Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 15, 2022

August 2022 Light Vehicle Production Forecast update

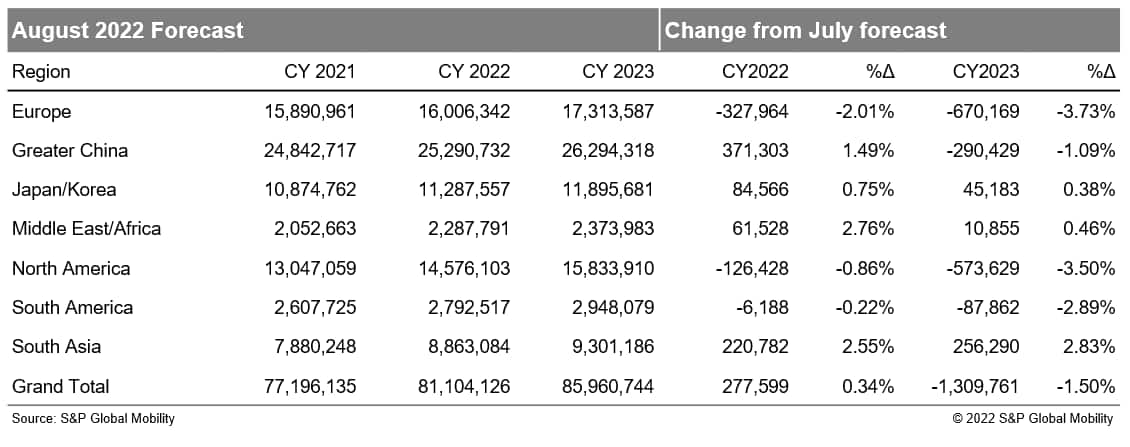

The following reflects the S&P Global Mobility August 2022 Light Vehicle Production Forecast update:

The August 2022 light vehicle production forecast update reflects deterioration in the near-term expectations for semiconductor supply coupled with enhanced risk for demand destruction due to macroeconomic conditions being pulled ahead into 2023. The implications are that the transition from "supply constrained" to "demand driven" will happen sooner rather than later and will also influence the amount of inventory rebuilding that will be required.

Automakers are expected to be somewhat less aggressive in their inventory builds, with many signaling concerns over aforementioned demand destruction, in order to avoid what could be a rapid shift from a low inventory profile to a return to overstock conditions.

This month's forecast update reflects a near-term upgrade for Greater China due to stronger demand post-COVID lockdowns and robust stimulus effects as well as a stronger near-term outlook for South Asia. However, more consequential are the near-to-intermediate term downward revisions, particularly focused on Europe and North America, among other regions.

In the extreme near-term, semiconductor availability/capacity has been marked down impacting the ability to accelerate production recovery. Further, we are seeing demand destruction pulling ahead into 2023 which has direct implications to production and impacts the magnitude/need for inventory restocking.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2faugust-2022-light-vehicle-production-forecast-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2faugust-2022-light-vehicle-production-forecast-update.html&text=August+2022+Light+Vehicle+Production+Forecast+update+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2faugust-2022-light-vehicle-production-forecast-update.html","enabled":true},{"name":"email","url":"?subject=August 2022 Light Vehicle Production Forecast update | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2faugust-2022-light-vehicle-production-forecast-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=August+2022+Light+Vehicle+Production+Forecast+update+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2faugust-2022-light-vehicle-production-forecast-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}