Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 24, 2024

January 2024 US auto sales feel the chill

January 2024 auto sales are expected to decelerate from the quickening realized in December, with the pace of demand falling back to a SAAR of 15.2 million units

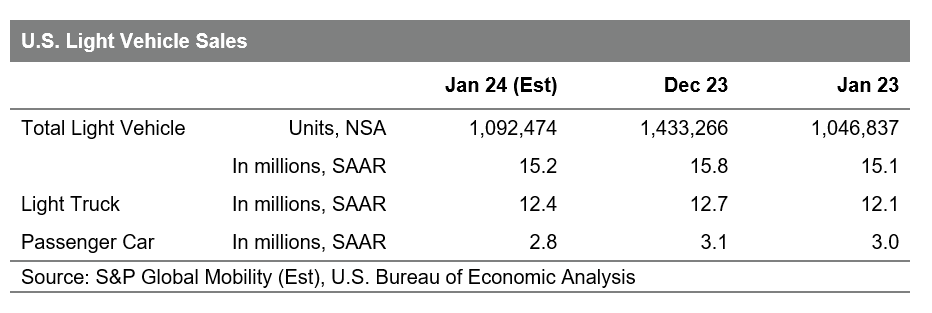

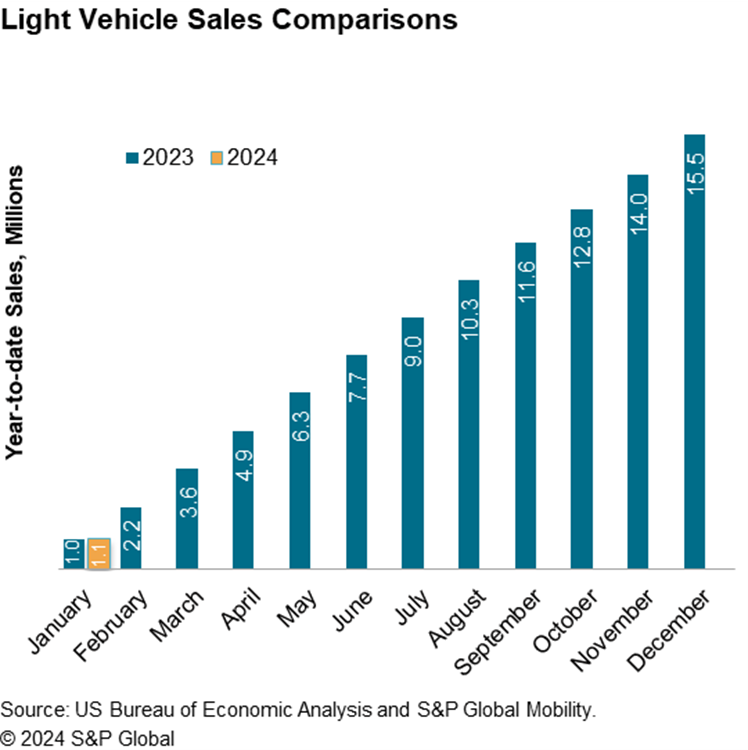

With volume for the month projected at 1.09 million units, January 2024 U.S. auto sales are estimated to translate to a sales pace of 15.2 million units (seasonally adjusted annual rate: SAAR). While this would be an improvement from the year-ago level, the result reflects a potential preview to the upcoming calendar year whereby month-to-month volatility is expected to remain in the market. Contributors to the chill in the January sales pace include an expected hangover from the solid closeout to sales in December 2023, combined with some inclement weather effects.

The S&P Global Mobility US auto outlook for 2024 projects sustained, but more moderate growth levels for light vehicle sales. We expect production levels to continue to develop, especially early in the year as some automakers look to continue to restock in the wake of production shutdowns late in 2023 and decent December 2023 sales volume. The advancing production levels set the stage for incentives and inventory to continue to develop, potentially enticing new vehicle buyers who remained on the sidelines due to higher interest rates. S&P Global Mobility projects a calendar-year 2024 volume of 15.94 million units, a 3% increase from the 2023 tally.

"Auto consumers continue to be impacted by an uncertain purchase environment. While positive developments regarding mildly retreating vehicle prices, rising inventory, and incentive levels bode well, interest rates remain high, and economic headwinds remain," said Chris Hopson, principal analyst at S&P Global Mobility. "A volatile purchase environment for auto consumers will continue to dictate monthly sales levels."

Dealer-advertised vehicle inventories continue to climb. Available new vehicle dealer inventory listings for the US market increased to 2.45 million units at the end of December, said Matt Trommer, associate director of Market Reporting at S&P Global Mobility. This is a slight 0.6% increase from November and a 53% year-over-year increase.

"With growing inventory levels, the average advertised discount of vehicle listings has continued to rise and by the end of December stood at $3,030, an increase of 10.5% vs. the previous month," Trommer said.

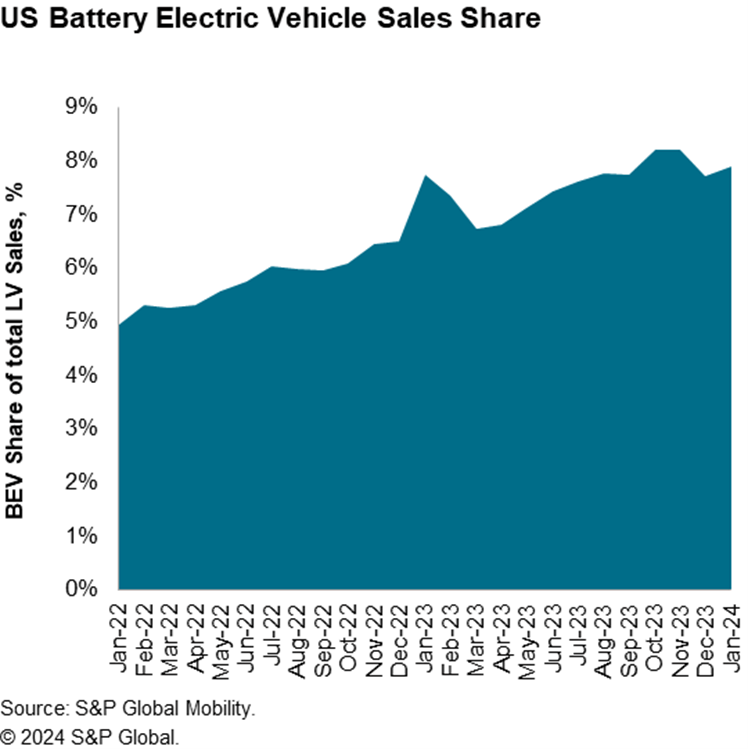

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer-term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. January BEV share is expected to reach 8.0%, similar to the month prior reading as automakers, dealers, and consumers digest the changes to IRA Federal tax credits to begin the new year. BEV share is expected to advance over the next several periods, pending the rollouts of vehicles such as the Chevrolet Equinox EV, Honda Prologue, and Fiat 500e, all scheduled for market introductions over the first half of 2024.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjanuary-2024-us-auto-sales-feel-the-chill.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjanuary-2024-us-auto-sales-feel-the-chill.html&text=January+2024+US+auto+sales+feel+the+chill+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjanuary-2024-us-auto-sales-feel-the-chill.html","enabled":true},{"name":"email","url":"?subject=January 2024 US auto sales feel the chill | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjanuary-2024-us-auto-sales-feel-the-chill.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=January+2024+US+auto+sales+feel+the+chill+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjanuary-2024-us-auto-sales-feel-the-chill.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}