Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Jan 17, 2023

Fuel for Thought: Automotive supply chain and technology themes for 2023

LISTEN TO THIS PODCAST

The end of cheap capital - combined with worsening macroeconomic conditions, the war in Ukraine, raw material uncertainties, and the continuing chip shortage - will combine to mark 2023 as the beginning of an era when demand-side considerations replace the current supply-side fixation.

Already, we are seeing these conditions impact the burgeoning mobility startup ecosystem. But in a larger framework, the industry will continue its pivot away from internal combustion engines toward electrified vehicles in all formats - as well as the exploration of connectivity and monetizing the reams of data produced as the industry seeks more profit pools.

CES 2023 indirectly underscored many of these conditions and uncertainties. A shirking of nebulous concepts in favor of production-ready products was predominant. Though visions of unmanned pods and shuttles made appearances, many brands focused on very near-term product developments.

For instance, Harman presented a handful of production-ready products in the in-cockpit experience space, many of which already have OEM installation wins. Bose brought the next generation of 3D audio and EV sound enhancement on display through production vehicles. Blackberry displayed Ivy - this time with automotive-grade hardware ready to launch with Dongfeng Motors. These examples paint a picture of companies aiming to make money today, rather than focusing marketing dollars on abstract visions of the future.

Suppliers facing mounting pressures

A confluence of factors are challenging suppliers, and many involve externalities beyond the control of all but the most resilient.

"The macro environment is not conducive to success for those suppliers who don't have a good handle on costs, or a degree of operational flexibility to manage the headwinds," said Matteo Fini, Vice President, Automotive Supply Chain, Technology and Aftermarket, S&P Global Mobility.

This is especially true in Europe, where high energy costs, combined with stagnant volumes and rising financing costs, will create major pressures for suppliers. The risk factors appear heightened in Germany, where smaller Tier 1 suppliers - those with revenues between EUR100 and EUR500 million - and Tier 2 suppliers seem the most exposed.

In recent months, German suppliers Ruester (vibration/damping products) and Dr. Schneider (ventilation and interior trim parts) have filed for insolvency; Ruester faced liquidity problems following two acquisitions and rising input costs. This may become a theme in 2023.

With soaring energy prices, energy-intensive parts of the supply chain, such as metal foundries, that were already overstretched from investments contingent upon a return of pre-crisis volumes will have to reconsider their priorities for survival.

Semiconductor shortages far from over

Although demand-side softness will bring some relief in 2023, the structural capacity deficit in semiconductors will take several years to solve.

A slowdown in other chip-hungry industries like telecoms and consumer electronics meant some semiconductor capacity in the sector was allocated to automotive in H2 2022. This will continue early into 2023.

While there was plenty of investment in added capacity in 2021 and 2022, it takes time to bear fruit. The lead time for equipment increased from one to two quarters to between two and two-and-a-half years. The investment and CAPEX boom in 2022 will not result in significant additional capacity before 2024 or 2025.

"Aggregate demand conditions are deteriorating globally due to the war in Ukraine, inflationary pressures, and generally macroeconomics. These conditions may mask the capacity issues in 2023, but no one should be fooled," said Jeremie Bouchaud, Director, Semiconductor, E/E and Autonomy practices, S&P Global Mobility. "The average chip content per car is increasing at an accelerated rate because of electrification. The capacity deficit will become visible again as soon as demand from other industries picks up."

Analog chips will remain the bottleneck, as the number of analog chips per car increases faster than the number of MCUs. Additionally, analog chips don't shrink as well as SoCs or microcontrollers. This means production remains on mature process nodes where there is not enough capacity and not enough investment.

To mitigate semiconductor risk, we expect that OEMs will rethink the way electronics are designed in their vehicles. Expect increasing standardization of chips and reduced fragmentation. We expect OEMs to insist their Tier 1 suppliers use fewer custom chips or chips designed for single applications - also known as ASICs and ASSPs - and use more general-purpose chips.

