Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 08, 2023

Can Brazil’s commercial truck fleet turn electric?

With 2.2 million heavy commercial trucks in the national parc, Brazil is facing international pressure to bring more eco-friendly vehicles to the roads. But the infrastructure and cost hurdles are massive.

In Brazil, intermodal transport is limited, with average truck trips spanning more than 2,000 kilometers. Combine that with a commercial truck fleet averaging 12 years of age, and a lack of affordable options to replace with new vehicles, and Brazil is facing a truck-emissions timebomb. Brazil has a truck parc of 2.2 million units, and the movements to modernize the fleet by agribusiness, e-commerce and construction have contributed to reducing the fleet average age.

However, while the emission restrictions for new trucks have limitations in terms of particulate matter and NOx, there isn't any other control during the truck life cycle, except for a few segments of truck application. Brazil created its control emission program in the 1980s, named Proconve. Since then, the program has gradually tightened Brazil's emission standards. Introduced in January 2023, the most current Proconve 8 standard is similar to Euro VI, and proposes significant reductions within the next decade.

But that is not enough. One proposed solution is to electrify the fleet, but infrastructure and affordability concerns may hamstring that effort.

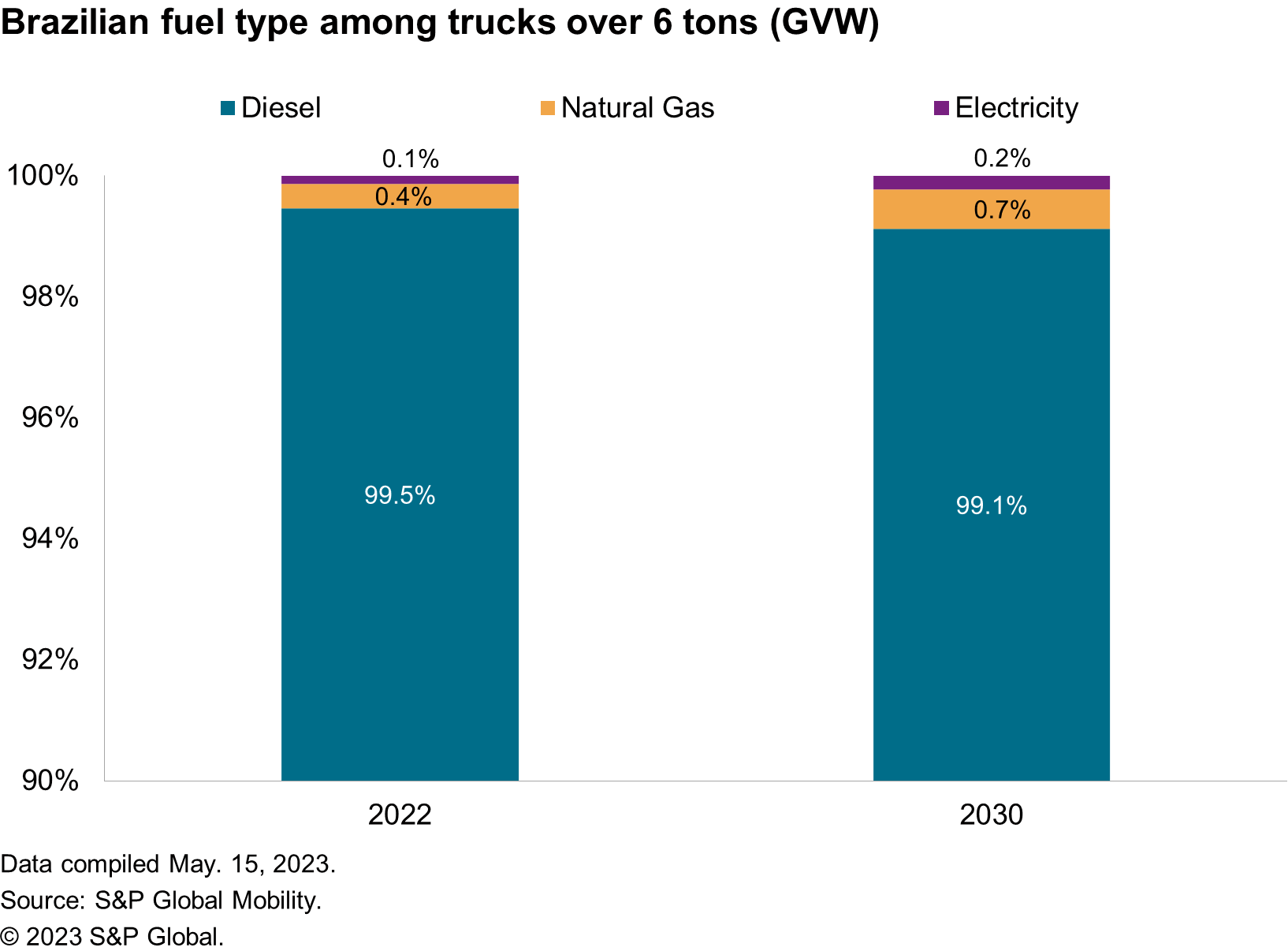

The stimulus for electric vehicles from the Brazilian government is limited, and only large companies with environmentally friendly policies have adopted electric trucks. The forecast take-up of electric or alternative propulsion trucks is meager in the medium-term - with less than 1% of vehicles powered by alternative propulsion, as demonstrated in S&P Global Mobility's latest commercial powertrain forecast.

