Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsLower-credit buyers pushed out of new vehicles; bad news for younger shoppers

Consumers with lower credit scores are increasingly being pushed out of the new-vehicle market by rising interest rates, leaving it dominated by more credit-worthy households. Younger buyers' market share is also shrinking, according to analysis from S&P Global Mobility.

"The market in general has moved in the direction of households with greater financial resources," said Tom Libby, associate director of loyalty solutions and industry analysis at S&P Global Mobility. "With rising interest rates, we're seeing a decline in the participation of the lower credit tier in the new vehicle market."

The average percentage rate (APR) for auto loans, not including leases, dropped slightly in February compared to the previous month, to 6.6%. The drop is not enough to impact the overall trend, however. The APR has been above 6% since November 2022. As a result, a growing segment of borrowers cannot access the new-vehicle market.

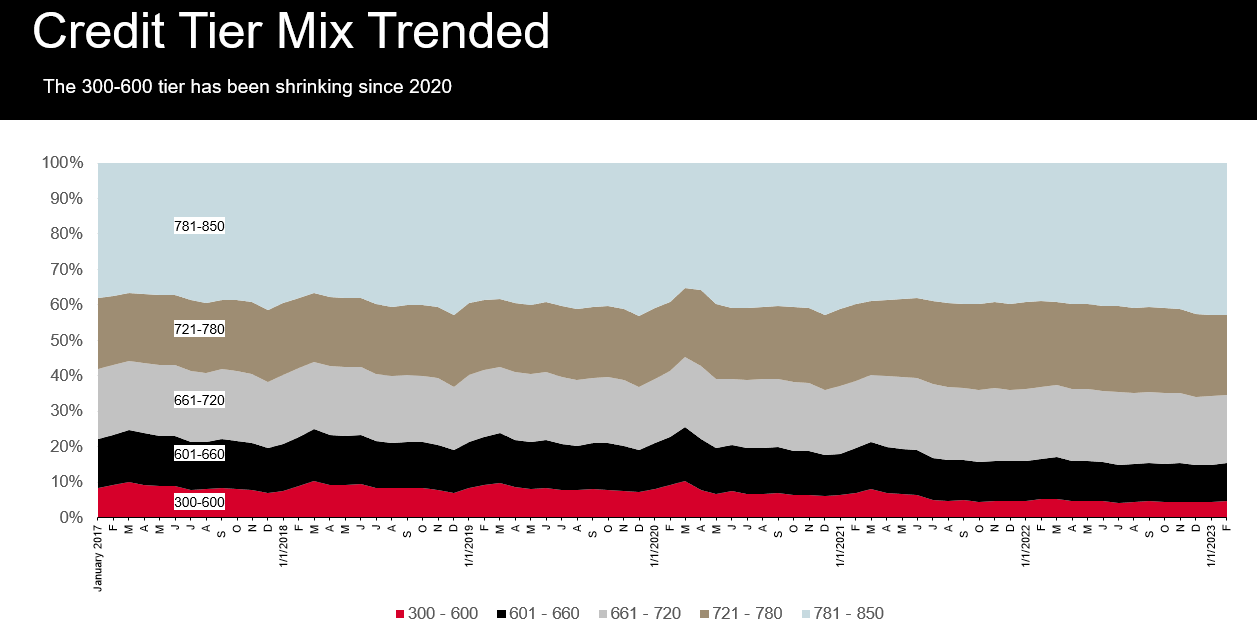

Source: S&P Global Mobility- Catalyst for Insight with TransUnion®

Note: All data filtered for new and loan

In February - the most recent data available - the average credit

score for a purchaser dropped 0.5 points compared to January to

744.8. But the average credit score has been rising for five years.

In February of 2017, it was 727.9, according to S&P Global

Catalyst for Insight with TransUnion®.

Source: S&P Global Mobility - Catalyst for Insight with TransUnion®

Note: All data filtered for new and loan

Fewer and fewer borrowers with credit scores between 300 and 600

have been obtaining loans. In February of 2023, only 4.7% of

financed vehicle loans had a credit score of 600 or less, compared

to 9.2% in the same month in 2017.

Borrowers with credit scores in the 781 to 850 range, meanwhile, accounted for 42% of auto loans in February of 2023, up from 37.4% in February of 2017.

