Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 21, 2024

3 Takeaways on the Latest Retail Advertised Inventory Trends

S&P Global Mobility analysis of current retail advertised inventory data for the United States finds that inventory is still on the rise, with electric vehicle (EV) inventory growing faster than the overall industry.

Here are three key takeaways from our team's latest analysis.

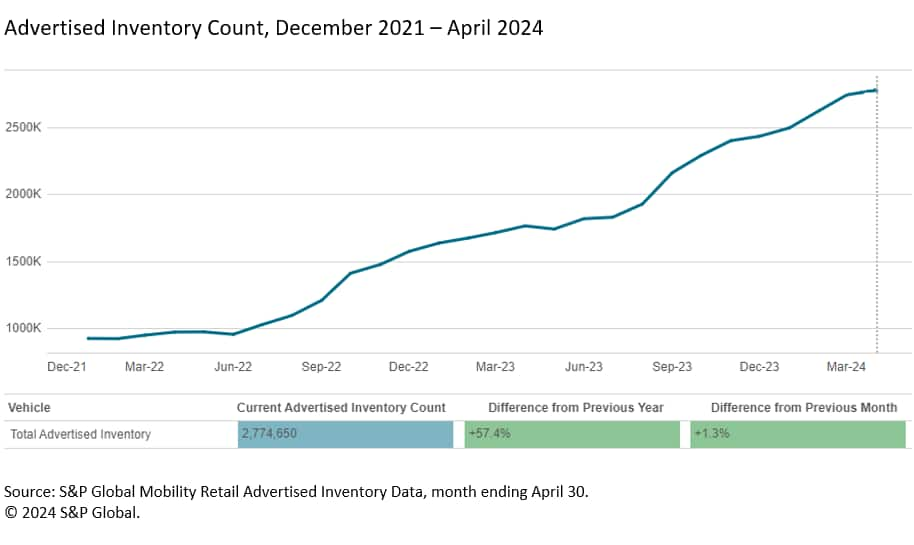

1. Available retail advertised inventory at the end of April

rose to 2.77 million vehicles, up 1.3% compared to March and 57%

over last April.

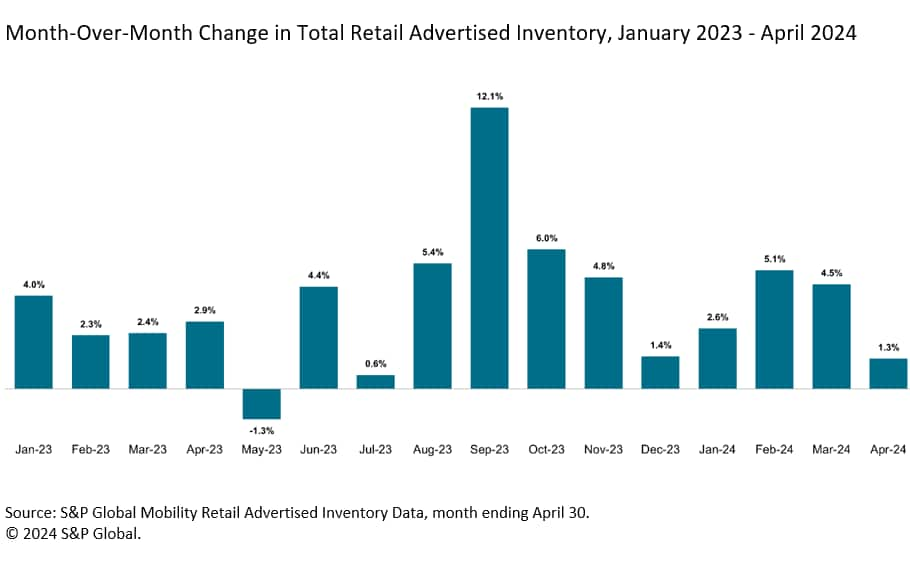

This is the 11th consecutive month of increases (22 of the last 24 months have grown vs. the prior month), but the rate of increase is the lowest since July 2023.

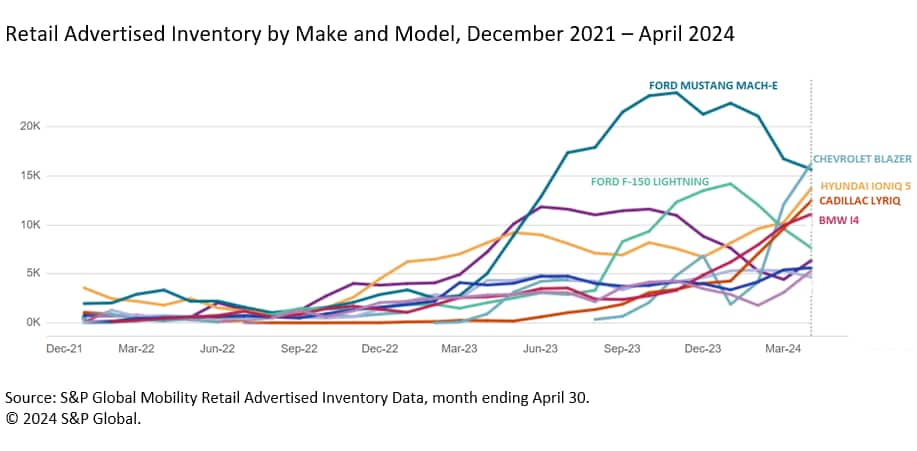

2. Electric vehicle inventory continues to grow faster than that of the industry as a whole.

April finished at 167,000 vehicles, an increase of 5.7% against March and 105% vs. last year. While Ford EV inventory levels have been decreasing, other models have been growing. The Chevrolet Blazer EV, Hyundai Ioniq 5, Cadillac Lyriq and BMW I4 have all shown consistent inventory growth over the last months.

