Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 23, 2023

The trouble with Nomads

Those car shoppers you're strategizing to conquest from your rival brands? Even if you win them over, there is a high probability they won't stick around.

Most automotive customers who are new to a brand often leave for yet another brand when they return to market. In fact, more than half of these "Nomads" make a habit of it.

Automotive marketers typically focus on two types of marketing: conquest and loyalty. What is less often talked about is the in-between - the loyalty of conquests. What does this mean? The effort and triumph of a successful conquest-marketing campaign can be undermined if automakers are losing most of their previous conquests at the same time.

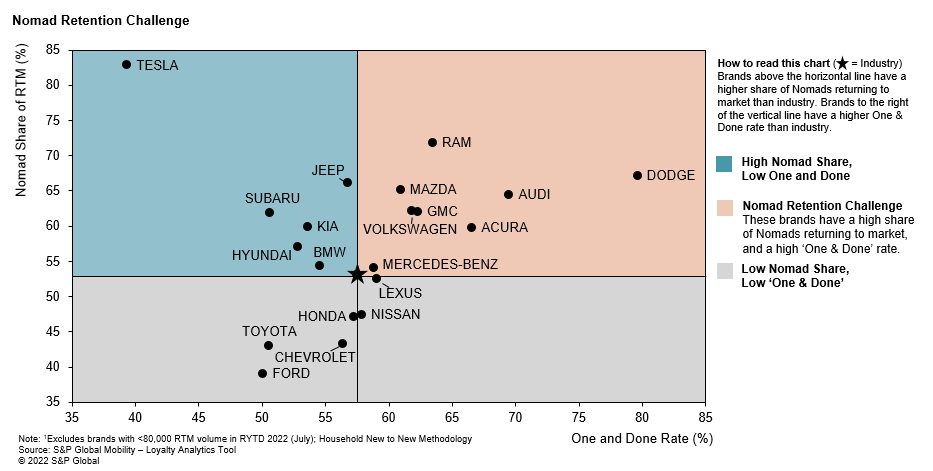

Nomads who own a brand once and leave are also known as 'One and Done' - about 58 percent of Nomads left their brand in the 12 months ending July 2022. That's the highest 'One and Done' rate (defection rate of Nomads) in at least 10 years, according to data analysis by S&P Global Mobility.

There are three distinct customer loyalty types: Super Loyalists, Loyalists and Nomads. Super Loyalists are consumers with a history of multiple repeat purchases and are most likely to repurchase from the same brand. Loyalists are consumers with a repeat purchase, and Nomads show no identifiable loyalty patterns to any brand and are most likely to defect.

Brands who have a presence in more segments tend to have a lower 'One and Done' rate. Filling a portfolio gap (by launching a vehicle in a key segment) helps brands retain nomads (and customers in general).

Between 2017 and 2019, Subaru, Volkswagen, Hyundai, and Kia all launched new models in the increasingly popular upper mid-size utility segment - with the Ascent, Atlas, Palisade, and Telluride. These roomier three-row models reduced the defection rate of the brands' overall return-to-market population and suggests that a model launch is an ideal time to target Nomads who might leave for a segment where their current brand isn't represented.

How much does a 'One and Done' household impact brands? It depends. Some brands have a higher-than-average share of Nomads returning to market. For those, the impact of those customers leaving is more significant, according to S&P Global Mobility data.

Is a high share of Nomads a bad thing? Not necessarily. First, newer brands like Tesla will obviously have a higher share of first-time owners than an established brand like Ford. Even established brands can have a higher share of Nomads when they've ventured freshly into popular segments and successfully brought in new customers. Volkswagen is a prime example, as the brand shifted its portfolio to contain more sport-utility vehicles.

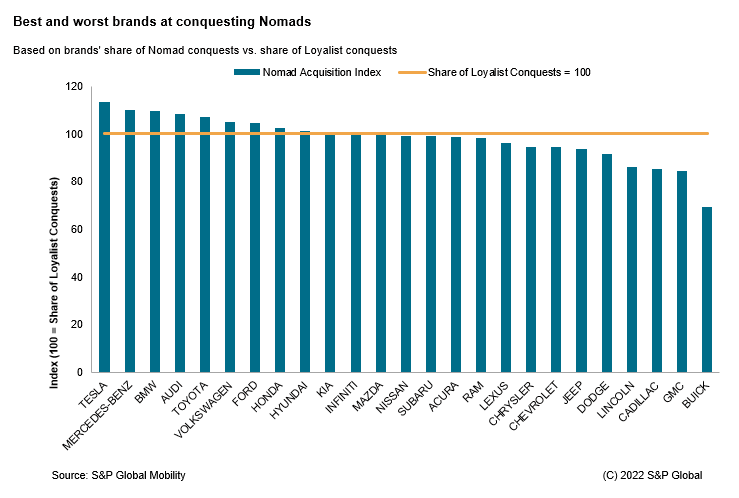

Best and worst brands at acquiring Nomads

Based on brands' share of Nomad conquests vs share

of Loyalist conquests

Each brand has a unique position when considering product portfolio, demographic profile, and geographic distribution of their consumers. While conquest, loyalty, and loyalty of conquests are all important, brands who have the highest concentration of Nomads and the highest risk of losing them should focus on the latter. And good news for those who are successful at conquesting: the high 'One and Done' rate industrywide means there is prime opportunity to conquest other brands' Nomads.

