Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 23, 2023

US auto sales sustain muted progress in March

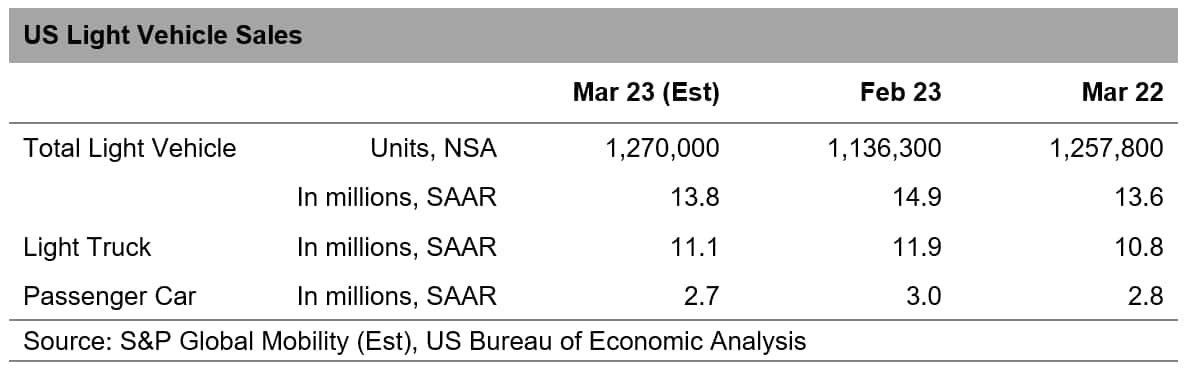

With volume for the month projected at 1.27 million units, S&P Global Mobility analysts expect March 2023 to be up more than 11% from the month-prior tally, attributable to three additional selling days. The expected March 2023 volume would be aligned with the year-ago period (with the same number of selling days), reflecting that sales momentum will be difficult to sustain given current economic headwinds and tailwinds.

March 2023 US auto sales are expected to translate to an estimated sales pace of 13.8 million units (seasonally adjusted annual rate: SAAR), down meaningfully from the January 2023 reading of 15.9 million units. However, that pace would bring the first quarter average sales rate to 14.9 million units. This would represent the strongest quarterly pace since the second quarter of 2021 - albeit nowhere near the SAAR reading of 16.7 million units at that time, when the auto market was still experiencing the pleasantness of stimulus checks and before supply chain issues began.

"Incoming reports of sustained - but still muted - retail demand in March reflect that those auto consumers willing, ready, and able to enter into a new vehicle agreement are continuing to do so, even in light of rising interest rates and still-high vehicle price levels," said Chris Hopson, principal analyst at S&P Global Mobility. "New vehicle incentives are rising slowly from historically low levels as vehicle production advances. The specter of further hikes in interest rates, and acceptance of current unsettled economic conditions, may be providing impetus for those considering purchasing a new vehicle."

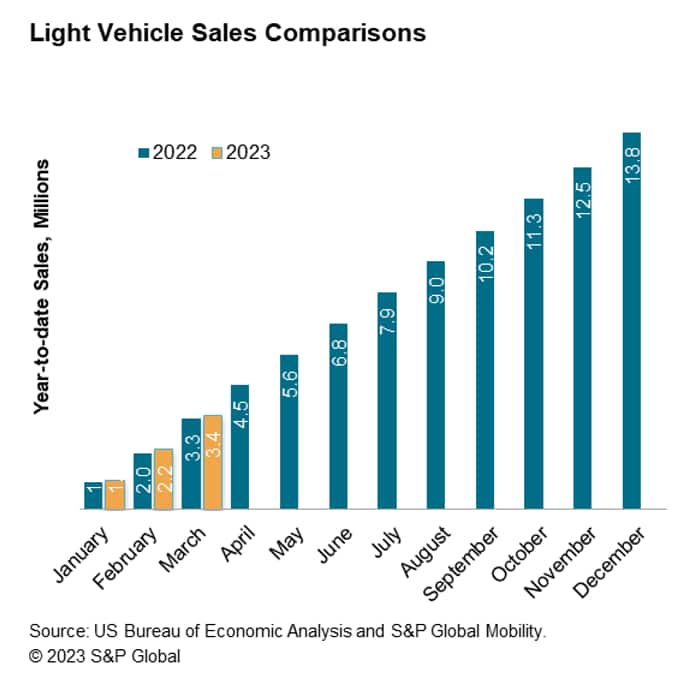

S&P Global Mobility projects calendar-year 2023 volume of 14.9 million units in the US, an 8% increase from the 2022 tally. Auto sales will be supported by advancing production levels, along with reports of sustained retail order books, recovering stock of vehicles, and improved fleet demand.

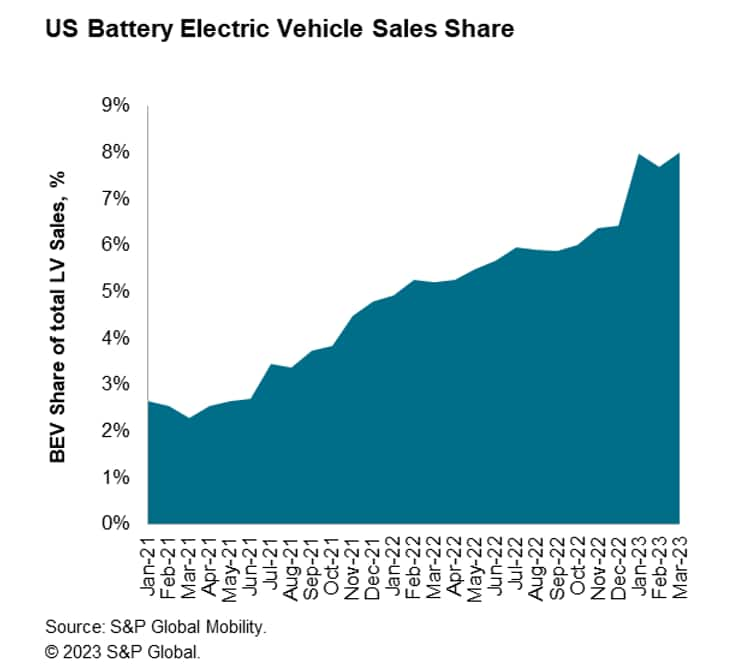

Sustained development of battery-electric vehicle (BEV) sales remains a consistent assumption for 2023. BEV share has hovered around 8% over the course of the first two months of the year. At a projected level of 8.0% share is expected to remain strong. While Tesla's pricing adjustments were the first shot in a BEV price war, the reaction of other auto companies will determine whether the gains in the BEV mix level will be a blip in the trend or a dynamic tipping point in the electrification progress of the market. Beyond the pricing developments, a sustained churn of new and refreshed BEVs will continue to promote BEV sales as the year progresses.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-sustain-muted-progress-in-march.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-sustain-muted-progress-in-march.html&text=US+auto+sales+sustain+muted+progress+in+March+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-sustain-muted-progress-in-march.html","enabled":true},{"name":"email","url":"?subject=US auto sales sustain muted progress in March | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-sustain-muted-progress-in-march.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+auto+sales+sustain+muted+progress+in+March+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-sustain-muted-progress-in-march.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}