Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 20, 2023

Mainland China commercial truck production starts 2023 with a powerful rebound

Strong initial results trigger an upgrade in S&P Global Mobility's year-over-year forecast, though economic and emissions headwinds remain.

Mainland China's medium- and heavy-duty truck production has surged strongly in early 2023, with double-digit year-over-year growth seen in the February through April period.

As a result, S&P Global Mobility has increased its outlook for mainland China's medium- and heavy-duty truck production for 2023 by an additional 4 percentage points to 914,000 units, bringing the forecast year-over-year gain from 2022 to 26%.

The better-than-expected readings and low-base effect are positive in supporting a solid near-term path to further improvements in the truck manufacturing industry, but constraints from both the demand and supply sides remain concerns.

The robust rebound was underpinned by the broad-based recovery of the domestic economy following the reopening from tough COVID restrictions and a continuous upturn in truck exports that seemed to defy the challenging external economic environment.

Speedy economic restoration unleashes pent-up demand

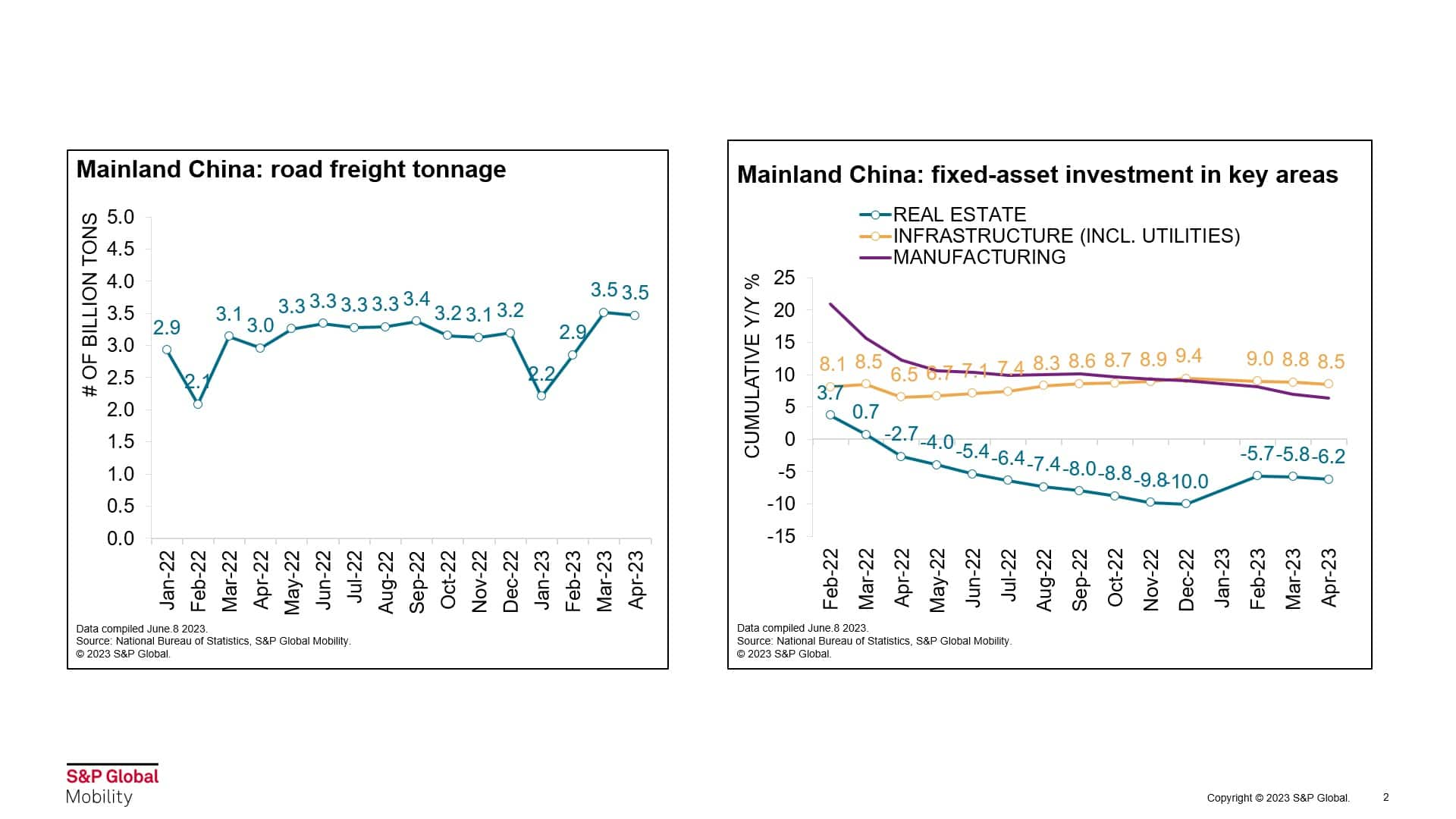

Driven by the post-pandemic business resumption and improved consumer confidence, household consumption, and industrial output recovered at a fast clip entering 2023, supporting the road freight sector to restart growth. This was seen in the January through April period when the road freight tonnage - which supports nearly 75% of domestic freight transport - rose by 8% from a year earlier.

At the same time, fiscal policies have remained accommodative. Specifically, the local government special-purpose bond quota, the main source of infrastructure investment, is set at 3.8 trillion yuan (approximately US$530 billion) for 2023 - higher than the originally planned quota of 3.65 trillion yuan for 2022. By the end of February 2023, more than 60% of the local government special-purpose bonds had been pre-launched - compared with around 30% in the same period of 2022.

Under this frontloaded stimulus, infrastructure investment (excluding utilities) expanded by 8.5% year-over-year through April. Also, the property market started to show signs of a restoration amid the ramp-up of bailout packages such as mortgage-rate reductions, easing credit conditions for developers, and loosening purchase restrictions for buyers.

