Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

WHITEPAPER

Aug 15, 2022

Battery Pack Costs Rise for Battery Electric Vehicles

[Whitepaper Excerpt]

Russia's invasion of Ukraine has caused prices of nickel, lithium, and other materials to soar, compounding the pain of the global chip shortage and other supply chain woes caused by the COVID-19 pandemic.

Prices of nickel and aluminum have been breaking records. Propulsion & Sustainability team at S&P Global Mobility has analyzed the impact of raw material prices for different cathode chemistries and the potential impact on battery pack cost. The purpose of this paper is to describe the trend of changing battery chemistries and battery pack cost forecast till 2030 under the foreseen raw material prices trend.

Battery demand and chemistry in passenger

vehicles

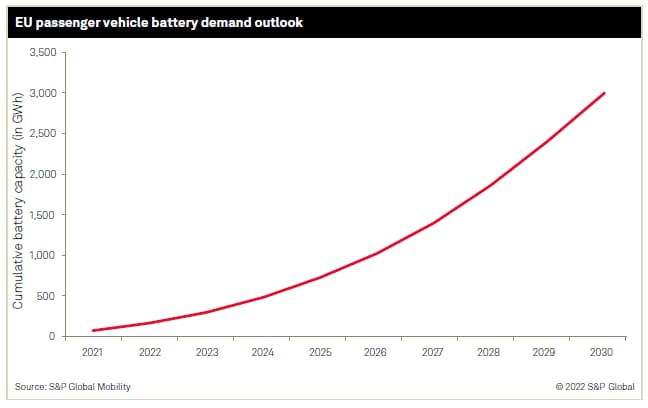

In the European Union (EU), the ambitions of 55% CO2 target

reduction from 2021 to 2030 and a zero-emission 2035 passenger car

market will accelerate electrification. According to H1 2022

powertrain-based sales forecast from the S&P Mobility team,

battery electric vehicles (BEVs) share for EU passenger cars is

projected to increase from 9.8% in 2021 to 67.9% in 2030. This will

result in a yearly capacity of 592 gigawatt-hour battery demand in

2030 from just 56 gigawatt-hour in 2021. Lithium-ion batteries will

ace the race amongst all other battery chemistry types. The EU

passenger vehicle market for lithium-ion batteries is estimated to

reach a cumulative size of nearly 3,000 gigawatt-hour between 2021

to 2030. The battery pack and electric drive unit that make up a

BEV powertrain are anticipated to increase in value from 13.8 to 50

billion euros by 2030.

Continue reading...

Download the complete whitepaper

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbattery-pack-costs-rise-for-battery-electric-vehicles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbattery-pack-costs-rise-for-battery-electric-vehicles.html&text=Battery+Pack+Costs+Rise+for+Battery+Electric+Vehicles+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbattery-pack-costs-rise-for-battery-electric-vehicles.html","enabled":true},{"name":"email","url":"?subject=Battery Pack Costs Rise for Battery Electric Vehicles | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbattery-pack-costs-rise-for-battery-electric-vehicles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Battery+Pack+Costs+Rise+for+Battery+Electric+Vehicles+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbattery-pack-costs-rise-for-battery-electric-vehicles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}