Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Dec 19, 2023

Fuel for Thought: Connected cars and the automotive revolution

LISTEN TO THIS FUEL FOR THOUGHT PODCAST

The automotive industry is reaching an inflection point that will reshape its near-term future, precipitated by the connected car era - also known as software defined vehicles or "SDVs." This will affect every aspect of future mobility, from Generative AI implications in Level 2+ autonomy to the HMI of the cockpit domain software.

On the eve of CES, automakers and suppliers are closely monitoring the evolution of connected cars - encapsulated in the "CASE" acronym of Connected, Autonomous, Shared, and Electric. This transition will be crucial to rebalancing the automotive value chain and to how OEMs exert control over the vehicle assembly process. But this involves more than just the building of the software-defined vehicle. Automakers also will attempt to extract more value from the service life of these vehicles.

OEMs are looking to wrest back control from tier 1 and system-on-chip (SoC) suppliers involving revenue that can accrue over a vehicle's lifetime, including in-vehicle applications and digitized services that SDVs facilitate with ease.

The side effect will be a period of upheaval and rebalancing in the supplier value chain, thus making the transition complex.

This change threatens to upend the industry's value chain, which has been taken for granted since Henry Ford's first moving production line in 1913 at Highland Park, and the accepted orthodoxy of the Toyota Production System that's shaped the industry's value chain through the 20th century and early part of the 21st.

Of course, such a reshaping of the automotive value chain will be strewn with obstacles and opposition - geopolitical and practical - and OEMs will face opposition from industry participants reluctant to cede their place at the table.

Historically, the automotive industry has focused on cost-optimizing hardware, such as with semiconductors. Software was seen as necessary, but not as strategically important as hardware. Tesla's unleashing of the software-defined vehicle - with its over-the-air updates - challenged the status quo. It's not that software wasn't strategically important, just that the industry simplified software to the cost of memory.

Development of electronic functions was rooted in both expediency and cost. The symbiosis between hardware and software was straightforward: More code simply translated to a more expensive microcontroller unit (MCU). Minimized hardware costs minimized software size. This justified the proliferation of MCU derivatives based on different memory sizes so long as smaller memory translated into lower hardware cost.

This approach has dominated automotive R&D thinking for decades, with gentle evolution fitting comfortably within the existing automotive value chain structures and traditional platform redesign cadences. OEMs orchestrated material flows and wielded cost-down power.

Electric vehicles and the connected car opportunity

OEMs are emboldened by the new E/E architectures and product development process shifts taking place. These changes will be evidenced in 2024 and 2025, when Level 2+ automated vehicles, complete with the widespread adoption of over-the-air (OTA) updates, will become more mainstream.

OTA brings multiple revenue opportunities. OTA updates also allow the vehicle to be maintained, updated, and have features added over its lifetime without visiting a dealership. With OTA, the initial sale of the vehicle becomes the start, rather than the end, of the value-extraction process for the automaker.

Within the current industry structure, there is little incentive in terms of return on investment for automakers to keep the status quo. The current practice is for hardware suppliers to embed their software in deliverables. A case in point is Mobileye's dominant position in the computer vision space, where they can leverage both their hardware and software stack. Where the software is embedded and there is a requirement for post-delivery customization, there either is a cost implication for the OEM, or the revenue generated from the innovation is shared with the vendor.

With the Level 2+ rollout, OEMs are wary of repeating that experience and being bypassed. With an increasing set of services being offered over a vehicle's usage life cycle - all enabled by software - and knowing that service revenues come with two- to four times the margins of hardware, OEMs see an opportunity not to be missed.

Tesla as harbinger of change

The early success that new-era OEMs like Tesla, Xpeng, and Nio have had in internalizing software development — and therefore revenues — has aroused envious glances from legacy automakers. And they have a point - up to a point. Tesla's EBITDA margin continues to outpace its competitors. In 2022, Tesla recorded a margin of 21.4%, while a selection of 11 of its established competitors managed an average of 12.6%. Tesla's margin in 2022 was nearly 50% more than that of Honda, which was the strongest-performing competitor, according to S&P Global Market Intelligence.

Of course, Tesla's margins are not solely attributable to its software approach, although it undoubtedly helps. It eschews advertising, and its platform range is narrow, which slashes costs. Additionally, other strategies such as the one-piece gigacasting will contribute to its bottom line.

But Elon Musk sees the sale of a software defined vehicle as just the starting point of the consumer relationship. During Tesla's Q4 2022 earning call, Musk stated, "We're the only ones making cars that, technically, we could sell for zero profit now and then yield tremendous economies in the future through autonomy. No one else can do that."

Musk put that claim to work at the end of 2022, when Tesla began deep price cuts to its models which lowered its margins - but still provided a greater return than its peers, causing jitters in competitors' electrification strategies.

