Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Jun 27, 2023

Fuel for Thought: The Transformation of Auto Retail – Bricks, Clicks, and People

LISTEN TO A PODCAST ON THIS TOPIC WITH S&P GLOBAL MOBILITY EXPERTS

When was the last time you went to a local travel bureau to book a flight? Exactly!

While most other industries have transitioned to a digital model for more than a decade — from travel services to consumer-packaged goods to banking — the car-buying process has remained a very traditional physical process. Until now.

No-haggle pricing, direct-to-consumer, and the agency model are new retail concepts often referenced in an EV context. But is selling EVs really all that different from selling ICE vehicles in an omnichannel environment?

Evolving customer expectations are the impetus for change. Electrification is merely the lever. Customers have been demanding a more exciting and simplified sales process for decades, but the industry has been resistant to change. It needed a global pandemic and new powertrain technology (along with increasing cost pressure) to force OEMs to rethink auto retailing.

So, what's different compared to a few years ago?

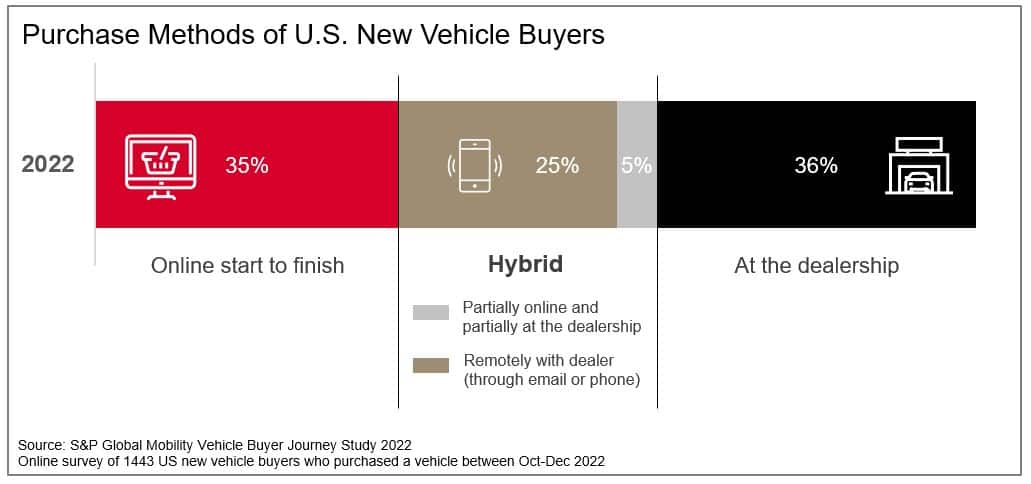

- The COVID pandemic had a lasting effect on

consumer behavior. 65% of US vehicle buyers shop online or

partially online according to S&P Global Mobility's latest

Vehicle Buyer Journey Study. This continues a trend, with 'Online

Readiness' up by 17 percentage points in the past two years. Most

importantly, though, 61% of US consumers said that the availability

of an online transaction option influenced their purchase decision.

This is a global trend also observed in Europe and China.

- Global inventory shortages during the pandemic

have further accelerated the shift in consumer behavior, as digital

shopping options made it easier to compare and locate the product

of choice, and high incentives/discounts stopped being the norm.

But the return of inventories and discounts could hinder this

retail transformation.

- EV disruptor brands may strive in this climate to prove that automotive commerce does not need extensive physical networks to create market reach. More as a necessity rather than planned revolution, new entry brands are creating a new experience of highly digitized and CAPEX-light retail networks while promising a superior customer experience.

The biggest motor for change, however, always was and still is cost pressure. Traditional internal-combustion manufacturers are finally buying into retail transformation — not 'outside-in' listening to customer expectations, but 'inside-out' driven by financial targets. To cross-finance the expensive shift to EVs while fighting dwindling margins at the same time, the reduction of cost of retail is one of the most significant cost levers.

