Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 21, 2022

The inevitable transformation of the bus industry in South America

Issues such as low speed, low efficiency and congestions are common across cities in South America. With more than 12 million people, Sao Paulo is the region's largest city and has become a role model for mobility initiatives. In 2021, more than 4.5 million passengers were transported per day, according to SPTrans - Sao Paulo's transport department. Sao Paulo operates a bus fleet of 13,800 vehicles. Gradually, Sao Paulo has become a hub for pilot projects in the mobility sector. For example, Sao Paulo was one the first cities to restrict cars and trucks in the city center. Sao Paulo has adopted bus corridors and improved the average speed of buses. The use of articulated and bi-articulated buses on some routes also improved the efficiency of public transport.

Looking ahead, new initiatives are likely to focus on climate and environment. Sao Paulo's climate committee created in 2009 suggested rules for cleaner public transportation. In 2021, a new schedule was adopted: the carbon emission will be cut by half in 2027 (based on total emission in 2016), and by 100% in 2037. Particulate matter has to be cut by 90% in 2027, and by 95% in 2037. The new rules mean that bus fleet operators will have to spend more on cleaner buses and the necessary infrastructure. Sao Paulo is one of the cities in South America that takes part in the Zero Emission Bus Rapid-deployment Accelerator (ZEBRA) program that promotes a transition to new technologies and will that change the automotive industry.

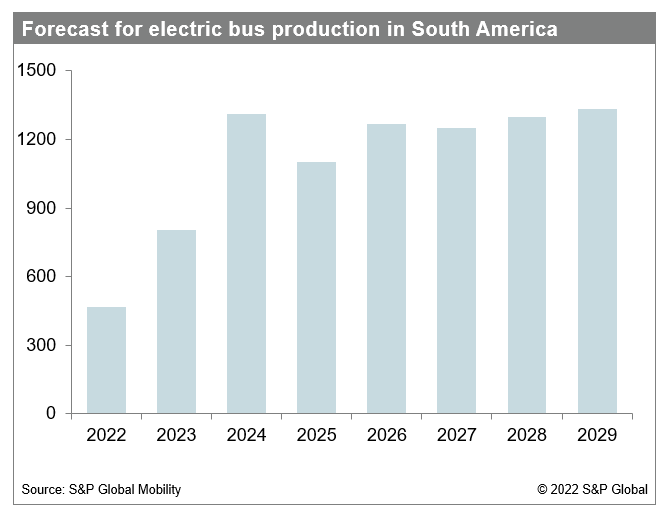

According to S&P Global Mobility Medium and Heavy Commercial Vehicle (MHCV) Industry Production forecast, Brazil was the fourth largest bus and chassis producer in the world in 2021, and nearly 90% of buses produced in Brazil have urban applications. Brazil will keep its rank in 2022. In the future, Brazil's bus production needs to transition to electric powertrains to keep its position and to continue to increase its output. Brazil is the major bus producing country in the region and serves with its chassis bus bodybuilders across South America. Brazilian OEMs have served the region for decades and offers now CNG/LNG vehicles to comply with Euro VI. These brands are now challenged by Chinese OEMs that offer complete buses at lower prices. This has been witnessed recently by the successful bids of BYD, Foton and Yutong in Chile and Colombia, insofar as a big part of the bids consist of electric buses.

Among bus producers, BYD was the pioneer bringing its electric models to be assembled in Sao Paulo state. Volvo, Mercedes-Benz, and Volkswagen already developed their models with launch timing in 2023. On the other hand, Scania and Iveco have natural gas as solution for alternative propulsion; meanwhile, Agrale has built partnerships to enter in the electric field. Furthermore, Higer is another beginner in electric vehicles offering their products in Brazil. But it hasn't all been good, the lack of government incentive incentives for new technology creates barriers for electricity. The shortage of components brought instability and concerns for industry. The price of new technology is another penalty, and the final price - it estimated an electric bus is three times more expensive than conventional bus. Of course, the initial costs will fall as the technology becomes more common. However, in the first moment the increase of operation costs will bring adjustments in subsidies or public ticket prices.

In fact, buses will be the entry point for electrification in South America, although the some movement has been noted in medium-duty segment, in minor scale. OEMs settled in Brazil have great potential to increase their production and rebound their profit margins due to new technologies and increase their penetration in South America countries, which brings more revenues for their headquarters. Moreover, the use of electric technology has increased globally, and the change will be needed to maintain Brazil at a competitive level for the bus industry. On the passenger side and bus driver side, the comfort and safety offered by electric buses may attract more users for public transport, and a reduction in occupational diseases and accidents for bus fleet operator. A reduction of greenhouse gas emissions has positive results for climate, meanwhile the public sector promotes social wellbeing with reduction of government health expenditures. In other words, it may be good for industry, good for users and good for the climate all at once.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-inevitable-transformation-of-the-bus-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-inevitable-transformation-of-the-bus-industry.html&text=The+inevitable+transformation+of+the+bus+industry+in+South+America+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-inevitable-transformation-of-the-bus-industry.html","enabled":true},{"name":"email","url":"?subject=The inevitable transformation of the bus industry in South America | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-inevitable-transformation-of-the-bus-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+inevitable+transformation+of+the+bus+industry+in+South+America+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-inevitable-transformation-of-the-bus-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}