Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 29, 2024

Electric Vehicles Battery Production India

Striking a deft balance between domestic electric vehicle battery production and international partnerships is crucial to a robust EV battery supply chain

At the COP26 conference, in a bold commitment to environmental sustainability, India's Prime Minister Narenda Modi pledged to achieve net zero emissions by 2070. As the world's third largest emitter of CO2, India is banking on electrification of the transportation sector, and the shift towards electric vehicles (EVs), to achieve this goal. This transition significantly increases India's need for lithium-ion (Li-ion) batteries for electric vehicles..

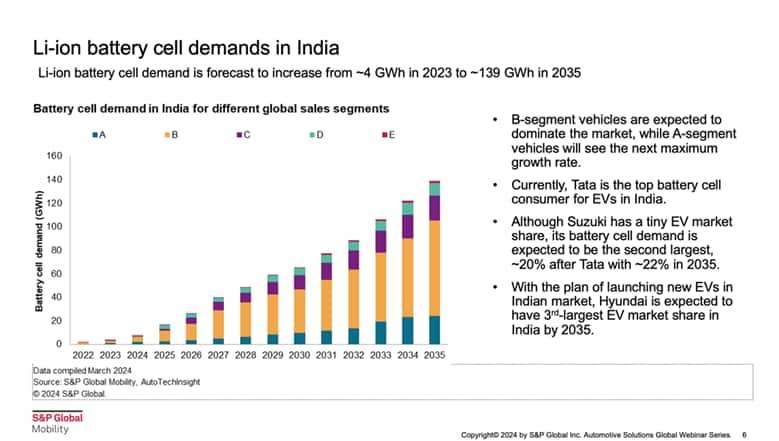

S&P Global Mobility's AutoTechInsight forecasts demand for EV lithium batteries in India to surge from 4 gigawatt hours (GWh) in 2023 to nearly 139 GWh by 2035. A major share of this demand is projected to come from the economically vital light vehicle segment - the workhorses of Indian commutes and commerce. The exponential growth in EV adoption will have implications for the sourcing and production of EV battery components by original equipment manufacturers (OEMs), suppliers and manufacturers in India.

Growing EV battery cell demand in India

EV battery cell demand is driven mostly by B and A segment passenger vehicles, which are characterized by their compact build and affordability. In particular, smaller B segment SUVs like the Tata Nexon are increasingly popular with Indian drivers. These vehicles have a higher ground clearance and a wider wheelbase, providing better control and protection over uneven terrain like potholed or gravelly roads.

Thanks to their strong EV portfolio, Tata Motors remains the top EV battery cell consumer in India. By comparison, Maruti Suzuki, the country's largest carmaker, has a relatively small share of the EV market. But with the automaker aiming to launch their first EV, the eVX in 2025, Maruti Suzuki is expected to drive 20% of battery cell demand in India by 2035, just behind Tata Motor at 22%.

While India continues to develop its EV production and technology, the EV supply chain remains fragmented. EV battery manufacturing involves installing individual cells into modules and arranging said modules into packs capable of delivering the power needed to operate a vehicle. These three distinct phases - cell, module, and pack - represent key opportunities for India to localize electric vehicles and EV battery production.

Driving India's Transition: Accelerating Domestic EV Battery Production

As local EV battery cell manufacturing capabilities are still nascent, India has historically relied on importing cells from Greater China, South Korea and Japan. This will likely change as India aims to become more self-sufficient to satisfy demand. S&P Global Mobility predicts that by 2030, 13% of total EV battery cell demand will be sourced domestically, with the rest still outsourced from other countries. Notwithstanding this forecast, OEMs in India are investing heavily into local cell manufacturing facilities.

This is further spurred by the Indian government's proactive stance on electrification. Policies such as the Production-Linked Incentive (PLI) scheme for advanced chemistry cell (ACC) battery storage and the Faster Adoption of Manufacturing Electric Vehicles (FAME) scheme have encouraged investments and strategic partnerships.

In 2024, Ola Electric started mass production of the NMV21700 cylindrical cell battery at its Chennai-based Gigafactory for its two-wheelers. Major industry OEMs like Rajesh Exports, Amara Raja, Reliance, and Adani also plan to build lithium-ion battery cell factories and ramp up domestic electric vehicle battery production capacities.

