Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Nov 19, 2024

Fuel for Thought: How EU Tariffs Will Impact the Battery Electric Vehicle Market

Listen to this Fuel for Thought podcast

The new EU tariffs

Following in the footsteps of the US, Canada and other markets, on Oct. 30, 2024, the EU imposed countervailing duties on battery electric passenger cars imported from China. This decision follows a 13-month European Commission anti-subsidy investigation, which found that the battery electric vehicle (BEV) value chain in China "benefits from unfair subsidization which is causing threat of economic injury to EU producers of BEVs."

The EU is applying these new tariffs — on top of pre-existing EU vehicle import duties of 10% — based on each manufacturer's contribution to the investigation and the support they are thought to have benefited from. Of the three sampled Chinese exporters, BYD Auto has a tariff of 17%, Geely Group's is 18.8% and SAIC Group's is 35.3%. Other collaborating companies have a 20.7% duty, although they can request an accelerated review to establish an individual rate.

This process is similar to what Tesla already requested, which resulted in its tariff rate of 7.8%. Tariffs for non-cooperating companies are 35.3%. These tariffs will be in force for five years, until the end of October 2029, unless the EU chooses to end them sooner.

Potential alternatives to tariffs

The EU and China are negotiating alternatives to tariffs. One solution is a "price undertaking," which would set a minimum price for imports. The China Chamber of Commerce for Import and Export of Machinery and Electronic Products initially proposed this solution on behalf of 12 exporting automakers, while three exporters have also put forward alternative price undertakings. However, the European Commission said in its final determination that a "price undertaking offer must be adequate to eliminate the injurious effect of the subsidies and its acceptance must not be considered impractical," and this is a bar that the proposals failed to meet.

China's response

China is also pulling other levers to end the tariffs. In November 2024, China filed a dispute complaint to the World Trade Organization.

China has also started to apply, or is considering applying, tariffs to products exported from the EU to China. It has warned that it could raise the tariffs applied to imported passenger cars that have large displacement internal combustion engines (ICEs). China is also looking to apply tariffs to other products, including EU-sourced cognac, pork and dairy.

Our forecast

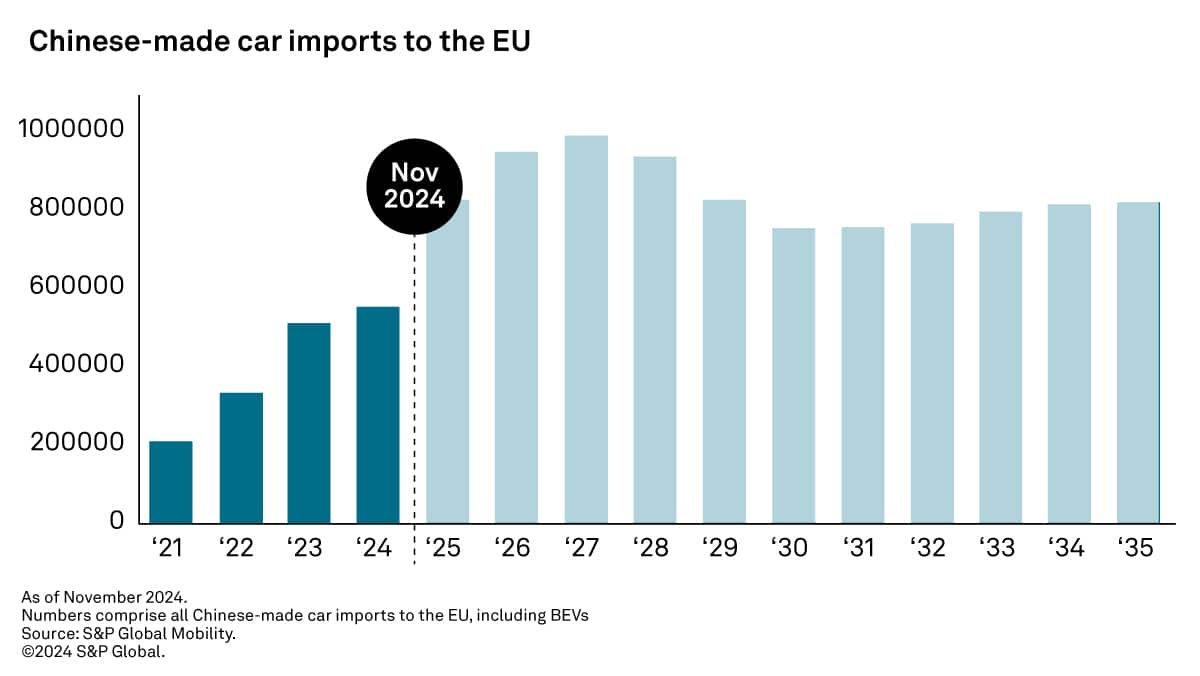

Since the European Commission formally introduced — but did not act on — provisional tariffs in July, S&P Global Mobility has made adjustments to its sales forecast for EU27 markets that partly reflect the impact these measures will have.

