Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 21, 2023

June auto inventory trends you should know

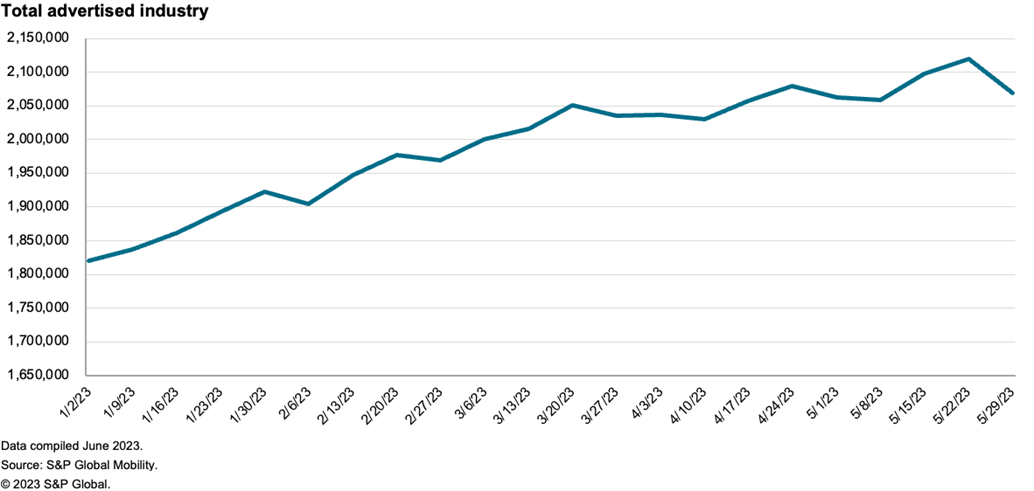

While dealer-advertised vehicle inventories continue their several-month trend of meandering around 2.050 million vehicles - though a startling 72% increase year-over-year - there are some discernable recent inventory trends based on S&P Global Mobility's data. While many brands continue to struggle to keep dealers supplied, others are seeing relief for the first time since the pandemic.

There has been a predictable rise and fall through the weeks of the

month since March - which hints at a return to a more normal or

predictable inventory flow. As dealers come under pressure to hit

volume targets, they accelerate sales at month's end, leading to

short supply in the first week of the new month, which then

restocks during the second and third week, leading once again to

month-end clearances. Here are some of the notable movers and

shakers in June inventories:

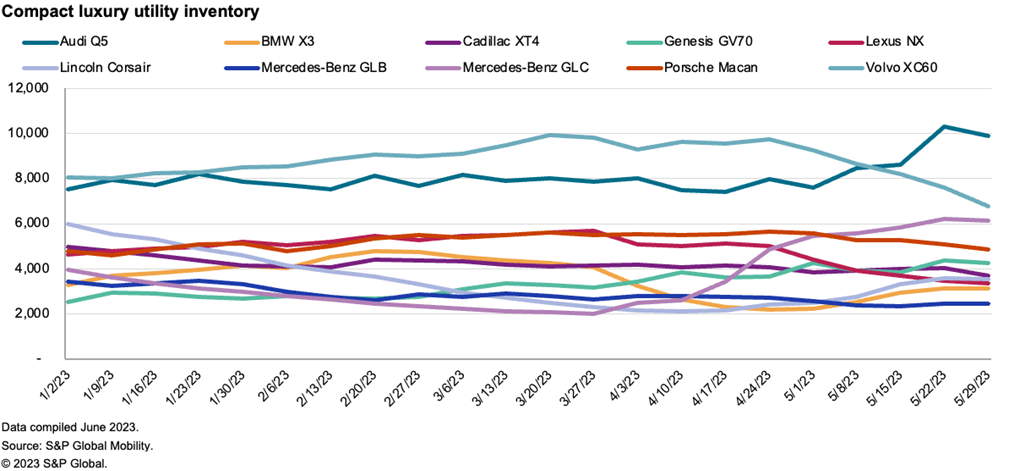

Compact Luxury Utility Vehicle dogfight

The European-brand luxury compact SUV market is heating up. The

Audi Q5 has seen its inventories jump sharply by 31% since January,

to about 9,900 units in June (a typical good sales month for the Q5

is between 5,500 and 6,000 units). Meanwhile, the redesigned 2023

Mercedes-Benz GLC is starting to arrive in showrooms in earnest,

after the selldown of the old model, and while inventories are

recovering somewhat, GLC stocks still remain in a valley. BMW X3

inventories remain flat. Meanwhile, Volvo is lurking with

substantial XC60 inventories, even though they have dipped since

March. This scenario may present Audi and Volvo with an opportunity

for conquest during the summer-sale season.