ADAS, Autonomy and Robotaxis

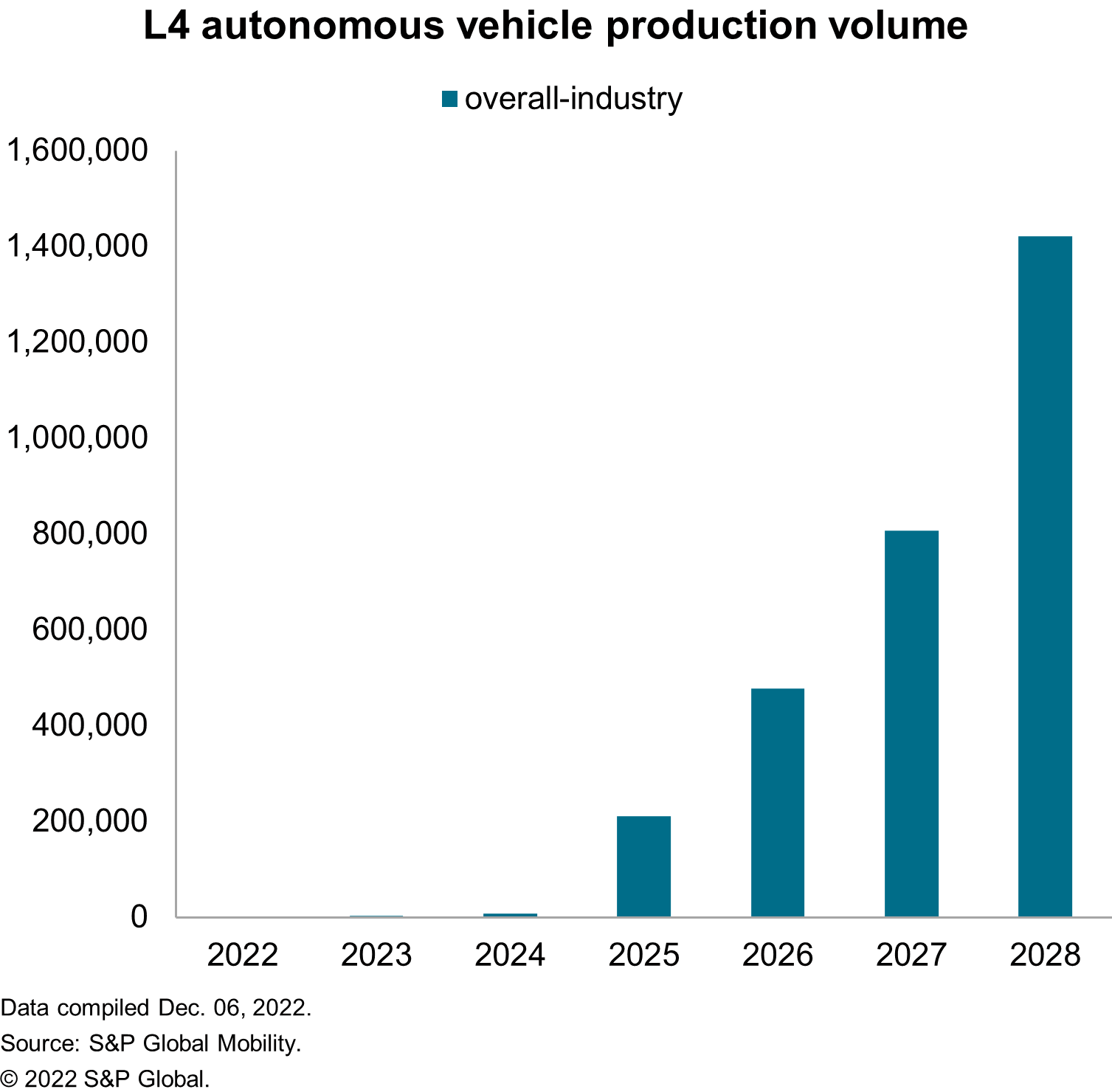

Though some may see the dissolution of Ford and VW's joint investment in Argo AI as a warning sign, the idea of autonomous taxis will continue forward - especially among Chinese OEMs.