As a result, between 2% and 5% cost savings are expected to result from retail transformation due to: lower incentives spend and higher gross profit per vehicle; reduced staffing due to simplified and digitized processes; and optimized stock management with a significantly reduced number of demo cars and higher share of build-to-order vehicles.

Aligning ICE and BEV marketing is key

You don't do your brand a favor if there are different marketing strategies for EVs and ICE vehicles.

EVs are not the impetus for change, but a very strong lever to make the transition to the future of automotive retail. Traditional ICE manufacturers have chosen different innovative approaches when it comes to launching and selling EVs. The retail model where every franchised dealer can sell a brand's electric vehicles (as opposed to only select, "qualified" dealers) does not seem to work for most mainstream OEMs — due to limited stock availability (for now), uneven regional distribution of demand, and the high level of investment required per dealer to become EV-ready.

Selective EV retailing approaches vary between voluntary dealer buy-out packages as offered by GM in the US, BEV-agency retail models as seen with multiple OEMs worldwide, to very bold strategies such as splitting entire business lines like Ford Blue and Ford Model E.

Lest we forget, today's EV strategy is the future strategy for the brand. Very soon electric vehicles will be the majority of vehicles for sale — by 2031 in both the US and globally — and those innovative approaches become the standard for most consumers.

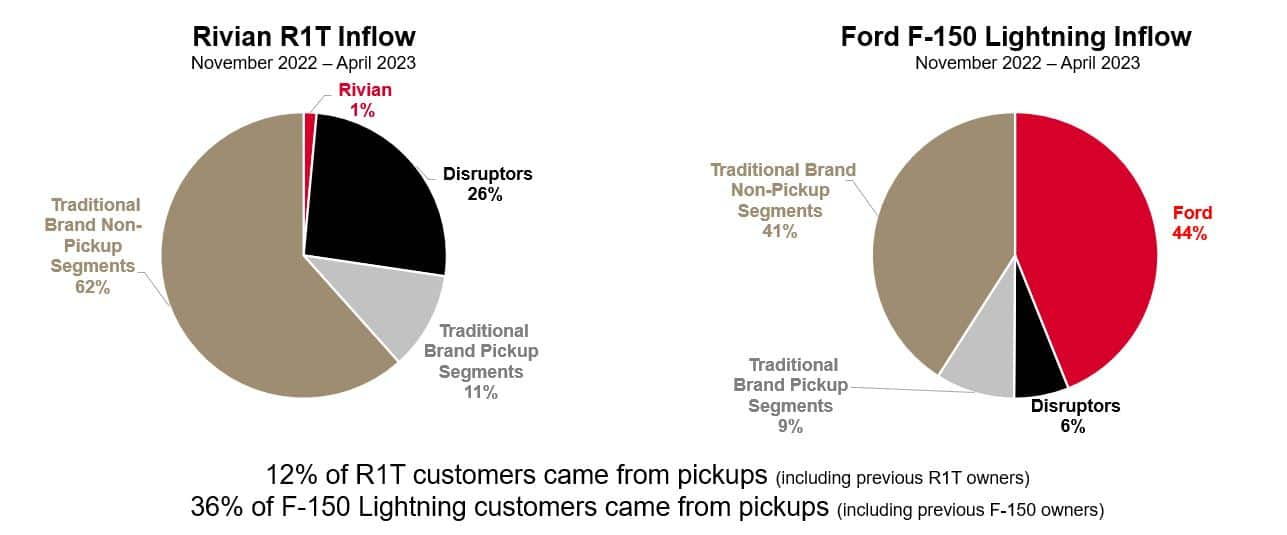

S&P Global Mobility's EV consumer analytics show distinct differences between the so-called disruptor brands vs legacy brands selling EVs. Disruptor brands conquest primarily fuel-type-loyal Tesla customers, followed by early-adopter type consumers across all segments. When established brands launch EVs, however, they pull from their own existing ICE customer base as well as the traditional core competitor basket in the established segments (some legacy brands have had limited success conquesting Tesla).