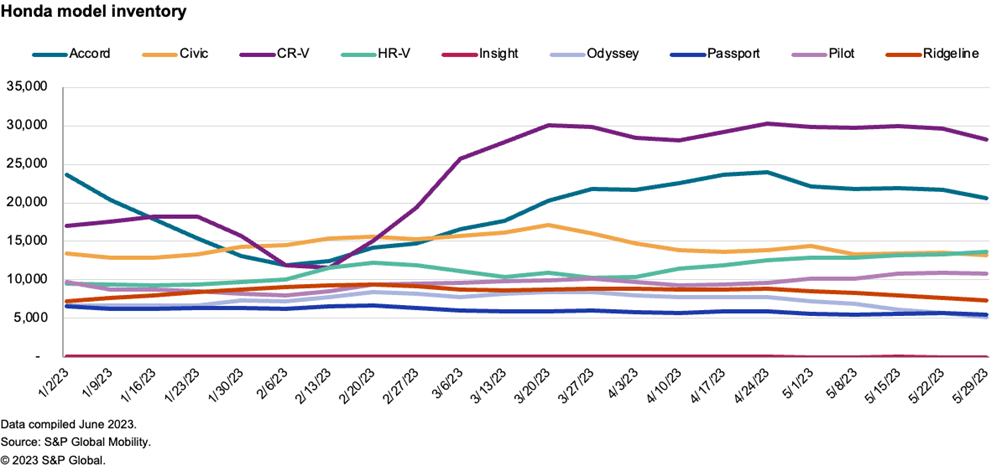

Honda CR-V, Accord launches

The redesigns of the top-selling Honda CR-V crossover and Accord

sedan put dealers in an inventory gulley as the old models sold

down, but stock is recovering quickly. Just a few months ago,

inventories for the CR-V were down to just 11,600 units in

mid-February (for a model that peaked at 384,168 units sold in

2019). As of the first week of June, CR-V inventories were a

healthy nearly-30,000-unit level. Same for the Accord: At about

11,900 units in mid-February; now at about 22,000. There is still

room to grow, but it seems sufficient to at least let consumers see

some variety on showroom floors.