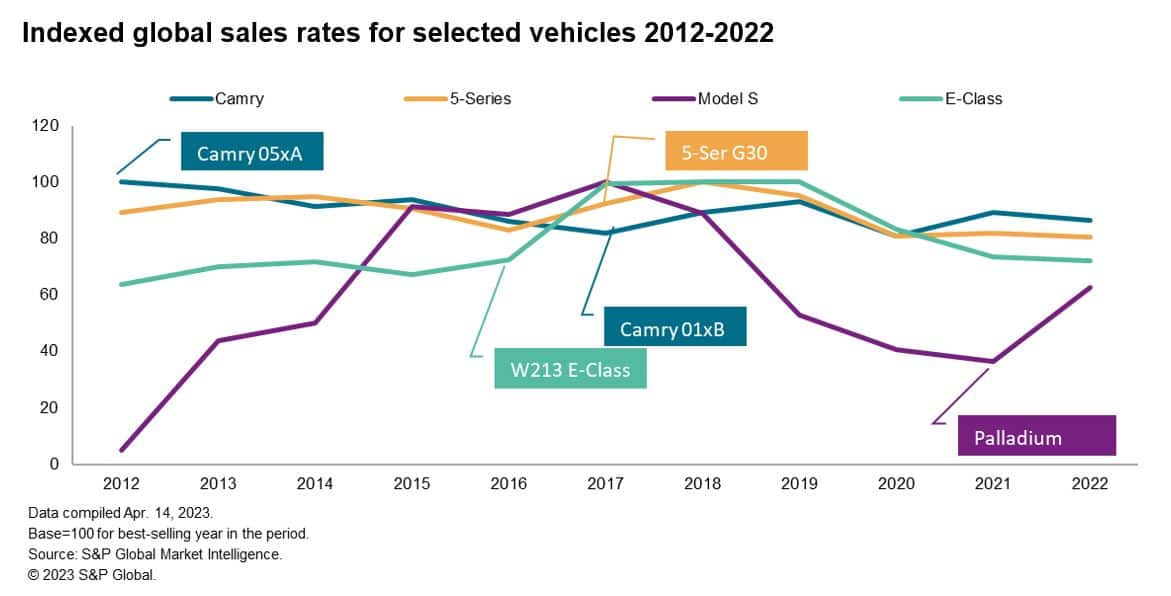

Tesla's SDVs also challenge vehicle development orthodoxy. Rather than a vehicle undergoing costly minor physical engineering changes every three years, then major architectural and platform redesigns every six years, the SDV allows for a different approach via OTA updates. Legacy OEMs will dissent, however, stating that adopting Tesla's practices will result in volume decay for vehicles that suffer long cycles between design changes.

The chart below indexes sales of E-segment vehicles that compete with the Tesla Model S globally over a period - beginning with the Model S's launch year of 2012 through 2022. Over the 10 years, competing models all underwent significant sheet metal changes, while the Model S's 2021 'Palladium' update was far less involved on a material basis. Whether legacy OEMs will stomach the prospect of such pronounced sales decay is a moot point.

Middleware and Connected Car development

The battleground for the SDV value chain is already developing - and the main clash involves middleware.

Foundational components like operating systems are not an area that OEMs will strategically invest in, but instead treat like a commodity by signing long-term contracts. The development of a virtual software layer between hardware and software by automakers is another area of intense research. This layer would enable the translation of complex hardware and software resources into a more straightforward format in the upper layer software stack.

Achieving this objective allows the separation of the hardware lifecycle from the software function development. Each can then function independently, providing more options for future collaboration with the new software supply chain.

The commodity middleware link will have a degree of customization and there will be some collaborative investment, but it will be with one eye on future infrastructure requirements for SDVs. Currently, this is where companies such as Mobileye and Nvidia exist.

But automakers want to develop and own the strategic middleware space. Vendors would have to keep the vendor's code or its interfaces, leading to a cost for every customization and, sometimes, a license fee payable on a per-vehicle basis. Suppliers rebut this position, insisting that software is not a core OEM competency - pointing to VW's notoriously troubled CARIAD software development. Furthermore, vendors such as Mobileye have built a formidable power base that will prove challenging for OEMs to separate responsibilities for software from hardware.

Not all OEMs will have the wherewithal or desire to own this area of the value chain. Some automakers actually see a turnkey middleware solution as attractive. This could be due to the OEMs lacking in-house software capability, not actively developing SDVs or Level 3 vehicles, or a preference to be a fast follower rather than a first mover and take advantage of lower development costs.

The human-machine interface (HMI) and user experience (UX) is a key part of any OEM's core competency - and a brand differentiator in a world of increasingly homogenous vehicle design. If control of the API and middleware is secured, this will be an area of 100% OEM participation.

There also is the SDV's backend to consider. SDVs need an instantaneous uplink and downlink cloud connection. As latency is essential in supporting the new business model, it is likely that OEMs will also seek to own the connection between cloud platform services and the middleware. This is a path that BMW, VW, and Tesla have already embarked upon, and others are sure to follow.