With that understanding, OEMs should rethink their selective and radical EV retailing approaches. It's still selling the same brand, just a different powertrain. Retail innovation is ultimately required for the entire brand network, and brand consistency can provide psychological reassurance for customers as they embark on the EV journey.

For all the praise of the Tesla model, this is not for everyone, and the Tesla success story has yet to be repeated. Traditional ICE OEMs should capitalize on the advantages of their dealer partners and brick-and-mortar networks, rather than trying to emulate new-entrant EV brands.

Redesigning bricks & mortar

So, what is the future role of the dealer? Undoubtedly the digitization of automotive retail will lead to a consolidation of brick-and-mortar showrooms. The conventional 'convenience' metric needs to be redefined — it's no longer convenient having to drive to a dealership. Dealers need to meet customers where they are: at home, at work, while shopping, etc. Convenience is about ease and simplicity and availability anytime and anywhere.

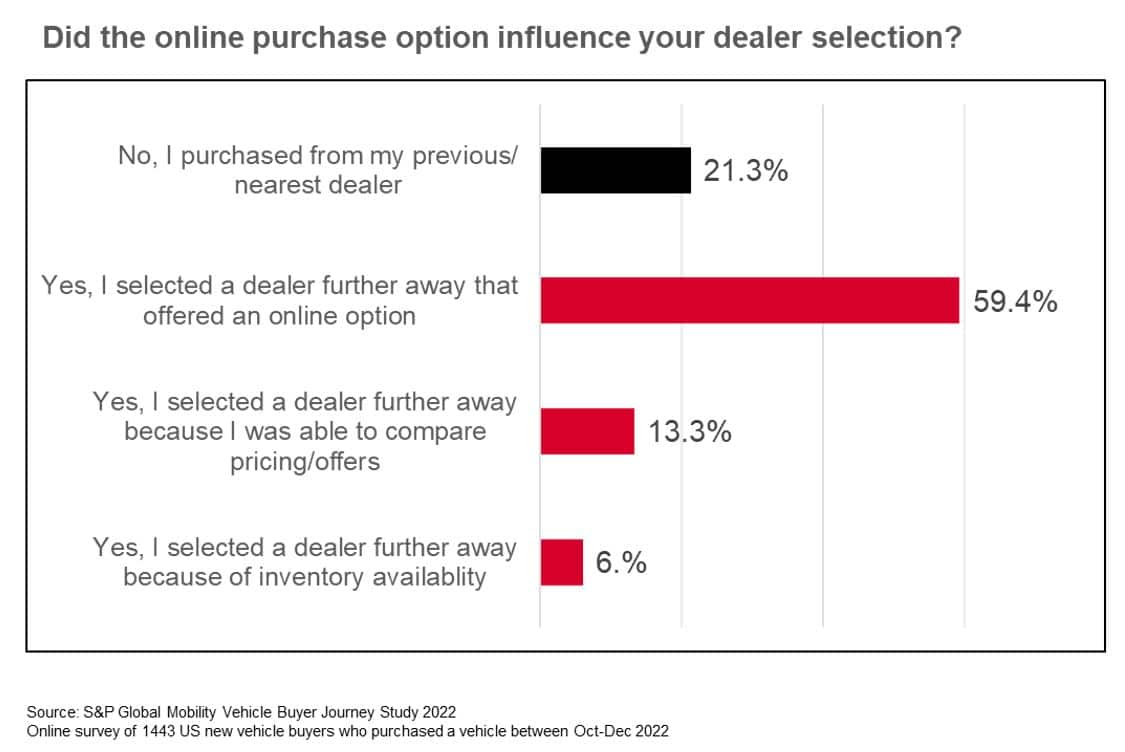

A stunning 60% of consumers surveyed in S&P Global Mobility's Vehicle Buyer Journey Study reported that they drove further than their nearest dealer due to the availability of online channels. And based on actual purchases (sales data statistics), US consumers today travel 11% further on average than five years ago, reducing the need for dense dealer networks.