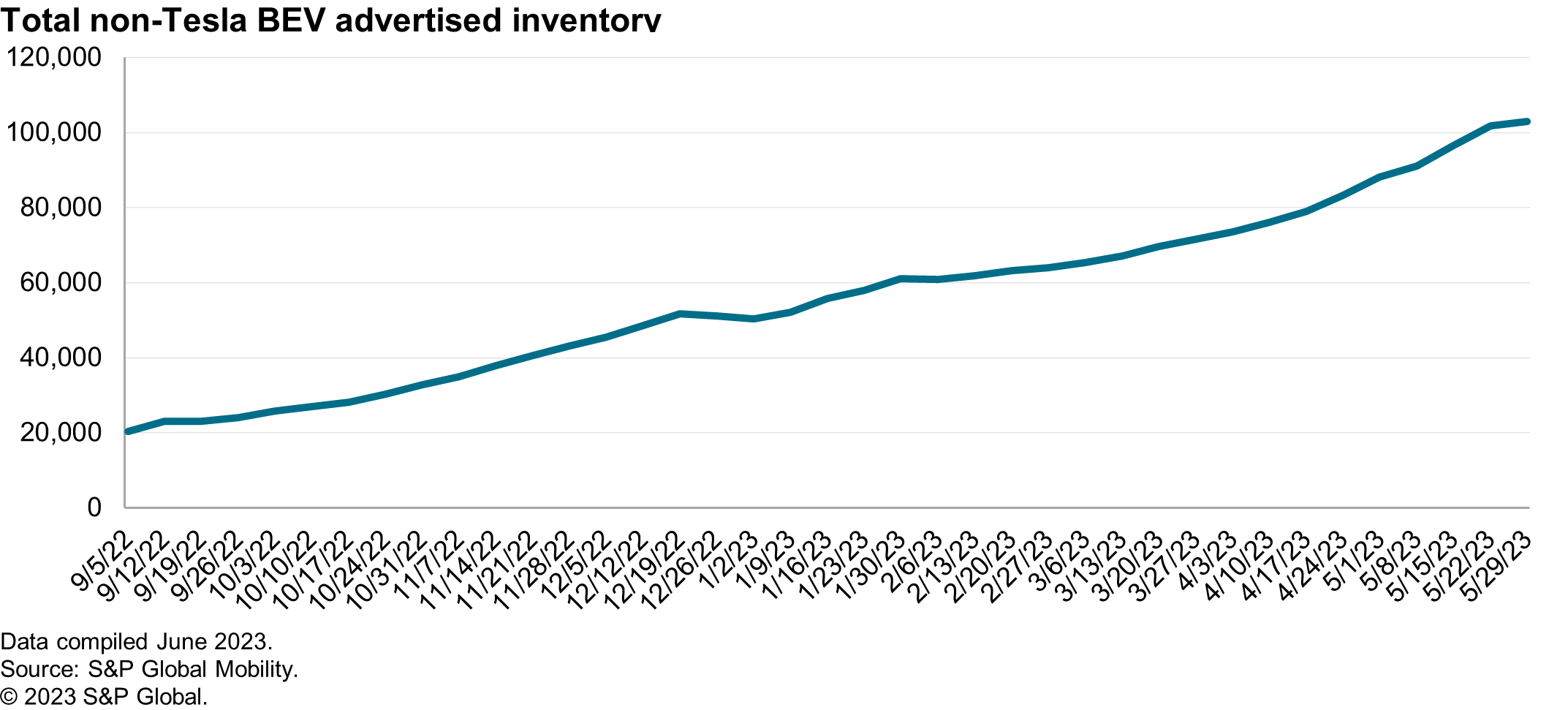

Non-Tesla EVs entering the fray

The battery-electric scene is heating up, even without counting

Tesla. In mid-September, legacy-brand BEVs accounted for about

20,000 units. As of early-June, that number has leapt to more than

100,000 units - a five-fold increase in just nine months (and not

counting Rivian, Lucid, or Tesla). Of that inventory, 30% is in

California. Given that the

San Francisco Bay Area just cracked 50% electrified share in

March and April, that allocation should be little surprise.

Hyundai, Ford carrying most EV inventory

At the end of May, Hyundai had the most EVs in dealer advertised

inventory, at about 15,000 units. But the fast mover is Ford, which

passed Hyundai in early June. Perhaps maximizing the marketing

impact of its shared-charger arrangement with Tesla, Ford has

tripled its advertised inventories of the Mustang Mach-E in little

more than a month. By early-June, Mach-E inventories were at about

11,000 units - for a vehicle that has cracked the monthly

5,000-units-sold only once since launch, and which hasn't broken

3,000 units yet this year. This could be a sign that Ford is truly

entering the EV sales and share race. Not that VW is standing

still, as its ID.4 advertised inventories have doubled to 10,900

units since early in the year - with no signs the Chattanooga

factory is slowing down. On the flipside, at the beginning of the

year, the Chevrolet Bolt had the most inventory of any BEV; now

it's a distant fifth.

Ford ramping up F-150 for summer

There is a lot of action happening in full-size pickups. Chevrolet

tapping its production brakes by halting its Fort Wayne, Indiana,

truck plant for two weeks in late March had an immediate impact.

Although GM's three other full-size pickup plants in Mexico, Canada

and Flint kept on trucking, inventories have decreased from about

90,000 units to about 72,000 units in early June. For reference,

Chevrolet sold 87,111 units of the Silverado 1500 (light duty) in

the first quarter. Meanwhile, Ford full-size pickup inventories

continue to climb, from about 43,000 units a year ago to 115,000

units in early June. But F-Series sales are also charging, with

April and May marking the hottest back-to-back F-Series months

since before the pandemic, with more than 140,000 total units sold.

Third-place Ram continues to see relatively lower inventories; in

fact, premium branded GMC pickups now have nearly as many

advertised units as the Stellantis truck brand.

As the summer selling season approaches, how OEMs deal with suddenly surging inventories against brands still facing availability challenges will mark who will blink first in what could be a red-hot incentives war to gain precious market share.

LOWER-CREDIT BUYERS PUSHED OUT OF

NEW VEHICLES

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN '23

AVERAGE VEHICLE AGE REACHES RECORD 12.5 YEARS

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjune-auto-inventory-trends-you-should-know-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjune-auto-inventory-trends-you-should-know-.html&text=June+auto+inventory+trends+you+should+know++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjune-auto-inventory-trends-you-should-know-.html","enabled":true},{"name":"email","url":"?subject=June auto inventory trends you should know | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjune-auto-inventory-trends-you-should-know-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=June+auto+inventory+trends+you+should+know++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjune-auto-inventory-trends-you-should-know-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}