With these circumstances, production of tractor-trailer and construction trucks had a combined market share of 60% in 2022 and surged by 50% year-over-year in the first four months of 2023. Riding on this trend, S&P Global Mobility added 10,000 units to the May production forecast.

Booming exports provide a boost to production

Mainland China's medium- and heavy-truck exports have entered a fast track since 2021 when pandemic-led supply chain disruptions crimped overseas manufacturing activities. With truck makers stepping up efforts in global expansion to counter the domestic industry downturn, exports from Mainland China have extended their rally into 2023 - increasing 57% to 97,000 units through April.

The headline growth was led by heavy tractor-trailers, which more than doubled in export volumes from a year ago. Supported by the government's Belt and Road initiatives, Southeast Asia, the Middle East, Africa, and South America have remained core export destinations - with market share staying above 70% of total exports over the years.

In addition, exports to Russia and Mexico became new bright spots in recent years. The exodus of Western automakers from Russia since early 2022, in response to the invasion of Ukraine, allowed Chinese brands to seize market share in the Russian MHCV market. In the first four months of 2023, exports to Russia continued explosive growth and amounted to 34,000 units, a level close to the entire 2022 total. The year-to-date share of Chinese brands in the market has grown to nearly 60%.

Meanwhile, exports to Mexico recorded a double-digit increase under the growing local demand for construction trucks. In the coming months, the run rate of MHCV exports is expected to hold steady, driving up the production forecast by 20,000 units compared to our outlook released in February.

Economic and emissions headwinds remain

A potential future upgrade of our production outlook is under assessment, with the domestic economic resurgence building momentum. However, reaching the peak level of 2020 is unlikely, as structural unemployment and still-tepid household income prospects could blunt pro-growth measures' ability to fully materialize. Meanwhile, aggressive economic stimulus policies could be restrained by the government's fiscal de-risking, as well as budget scarcity.