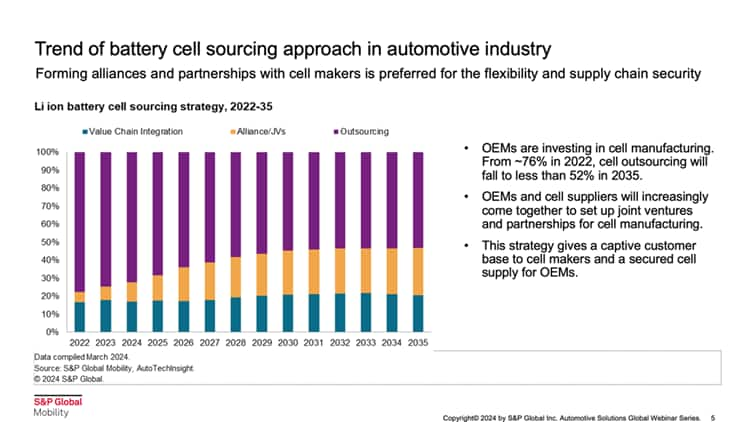

Concurrently, OEMs and EV battery cell manufacturers in India

are forming joint ventures (JV) with international cell makers,

module makers and pack suppliers. Key alliances include Suzuki's JV

with Toshiba and Denso in 2017 to construct a cell manufacturing

plant in Gujarat. The facility started as an assembly plant for

modules and packs and is set to begin manufacturing EV battery

cells in 2024 and 2025.

Overall, the increase in JVs and value chain integration reflects

the broader industry move towards securing supply chains and

fostering sustainability and efficiency. Outsourcing is expected to

decrease markedly, from 76% in 2022 to less than 52% by 2035.

Trends in India's EV Battery Chemistry and Mineral Sourcing

Growing demand for EV battery cell production has also cast a spotlight on battery chemistry trends in India. Not all lithium batteries for electric vehicles are created the same. The choice of cathode material influences performance, cost and environmental impact, making it a crucial factor for EV batteries manufacturers and policymakers. Currently, LFP (Lithium Iron Phosphate) and LMFP (Lithium Manganese Iron Phosphate) chemistries dominate in lower vehicle segments due to their thermal stability and cost effectiveness, attributes that are critical in price-sensitive markets like India.

By 2030, high nickel NCM (Nickel Cobalt Manganese) is expected to capture greater market share in higher vehicle segments owing to its higher energy density, making it suitable for longer range travel. Mid Nickel NCM and NCMA (Nickel Cobalt Manganese Aluminum) are also gaining traction, particularly in the mid-range vehicle segments.

Cathode and anode active materials (CAM/AAM) used in the construction of lithium EV batteries are crucial components that determine performance and energy storage capabilities. Strategic acquisitions and investments from India OEMs and manufacturers not only help to expand EV battery production capacity but can also improve domestic technological capabilities.

For instance, Himadri's investment in Sydney-based start-up, Sicona Battery Technologies, which specializes in high-capacity silicon anode technology, is poised to revolutionize battery capacities and charging speeds. Likewise, India's first CAM supplier Altmin is ramping up its production of LFP cathode materials, which will be essential to powering a wide range of electric vehicles.

With the automotive industry exploring cost-effective alternatives to lithium EV batteries, sodium-ion technology has emerged as a promising candidate. Albeit with a lower energy density, sodium EV batteries are low cost, abundant in supply, and safer, making them suitable for two and three-wheelers with smaller electric vehicle battery packs. Commercialization of sodium EV battery technology, which is still maturing, may not be fully underway till 2030, but companies like Reliance New Energy Solar - which acquired UK-based sodium-ion technology company Faradion - are gearing up to lead in this nascent market.

The ethical sourcing of battery minerals is becoming a paramount concern as the industry scales. Narratives around lithium, nickel, and cobalt are increasingly scrutinized under the lens of ESG principles, forcing suppliers and corporations to balance cost efficiency with ethical responsibility. While an estimated 5.9 million tons of lithium reserves in Jammu and Kashmir offers potential to localize mineral supply, it also highlights complexities of extraction and their environmental impact in these mountainous regions. Like with EV battery cell manufacturing, it will take strategic partnerships with Bolivia, Argentina, Indonesia, Australia and other nations to procure the necessary Lithium, Nickel and Cobalt supplies.

As the industry continues to evolve, the integration of advanced technologies and strategic partnerships will be key to sustaining growth and achieving the electrification goals set forth by the government. This holistic approach will ensure a future where India is both a consumer and a crucial contributor to the global shift towards sustainable automotive solutions.

This article is part of a series featuring highlights from S&P Global Mobility's 2024 Solutions Webinar Series. The Indian EV Battery Outlook webinar occurred on April 2, 2024.

Register for upcoming webinar sessions.

Keep yourself updated with the latest automotive insights featured on our Mobility News and Assets Community page to stay ahead of your competition.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-vehicles-battery-production-india.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-vehicles-battery-production-india.html&text=Electric+Vehicles+Battery+Production+India+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-vehicles-battery-production-india.html","enabled":true},{"name":"email","url":"?subject=Electric Vehicles Battery Production India | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-vehicles-battery-production-india.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Electric+Vehicles+Battery+Production+India+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-vehicles-battery-production-india.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}