Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 19, 2023

8 vehicle inventory trends you should know about in May

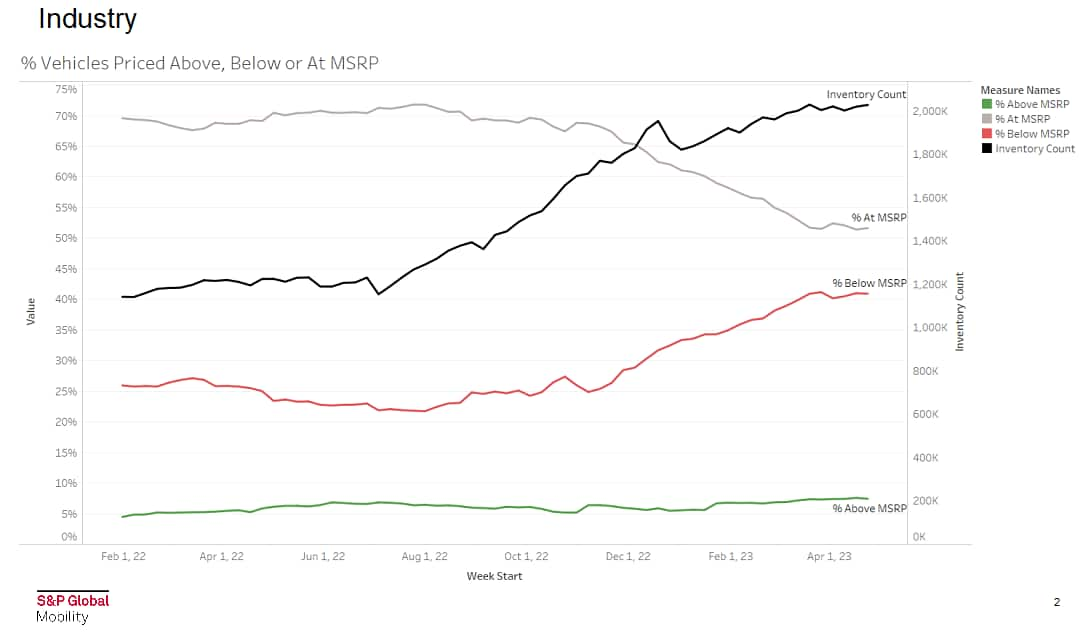

Retail advertised inventory - the availability of vehicles as communicated by dealerships across the country - has been on the rise from July 2022 until mid-March 2023. However, based on month-end April data, S&P Global Mobility's Advertised Dealer Inventory analysis shows that inventory recovery will remain erratic and spiky for the near term, depending on the brand and segment.