VantageScore® 4.0 risk ranges, calculated at origination

Subprime = 300-600, Near prime = 601-660, Prime = 661-720, Prime plus = 721-780, Super prime = 781+

Source: S&P Global Mobility - Catalyst for Insight with TransUnion®

Note: Originations are viewed one quarter in arrears to account for reporting lag

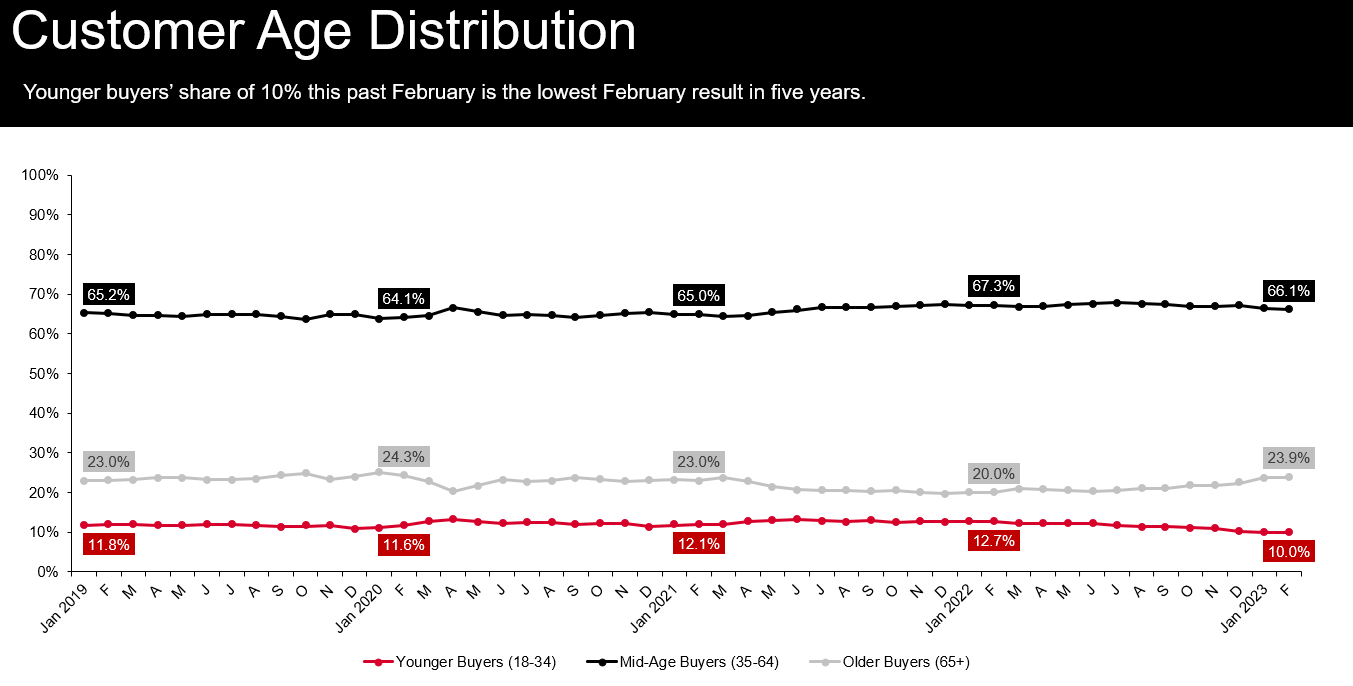

The trend of consumers with lower credit scores being pushed out of

the auto loan market has coincided with a drop in younger buyers'

share of the new -vehicle market.

In February of 2023, the market share of buyers aged 18 to 34 fell 2.7 percentage points compared to the same month in 2022 - to a five-year low of 10%.

That makes sense, because, "All things being equal, young buyers will have fewer financial resources than older buyers," Libby said.

Source: S&P Global Mobility

Note: Registration Type: Retail (19)

As borrowers with lower-tier credit scores get pushed out of the

current market, it creates "white space" at the bottom, Libby said.

Automakers may see an opportunity to offer a lower-priced

model.

"As this market financially goes upstream and the lower credit tiers are getting pushed out, does a dealer or brand want to appeal to the market that right now is being shut out?" Libby said.

They will probably want to hold off. After all, in February the average credit score and the APR came down slightly. Inventory is improving, which should take pressure off prices and give consumers more flexibility. "But we will have to wait for a few months to see if it is a trend," said Libby.

Much depends on what the Federal Reserve does regarding interest rates. Since March 2022, the Fed has attempted to tame inflation with a series of 10 rate hikes - rapidly pushing the Fed Funds rate from 0.25% up to roughly 5.1% as of May 3, 2023. Although some prognosticators believe a reversal could begin as soon as this summer, S&P Global Ratings believes the current rates will hold until mid-2024.

"If the Fed does pull back," Libby said, "We could see a swing in these trends back the other way."

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.