Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 12, 2023

Tesla fuels electrification of US luxury vehicles; segment share hits record 42.4%

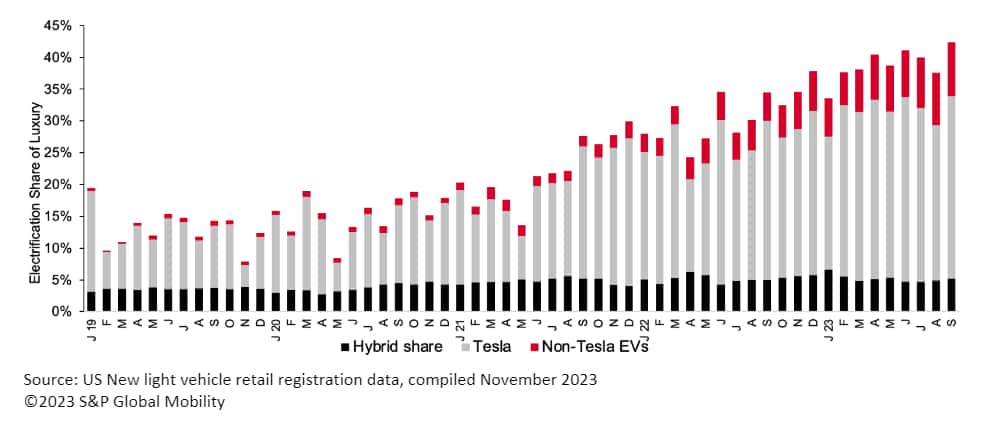

On the surface, it would appear luxury consumers have embraced the electrification of the automobile. As a percentage of luxury vehicle retail registrations, electrified vehicles have climbed steadily through the pandemic to a record 42.4% in September 2023, according to S&P Global Mobility analysis of US retail registration data.

This is up from 15% in September 2019 - with "electrified" registrations including battery-electric vehicles, plug-in hybrids, and gas-electric hybrid vehicles.

However, if Tesla is removed from the equation, the remaining brands account for a mere 14% of luxury vehicle retail registrations in September - with a split of 9% for BEVs and 5% for hybrids. But luxury BEVs have been growing, while hybrid and PHEV share of luxury vehicle registrations have been stable at roughly 4% to 6% for several years.

Electrified share of luxury vehicle registrations

On a year-over-year percentage growth basis, BEV growth among non-Tesla brands might appear impressive. And those brands are indeed taking bites out of Tesla's share among electric vehicle registrations. But the BEV unit counts remain small compared to a legacy OEM luxury portfolio that remains dominated by internal combustion powertrains.

Tesla has benefitted from being the first mover for many years. In January 2019, Tesla owned the nascent luxury EV segment (a meager 326,000 units from a 17 million total US vehicle market). The only luxury electrified competition at the time was the BMW i3, Jaguar i-Pace, and Audi e-tron.

In subsequent years, even as more competing luxury EVs came to market, Tesla market share continued to grow. Tesla's share of total luxury vehicle registrations was 29% as of September 2023, a 19 percentage-point increase over the four-year time span.

Prior to that, the non-Tesla luxury EV market barely made a mark at 1% to 2% share of luxury vehicle registrations. However, starting in 2022, that share started to grow with each successive quarter. Current market share for non-Tesla luxury EVs is 9% in September 2023 - impressive growth, but still far from crossing the chasm.

Legacy luxury brands have brought offerings like the Porsche Taycan; BMW i4 and iX; Mercedes-Benz EQS, EQE, and EQB; the expansion of the Audi e-tron lineup, and Volvo's Recharge line. The new-arrival disruptor brands - Polestar, Lucid, Fisker, and mostly Rivian - have also made an impact among non-Tesla brands. As more products come to market, the share split between Tesla and non-Tesla brands will continue to shift, according to S&P Global Mobility analysis.

But in looking at overall EV adoption, specifically at luxury EV households, roughly 90-95% of them also have an internal combustion vehicle in the garage. This can be a traditional gas engine, hybrid powertrain, or diesel. So while there is EV growth, the vast majority of luxury households have not converted to a purely electric fleet. Rivian households - not Tesla ones - are most likely to have another EV in the garage. Yet about 80% of Rivian garages also have an ICE vehicle, according to S&P Global Mobility Garage Mates data.

One electrified area lacking growth is luxury hybrids and PHEVs - an intriguing development as mainstream-brand hybrid sales have been outpacing BEVs Back in 2019, Acura, Infiniti, Lexus, and Lincoln had hybrid models for sale; today only Lexus sells any meaningful volume of hybrid vehicles while the others have been discontinued. BMW, Porsche, and Volvo have created a presence in the PHEV market but have seen little growth as they have prioritized their BEV lineups.

And while Tesla continues to dominate the BEV market, S&P Global Mobility forecast last year that Tesla share would erode as more legacy and disruptor brands entered the market, even if Tesla volumes were to increase. As non-Tesla luxury brands' commitment to electrification grows, it appears that trend is coming to pass - albeit slowly.

MORE ON AUTOMOTIVE PLANNING AND FORECASTING

CONTACT OUR ELECTRIC VEHICLE CONSULTANTS

TRACK AUTOMOTIVE INDUSTRY DEVELOPMENTS AROUND THE GLOBE

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ftesla-fuels-electrification-of-us-luxury-vehicles-segment-shar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ftesla-fuels-electrification-of-us-luxury-vehicles-segment-shar.html&text=Tesla+fuels+electrification+of+US+luxury+vehicles%3b+segment+share+hits+record+42.4%25++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ftesla-fuels-electrification-of-us-luxury-vehicles-segment-shar.html","enabled":true},{"name":"email","url":"?subject=Tesla fuels electrification of US luxury vehicles; segment share hits record 42.4% | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ftesla-fuels-electrification-of-us-luxury-vehicles-segment-shar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tesla+fuels+electrification+of+US+luxury+vehicles%3b+segment+share+hits+record+42.4%25++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ftesla-fuels-electrification-of-us-luxury-vehicles-segment-shar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}