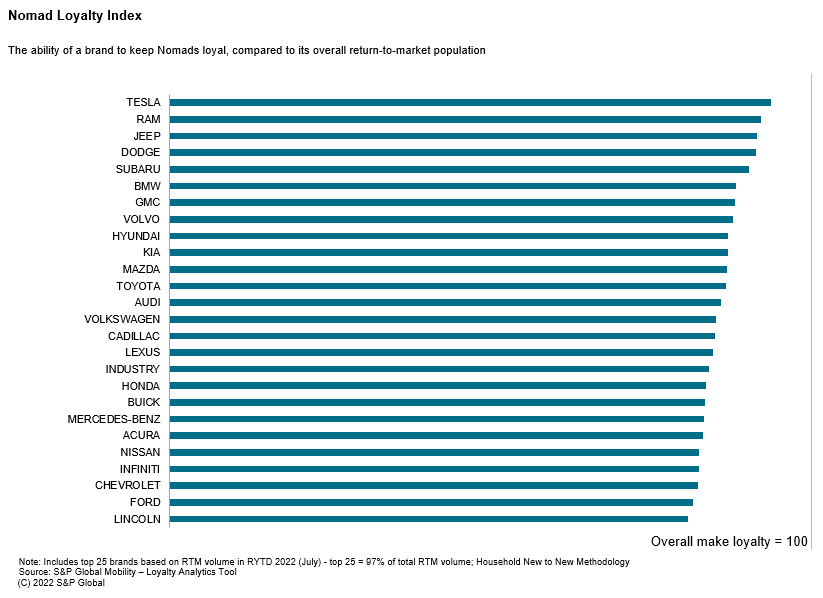

"Loyalists have an average 13-point advantage on a brand's loyalty rate than Nomads," said Erin Gomez, associate director of consulting for S&P Global Mobility. "Brands that fail to transform Nomads into Loyalists not only lose out on the immediate sale to the Nomad, but also the future loyalty benefit they could have provided as Loyalists."

While Tesla's high share of first-time owners (83%) isn't too surprising, their ability to keep those new customers is extraordinary. Tesla's 'One and Done' rate is just 39% compared to 58% for the industry (remember, a lower number is better in this case). The next-best 'One and Done' rate goes to Ford at 50%. However, Nomad share of Ford's return-to-market households in less than half of Tesla's.

Because Loyalists are more likely to stay with the brand than a Nomad (56% make loyalty for Loyalists vs. 43% make loyalty for Nomads), turning a Nomad into a Loyalist not only keeps the customer at that return-to-market event, but also makes them more likely to stay with the brand when they are ready to buy again. If a Nomad defects versus moving into the Loyalist bucket, the cost to the brand is the sale to the Nomad but also, on average, 13 incremental percentage points of loyalty compared to replacing them with another Nomad.

So, who are Nomads? Nomadic households tend to skew toward the wealthiest families of highly educated professionals. They tend to live in suburban neighborhoods and have high disposable incomes. Households that fit this profile could be high risk for One and Done if they chase the latest trendy product.

But a one-size-fits-all approach shouldn't be taken when identifying possible One and Done customers. Understanding and segmenting the consumer and their propensity to move into certain body styles, fuel types, and brands is also important. Consider a brand that does not offer a pickup truck. It would not make sense to attempt to retain a Nomad who owns a mid-size utility but who is coming back to market for a pickup.

While one can look strictly at the One and Done rate (defection rate of nomads), that's only part of the story. Also important is the brand's overall loyalty rate. S&P Global Mobility has created an index looking at a brand's loyalty among nomads vs. overall loyalty. For instance, Ford has a low 'One and Done' rate, but they also have a high overall brand loyalty rate. Meanwhile, RAM has a higher than average 'One and Done' rate, and also a low brand-loyalty rate, because the brand's portfolio is limited to trucks. That said, relative to its overall brand loyalty, RAM doesn't do a bad job turning its Nomads into Loyalists, and might look at focusing on manufacturer loyalty to ensure the Nomads leaving the brand for a different body style stay within the Stellantis family.

"Aside from the massive, long-term undertaking of creating products in new segments, there are other ways automakers can increase loyalty from their current Nomads," Gomez said. "By understanding the loyalty makeup of their customer base, and where their Nomads are going, brands can take a more targeted and efficient marketing approach to retain them."

Keep yourself updated with the latest automotive insights featured on our Mobility News and Assets Community page to stay ahead of your competition.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-trouble-with-nomads.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-trouble-with-nomads.html&text=The+trouble+with+Nomads++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-trouble-with-nomads.html","enabled":true},{"name":"email","url":"?subject=The trouble with Nomads | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-trouble-with-nomads.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+trouble+with+Nomads++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fthe-trouble-with-nomads.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}