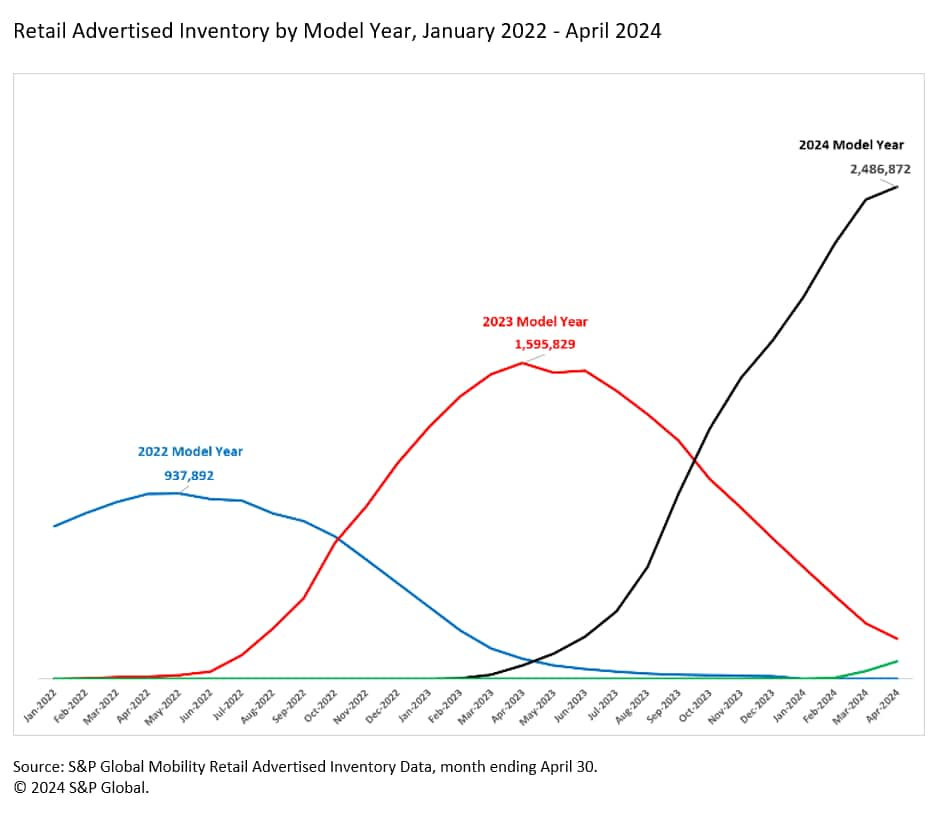

3. Model Year 2024 vehicle inventory continues to ramp up, with a total available inventory now standing at 2.49m vehicles.

This is already well above the peak seen for the 2023 model year, which only hit 1.60m vehicles. In comparison, 2022 model year only reached a peak of 938K.

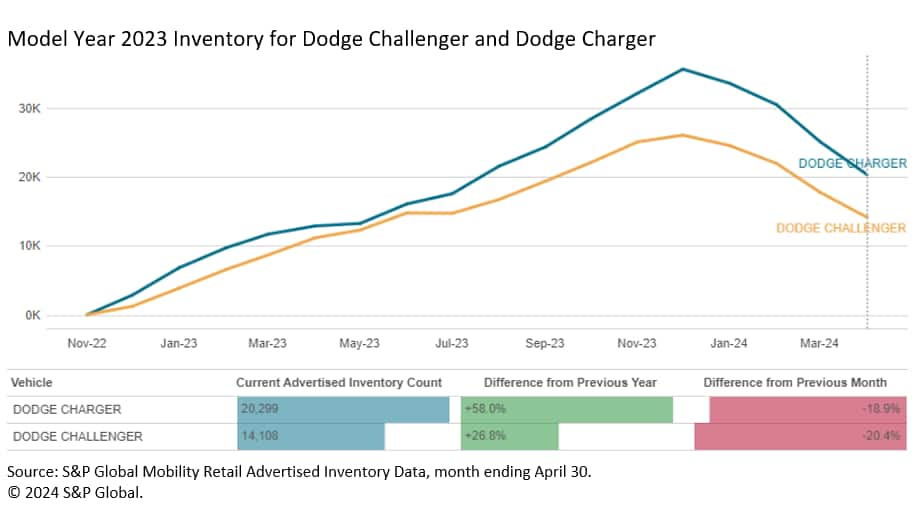

However, some 2023 model year vehicles still remain,

approximately 202k vehicles, representing 7.2% of all inventory. Of

note are the Dodge Charger and Dodge Challenger, which are the two

models with the most remaining 2023 model year inventory, although

levels have decreased by around 20% compared to the end of

March.

Dealers are listing these vehicles on average at around $7,000

below MSRP, with the best offers appearing in Florida ($8,900) and

Nevada ($10,000). There are opportunities for consumer deals with

the remaining 2023 model year inventory as well as with the higher

absolute levels now appearing of 2024 model year.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fretail-advertised-inventory-trends-april-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fretail-advertised-inventory-trends-april-2024.html&text=3+Takeaways+on+the+Latest+Retail+Advertised+Inventory+Trends++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fretail-advertised-inventory-trends-april-2024.html","enabled":true},{"name":"email","url":"?subject=3 Takeaways on the Latest Retail Advertised Inventory Trends | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fretail-advertised-inventory-trends-april-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=3+Takeaways+on+the+Latest+Retail+Advertised+Inventory+Trends++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fretail-advertised-inventory-trends-april-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}