"At the moment, tech companies like Waymo, Cruise, and Baidu are seen as winning the race. But first-mover status won't confer much sustainable competitive advantage," said Owen Chen, senior principal analyst for Autonomy in China with S&P Global Mobility. "The first part is only the technological demonstration. To deliver a robotaxi future, the much more difficult piece to execute is the commercialization."

At issue: Neither investors nor the capital markets will foot the bill for initially meager ROI. Entering the commercialization phase, challenges will emerge from robotaxi tech peers like Pony and WeRide, but also from the OEMs. Tesla and XPENG are targeting the delivery of robotaxis in 2023, but mobility providers like Waymo and Cruise (part of General Motors) will still lead the way in these early years.

The automakers' advantage? They already are operating a large ADAS fleet complete with Level 2+ applications. As such, they are training the software with data that comes free of charge from the millions of vehicles already on the market. By contrast, robotaxi tech companies are burning cash to collect data from a far smaller pool of vehicles on the roads.

Trained software, built on real-life data, is a more scalable path forward, and will be augmented by simulation to cover edge cases. However, it has not yet been proven that ADAS on-road content can be successfully pivoted to L4 on-road deployment.

Considering commercialization and productization issues, cost discipline and awareness is a bread-and-butter competency of the OEMs. If Tesla and XPENG can demonstrate this approach in 2023, we're going to see more legacy OEMs jostle for position in the robotaxi marathon. Tech companies like Waymo and Baidu must have enormous cash reserves to sustain a position in the race before profits take off.