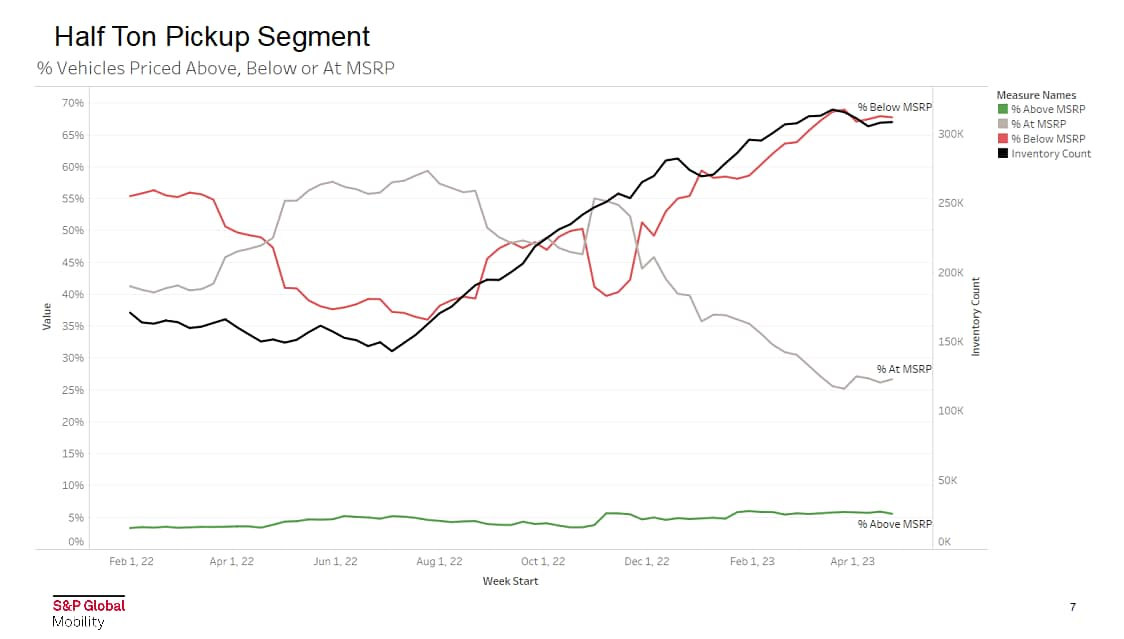

The key takeaway on the new-vehicle purchase front for consumers: The percentage of vehicles offered below MSRP has risen as advertised inventory count increased. Meanwhile, the percentage offered at sticker price has fallen and the percentage offered above MSRP has remained basically stable.

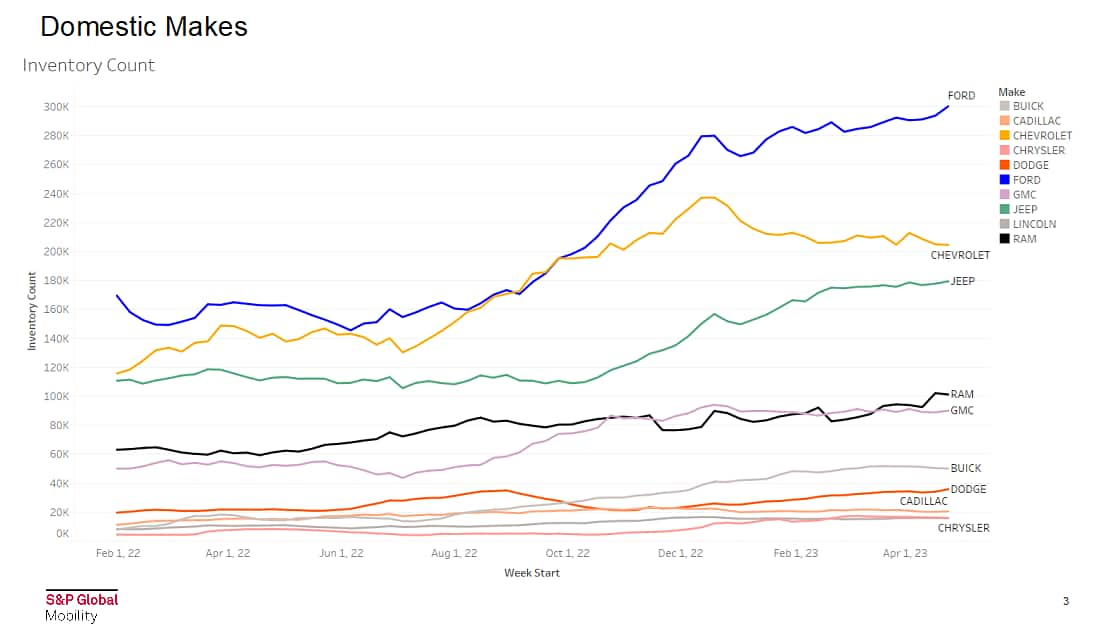

The pace of advertised inventory growth of domestic brands is slowing. Domestic advertised inventory rose by single digits (on an annualized basis) in the last month, and growth slowed through the quarter. By comparison, it grew by 25% in the last six months overall.

