Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 17, 2024

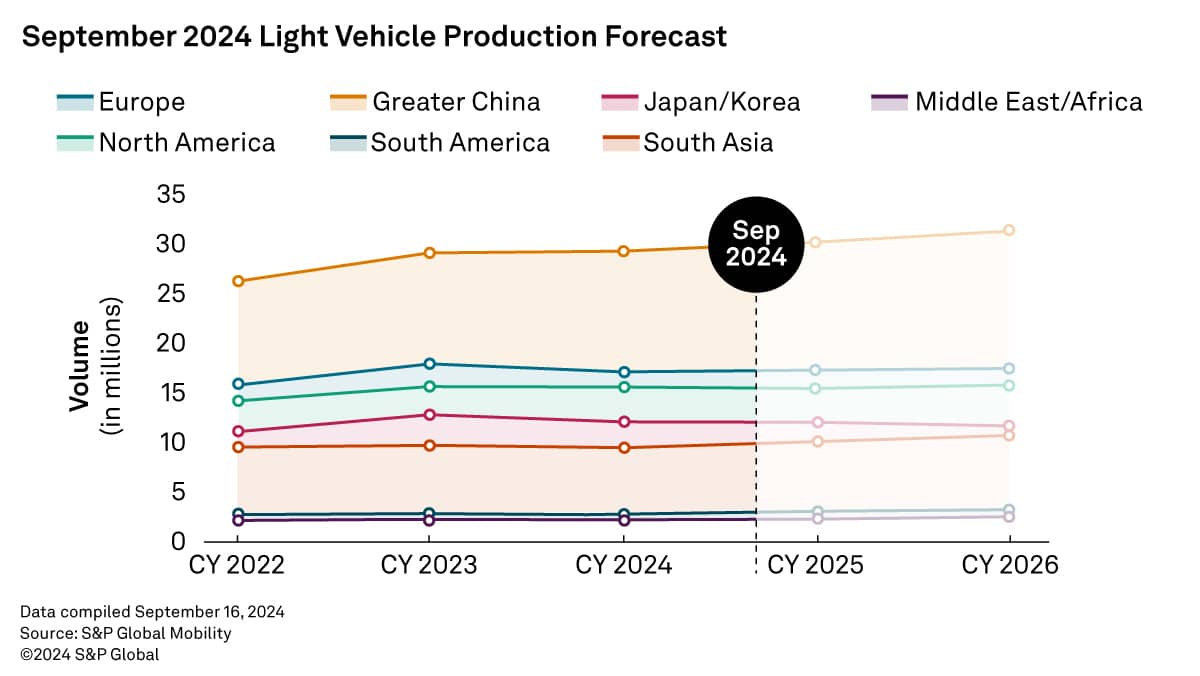

September Light Vehicle Production Forecast

By Mike Wall, Executive Director, Automotive Analysis, S&P Global Mobility

Each month, we leverage global light vehicle production actuals, registration data, and sales data to give you the most up-to-date, short-term production forecast available.

Here's a close look at global production data by region and our updated September production forecast.

Top Takeaways for the Month:

This month's forecast represents ongoing challenges with managing production and inventory amidst volatile demand and uncertainties surrounding electric vehicle (EV) adoption. Forecasting downgrades due to weaker demand fundamentals, timing actions, and macroeconomic pressures. While some regions like South America show signs of improvement, overall, global light vehicle production has been revised down for the near-to-intermediate term.

Noteworthy Adjustments

Europe's light vehicle production outlook for 2024 was slightly downgraded by 14,000 units, largely due to weaker actualized production in Western and Central Europe. Though stronger output from premium German manufacturers helped offset some of the reduction. The region's forecast remains stable for 2025, with a modest upward revision for 2026 due to a slightly improved demand outlook, particularly in Russia.

Greater China saw a reduction of 19,000 units for 2024 and a more significant downgrade of 205,000 units for 2025, reflecting subdued domestic demand despite government incentives. Aggressive price competition and consumer hesitation, coupled with a weaker macroeconomic environment, have further dampened the production outlook. The long-term forecast for 2026 remains under pressure on expectations for a weaker market recovery amid macroeconomic headwinds.

Japan and Korea faced mixed adjustments, with Japan's production outlook for 2025 reduced by 29,000 units due to potential regulatory compliance issues for Daihatsu. However, 2026 saw a slight upgrade due to increased momentum for ICE and hybrid models like Toyota's ES and Corolla Cross. Korea's production for 2024 and 2025 was reduced due to wage-related strikes and weaker demand, particularly in the U.S. and Europe, but the long-term forecast remains stable.

North America's production outlook was substantially downgraded by 120,000 units for 2024 and 429,000 units for 2025, driven by a cut in U.S. light vehicle sales and program cancellations. Vehicle timing actions and inventory corrections further impacted the forecast, with the steepest cuts anticipated for 2026. Overall, North American production is expected to decline year-over-year for two consecutive years, with BEV-related program revisions contributing to the reductions.

South America's forecast improved, with upgrades of 30,000 units for 2024 and 79,000 units for 2025, driven by stronger production and demand in Brazil and Argentina. Key models like the Fiat Strada pickup and Hyundai HB20 are expected to boost production. However, caution remains due to seasonal effects and inventory management challenges.

South Asia's production forecast for 2024 was reduced by 50,000 units, reflecting ongoing weakness in ASEAN markets, particularly in Thailand and Indonesia, due to stricter loan approvals and economic headwinds. India also saw a downgrade for 2025 and beyond, affected by the weaker rupee, elevated interest rates, and a shift toward retail sales reporting, suggesting companies will seek to reduce excess inventory and streamline inventory management from dealers to the production line.

Download a free light vehicle production forecast sample here

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fseptember-light-vehicle-production-forecast.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fseptember-light-vehicle-production-forecast.html&text=September+Light+Vehicle+Production+Forecast+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fseptember-light-vehicle-production-forecast.html","enabled":true},{"name":"email","url":"?subject=September Light Vehicle Production Forecast | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fseptember-light-vehicle-production-forecast.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=September+Light+Vehicle+Production+Forecast+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fseptember-light-vehicle-production-forecast.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}