Luring automotive software talent

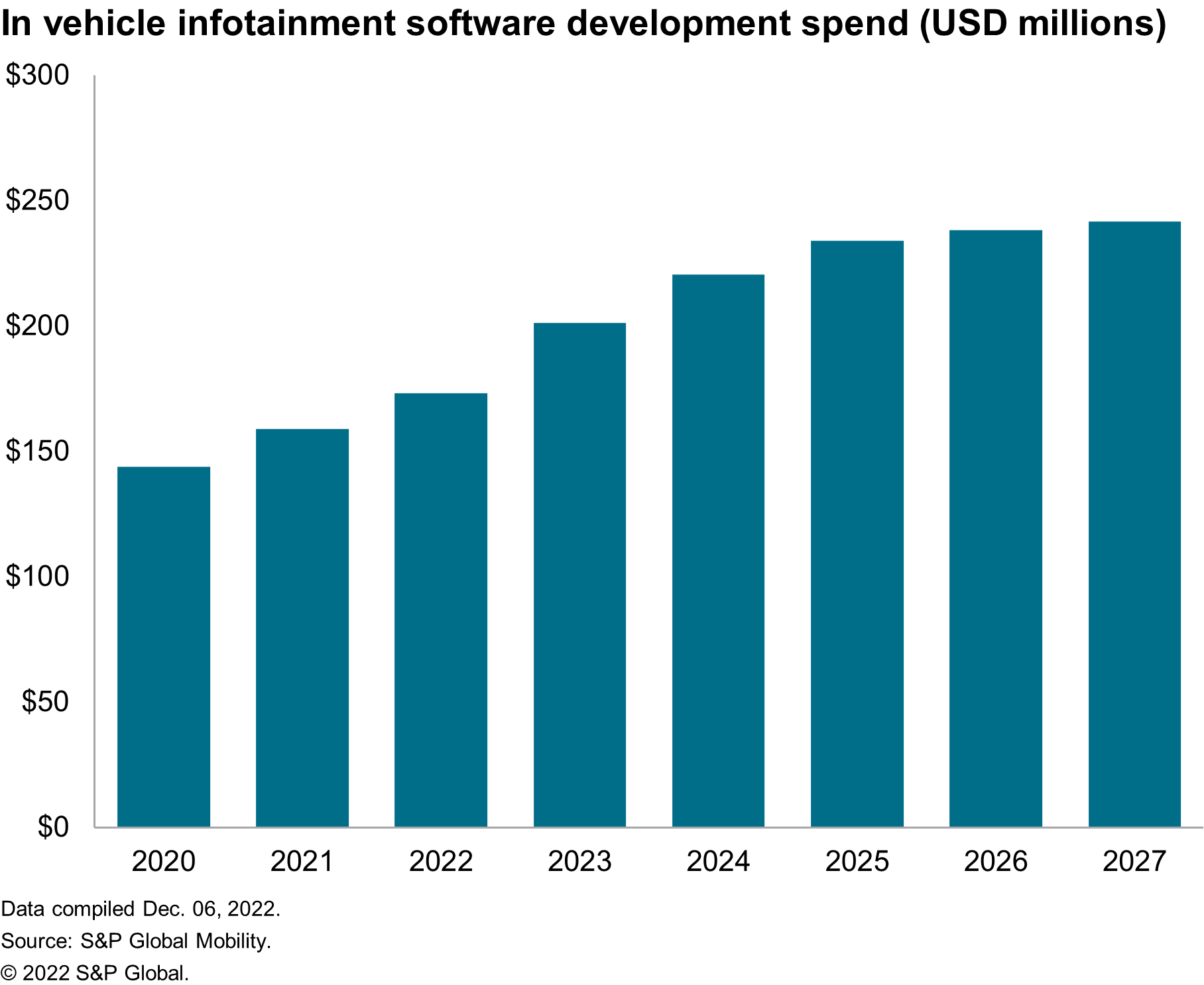

Consumers are adapting to the concept of tech-focused transportation. The pressure to deliver new groundbreaking technologies will be enormous for OEMs. But with software spend set to grow at a CAGR of 7.7%, the requisite skill sets needed by OEMs won't come cheap.

Furthermore, is the automotive sector an attractive enough market to attract top talent in the highly competitive software engineering sector, when facing off against tech companies and their own supplier base? Already we've seen VW's CARIAD - an attempt to create a company with big tech behaviors - struggle to deliver.

"The automotive sector has a couple of obstacles in its path if it wants to develop its own software ecosystems," said Dr. Tawhid Khan, Director, Software practice, S&P Global Mobility. "The industry is bound by process and legislation, and this doesn't make the sector particularly attractive to young software graduates. Finding a way to attract the necessary talent to the industry will be key."

The ROI of connected services

The tumultuous economic and supply chain situations of the previous few years have put a focus on margin performance by automakers, which have soared to record highs. But OEMs hoping to continue those impressive results will struggle as demand for new vehicles faces headwinds.

The new area for margin growth: add-on features and services.

These connected services and paid updates can achieve a margin of greater than 70%, which makes this space incredibly attractive for an industry seeking cover from the cyclical nature of selling vehicles. This new revenue stream has attracted the attention of Wall Street, although projected long-range revenue targets may be ambitious.

The pre-COVID years involved automakers standardizing connectivity hardware in regions that don't traditionally support higher option pricing, as well as the release of new generations of telematics control unit (TCU) hardware that will keep a connection active much longer.

The last three years have seen releases of innovative service-oriented business models beyond those offered by Tesla, with leading automakers leveraging the flexibility of these services to adjust packaging, pricing, and availability of features.

2023 is expected to be the launching pad for similar features, with much broader use cases, from mainstream follower automakers. This development will be critical to moving the concept of built-in upgradable content from headlines to reality.

Raw materials supply and BEVs

The auto industry's need to increase annual raw materials acquisition from its current level of 0.29 Terawatt hours (TWh) of lithium-ion batteries to about 3.4 TWh by 2030 will place incredible stress on the sector supply chain.

In addition, the US Congress' passage of the Inflation Reduction Act (IRA) in 2022 could reshape sourcing of and add complexity to obtaining battery raw materials, while near-term inflation could precipitate strategy changes.

The raw materials deficit, how the industry addresses that, and the additional implications for sourcing decisions on the carbon footprint are vital considerations. But sourcing these raw materials can't be secured in a laissez faire manner, as ESG considerations are gathering momentum.

