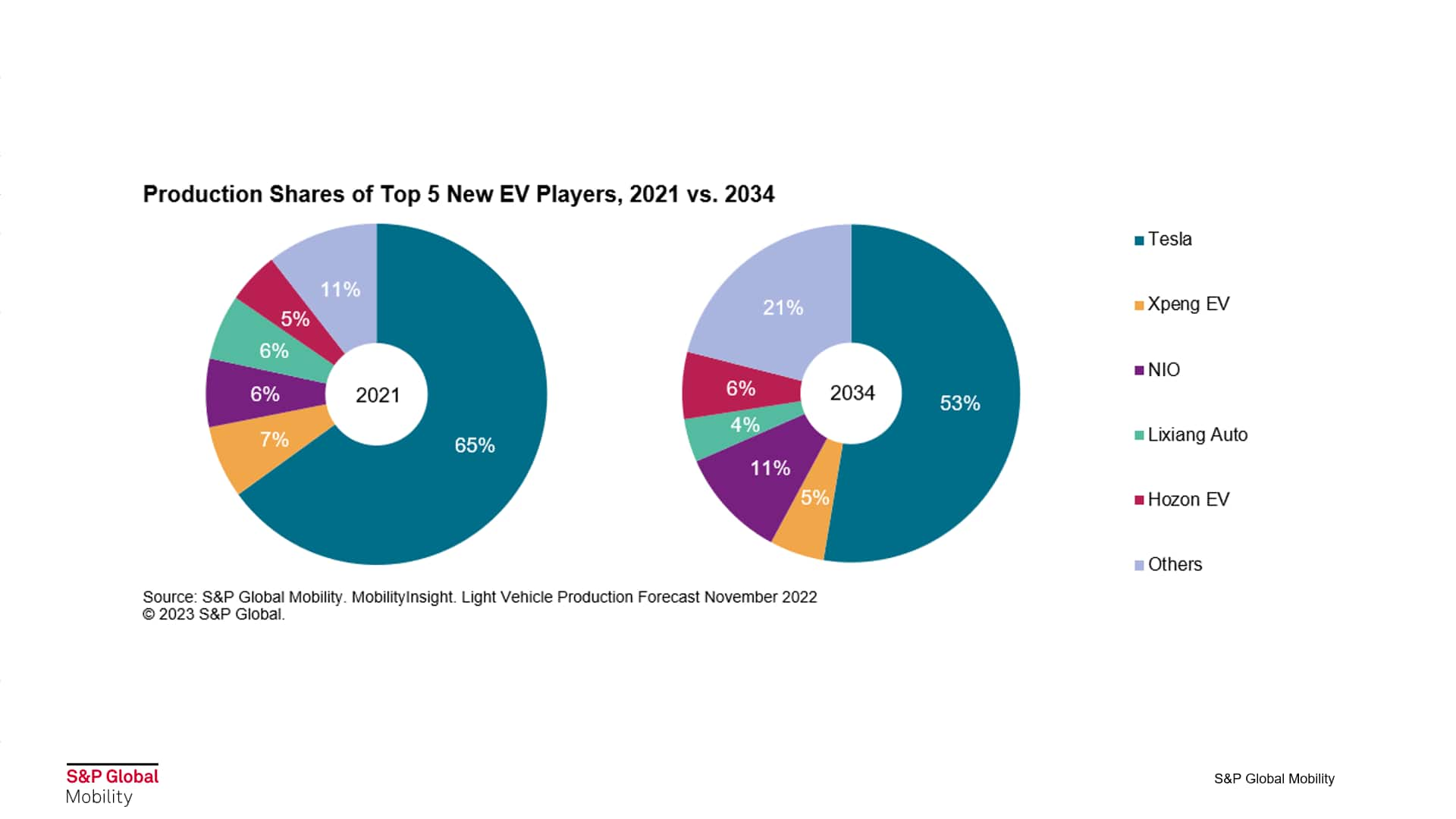

In 2021, five out of 45 manufacturers accounted for nearly all (89.5%) of the BEV production attributed to new EV players. Tesla accounted for 65%, with the remaining production relatively evenly distributed between start-ups from China: Xpeng EV, NIO, Lixiang Auto, and Hozon EV.

By 2034, we believe these same players will still account for 80% of disruptor entrants; Tesla will continue to dominate with 53%, and NIO will grow to become the second top producer with 11%.

These 5 players are capitalizing on their first-mover advantage. But more recent disruptor entrants will not have such opportunities, as traditional OEMs ramp up their EV offerings and leverage their established branding, dealer networks, and supply chains.

Lack of funding or appropriate investment vehicle will also suppress the number of operational new EV players

<span/>Surviving the jump from pre-production to production is rare; 70% of 130 EV start-ups researched became defunct before their announced SOP. Still, investment requirements exceed USD500 million for brands with lesser-volume aspirations, while those wanting to challenge full-line OEMs will require more than USD2 billion to reach production at scale. As such, many new EV firms aspiring to reach mass production have also ceased operations in the last couple of years.

Nearly USD10 billion was raised between 2020 and 2022 across 12 (mostly pre-production) EV start-ups that went public via SPAC merger. Since then, deteriorating market conditions have made access to funding for new entrants more difficult. As such, time limits on production readiness and financial self-sufficiency are tightening - and only the strong may survive.

Co-authored by Georgie Lamb, Associate, Automotive Strategy and Industry Insights

Learn more about our MobilityInsight service

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fev-startups-share-of-global-bev-market-will-halve-by-2034.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fev-startups-share-of-global-bev-market-will-halve-by-2034.html&text=EV+start-ups%e2%80%99+share+of+global+BEV+market+will+halve+by+2034+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fev-startups-share-of-global-bev-market-will-halve-by-2034.html","enabled":true},{"name":"email","url":"?subject=EV start-ups’ share of global BEV market will halve by 2034 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fev-startups-share-of-global-bev-market-will-halve-by-2034.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EV+start-ups%e2%80%99+share+of+global+BEV+market+will+halve+by+2034+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fev-startups-share-of-global-bev-market-will-halve-by-2034.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}