Brazil's road-intensive, diesel-dependent infrastructure has limited the use of electric trucks to short trips and urban deliveries. Standing in the way of further development are an underdeveloped recharging infrastructure, high vehicle prices (electric trucks are nearly four times the diesel truck price), long charging times, and the poorly constructed highway network - only 12% of roads are paved in Brazil.

Consequently, while the total production volume of electric and natural gas medium- and heavy-duty trucks in Brazil will increase during the decade - from 850 units in 2022 to 1,450 in 2030 - it will hardly be enough to make a dent in the 2.2-million-unit truck parc.

Therefore, the electrification of Brazil's trucking industry will make only small steps in the current decade. Before a higher ramp-up can be envisaged, hurdles such as infrastructure, lack of subsidies, and acceptance of the innovative technology by the decision makers will need to be overcome. Without a more receptive operating environment South America will continue to lag other regions in electrification and the reduction of its emissions footprint.

Until that time, much of Brazil's efforts lie in limiting the environmental impact of the existing commercial truck parc. The carbon market is one opportunity for the government to create incentives and boost the financing of ecological projects.

In parallel, OEMs have offered alternative propulsion vehicles to their clients, but infrastructure again remains a challenge. Natural gas has been a popular solution, but its limited distribution network is a huge obstacle to its expansion.

With increasing emission restrictions, the discussion as to which is the best alternative fuel has resurfaced. In 2018, Brazil's energy minister introduced measures to change the energy mix in favor of natural gas for industries including transportation. Since then, investments in infrastructure and natural gas exploration have increased. Furthermore, a couple of OEMs have introduced their eco-friendly products with natural gas or green diesel (non-fossil diesel) powertrains.

Looking medium term, the situation is far from static. In terms of bringing more eco-friendly vehicles to Brazil's roads, the use of alternative eFuels has proven to be the optimal solution. The most popular options are:

- Green diesel

- Hydrotreated Vegetable Oil - HVO

- Blended R5 diesel (95% diesel, 5% bio diesel)

- Biodiesel

- Natural gas

- Compressed Natural Gas (CNG)/Liquefied Natural Gas (LNG)

- Methane

- Biomethane

On the natural gas side, the low operational cost compared to traditional diesel (10% lower maintenance cost) is a great selling point, but its limited availability (it's mainly available in the South-East region [states of Rio de Janeiro, Sao Paolo, Minas Gerais]) - is less so.

New projects appear in the north/northeast region but are still small. Methane or biomethane have emerged as a solution by and for agroindustry. Agribusiness is the largest driver of heavy-duty truck demand in Brazil and Argentina. The agro-industry's strong earnings have allowed investments in other segments of the agroindustry: from agro-tech (start-ups focused on solution to fields) to new means of transport (increasing the use of rail and water transport).

By contrast, the diesel distribution and technology have been well demonstrated, which makes a compelling case for green diesel.

Indeed, the solution for climate-friendly transport will go beyond fuel. The more rational use of transport with integration between modals reduces the costs of operation and improves the well-being of society. Structural change in transport must be the priority together with emissions control. The government might create incentives to boost initiatives for integration. Some measures already have been seen, like BR do Mar - the incentive to Brazilian coast cabotage - or the mark to change the country's energy matrix which will boost the use of natural gas for industry and transport.

Brazil's road to clean transportation will happen in two stages: First will come a move from diesel to green diesel/ natural gas. Second, there is the hoped-for shift to electric. But many developments must fall into place first.

The future of EVs and alternative propulsion in the commercial market

Medium- and Heavy-Commercial Vehicle Engine Production Forecast

Hydrogen: In it for the long haul

MHCV Alternative Propulsion Forecast Module

Commercial vehicle insights, trends and marketing

The inevitable transformation of the bus industry in South America

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fcan-brazils-commercial-truck-fleet-turn-electric.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fcan-brazils-commercial-truck-fleet-turn-electric.html&text=Can+Brazil%e2%80%99s+commercial+truck+fleet+turn+electric%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fcan-brazils-commercial-truck-fleet-turn-electric.html","enabled":true},{"name":"email","url":"?subject=Can Brazil’s commercial truck fleet turn electric? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fcan-brazils-commercial-truck-fleet-turn-electric.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Can+Brazil%e2%80%99s+commercial+truck+fleet+turn+electric%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fcan-brazils-commercial-truck-fleet-turn-electric.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}