"The IRA has sparked many OEMs and suppliers into tearing up their battery playbooks for the US market to secure access to manufacturing subsidies and purchase subsides for their consumers," said Graham Evans, Director, Battery, Charging, Propulsion, and Thermal practices, S&P Global Mobility.

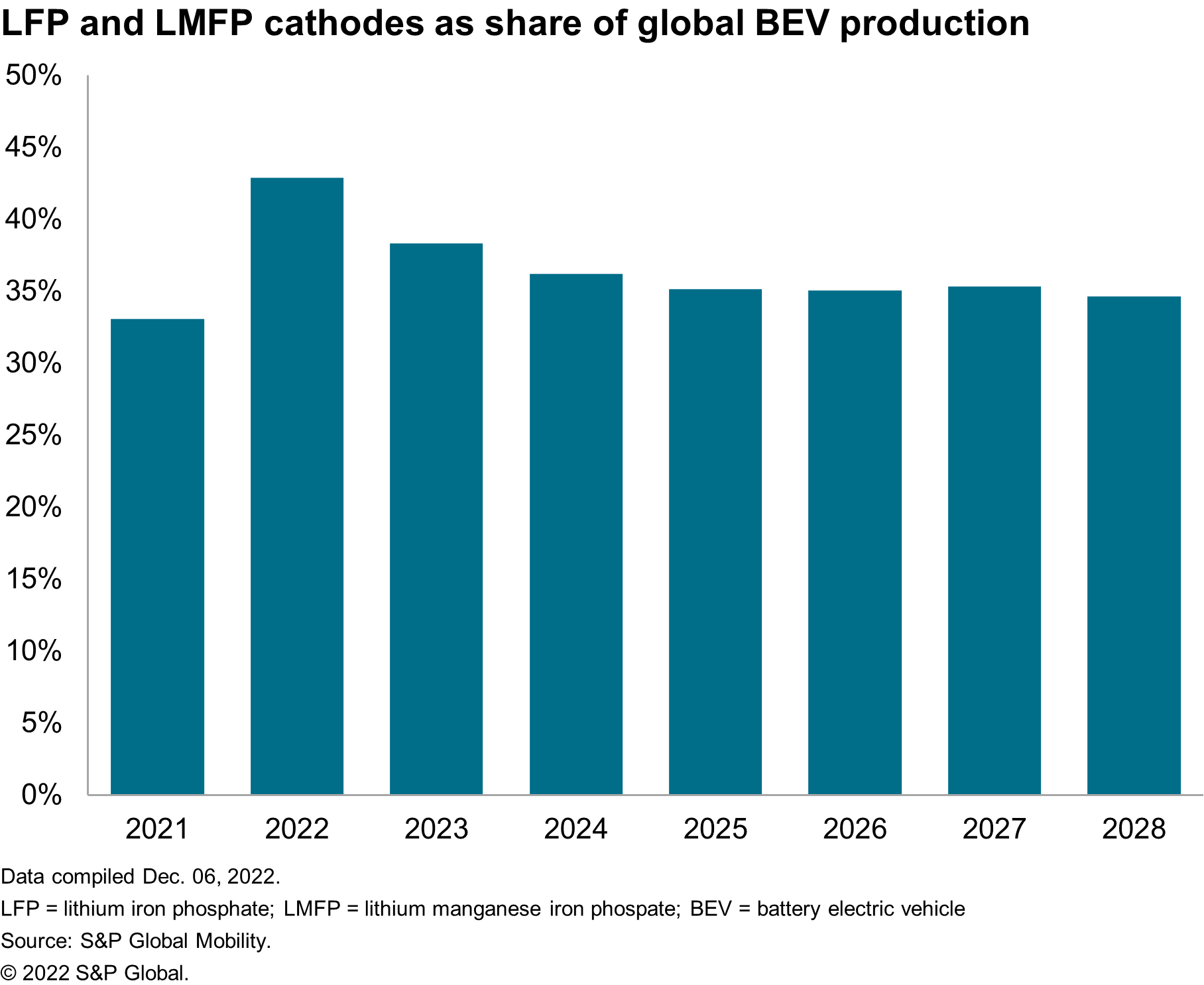

Soaring inflation is putting pressure on consumers, which could result in an OEM pivot to address the changed macroenvironment.