While we still expect sales volumes of imported Chinese passenger cars to continue to grow in this region over the next few years, we have adjusted the forecast volumes downward compared to our June sales forecast, before the EU announced preliminary tariffs. Our registration forecast for Chinese-made passenger cars in EU27 now stands at around 550,100 units. Although this figure is down from our earlier expectations, it will still be an improvement over 2023 by 8.1%.

We are adjusting our forecast for Chinese-built passenger cars registered in EU27 beyond 2024. In S&P Global Mobility's Light Vehicle Sales forecast for November, the sales ramp-up from 2025 to 2027 is expected to decrease again. Tariffs will prevent China-built passenger car sales in the EU27 from reaching the previously forecasted peak of 1 million units in the second half of the decade.

The forecast volumes above include not only vehicles from Chinese brands but also passenger cars built by non-Chinese automakers. These companies — including Tesla, Renault Group, VW Group, BMW Group, Honda, Mazda and Toyota — import vehicles into EU27 from their production sites in China.

How automakers are responding

Beyond the impact of tariffs on BEVs, a key reason for the decline of imported Chinese-built passenger cars to the EU27 is non-Chinese manufacturers' plans to move production of some Chinese-assembled products to Europe toward the end of the decade. This move would include the Volvo EX30, which will be moved to a facility in Belgium, and the new generation battery electric Mini Cooper and Aceman, which will be made in the UK.

Chinese automakers have also taken steps to move production to EU27 or the surrounding regions. BYD plans to open production sites in Hungary and Turkey during the next three years, but other Chinese automakers' plans to make investments in the EU have cooled. This may be linked to reports that the Chinese government is putting pressure on its vehicle producers to pause searches for sites in the region and not sign new deals as negotiations about the tariffs continue. Those thought to be doing so include Chery Auto, Chongqing Changan Automobile and Dongfeng Motor Group.

Nevertheless, the door appears to remain open for Chinese vehicle producers to build assembly plants in Turkey, where rules allow them to avoid some import tariffs by making local investments. Thanks to a customs union—an agreement to eliminate tariffs — between Turkey and the EU, these investments could allow Turkey to serve as an export hub to the EU for Chinese automakers. BYD, SAIC Group and Chery have been linked with Turkish production investment.

Despite the tariffs on BEVs, several factors will come into play that suggest the impact on Chinese passenger car imports will not be as significant as it could have been. For example, S&P Global Mobility expects that Chinese brands will replace some of the decreased BEV imports to the EU with more imports of ICEs, hybrids and plug-in hybrids.

At the same time, Chinese brands' pricing strategies may have allowed them to handle some of the increased costs despite tariffs. Our analysis suggests that the on-the-road price discrepancy for some models in China vs. in EU27, especially that seen by Chinese brands, is unlikely to be solely due to the 10% import tariff and shipping costs and more likely to OEMs choosing to have higher prices as part of their EU27 market strategy.

Nevertheless, there will be other knock-on effects from having fewer Chinese BEV imports to the EU. There could be fewer BEVs overall registered in the EU, especially if some customers are no longer interested in switching because the Chinese-made products don't appeal to them anymore. At the same time, these customers could also replace existing vehicles with non-BEVs from China or elsewhere. This would slow the growth of BEVs in the EU27 market and run counter to the European Commission's current carbon dioxide reduction targets.

Get updated forecast through 2028: EU BEV Sales (Imported from China)

Subscribe to our Fuel for Thought newsletter

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2feu-tariffs-chinese-electric-vehicles-impact.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2feu-tariffs-chinese-electric-vehicles-impact.html&text=Fuel+for+Thought%3a+How+EU+Tariffs+Will+Impact+the+Battery+Electric+Vehicle+Market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2feu-tariffs-chinese-electric-vehicles-impact.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: How EU Tariffs Will Impact the Battery Electric Vehicle Market | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2feu-tariffs-chinese-electric-vehicles-impact.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+How+EU+Tariffs+Will+Impact+the+Battery+Electric+Vehicle+Market+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2feu-tariffs-chinese-electric-vehicles-impact.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}