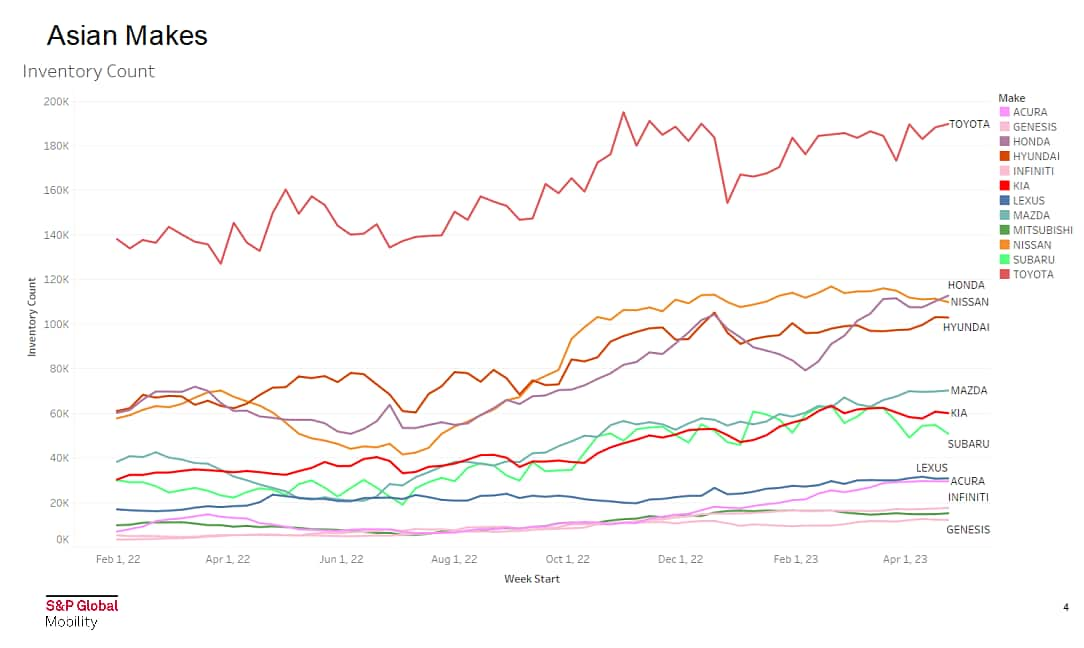

Meanwhile, Asian makes continue to struggle to gain inventory count on dealership lots. Since the new year, volume leader Toyota has kept on pace to have advertised inventories equivalent to one month's pre-pandemic sales. Honda, Nissan, and Hyundai all have roughly the same advertised dealer inventories.