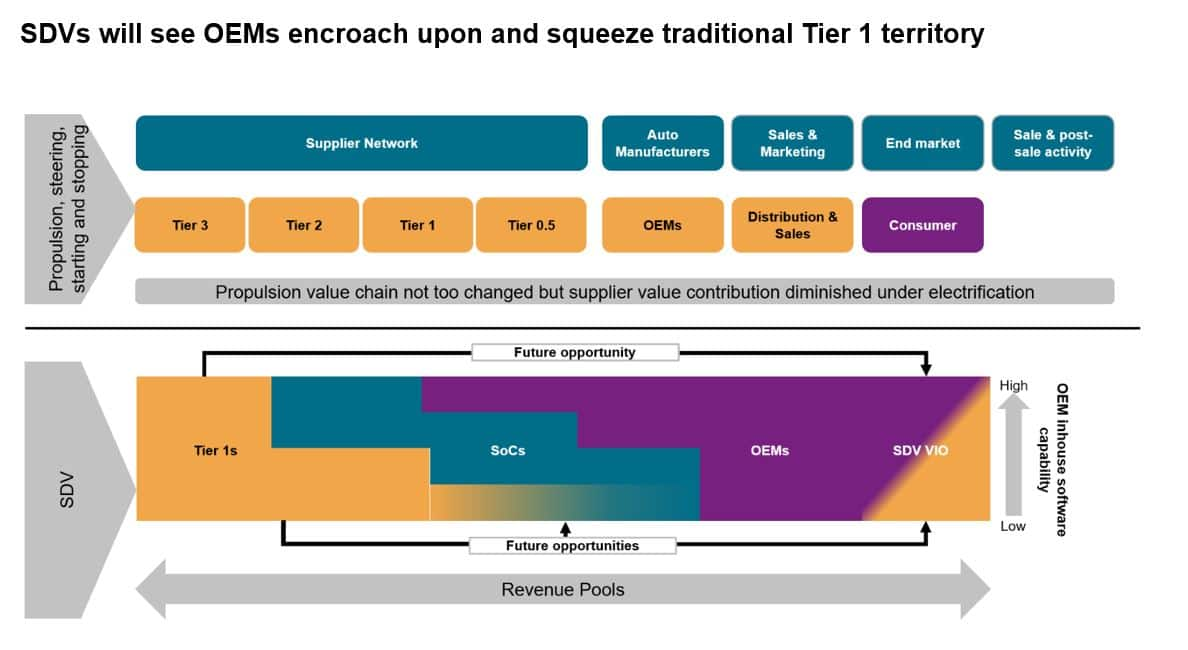

SDVs and parallel value chains

The decoupling of the vehicle development process from a vehicle's hardware and software integration under the SDV megatrend will see two value chains develop in tandem. While the traditional view of the value chain will last, its focus will shift to what makes the vehicle move, change direction, and start and stop.

Electrification will diminish the value that traditional mechanical components contribute to a bill of materials (BOM), due to the battery and electric motors becoming bigger constituent components compared to internal combustion. Because of the E/E and software revolution, traditional mechanical components will become increasingly commoditized, placing pressure on the supply base.

Tier 1 suppliers hoping to use their automotive software expertise to cash in on SDVs and migrate from their role as system integrators to software integrators face a battle. In an idealized scenario, OEMs are reluctant to cede ground to either the SoC vendors or the tier 1s. However, given the choice of who is more central to future business, they are likely to choose the SoC vendors.

OEMs will lead the decision

Automakers are essential in determining how the SDV value chain develops. The extent of their involvement will boil down to the level of in-house software capability. This can be shaped from a philosophical or strategic viewpoint, or it can be due to the availability of financial and human resources.

Those without the financial capability to go it alone will opt for development partnerships in commodity middleware and foundational parts of the strategic middleware. Here, an OEM can then use the platform a partner supplies to develop their API. This allows an OEM to at least have some skin in the game.

For the supplier of the middleware platform such a partnership also offers a way forward — but relies upon the supplier having developed a solution set in-house (e.g., Bosch and ETAS, ZF and Mediator) or acquiring the capability. Such an arrangement was formed in April 2023 by JLR with Elektrobit, which is owned by Continental. From 2024, JLR's EVA Continuum platform will use Elektrobit's software platform and operating system.

These new partnerships could portend the end of eras defined by often confrontational and adversarial supplier relations. The advent of the SDV could usher in a more collaborative era, allowing more industry participants to share in the spoils on offer from the SDV revolution.

--------------------------------------------------------------

Dive deeper into these mobility insights:

MORE ON THE FUTURE OF MOBILITY AND CONNECTED CARS

MORE ON AUTONOMY, CAR SHARING AND ELECTRIFICATION

AUTOMOTIVE PLANNING AND FORECASTING

TECHNOLOGY VEHICLES IN OPERATION

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-connected-cars-and-the-automotive-revolution.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-connected-cars-and-the-automotive-revolution.html&text=Fuel+for+Thought%3a+Connected+cars+and+the+automotive+revolution+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-connected-cars-and-the-automotive-revolution.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: Connected cars and the automotive revolution | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-connected-cars-and-the-automotive-revolution.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+Connected+cars+and+the+automotive+revolution+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-connected-cars-and-the-automotive-revolution.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}