Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 24, 2024

Shop Your Own Closet: How Cleaning & Augmenting First-Party Data Supercharges Automotive Marketing

Marketers can use their first-party data to develop more effective messaging, reduce waste and sell more vehicles.

You know who purchased the vehicle. You have their address, phone and e-mail. You know the model, trim level, and where and when they purchased. This information is a strong start for a customer profile, but it's just a start and everyone else who sold a car has the same data. Considering that nearly one-in-two new car buyers today will switch brands, the competition for customers has never been greater, especially in today's increasingly fragmented and data-driven economy.

The competition for customer attention, retention and growing sales will be won in the trenches of first-party data.

Managing consumer identity and associated attributes touches every element of automotive marketing. As fragmentation across media types and customer connection points expands, the challenges of acquiring and retaining customers increases exponentially.

From building a pipeline for new vehicle launches to generating service revenue and vehicle acquisition efforts, marketers that can match targeted offers to specific customer segments are going to be more effective in driving conversions and improving campaign performance.

With more than 50 new vehicle launches scheduled for 2025 — and nearly half will be an EV — every OEM should be looking at their customer base to evaluate and find the best prospects. The brands that have the richest view of their customers will ultimately emerge as the winners.

Are your marketing strategies using first-party data to outsell the competition?

Shop your own closet — find the best opportunities in your customer base

Let's say you're an OEM getting ready to launch a Compact Utility EV. Step one is looking in your own closet and understanding which existing customers are your best prospects for an EV and which ones are most likely to be shopping full-size SUV gas vehicles.

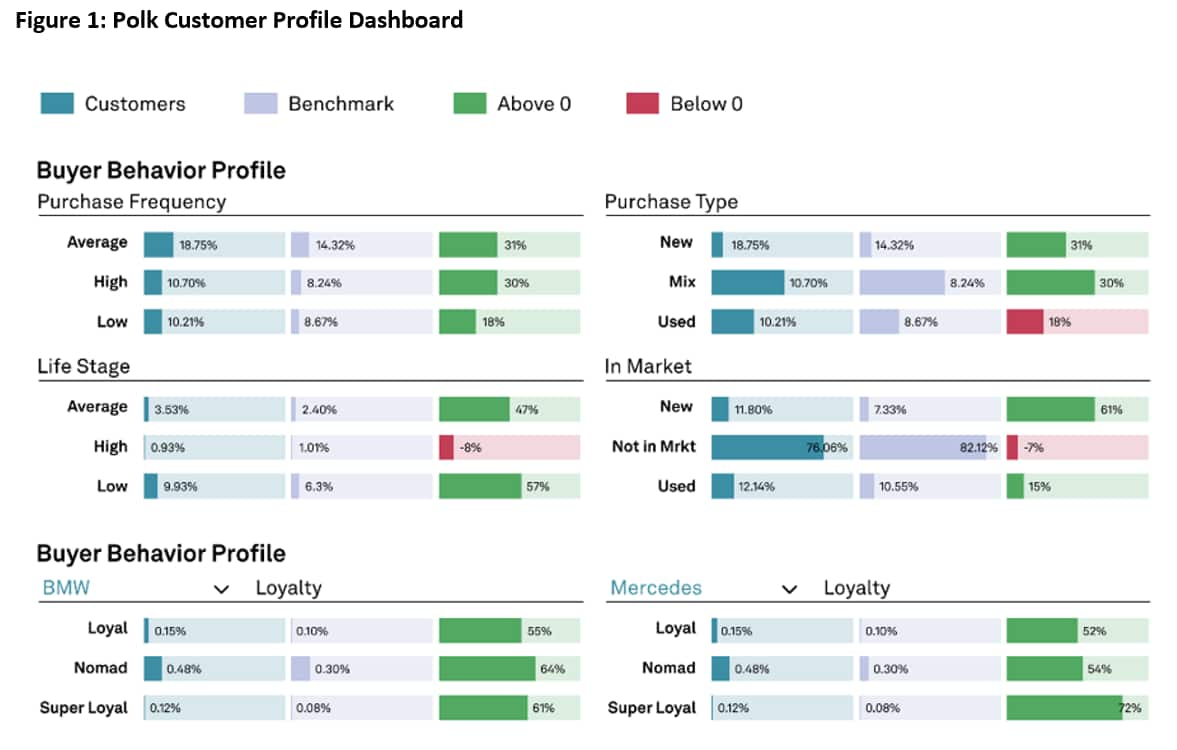

By using the most recent 12 months of insights from Polk Audiences' data, marketers can learn more about ownership trends as well as compare marketplace benchmarks between new, existing, and competitive model customer sets to inform messaging and get the most of that closet (See Figure 1).

First-party data enhancement helps both manufacturers and dealerships reduce waste and improve ROI

Additionally, enriching your first-party data assets also provides an opportunity to clean your closet. Are your customers still your customers? How many service offers do you send a year to customers that no longer own that vehicle? At minimum, this is a lost cost fueled by wasted impressions; potentially worse, a customer or prospect becomes annoyed with an irrelevant offer.

For example, while using our PAS suite of solutions, a dealer group recently discovered that nearly 40% of their customer database was obsolete. This equated to nearly 1 million customers receiving regular owner e-mails and direct mail service offers for a vehicle they no longer owned. Imagine the cost savings realized when impressions aren't wasted on one million obsolete profiles every year.

Here are a few important ways marketers can use their

first-party data to develop more effective messaging, reduce waste

and sell more vehicles:

- Employ vehicle verification. Does the household still have the

car or not?

- Resolve gaps from inaccurate data. Uncover prospects in your

existing customers for new vehicle launches.

- Enrich customer profiles. Go beyond the most recent purchase to

bring multiple datapoints together to develop a comprehensive

household profile.

- Scale your first-party assets to develop more informed communications to your customers and extend your reach with these net-new audiences.

Authored by Craig Prater, Product Management Associate Director and Julie Mynster, Product Management Executive Director, S&P Global Mobility.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirst-party-data-automotive-marketing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirst-party-data-automotive-marketing.html&text=Shop+Your+Own+Closet%3a+How+Cleaning+%26+Augmenting+First-Party+Data+Supercharges+Automotive+Marketing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirst-party-data-automotive-marketing.html","enabled":true},{"name":"email","url":"?subject=Shop Your Own Closet: How Cleaning & Augmenting First-Party Data Supercharges Automotive Marketing | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirst-party-data-automotive-marketing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shop+Your+Own+Closet%3a+How+Cleaning+%26+Augmenting+First-Party+Data+Supercharges+Automotive+Marketing+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirst-party-data-automotive-marketing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}