Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 13, 2023

First-ever major US metro area hits 50% electrified vehicle registrations in March

San Francisco BEV and hybrid sales combine to outsell pure-gasoline vehicles

In a milestone for the growth of electrified vehicles in the United States, half of all new retail vehicle registrations in the San Francisco DMA (Designated Market Area) in March were electrified, according to new analysis of the latest registration data available from S&P Global Mobility. This represents the first time a major US metropolitan area has reached this threshold. San Francisco's 50% electrification level is more than three times that of the United States (16.6%) in the same March period. To show it was not a one-time event, the growth of electrification in San Francisco continued in April, reaching yet another record of 53.1%.

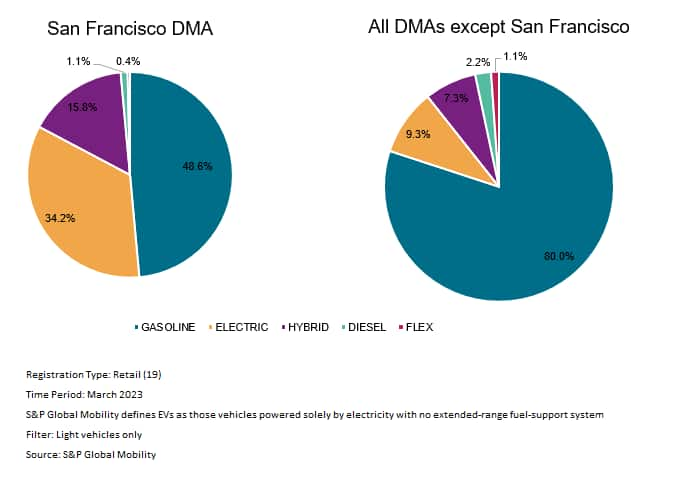

Note that "electrified" includes battery-electric and gasoline-electric hybrid vehicles; both of which played roles in propelling San Francisco to this new height: The San Francisco DMA's EV share in March of 34.2% was more than four times the US average of 7.3%, and the Bay Area's hybrid share of 15.8% was more than 6 percentage points above the United States' hybrid rate of 9.3%.

Retail market share by powerplant, San Francisco vs Rest of United States, March 2023

Two key drivers of San Francisco's success with electrification include:

- The remarkable similarities between the San Francisco and EV customer profiles (see table below); and,

- The appeal of several EV brands outside of just Tesla, including less well-known (for EVs) marques as well.

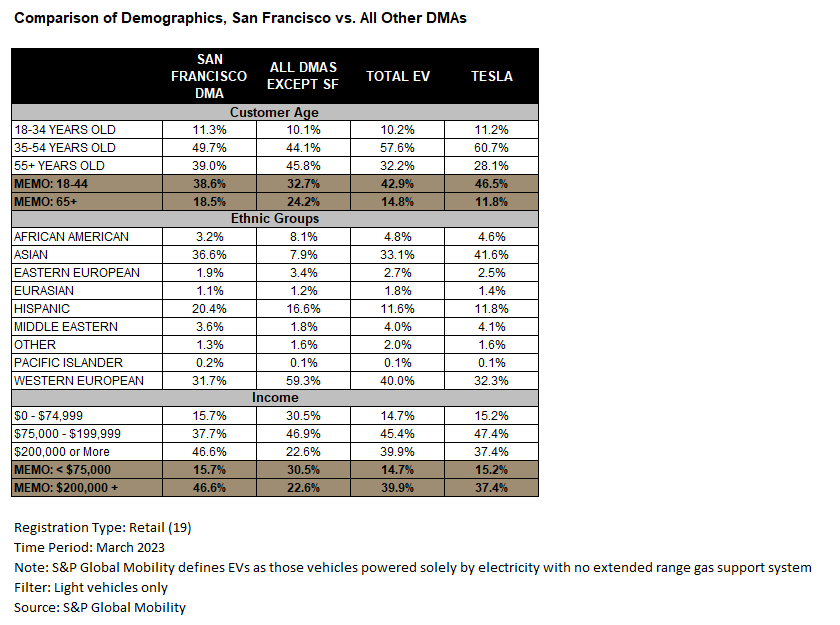

In the Bay Area, 38.6% of new vehicle buyers in March were ages 18-34, versus 32.7% in the remaining DMAs; this skew towards younger buyers in the Bay Area was in the direction of but still below 42.9% for all EV buyers nationally.

