Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 16, 2024

eAxle and Electric Motor Drive EV Evolution

To develop more efficient electric motors (e-motors), OEMs and suppliers must innovate, balance design control with outsourcing, and manage supply chain risks.

The electric motor market is forecasted to increase rapidly over the next decade, driven by advancements in electric motor technologies like the eAxle and its original equipment manufacturer car parts.

Innovation in electric motor design and power

The eAxle is a compact, integrated assembly that combines the motor, power electronics, and transmission essential to an electric vehicle's (EV) infrastructure. S&P Global Mobility estimates over 122 millionelectric motors will be produced by 2035, with over 70% of them using electric Axle, driven by advancements in power density and efficiency.

In particular, electric motor designers focus on achieving higher specific power, which measures the power output per unit of weight. High specific power gives greater power output in a lighter and smaller motor. This phenomenon translates to improved energy efficiency, more extended range, and better overall system performance for an electrical vehicle.

Power trends show an average increase in specific power by 35% from one generation to another. This EV trend is the result of innovative strategies by suppliers like Bosch, Valeo, and others that either focus on augmenting power while maintaining weight, reducing weight while keeping power constant, or ideally achieving gains in both power and weight simultaneously. It will be incumbent upon manufacturers to understand the trade-offs and choose the eAxle configuration for their specific use case.

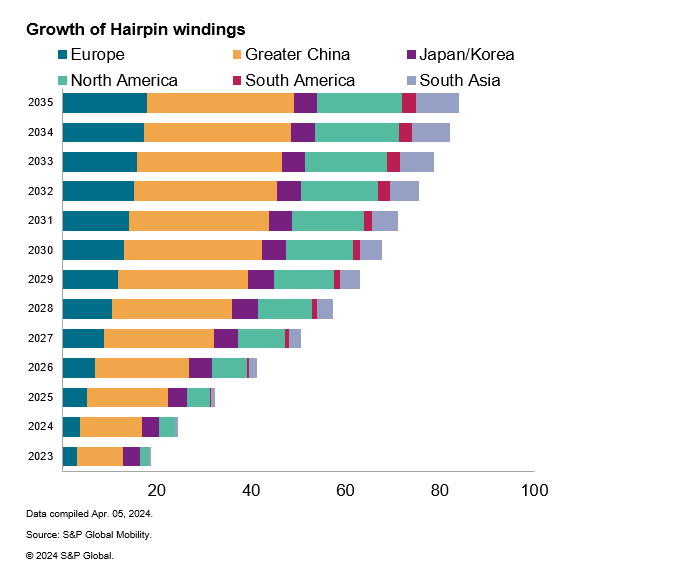

System designers have also made progress in improving the electrical motor speed. S&P Global Mobility forecasts that 19% of the Indian market demand by 2035 will be for electrical motors capable of operating at speeds above the 20,000 RPM limit. Original equipment manufacturers prioritize high-performance winding technologies like hairpin winding to achieve more thermally efficient and power-dense motors capable of maintaining these higher speeds.

Winding technology, which involves arranging coils within the electric motor, is a crucial factor in optimizing motor performance, efficiency, and power density. A hairpin winding design is preferred as it minimizes losses and maximizes fill factor - the ratio of the amount of copper wire used in the winding to the total available space within the stator.

EV Market Trends: Advances in Electric Motor Efficiency

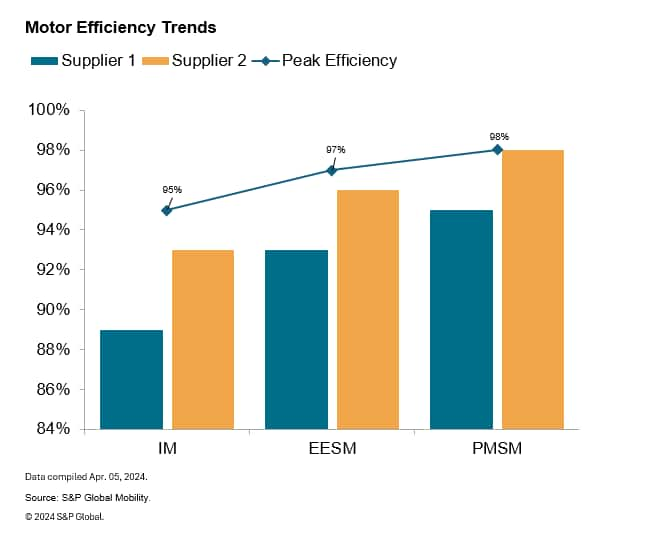

Permanent Magnet Synchronous Motors (PMSMs) have emerged as the EV industry standard among the different electric motor types due to their superior efficiency and power density. These attributes make them highly suitable for electric vehicles where performance and range are critical. However, their reliance on rare earth materials, necessary for their strong magnetic fields, poses cost and ethical sourcing challenges.