For example, does this mean a switch to lower-tech battery solutions (and implicitly lower cost structures) such as Lithium-Iron-Phosphate cathode chemistries to secure higher margins? Or could it mean increasing demand for batteries with a lower capacity and thus compromising vehicle range?

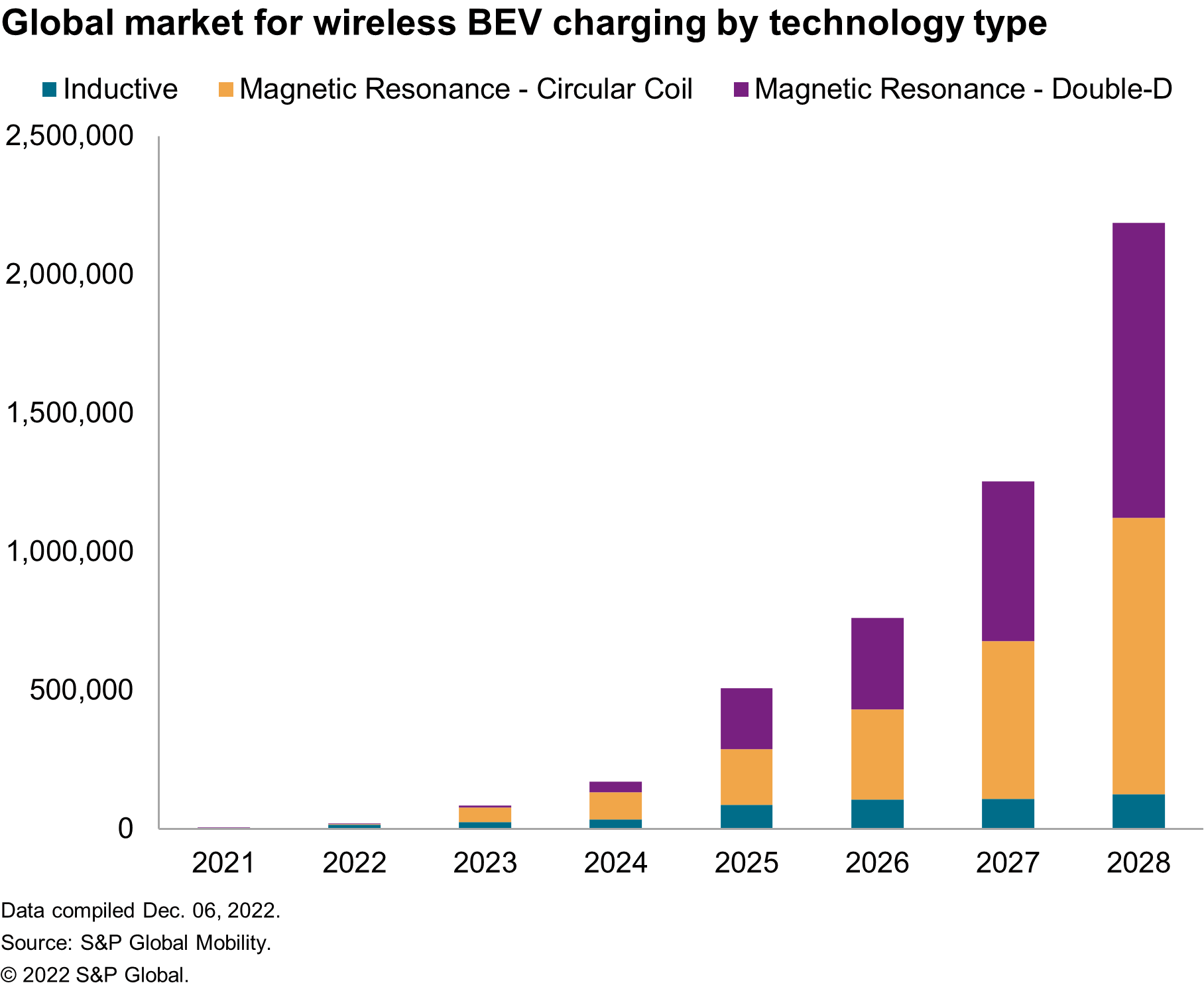

Wireless charging and battery swapping

Presently, only Mainland China has seen any demand for battery swapping in the electric vehicle space - and that is largely due to government incentives and geospatial issues in cities that have driven its success.