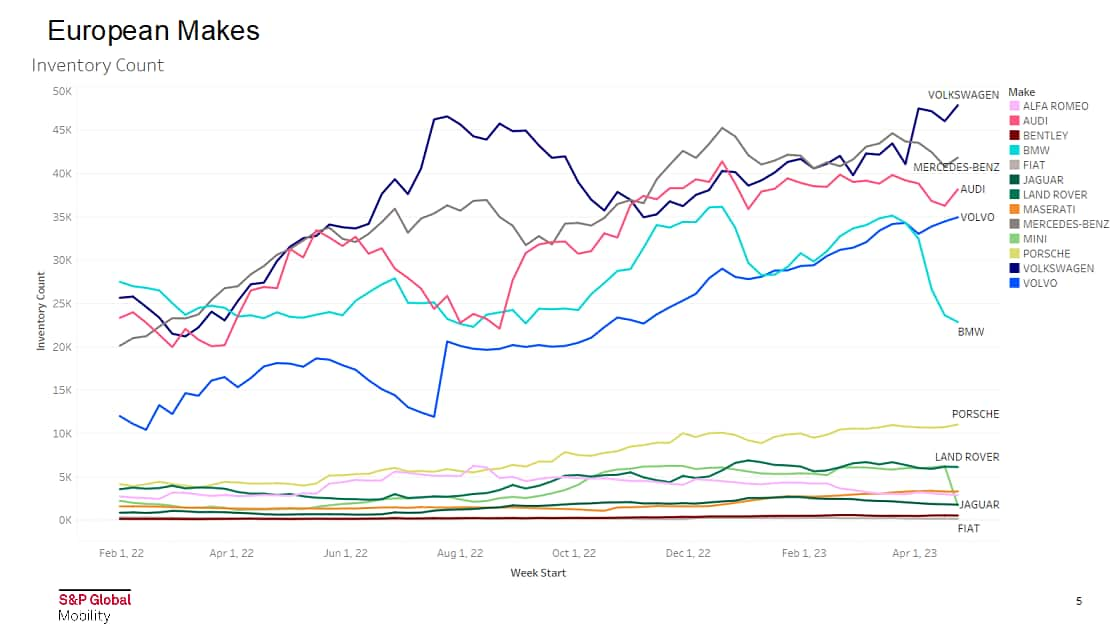

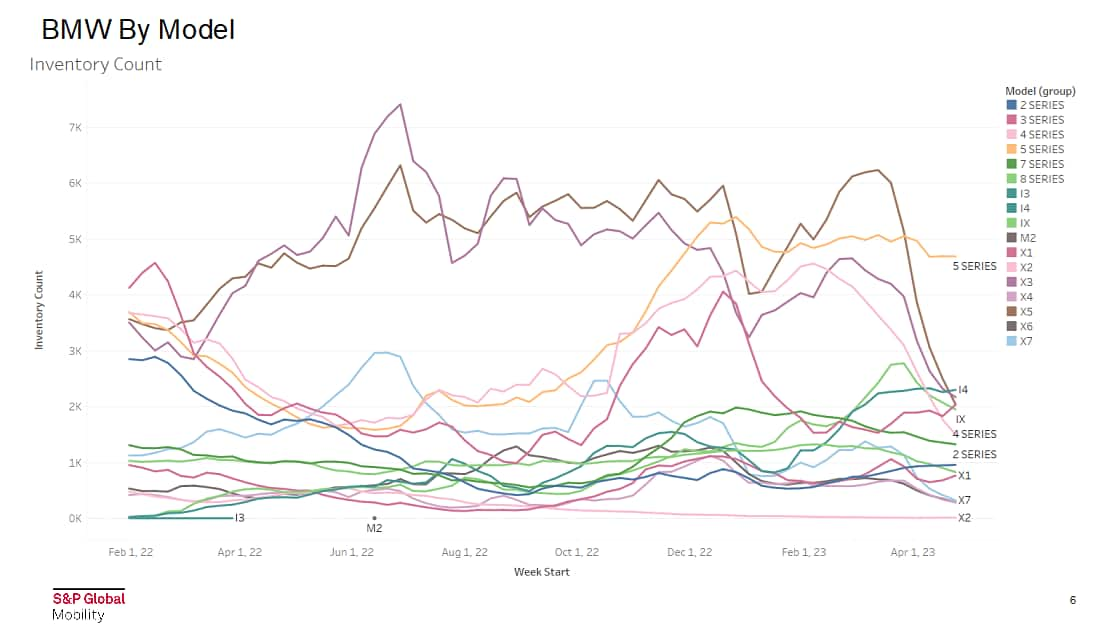

European brand advertised inventory actually shrank in the last month and was flat in the last quarter. That masked wide disparities among individual automakers, however. Volkswagen advertised inventory spiked by 16% in the last quarter, while BMW advertised inventory dropped by 22%, for example. The same erratic trends continued in the last month.

Taking a look at BMW specifically, individual model inventory has fluctuated greatly over the last half year. The 5 Series advertised inventory rose in the last quarter of 2022, then remained constant. The high-volume X3, X5, and 3 Series saw advertised inventory decrease sharply late last year and early this year. The X5 has seen the most fluctuation.