Intriguingly, out of consumers who admitted to choosing a further away dealership due to online features, almost double the amount of consumers in China and Europe (compared to the US) said the specific online element that influenced their dealer choice was the ability to compare pricing and offers, as opposed to being able to complete parts of the purchase process online.

But consumers still want to touch, feel, and experience the product. They also need the peace of mind to have a local go-to point for servicing — as remote-servicing models continue to face challenges. Physical representation will therefore remain crucial. Consolidation should first occur in facility optimization and investor consolidation, only then followed by responsible rooftop consolidation.

Facility recycling and right-sizing showroom space is not only important to reduce dealer operational costs, but also imperative to adjusting the remaining showrooms as the sales process struggles to remain casual and personal, rather than transactional — even though replacing bricks with clicks might remove that personal touch.

Brands need to create a new less intimidating feeling, with a focus on hospitality. Showroom design should think of the human being first, not the display of vehicles. Removing desk space and printers in exchange for casual seating and coffee bars is only the tip of the iceberg to a new physical retail experience - which provides an opportunity to improve on ESG in retail.

There is opportunity to generate a win-win outcome from this industry disruption, for OEMs, dealers, and consumers.

Breaking the model

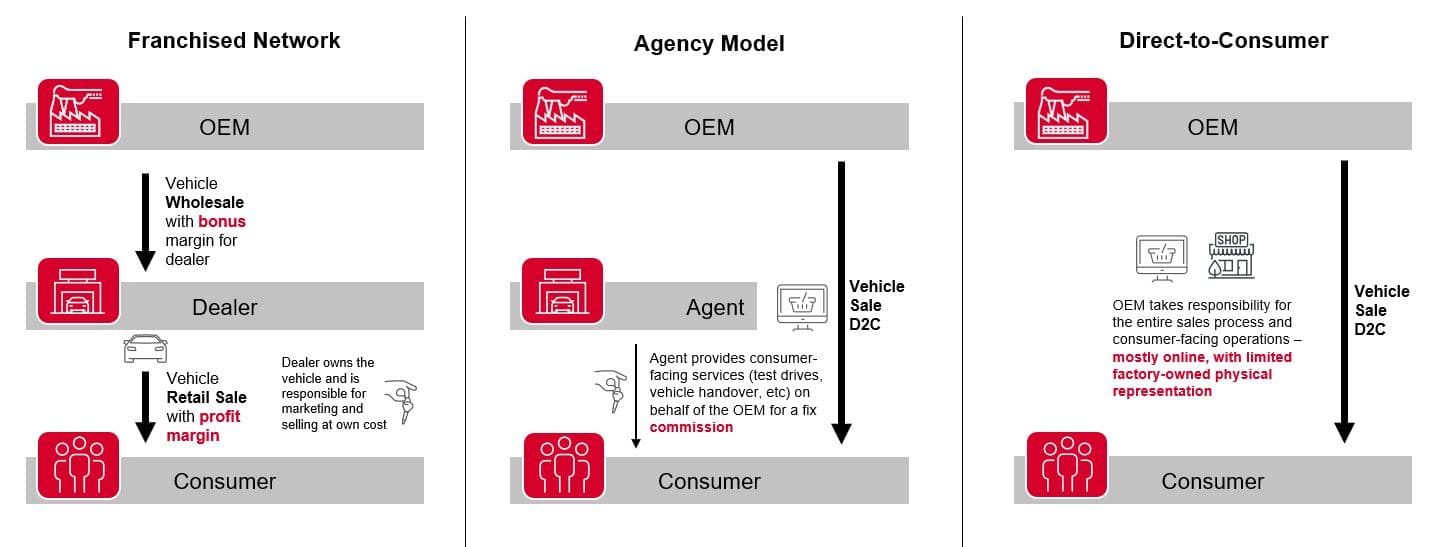

Although anathema to franchised dealers, can the direct-to-consumer (D2C) model provide an answer?