Nio, a key player in China, is launching in Europe and has a handful of stations in Norway - so that market will be an interesting petri dish for swapping in Europe. In the US, California start-up Ample is attempting to drum up interest in the fleet sector it's targeting.

While BMW and Hyundai (with WiTricity's Halo), and Volvo (with InductEV), have already dabbled with wireless charging, widespread adoption of the technology has the potential to challenge the current stand-off between battery size and range. The technology also suits fleet applications well, such as taxis.

"Consumers could charge more conveniently at home, and adopt 'splash and dash' behaviors if dynamic wireless charging becomes widespread," said Graham Evans, Director, Battery, Charging, Propulsion, and Thermal practices, S&P Global Mobility. "But mainstream consumers may not be prepared to pay a premium for such convenience technology when the industry has already converged on the charging plug."

Large-scale swapping has many other barriers in its way: In addition to the propensity for home charging, there is the lack of governmental directive, and the need to homogenize battery packs which would see OEMs and T1s surrender some of their intellectual property.

Consumer- and restricted-access charging could get a boost from DC wallbox chargers in the domestic charging sphere. These offer a middle option between slow AC chargers and the superfast public DC chargers. Their wider deployment has potential to shift the balance in the domestic vs. public charging conundrum. Furthermore, there are models available that facilitate V2G (vehicle to grid) operation, which could prove more appealing in these energy conscious and cost-sensitive times.

Euro 7 driving powertrain planning

The proposed Euro 7 emissions regulations carry huge capital-spend implications for technology fitment on future internal-combustion vehicles.

The watering down of Euro 7's initial framework will cause many OEMs to reconsider the rapidity of their electrification rollouts. Do the less stringent Euro 7 regulations now make it worth OEMs investing in one more cycle of ICE updates? Or does it make more sense for an OEM to focus on electrification, and splinter their ICE and EV businesses as Renault and Ford have done? And how does this affect a supplier base ramping up to support E-motor applications?

"The tightening of electrical steel capacity could also impact the electrification rollout," said Graham Evans, Director, Battery, Charging, Propulsion, and Thermal practices, S&P Global Mobility. "A shortage of e-steel could mean that a planned product mix could change in the short- to medium-term in favor of ICE and hybrid applications, where there's much less demand for steel, in particular high specification (extremely thin) electrical steel."

