Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

NEWSLETTER

Oct 25, 2023

Fuel for Thought: Waiting for Autonomy

LISTEN TO A PODCAST ON THIS TOPIC WITH S&P GLOBAL MOBILITY EXPERTS

Five years ago, hype surrounding "autopilot" cars peaked. But S&P Global Mobility's updated forecast offers a reality check of careful, limited adoption of self-driving technology through 2035.

A world of autonomous vehicles is likely to exist eventually, but for at least the next decade, that will be mostly in two very specific areas: geofenced robo-taxis operated by fleets in specific areas and hands-off systems with various safeguards in personal vehicles that require some form of driver engagement.

As for a "World of Tomorrow" self-driving vehicle where you and the family can sleep in your seats and wake up 200 miles away at Grandma's? The industry calls that "Level 5" autonomy, the highest level of vehicular autonomy defined by the Society of Automotive Engineers (SAE). That idea will stay firmly in the distance for the foreseeable future, according to the latest forecast on vehicle autonomy by S&P Global Mobility.

The ability for a consumer to buy a car that will drive itself everywhere without the driver ready to take the wheel is unlikely to happen by 2035. Level 5 implementation of fully autonomous technology in the automotive retail fleet has zero representation before 2035 in the S&P Global Mobility forecast, "and probably for some time after that," said Jeremy Carlson, associate director for the autonomy practice at S&P Global Mobility.

"Level 5 is essentially perfect replication of human driving," Carlson said. "A car that is able to drive anywhere and everywhere a human driver can go is simply not going to happen anytime soon."

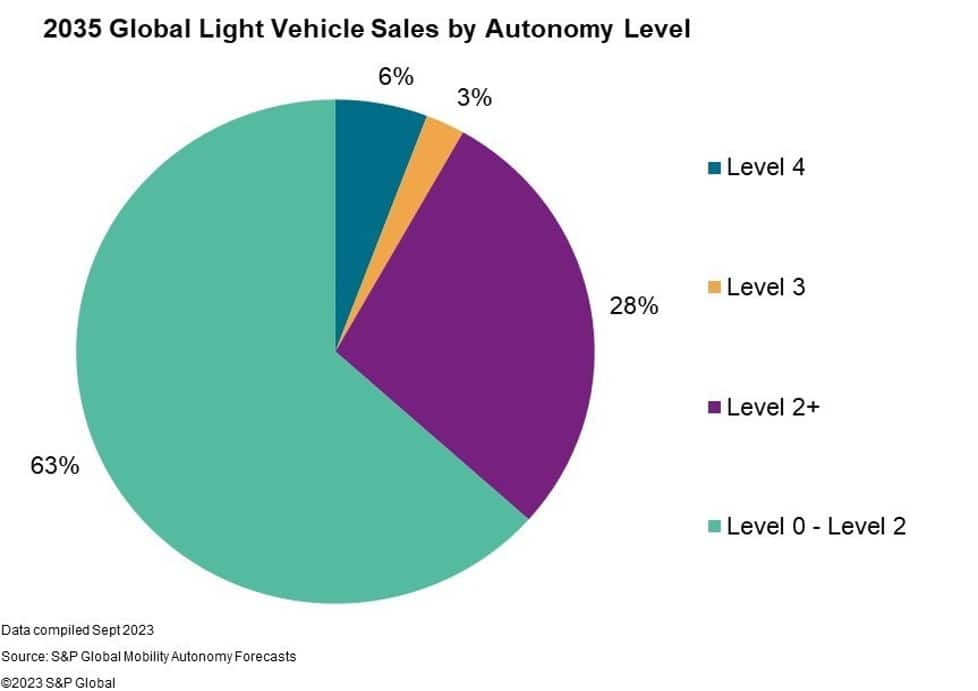

Moreover, the S&P Global Mobility forecast predicts a very low percentage of personal vehicles sold by 2035 will possess even a limited version of autonomous vehicle technology described as "Level 4" under the SAE J3016 standard.

The latest S&P Global Mobility Autonomy Forecast details the numbers, timing, and countries for rollouts of varying degrees of autonomous technology — based on a rigorous forecasting methodology analyzing OEM and supplier strategies, regulations, technology maturity and cost, consumer desirability and willingness to pay, plus extensive interviews both with automakers and across the supply chain.

This latest outlook continues to reflect the headwinds and slower pace of development that both the automotive and tech industries have demonstrated over the past several years. But it also paints a stark contrast to the optimism of just five years ago, when the world was swept up in the excitement of a future of autonomous vehicles.

Now, S&P Global Mobility presents a more realistic forecast while also unveiling new data on the intersection of autonomy and mobility-as-a-service (MaaS).

Waypoints and indicators

As technology advances, of course, the array of automated driver assist systems (ADAS) to compensate for driver inattention or error will proliferate — helping to reduce crashes, injuries, and deaths along the way. But it has proven incredibly difficult to combine those systems and sensors with the necessary predictive software and engineering into a vehicle that will carry us or our loved ones to our destination unsupervised.

There have been extreme instances of autonomous test vehicles performing as perfectly as a human would — perhaps the most famous early example came in 2015 when a Google test car navigated a situation where a woman in an electric wheelchair maneuvered erratically on a residential street, while wielding a broom and chasing a wayward duck.

But serious malfunctions of the nascent technology have brought mass-production — and public trust — back to a more conservative reality. And the ability of autonomous systems to operate in the complex and unpredictable world of interactions with human drivers (and evolving driving circumstances) has proven a massive hurdle. From the endless cycle of software development and training of neural networks, to continuous improvements in sensor hardware capabilities, to preparing for infinite corner cases that may arise, driving through the world has proven a complex task to solve.