Franchised networks in most mature markets are over-dealerized, highly cannibalistic, and have not proven sustainable. Many pure D2C networks, however, face the opposite challenge; very lean networks do not reach certain geographies and demographics, especially in regard to service coverage.

Agency retail models can be seen as transitional, combining the best of both worlds: the backbone of a strong physical partner network with the cost savings of D2C models. If such a model is adopted, OEMs and retailers should go all-in, as hybrid approaches such as 'non-genuine agency' tend to fall short of generating the expected efficiencies and expose legal risks.

However, agency or direct-to-consumer retail models alone are not the answer and are not going to solve the omnichannel retail challenge. Retail transformation is more than just a contractual or facility issue, it is a data and a people issue. There needs to be a parallel approach.

Pricing is one of the biggest challenges hindering online adoption. Consumers will still go to the dealer if they can negotiate a deal, even if the experience is terrible an online purchase would be more convenient. The Vehicle Buyer Journey survey showed most showroom visits in recent years were not actually customers wanting to go to a dealer to touch and feel the product, but customers cross-shopping between dealers of the same brand to get the best deal for the product they already selected online.

During the pandemic-related inventory shortages, even traditional US inventory-push models began making a gentle push towards 'build-to-order' with online configurators and remote test-driving options. As inventory is slowly coming back, it will be essential for OEMs to keep incentives at moderate levels and manage intra-brand cannibalization to enable effective digital retailing. Of course, more than a century of habits may be tough to break in transitioning to a new retail model.

Despite all the focus on digital tools and new forms of bricks-and-mortar, the automotive industry is still caught in a traditional retail mindset that has cemented over decades and generations of dealers.

Firstly, people: The modern retail approach requires an innovative mindset and new skillsets. OEMs and dealers need to hire a different type of staff — less transaction focused, more hospitable. We see OEMs hiring residential architects instead of commercial architects to design new facility standards, for example. More women leaders in dealerships to target a demographic group that makes up 50% of consumers but traditionally has been overlooked. Or product experts who support customers and make the purchase experience less intimidating without the pressure of sales targets or commission-based pay.

Secondly, data: The landscape of data, systems and vendors in use at vehicle dealerships today is exhaustive and exhausting. In most cases, customer data is fragmented and not connected across systems — hindering a truly seamless customer experience between online and offline channels. Data integration is the single most important success factor for effective e-commerce, with seamless hand-off points along the customer journey.

Both people training and data integration are not easy to overcome as they require significant investments and scale. It seems only large dealership groups can make that shift. Not surprisingly, the consolidation of rooftops under fewer but bigger groups is expected to continue, in parallel with facility transformation and reduction of rooftops overall.

Future automotive retailing requires the holistic transformation of bricks and clicks, and the people who will make this new omnichannel platform work effectively.

Online platforms alone won't do the job without an effective physical footprint. But redesigned bricks and mortar is a wasted investment without trained staff and a truly integrated omnichannel process. This transformation goes beyond adjusted dealer contracts; it needs a new collaborative approach between manufacturers and dealers.

--------------------------------------------------------------

Dive deeper into these mobility insights:

Top 10 Industry Trends Report: Download Now

Vehicle Retailing: Old Dog, New Tricks - Read the blog

Learn more about S&P Global Mobility's Micro-Level EV Adoption Forecast

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-transformation-of-auto-retail.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-transformation-of-auto-retail.html&text=Fuel+for+Thought%3a+The+Transformation+of+Auto+Retail+%e2%80%93+Bricks%2c+Clicks%2c+and+People++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-transformation-of-auto-retail.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: The Transformation of Auto Retail – Bricks, Clicks, and People | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-transformation-of-auto-retail.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+The+Transformation+of+Auto+Retail+%e2%80%93+Bricks%2c+Clicks%2c+and+People++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-the-transformation-of-auto-retail.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}