The EV industry is exploring alternatives to Permanent Magnet Synchronous Motors (PMSMs), such as induction and externally excited motors, which do not require rare earth elements but may have varying weight, power, and efficiency trade-offs. For instance, Tesla is developing a rare earth-free magnet that targets lower-cost vehicles. Other original equipment manufacturers (OEMs), such as GM and Stellantis, also invest in this area.

The global shift towards sustainability is also influencing the production of electrical motors. While Permanent Magnet Synchronous Motors (PMSMs) will continue to dominate the EV market, there is a noticeable EV trend towards non-magnet-based motors, which are forecasted to constitute 23% of the global market by 2035. OEMs are keen to reduce dependency on neodymium, a rare earth element used in permanent magnets, which frequently fluctuates in availability and price. By decreasing the use of neodymium in electric motors, manufacturers can reduce costs and enhance sustainability.

Major automotive players are investing in recycling and sustainable materials to reduce their products' environmental impact further. Copper is a critical material in electrical motor construction and assembly. With advancements in wire technology, such as the transition from round to rectangular wires, manufacturers optimize copper utilization, leading to better efficiency and reduced material use.

Mainland China is the leading global supplier of electric motors due to its abundant reserves of rare earth elements. However, investments in material partnerships are reshaping the EV motor production landscape. For example, BMW iVentures' investment in rare earth element recycling and Niron Magnetics' development funding for clean earth magnets are just some of the efforts to innovate and secure supply chains in the EV industry. As major OEMs look to diversify supply away from mainland China, India stands to gain. Nidec and ZF have invested in new plants in Karnataka and Orgadam to increase production.

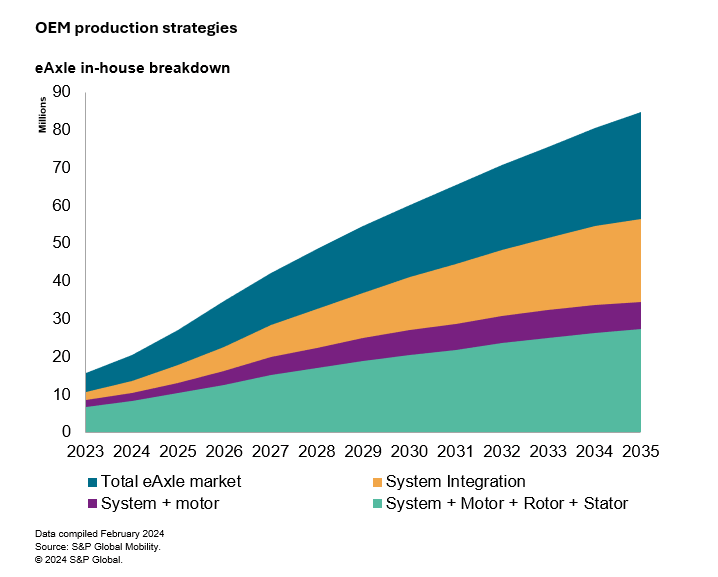

As electric vehicle adoption grows, the eAxle in-house production levels increasingly indicate OEMs' strategy to integrate design and control production. By 2030, 68% of the electric Axle will result from in-house OEM system integration.

This transition, however, is not devoid of challenges. With rising volumes, OEMs must diversify the supply chain and potentially rely on outsourcing for specific production processes. By so doing, OEMs can then focus on system integration while leveraging the expertise of specialized suppliers.

The regional dynamics of electric Axle production can vary depending on technological capabilities and supply chain constraints. Equity alliances are more favored in regions like Japan and Korea, while North America prioritizes in-house production. By 2030, the in-house production of systems that include motor and rotor or stator components will decline to 34%, marking a strategic reliance on supply chain partnerships to optimize production efficiency and cost.

As the EV market matures, efficiency is the central theme, not just in the electric motors but across the entire supply chain, from raw materials to final assembly. It will take innovation, strategic material sourcing, and production efficiency from automakers, suppliers, and OEMs to drive the future of electric vehicles.

This article is part of a series featuring highlights from S&P Global Mobility's 2024 Solutions Webinar Series. The E-Motor Technology and Supply Chain Evolution webinar occurred on April 16, 2024.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-motors-eaxles-growth-trends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-motors-eaxles-growth-trends.html&text=eAxle+and+Electric+Motor+Drive+EV+Evolution+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-motors-eaxles-growth-trends.html","enabled":true},{"name":"email","url":"?subject=eAxle and Electric Motor Drive EV Evolution | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-motors-eaxles-growth-trends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=eAxle+and+Electric+Motor+Drive+EV+Evolution+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2felectric-motors-eaxles-growth-trends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}