Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 16, 2022

Implications of Inflation Reduction Act on the North American Battery Supply Chain

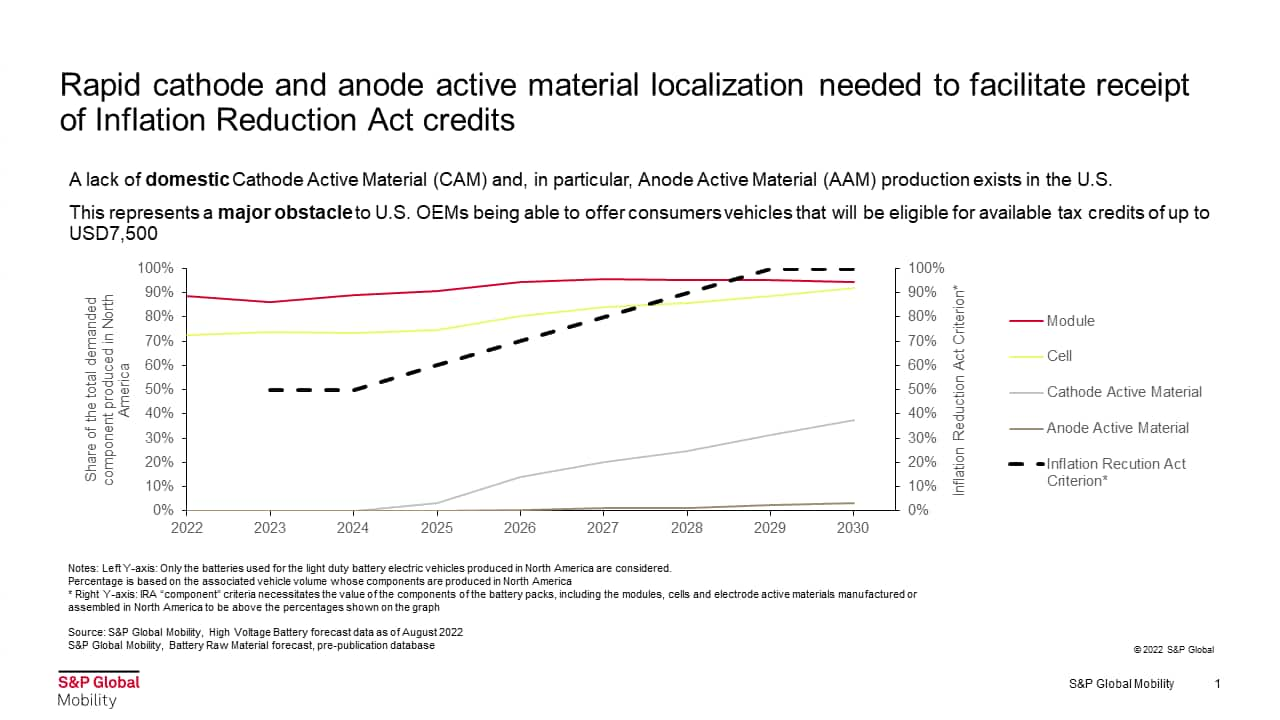

The Inflation Reduction Act (IRA) strives to shore up the battery supply chain to North America. OEMs who can fulfill the "component" and "critical mineral" requirements will be awarded with USD7500 tax credit. In addition, a production tax credit as large as 10% for the battery mineral and material processing companies and 35USD/kWh for the cell manufacturers is considered in the "advanced manufacturing production credit".

The component criteria, which constitutes half of the USD 7500 credit, as seen in the chart, puts a threshold for the minimum percentage of total value of the battery components including modules, cells and cathode and anode that are produced in North America. Despite a strong localization trend for the cell and module, cathode and especially anode materials, are still predominantly imported from other regions. In particular, in 2029, 100% of the battery components need to be produced in North America to satisfy the IRA requirement whereas the soon-to-be-published battery raw material forecast shows that only 3% of vehicles are expected to use locally produced anode active material.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fimplications-of-inflation-reduction-act-on-the-north-american-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fimplications-of-inflation-reduction-act-on-the-north-american-.html&text=Implications+of+Inflation+Reduction+Act+on+the+North+American+Battery+Supply+Chain+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fimplications-of-inflation-reduction-act-on-the-north-american-.html","enabled":true},{"name":"email","url":"?subject=Implications of Inflation Reduction Act on the North American Battery Supply Chain | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fimplications-of-inflation-reduction-act-on-the-north-american-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Implications+of+Inflation+Reduction+Act+on+the+North+American+Battery+Supply+Chain+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fimplications-of-inflation-reduction-act-on-the-north-american-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}