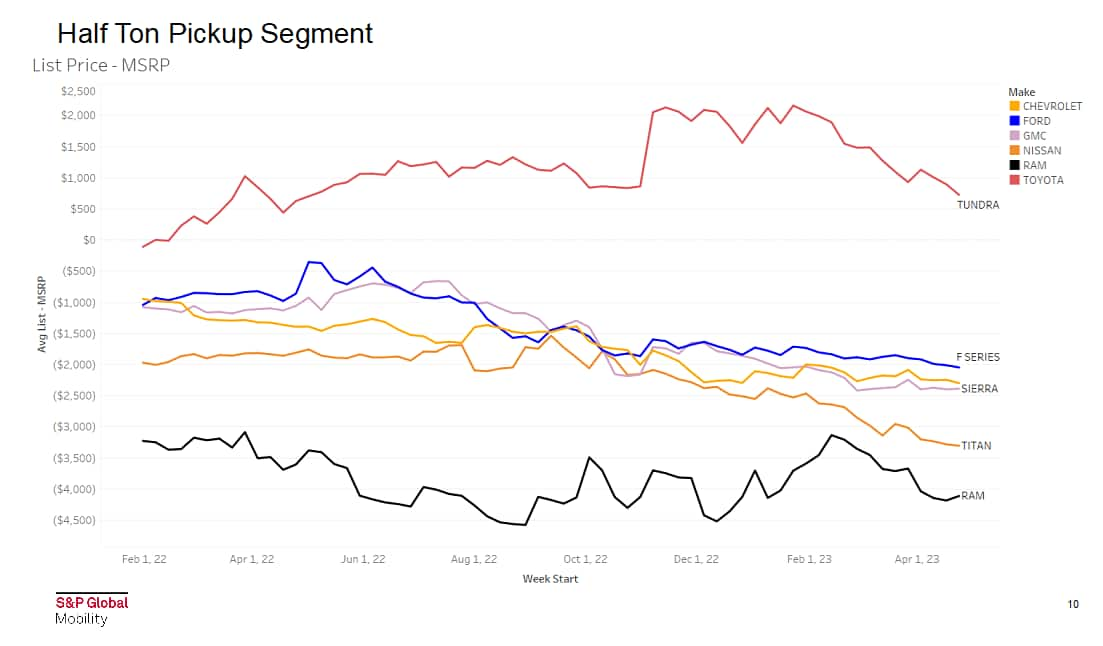

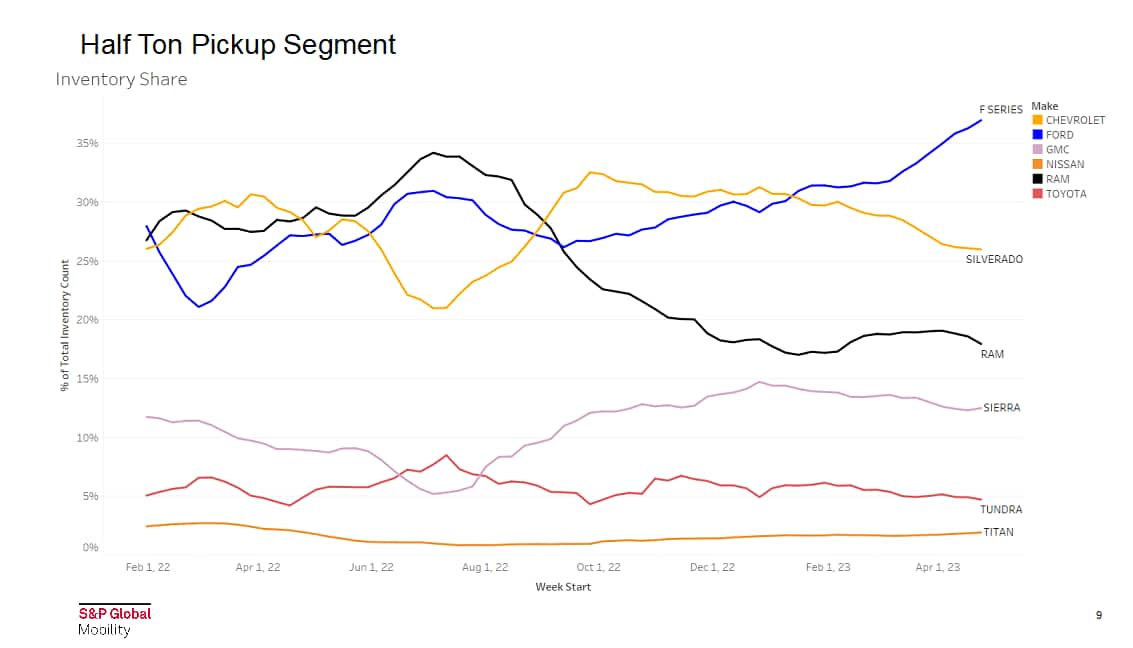

Moving to half-ton pickups, Ford, Chevrolet, and Ram trucks were, on average, advertised below MSRP from February 2022 to April 2023, while the Toyota Tundra was advertised above MSRP for that entire period.

In this hyper-competitive full-size segment, Ram has consistently seen the greatest advertised discounts from MSRP, although