Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 03, 2023

Premium audio enters the mass market

Car buyers want better sound systems, and they are willing to pay more for higher-quality audio. As a result, premium sound isn't just for luxury brands anymore.

More than 70% of consumers desire a premium audio system in their next vehicle, according to a recent S&P Global Mobility survey. Automakers are addressing this strong demand by taking high-end audio to the mainstream.

"Mainstream consumers are expecting more out of their technology," according to Yanina Mills, senior technical research analyst for Auto Tech Insight at S&P Global Mobility.

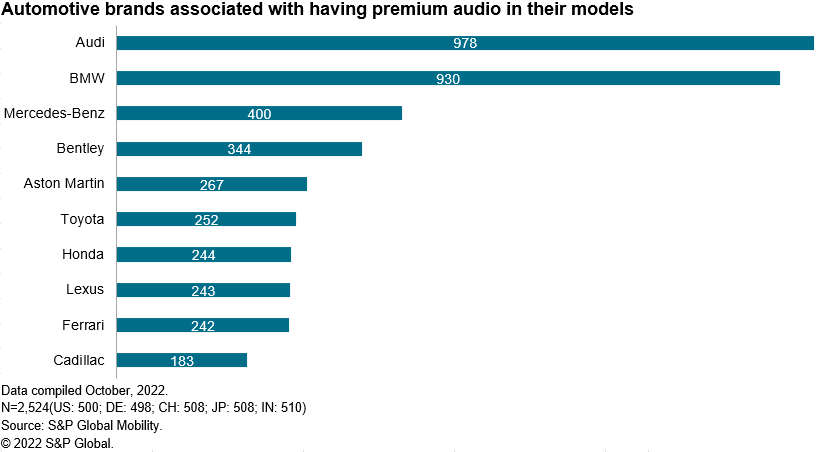

Automaker brand perceptions confirm this trickle-down effect. Honda and Toyota rank within the top 10 brands that global consumers associate with premium audio - even outranking luxury brands Lexus and Cadillac.

Meeting this high level of demand requires automakers to offer

premium audio options at all cost points. As average vehicle

transaction prices increase, "Consumers are expecting more,

especially given how much more they're paying," Mills said.

But even well-regarded brands can improve their audio-feature proliferation. While buyers associate Honda with premium audio, the brand's rigid options structure restricts premium Bose stereos to top-trims of their larger models. Civic and HR-V buyers who expect options for better sound will be disappointed. By contrast, Toyota offers optional JBL premium audio systems on most models, including the Corolla.

When it comes to premium audio, the 2,524 global survey respondents stated sound quality matters more than gaudy specification numbers. Premium sound quality, surround sound, and active noise cancellation are more important to consumers than the number of watts or speakers (audiophiles need not apply). Indeed, 33% of consumers do not know how many watts they would want in their next sound system.

This ambivalence provides audio suppliers with a guided path in

audio system product planning, marketing and even design. This may

help electric vehicle engineers struggling to reduce overall weight

by cutting audio system heft via reduced wiring, speaker count, and

overall wattage. Since consumers desire sound quality benefits over

specifications, these systems can remain highly marketable, despite

relying on software-based imaging over sheer component count.

Reducing EV weight also means cutting back on heavy sound insulation. Active noise cancellation (ANC) quells road noise, making the technology a natural fit. Currently a hallmark of luxury vehicles, the trickledown of ANC benefits mainstream automakers, whose vehicles typically lack luxury-level soundproofing.

Not only does ANC solve engineering noise, vibration and harshness (NVH) problems, it also addresses consumer desires. S&P Global Mobility research shows that 70% of consumers feel that ANC is an important feature for a premium audio system. Economies of scale reduce ANC's cost, making it more affordable and accelerating the technology's spread.

While ANC reduces cabin noise, surround sound increases musical enjoyment. Strong consumer interest in surround sound - 71% deem it to be important - suggests that 3D surround sound will be the next audio feature to reach the mainstream.

While surround sound provides depth and width, 3D surround sound adds height. The technology is currently offered in premium audio systems from Bose, Harman, Burmester, Meridian, and Bang & Olufsen.

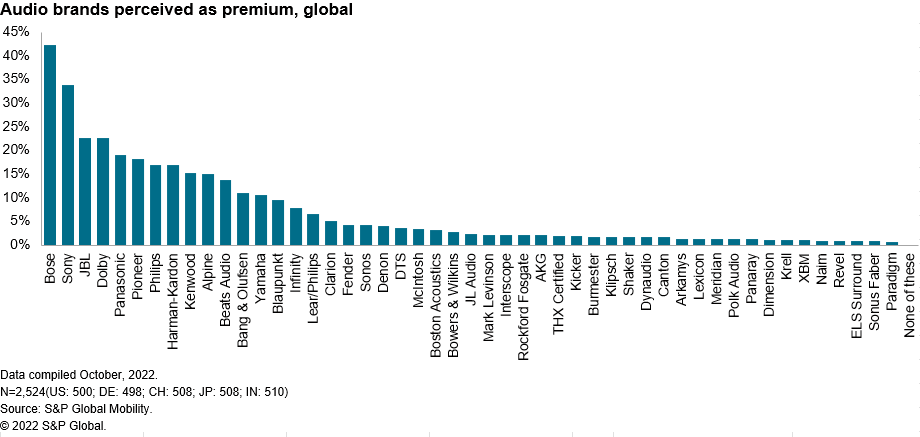

System size might not matter to consumers, but the audio brand does. "It's a combination of automaker marketing, as well as consumer experience with a brand outside of the vehicle," according to Mills. Brand names were seen as either very or somewhat influential by 85% of respondents.

That's good news for Bose, the most recognizable premium audio

brand in the survey. Indeed, Bose sound systems are offered by many

automakers, and Bose is the fourth-most recognized audio brand

overall. But Bose cannot rest on its laurels. Alpine and Harman

Kardon are gaining ground, with the two brands showing the greatest

increase in popularity among vehicle owners.

Image-conscious automakers also appeal to brand-centric buyers with boutique audio brands. Audi - the automaker most associated with premium audio - moved away from Bose to Bang & Olufsen. But niche audio brands are also found in mainstream vehicles. The Jeep Wagoneer offers audio from McIntosh, and the Kia EV6 incorporates a Meridian system. While these brands aren't likely to become household names anytime soon, they offer a way for automakers to distinguish their vehicles in a crowded market.

Whether listening to satellite radio, a downloaded mp3, or a niche podcast, sound system quality matters to consumers. Mainstream brands who fail to offer premium sound systems throughout their product line need to get tuned in to their shoppers' frequencies.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpremium-audio-enters-the-mass-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpremium-audio-enters-the-mass-market.html&text=Premium+audio+enters+the+mass+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpremium-audio-enters-the-mass-market.html","enabled":true},{"name":"email","url":"?subject=Premium audio enters the mass market | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpremium-audio-enters-the-mass-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Premium+audio+enters+the+mass+market+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpremium-audio-enters-the-mass-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}