Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Feb 21, 2023

Fuel for Thought: The old way of selling cars won’t work anymore

LISTEN TO THIS PODCAST

Vehicle inventories are returning to dealer lots, purchasing methods are changing, and car-shoppers are expecting more of the transaction process to occur online.

The easy days of selling from low inventories are over. Brands, dealers, and salespeople need to start fighting for auto buyer attention and consideration once again, and need to work together to win. As inventories continue to move toward pre-pandemic levels, customers are finding themselves with more freedom when it comes to selecting a vehicle, the price they pay, and how they shop.

Nowhere was this looming trend more evident than on the NADA show floor in Dallas, where thousands of dealers, vendors, and automaker reps came together to discuss the near- and long-term future of automotive retail.

Inventories Are Coming Back

While still nowhere near pre-COVID levels, S&P Global Mobility analysis shows that dealer advertised inventory has been steadily increasing over the past six months across both mainstream and luxury markets. On average, mainstream customers have over 50% more inventory to shop from than they did six months ago; and luxury customers, about 40% more.

This uptick in advertised inventory is adding some autonomy back into customers' purchase decisions. "There's not as much pressure to take what's on the lot today, so customers are able to shop different brands and dealerships more than over the past year or so," said Kristen Balasia, vice president of advisory services at S&P Global Mobility.

We're also seeing that US car-shoppers who don't need a vehicle urgently are more willing to order and wait for the car they want. Retailers need to be prepared for potential customers to start shopping around again ahead of signing purchase agreements.

Customers are searching for more than just the vehicle, they're also out looking for the deal they want, according to our Vehicle Buyer Journey survey. As inventories continue to creep up, so will the incentives and discounts. For most of the past two years, the high-demand vs short-supply gap almost guaranteed a new-car shopper would pay well more than sticker price - which also drove used-car prices higher.

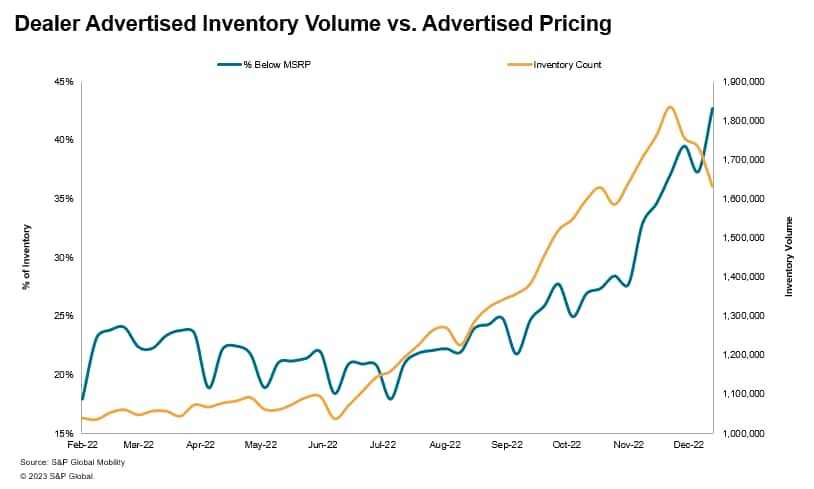

As the gap narrows (albeit still sizeable from traditional norms), we're starting to see more vehicles listed for less than MSRP. As of January, S&P Global Mobility analysis shows that 40% of inventory is being advertised with some kind of discount, compared to less than 20% six months ago. (Dealer inventories that did not list pricing are excluded from this calculation.)

Customers can now be pickier with the vehicle and price, which translates into being picky about the brand and dealership they want to buy from. This likely means a return of cash and APR incentives to close the deal.

"Brands and dealers should be mindful of what offers potential buyers are seeing online or see hitting their mailboxes. With more availability and competition, the fight for market share and loyalty is back," Balasia said.

S&P Global Mobility research shows a decline in brand loyalty while inventory was scarce. Now loyalty is rebounding slightly as inventories rise. But will that continue, or will customers continue to shop around? Retailers need to have the right procedures in place to keep their remaining customers and lure back the defectors.

On average, as advertised inventory increases, the percentage of advertised listings priced below MSRP also increase, reaching more than 40% in January.