other domestic truck brands are more recently engaging in a race to that discount level.

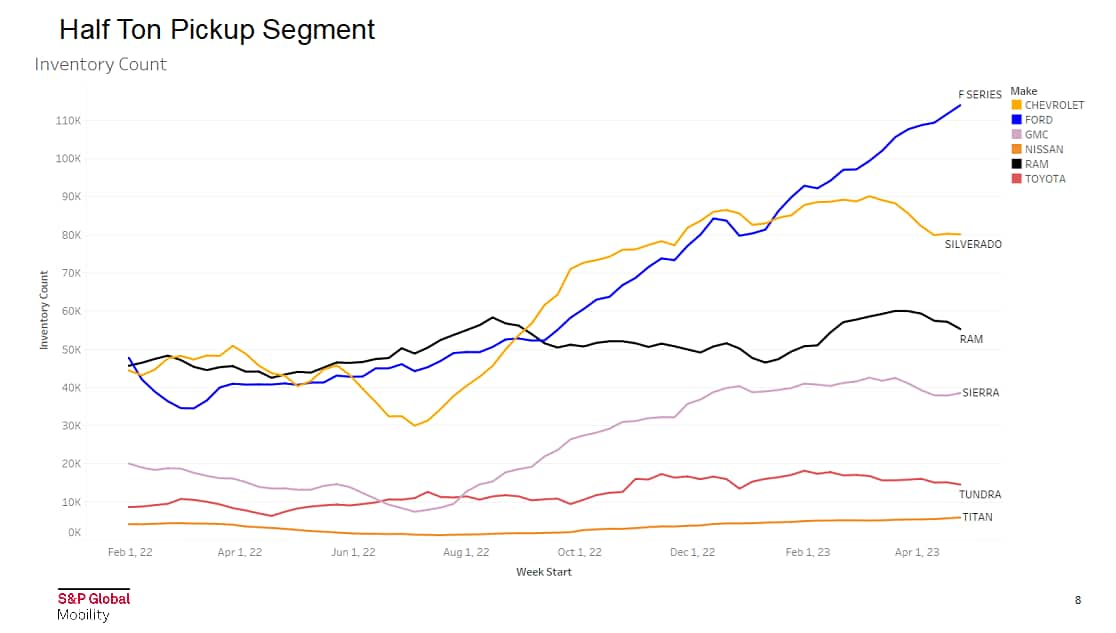

Ford's F-Series advertised inventory increased sharply beginning late Sept 2022 from around 47,000 units to 110,000 in April 2023. Part of the increase can be assigned to post-build trucks parked in giant lots awaiting essential final parts before finally being allocated to dealers.