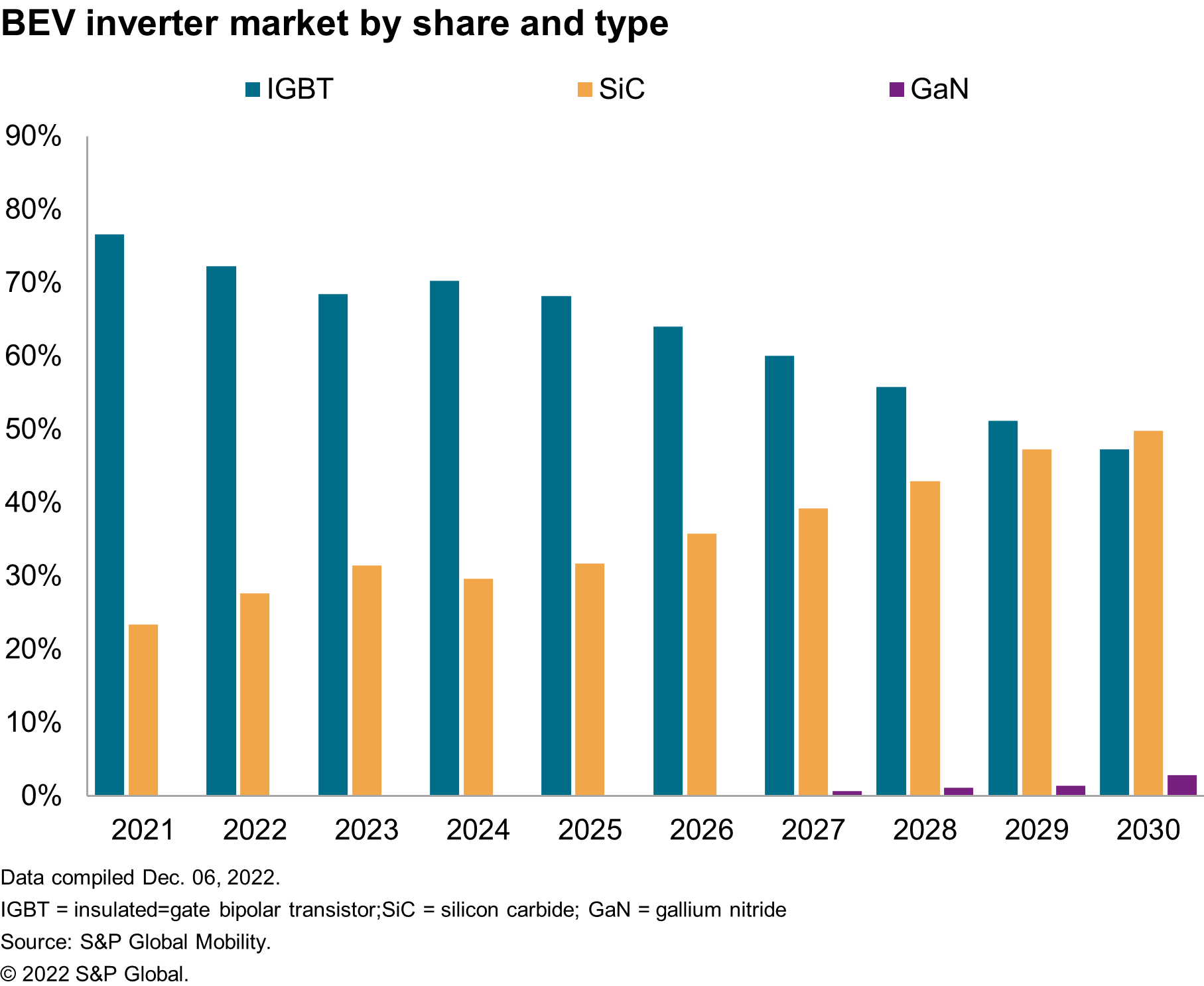

Meanwhile, the desire to squeeze more range and efficiency from existing BEV parameters should prompt more in the industry to switch to silicon carbide (SiC) inverter technology.

SiC inverters are more efficient, can also run at higher temperatures and power output for a longer time. The tradeoff is cost. Major power electronics suppliers such as Marelli, BorgWarner, and Delphi Technologies have been increasingly active in this area recently, developing their products and securing orders - which suggests that we'll see increasing SiC inverter adoption in the short-term.

------------------------------------

Dive Deeper

Autology Podcast: CES 2023 Day 1

Recap - Listen Here

Autology Podcast: CES 2023 Day 2

Recap - Listen Here

Autology Podcast: CES 2023 Event Wrap Up - Listen Here

AutoTechInsight Webinar: CES 2023 - Watch Now

Feature your exclusive automotive industry insights on our Mobility News and Assets Community page, a platform that is designated for automotive and mobility industry thought leaders and the community.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-automotive-supply-chain-and-technology-themes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-automotive-supply-chain-and-technology-themes.html&text=Fuel+for+Thought%3a+Automotive+supply+chain+and+technology+themes+for+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-automotive-supply-chain-and-technology-themes.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: Automotive supply chain and technology themes for 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-automotive-supply-chain-and-technology-themes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+Automotive+supply+chain+and+technology+themes+for+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-automotive-supply-chain-and-technology-themes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}