Digital Retail Transformation

One of the more potent retail concepts is, "Right product, right price, right place." We know that customers are more willing to wait for the right product, and shop for the right price. An increasing trend in data also confirms a transformation to digital retail. More than ever, the "place" is no longer only a physical location. This was borne witness at NADA, where so many conversations involved the evolution in digital tools and processes.

Car shoppers have long been initiating the buying process online by manually comparing and researching. But online comparison tools are merely table stakes; being able to complete parts of the lengthy (formerly entirely in-dealership) transaction process online is the new differentiator. The availability of these conveniences is not a nice-to-have amenity; consumers tell us that they've driven further, and interacted with unfamiliar dealerships, to get the desired online experience.

Many vehicle buyers surveyed in 2022 stated they expect to complete their next vehicle purchase entirely online. Retailers should be ready to allow their customers virtual access to the process of buying a vehicle.

"Whether this means dealerships open their virtual doors to parts of the process like F&I, or offer the option for a completely online transaction, it's the direction that consumers are pushing us in, and they'll go where they need to to find it." said Balasia. And while the vast majority of car shoppers still expect to conduct test drives, they want to schedule them online and have the experience delivered right to their driveway.

The growth in EVs

The arrival of electric vehicles into the internal-combustion marketplace is having unintentional consequences for dealers and manufacturers.

Selling an EV is a completely different sport than selling an ICE vehicle. Even brand-loyal customers are basically starting over when purchasing an EV; consumers moving to electric vehicles in 2022 are largely doing so from Toyota and Honda.

"With all the new EV entrants hitting the market, a customer deciding that an EV fits their lifestyle is entering a different class and competitive group for potential options than they've previously considered," said Joe Kyriakoza, vice president, Polk Automotive Solutions at S&P Global Mobility. "Brands will need to think differently about their marketing strategies in order to stand out against this different pool of competitors."

We're still in the early days of the EV conversation for dealers, but savvy dealers know that this revolution is coming and that it will impact the way they do business. They're looking at the time and monetary investments needed to compete in the EV world and learning the different processes required to sell an EV.

Salespeople in dealerships also need to embrace a different knowledge set on what EV ownership looks like to properly educate and ultimately sell to customers. EVs are requiring a new step in the sales process; salespeople need to guide customers on how to own an EV, rather than just how to purchase it.

It's not just a different driving experience. EV customers need to feel comfortable knowing how they're going to live with their vehicle. Which charging stations can they use? How will different station types impact charging times and range? Is the EV buyer's house properly equipped to have a charger installed?

Another disruptive aspect of EVs is in marketing. "You would market an electrified version much differently than the ICE version of the same vehicle," Kyriakoza said. "Your competitive set would be different, your audience would be different, and so would the channels by which you reach your customers. We're constructing and launching entirely new audiences to support EV marketing."

All aspects of this new environment tell us that selling is coming back into the picture. Being sold a car is organically growing to be part of the consumer process again. Customers are walking away from what would have been a done deal six months ago; every step of the sales process needs to be tailored to meet the new expectations of our product's audience.

With increasing expectations and competition, dealers and brands need to take a deep look into how their products, incentives, processes, and marketing align with their customer. Everyone involved on the retail side needs to commit to these changes or else risk being left behind.

Author: Grant Gitre, Consulting Associate Director, S&P Global Mobility

--------------------------------------------------------------

Dive deeper into these marketing assets:

Register Now: Join our 2023 Automotive Loyalty Summit Webinar on Feb. 28th

Read the Blog: Americans appear ready for the European car-ordering model

Register Now: 2023 Brand Performance Review Webinars - March 16 & 23

Download: Polk Audiences: Learn more about our new EV segments

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-old-way-of-selling-cars-wont-work-anymore.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-old-way-of-selling-cars-wont-work-anymore.html&text=Fuel+for+Thought%3a+The+old+way+of+selling+cars+won%e2%80%99t+work+anymore+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-old-way-of-selling-cars-wont-work-anymore.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: The old way of selling cars won’t work anymore | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-old-way-of-selling-cars-wont-work-anymore.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+The+old+way+of+selling+cars+won%e2%80%99t+work+anymore+++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-old-way-of-selling-cars-wont-work-anymore.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}