Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

WHITEPAPER

Jul 19, 2024

Building bridges in a global EV supply chain: India's new EV policy

India is poised to become the world's third-largest economy by the end of this decade. Despite the recent global challenges impacting economies, including the COVID-19 pandemic, semiconductor shortage, geopolitical tensions with its neighbors, and the impact of the Russia-Ukraine crisis, India has demonstrated remarkable stability in its economy and supply chain compared to other countries.

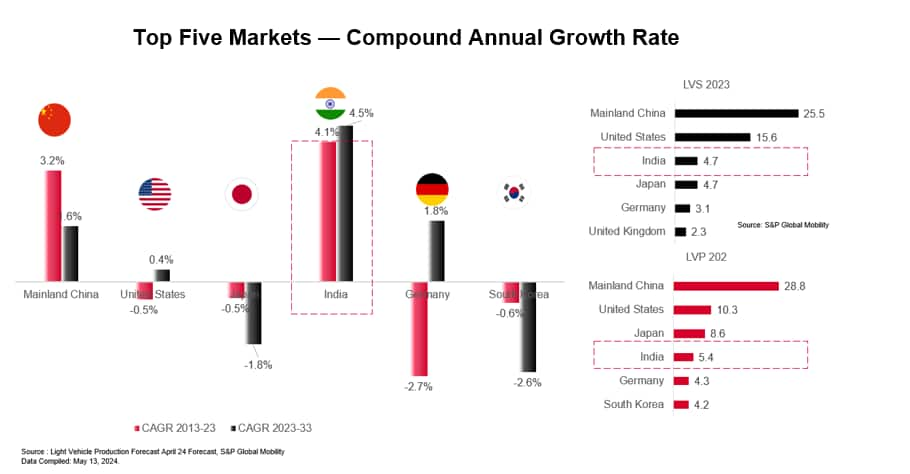

In the light vehicle production market, India has outperformed the top-five global light-vehicle production markets over the last decade (calendar years 2013-23), with a compound annual growth rate (CAGR) of 4.1%. The Indian light vehicle production market, which accounted for 3.65 million units in 2013, increased to 5.44 million units in 2023, making India the fourth-largest market in 2023. Meanwhile, the light vehicle sales market accounted for 4.72 million units in 2023, making India the third-largest market in 2022, surpassing Japan.

India has successfully navigated the recent years of disruption in the automotive industry. Supplies of semiconductor chips were quickly secured, while producers in other regions found it more challenging to adapt to the shortage. India's low reliance on mainland China has supported growth in production since 2020. A stable, growing domestic marketplace is also increasingly attractive to automakers looking to establish low-cost export hubs to serve overseas markets. This topic has been visited in the past but now appears more realistic with a stable supply chain and when the world is looking beyond Mainland China.

Continue reading...

Download the complete whitepaper

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbuilding-bridges-in-a-global-ev-supply-chain.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbuilding-bridges-in-a-global-ev-supply-chain.html&text=Building+bridges+in+a+global+EV+supply+chain%3a+India%27s+new+EV+policy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbuilding-bridges-in-a-global-ev-supply-chain.html","enabled":true},{"name":"email","url":"?subject=Building bridges in a global EV supply chain: India's new EV policy | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbuilding-bridges-in-a-global-ev-supply-chain.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Building+bridges+in+a+global+EV+supply+chain%3a+India%27s+new+EV+policy+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbuilding-bridges-in-a-global-ev-supply-chain.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}