But while the advertised dealer inventory unit count of Chevrolet Silverado has climbed and Ram full-size pickups have remained steady, the sharp increase of F-150 unit count means Chevy and Ram share of half-ton pickup inventory has fallen off and not recovered since late summer. Only the GMC Sierra has matched the F-150s pace of share increase.

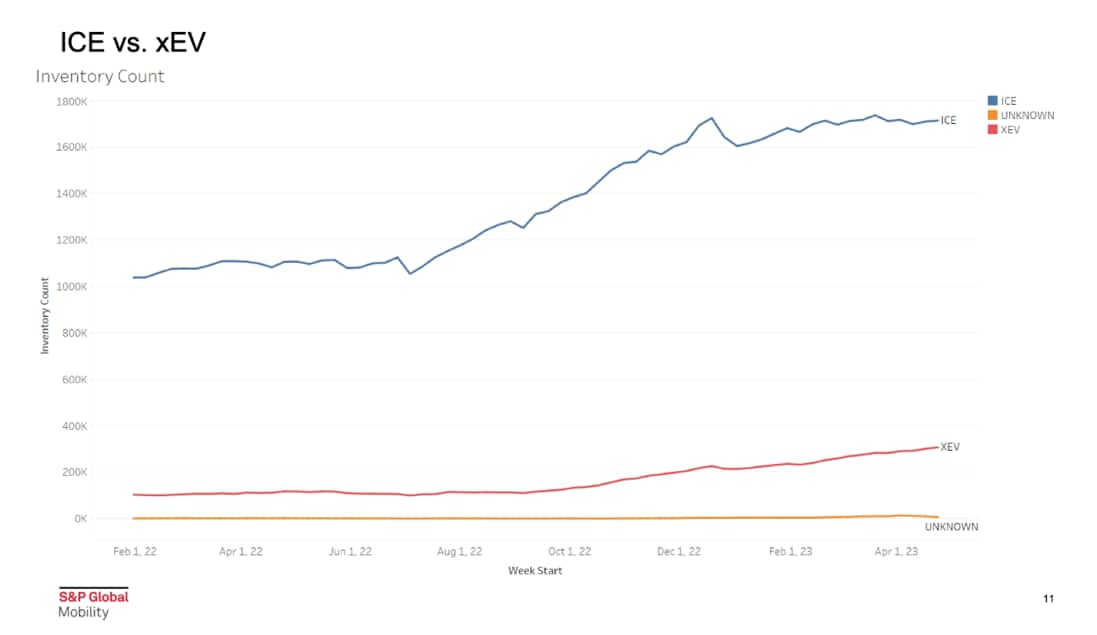

Battery-electric and hybrid-electric vehicle advertised inventory tripled from February 2022 to early April 2023 to some 300,000 units, a faster rate of increase than advertised inventories of pure internal-combustion vehicles. That said, the amount of xEV inventory remains in line with current market share percentages for BEVs and hybrids.

As the industry continues to replenish its inventory, there will be knock-on effects in terms of pricing and incentives. S&P Global Mobility analysts foresee the stabilizing of inventory, combined with economic headwinds facing consumers, to create a more traditional retail environment in 2023 with OEMs once again battling for market share.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f8-vehicle-inventory-trends-you-should-know-about-in-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f8-vehicle-inventory-trends-you-should-know-about-in-may.html&text=8+vehicle+inventory+trends+you+should+know+about+in+May+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f8-vehicle-inventory-trends-you-should-know-about-in-may.html","enabled":true},{"name":"email","url":"?subject=8 vehicle inventory trends you should know about in May | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f8-vehicle-inventory-trends-you-should-know-about-in-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=8+vehicle+inventory+trends+you+should+know+about+in+May+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2f8-vehicle-inventory-trends-you-should-know-about-in-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}