The demographic makeup of the San Francisco market is similar to the profile of the EV buyer nationally, as reflected in several metrics. Looking specifically at the ethnic mix, more than a third of all San Francisco buyers in March were Asian-American, slightly above the national EV average of 33.1% but more than four times the average across the rest of the United States. Further, Middle Eastern households represent 3.6 percent of all new vehicle registrations in San Francisco, near to the national EV mix of 4.0 percent but double the non-San Francisco average of 1.8%.

One key demographic element among electrified buyers: They are well off financially. Almost half of San Francisco buyers (46.6%) enjoyed a household income of more $200,000, similar to the 39.9% for all EV buyers, but more than twice the ratio of non-San Francisco consumers at 22.6%. At the other end of the spectrum, only 15.7% of Bay Area buyers had household income of less than $75,000, close to the 14.7% for all EV buyers nationally but only half of the non-San Francisco average of 30.5%.

Additional S&P Global Mobility analysis of registration data by zip code showed the top penetrations for electric vehicles were not in the "7-by-7" square miles of what is considered the city of San Francisco - although hybrid vehicles make significant penetration there. Rather, the wealthy Bay Area enclaves such as Los Altos, Saratoga, Piedmont, and Orinda have among the largest EV representations. One intriguing data point: One of the highest EV penetrations was in the zip code for San Ramon - home to the global headquarters of Chevron.

San Francisco Bay Area zip codes by EV Retail Share: April 2022-March 2023

In reaching such lofty electrified registration numbers, several brands achieved shares of the EV market in the Bay Area far above their EV shares in the remaining DMAs (see table below).

Predictably, Tesla's share in the backyard of its original Palo Alto world headquarters and the Fremont home of its first US assembly plant was almost five times its share in the rest of the country. Tesla's share of the overall San Francisco EV market was 66.4% in March, with the brand accounting for almost one of every four new vehicles registered in San Francisco (across all fuel types and all brands).

But other EV models also performed well in the Bay Area: The Volkswagen ID4's share of the San Francisco DMA quadrupled from 0.3% to 1.4%, and Chevrolet Bolt share rose from 0.2% to 1.2% with its resurgence.

Hybrids also played a key role in driving San Francisco beyond the rest of the US in electrification. The strong Toyota hybrid share of 6.5% has been driven by its broad hybrid product portfolio. Honda hybrid share has climbed to 2.8%, Lexus hybrid share tripled to 1.5%, and Kia also gained ground in the Bay Area due to strong hybrid demand.

The S&P Global Mobility analysis indicates the Bay Area results in March are not an anomaly. While San Francisco was the first DMA to reach 50% electrification, other DMAs are not far behind. Five DMAs' electrification rates (besides San Francisco) surpassed 30% in March, including Seattle, San Diego, Portland, Los Angeles, and Sacramento, with the first two exceeding 35%. As more EVs become available in the US market, an increasing number of DMAs will achieve a 50% electrification rate - and beyond.

Read more

When will the heartland embrace electric vehicles

Improving real-world driving range is crucial to mainstream EV adoption

EV chargers - How many do we need?

Electric vehicles have a gender issue with women

FOR MORE ANALYSIS OF ELECTRIC VEHICLE TRENDS

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirstever-major-us-metro-area-hits-50-electrified-vehicle-regi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirstever-major-us-metro-area-hits-50-electrified-vehicle-regi.html&text=First-ever+major+US+metro+area+hits+50%25+electrified+vehicle+registrations+in+March+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirstever-major-us-metro-area-hits-50-electrified-vehicle-regi.html","enabled":true},{"name":"email","url":"?subject=First-ever major US metro area hits 50% electrified vehicle registrations in March | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirstever-major-us-metro-area-hits-50-electrified-vehicle-regi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=First-ever+major+US+metro+area+hits+50%25+electrified+vehicle+registrations+in+March+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffirstever-major-us-metro-area-hits-50-electrified-vehicle-regi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}