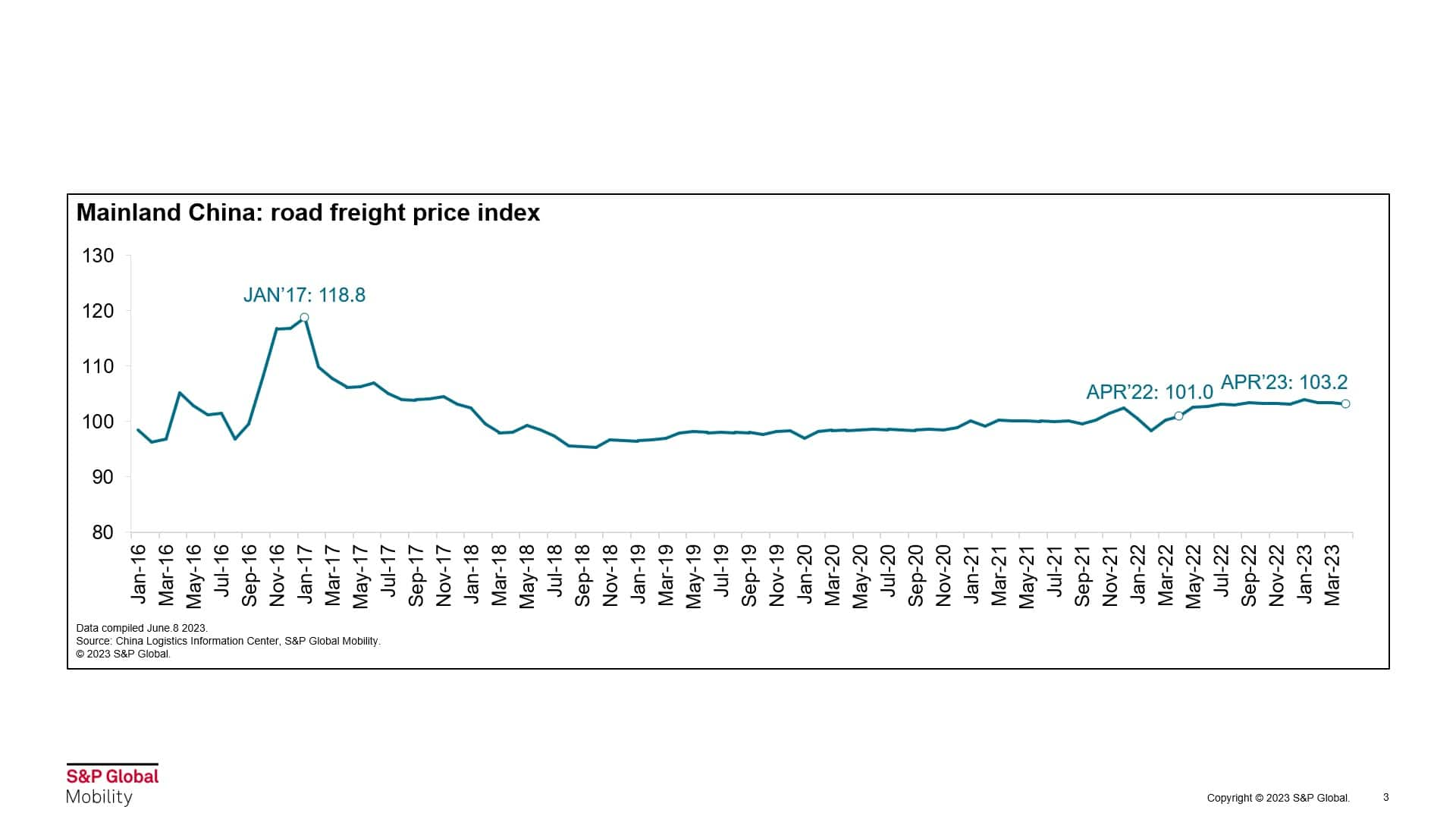

On the emissions front, although more cities doubled down on the fight to remove CN4-compliant trucks from roads starting in 2023, many areas lacked specific targets and subsidy plans - curbing the effect of policies. In addition, despite the healthy recovery of road freight transport, freight rates have remained in depression, reflecting an oversupply of trucking. These factors may lead truckers and fleet operators to postpone purchase decisions or shift towards used trucks for cost-saving purposes.

CHINA TO BECOME #1 LIGHT-VEHICLE EXPORTER THIS YEAR

CAN BRAZIL'S COMMERCIAL TRUCK FLEET TURN ELECTRIC?

MHCV ALTERNATIVE PROPULSION FORECAST

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-china-commercial-truck-production-starts-2023-with-a-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-china-commercial-truck-production-starts-2023-with-a-.html&text=Mainland+China+commercial+truck+production+starts+2023+with+a+powerful+rebound+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-china-commercial-truck-production-starts-2023-with-a-.html","enabled":true},{"name":"email","url":"?subject=Mainland China commercial truck production starts 2023 with a powerful rebound | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-china-commercial-truck-production-starts-2023-with-a-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mainland+China+commercial+truck+production+starts+2023+with+a+powerful+rebound+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-china-commercial-truck-production-starts-2023-with-a-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}