Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 12, 2023

Does the auto industry have an EV loyalty problem?

The easy headline is: "3 out of 4 Luxury EV Households Stick with EVs for Next Vehicle." But remove Tesla's industry-leading loyalty numbers from the equation, and the percentage for the rest of the industry falls off sharply. That could pose a problem for legacy automakers getting people to like — and stay loyal to — electric vehicles.

On the plus side, overall loyalty by fuel type for EVs among luxury

and mainstream brands collectively has soared in the past three

years, according to S&P Global Mobility registration data. But

the data also tells a sobering story: <span/>Nearly half of those non-Tesla EV

households that have acquired a new electric vehicle still purchase

an internal combustion vehicle the next time around.

Excluding Tesla, the fuel type loyalty rate for mainstream brand EV households is 52.1% this year through July, according to the latest S&P Global Mobility loyalty analysis. <span/>That's staying loyal to electric vehicles, regardless of which brand they purchased next (even if they moved on to a Tesla).

"The OEMs are spending huge amounts of money to develop EVs," said Tom Libby, associate director for loyalty solutions and industry analysis at S&P Global Mobility. "<span/>So the last thing they want is for an EV owner to go back to ICE."

Libby adds a caveat: The household data does not necessarily measure whether an EV has been replaced by another EV. The new purchase, in other words, could be a replacement for a different household vehicle.

Part of the loyalty struggle can be attributed to a decrease in openness to purchase an EV. A recent consumer survey by S&P Global Mobility found that a consumer's consideration for purchasing an EV has fallen to 52% from a high of 81% in 2021. Pricing, infrastructure, and range were the top 3 reasons consumers listed for not purchasing an EV. For some consumers, having a traditional ICE or hybrid vehicle is a way to hedge against some of these obstacles.

Among mainstream brands with return-to-market volumes over 1,000 households YTD through July, Nissan had the strongest loyalty to EVs at 63.2%, followed by Chevrolet at 60.6%. To be clear, that's loyalty to EVs in general, not Nissan-to-Nissan EVs or Chevrolet-to-Chevrolet EVs.

Individual models had varied results. Only 37.3% of Ford Mustang Mach-E households bought another EV, versus 45.8% opting for gasoline power. A large chunk of buyers went to Ford truck and SUV models in both ICE and hybrid powertrains, suggesting that vehicle type and capability were more important than the fuel used.

By bittersweet contrast, of the Nissan Leaf households that bought another EV, the most popular next purchase was a Tesla Model Y at 14.3%, followed by another Leaf at 12.4%. Leaf non-EV buyers were <span/>largely brand-loyal — migrating to the Rogue, Pathfinder, Altima, and Sentra.

The Chevrolet Bolt also kept <span/>a majority of households - 60.7% - in EVs, with 28.8% getting another Bolt. Like the Mach-E with Ford, the Bolt saw households that went for gas power mostly turning to Chevrolet SUVs and trucks.

Loyalty to EVs in the Luxury Space

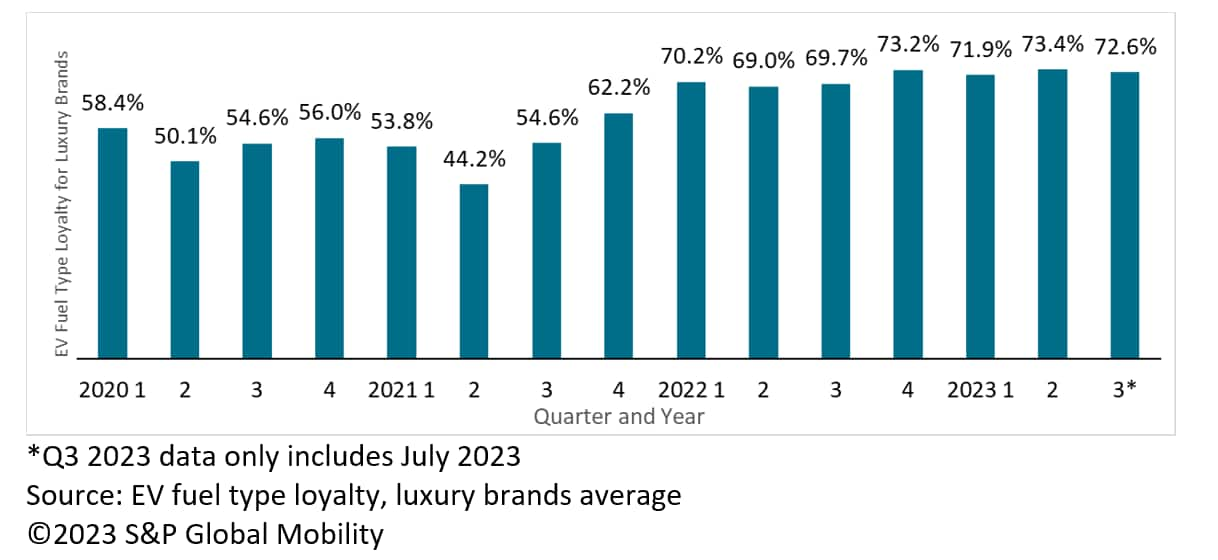

Similar loyalty results appeared in the luxury EV space as well. The EV loyalty rate across the luxury segment has remained consistently above 70% for the past three full quarters and above 60% for the past 18 months.

Impressive, right? However, as the chart below shows, breaking it

down to the specific brand level paints a different picture. With

Tesla's impact on the overall segment removed, S&P Global

Mobility data analysis <span/>show some luxury brands have <span/>a hard time keeping

customers intrigued by EVs.

On the upside, many non-Tesla luxury brands have improved their EV

loyalty rate — especially Jaguar, Mercedes-Benz, and Audi.

Intriguingly, among luxury brands with significant return-to-market

volume, BMW had the highest EV loyalty rate three years ago, but

also has not changed that percentage since.

But can these rates hold as product lines age and new competitors

arrive? What will the Mercedes-Benz EQS or Porsche Taycan buyer do

when they come back to market for a new vehicle in the next few

years? Will they buy one of the 200+ EVs expected to be available

for sale in 2026, or harken back to their legacy luxury brands'

heritage of internal combustion?

Between Tesla picking off EV intenders, and the draw of internal combustion strengths such as towing and payload, legacy ICE automakers face a battle to increase EV loyalty as they transition. Doubling down on EVs to expand their lineups might be the required path to ensure continued loyalty to brand and fuel type.

LIGHT VEHICLE POWERTRAIN FORECASTS

WHAT DO TESLA OWNERS BUY WHEN THEY RETURN TO MARKET?

FUEL FOR THOUGHT: TOO MANY TOYS ON THE SHELF

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

WARNING SIGNS ON THE PATH TO MASS EV ADOPTION

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdoes-the-auto-industry-have-an-ev-loyalty-problem.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdoes-the-auto-industry-have-an-ev-loyalty-problem.html&text=Does+the+auto+industry+have+an+EV+loyalty+problem%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdoes-the-auto-industry-have-an-ev-loyalty-problem.html","enabled":true},{"name":"email","url":"?subject=Does the auto industry have an EV loyalty problem? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdoes-the-auto-industry-have-an-ev-loyalty-problem.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Does+the+auto+industry+have+an+EV+loyalty+problem%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdoes-the-auto-industry-have-an-ev-loyalty-problem.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}