Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsBriefCASE: Mexico’s automotive salsa - Tesla and mainland Chinese suppliers spice things up

As with everything that Tesla says and does, its investment in Mexico for a new vehicle plant has attracted much attention. The latest hubbub around the Santa Catarina, Nuevo Leon, plant surrounds reports that Tesla is looking to invite its mainland Chinese suppliers at its operations in Shanghai to join it in investing in Mexico. That it is looking to bring some of its mainland Chinese suppliers to Mexico is not surprising. Original equipment manufacturers (OEMs) do this all the time with their preferred suppliers. However, Mexico, as an automotive investment destination, is doing very well, thank you, with or without Tesla.

We will turn to why Mexico's doing so well in good time. First, we will address the elephant in the room. S&P Global Mobility has analyzed recent investment announcements by mainland Chinese suppliers where Mexico is the destination. Using our bespoke Component Forecast Analytics (CFA) suite of supply chain data, we have then traced back those suppliers that are engaged with Tesla at its Shanghai facilities.

The analysis reveals that out of the 90 investments by mainland China-affiliated automotive companies in Mexico from 2019 until the present, 21 of them, or 23.3% of the companies, are known Tesla suppliers. Of course, even if a company is a known Tesla supplier, it does not necessarily follow that those suppliers' facilities will expressly supply Tesla. This is illustrated by the fact that where the investment location is known, only nine of the 21 are setting up in Nuevo Leon.

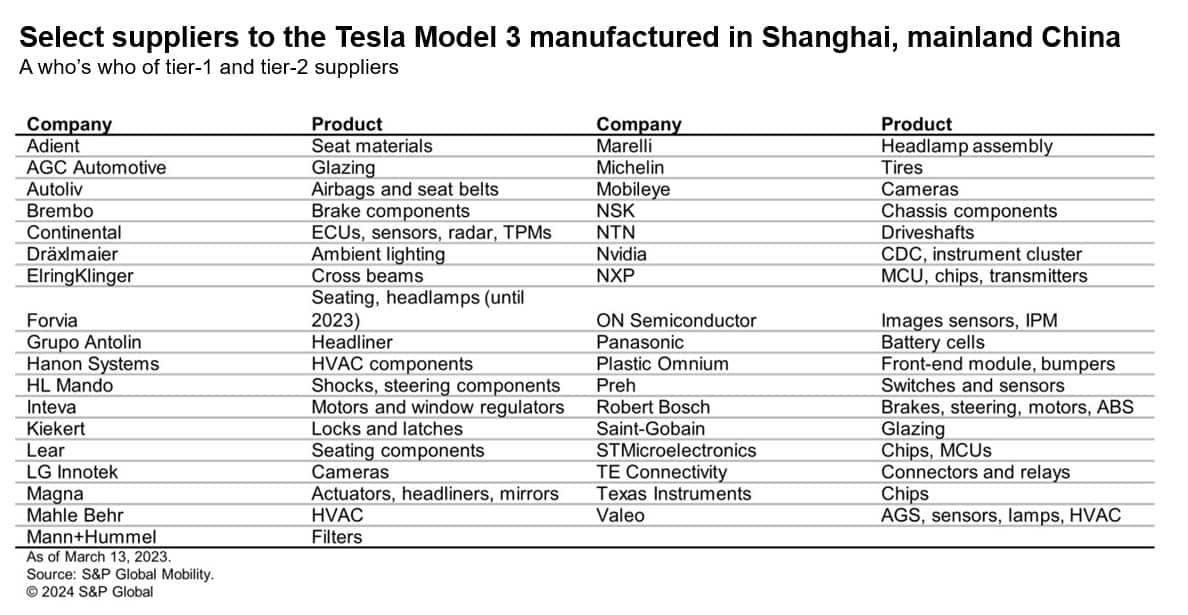

While there is some substance in Tesla wanting to 'lift and shift' some of its Shanghai supply chain to Santa Catarina, it is not a wholesale replication. That is because many of its Shanghai suppliers are the everyday suppliers you would see anywhere else in the world with a few exceptions. For example, a cut-down list of suppliers for Tesla's Model 3 manufactured in Shanghai is a who's who of Western tier-1 and tier-2 suppliers.

So why the drip-feed of information to the media about Tesla's plans for Mexico? The Santa Catarina plant is central to the next stage of its growth at a time when Tesla is facing headwinds in the market. Santa Catarina is central to those plans, whether or not they involve the prior entry-level car or as the pivot to focus on robotaxis. Either route means that costs have to be controlled (cf. Tesla's unboxed production system), and Tesla has to keep its suppliers on the right side of its cost projections. What better way to keep supplier costs down than using countervailing power?

The noise surrounding Tesla's new plant, as well as the prospect of mainland China-domiciled suppliers locating there, does Mexico and its wider automotive sector a disservice. Directorio Automotriz, a Mexican public relations agency that acts as a go-between for the various stakeholders involved in setting up shop in Mexico, tracks automotive investments in the country. Its data for the past two and a half years does demonstrate the inroads made by mainland China-domiciled suppliers, but it also shows a broader base of interest in Mexico. Over the period, Mexico attracted $31.9 billion in automotive FDI from 32 countries.

The two biggest factors behind any FDI relate to the local market, in both size and growth. Mexico is well-placed due to the number of markets that companies there have access to. The biggest pull remains tariff-free access to its neighbors, the US and Canada, through the United States-Mexico-Canada Agreement (USMCA). This has proved attractive to OEMs (and a route to market that may be closed to future investments according to a Reuters report on April 18) in terms of building vehicle manufacturing capacity in the country, and where OEMs tread their suppliers follow. Between 2015 and 2025 (which excludes Tesla's plant), 1.9 million units of light vehicle manufacturing capacity will have been added according to S&P Global Mobility data, making Mexico the third biggest contributor to global capacity growth.

While Tesla has had a significant role in shaping the automotive industry since its inception, it is not always the ultimate arbiter. That is something worth remembering when every Tesla move or pronouncement by Elon Musk is subject to amplification often beyond its significance. Tesla's decision to set up shop in Santa Catarina is the cherry on top of a cake that already benefits from many of the right ingredients.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.