While there are growing numbers of driverless prototype vehicles and pilot deployments already on city streets, S&P Global Mobility forecasters do not expect that to become widespread and broadly accessible within the next decade. The vehicles you will see will be capable of driving themselves in MaaS use cases. You can think of them as "robo-taxis," replacing anything from the NYC yellow cab to rideshare services such as Uber and Lyft.

Robo-taxis come before personal vehicles

Robo-taxis are expected to be carefully geofenced for the foreseeable future — offering revenue service only within well-mapped areas where they have already been extensively tested, Carlson predicts. That's the model for current services from Cruise, Waymo, Motional, Didi, Baidu and others. Waymo was first to launch a commercial service in certain Arizona suburbs and is testing in several major California cities. Cruise began testing in San Francisco in late 2020 (and operating limited public robo-taxis in 2022) and is now expanding to its seventh city. Several Chinese mobility providers — from Baidu to Didi to Pony AI and more — have similar approvals for testing and early, limited MaaS operations in various cities and regions as well.

The cost of the multiple camera, radar and lidar sensors and the high-performance computer systems, chips, and semiconductors to enable the technology will remain sufficiently high that most personal-vehicle buyers simply won't pay for the functionality — but taxi and ride-sharing services may. Those businesses want to keep their vehicles on the road 20 or more hours a day, stopping only to refuel or recharge the batteries. With that amount of uptime, they can earn revenue without the inconvenience of drivers, who need to be paid, change shifts, and often stop for breaks. All of those factors cut into potential revenue hours; robo-taxis have none of those constraints.

The ultimate goal — and the vision of lots of movies and other science fiction over the past 75 years — is an unpiloted vehicle where a rider can get in, input where they want to go, and relax in the back seat. No matter the destination (anywhere on earth a vehicle can go), the weather, or road conditions, the vehicle simply drives there itself. "The industry is a long way off from that," Carlson says. "But forms of Level 4 are operating today in limited numbers and have a promising decade of development and growth ahead."

A decade of tech hype

Fifteen years ago, the seminal DARPA Urban Challenge proved vehicles could navigate themselves to a destination through unknown and unpredictable environments. What followed was a wave of hype splashing over what many saw as the imminent arrival of autonomous-driving technology across the automotive spectrum. Billions of dollars in capital expenditures were invested into autonomous vehicle development, with substantial progress but varying degrees of success. Bold visions have been espoused, and while a few waypoints have been reached, the grandiose proclamations have not been achieved.

Part of the overoptimism, Carlson says, came from technology firms being the first to promote driverless cars in a big way. From the multiple lidar firms commercialized after the DARPA event, to Google, Uber, and Tesla, self-driving tech was assumed to be largely a problem of sensors and software — and software could be developed fast, right? The peak of autonomy hype came in 2018 at venues like the Consumer Electronics Show.

Automakers and tech companies (and more than a few consultancies and industry think tanks) were swept up in the fervor, with executives and investors catching the fever — despite protestations from engineers that even limited autonomy was a really, really hard problem.

It was at CES in 2020, just before the global COVID-19 pandemic shut down much of business as usual, that it became apparent lidar makers would need more time to meet the cost and performance goals their customers — the automakers — had set, pushing back timelines for introductions of automated driving systems in Level 2+ and Level 3. While lidar is a key enabler of autonomous vehicles, a similar but also unrelated reset of expectations occurred with autonomous vehicles themselves.

Now, S&P Global Mobility states, the line of thinking is more grounded: Unbridled optimism has given way to the slow, measured development of new, highly complex technologies. Tech companies must fuse reams of digital input from a variety of sensors, model the results, and pass that model through software that determines what behaviors to require of the vehicle as a result.

Obstacles to progress

To understand how monumentally difficult this accomplishment will be, an examination of each step in the route to fully autonomous technology is required. And each step is steeper — and more costly and legally binding — than the one before.

New-car shoppers today will have found most of the latest vehicles now offer a variety of ADAS technologies, as either standard or optional equipment. The lowest tiers of the SAE autonomy scale, Level 0 and Level 1, are used for functions a driver can invoke to control individual aspects of a vehicle's travel automatically, or otherwise assist the driver with alerts or specific emergency interventions. From adaptive cruise control to lane-departure correction, these systems compensate for driver error or inattention, but generally only in one direction of travel: either longitudinally (headed down to the path of travel) or laterally (side to side within a lane).

Integrating several Level 0 and Level 1 features allows the car to effectively drive itself within lanes (usually on limited-access highways), which can extend the vehicle into Level 2. S&P Global Mobility sees a huge proliferation of Level 2 systems — becoming the de facto standard equipment for many vehicles — along with a more capable subset of what has come to be known as "Level 2+." Standard Level 2 can be found on vehicles from the likes of Tesla, Toyota, and Honda, but the driver must prove they are paying attention by keeping hands on the steering wheel — as the vehicle will only provide emergency avoidance support (like braking) but is not capable of responding to more complex changes in traffic conditions.

The system tests for driver interaction by searching for constant small inputs into the torque sensor of an electric power steering system, which correspond to natural human movements on the wheel. The problem is that this check process is easily defeated, as dozens of YouTube videos show: Tape a half-full water bottle to the steering wheel, and road imperfections cause the water to slosh, jostling the wheel enough to "prove" a human has hands on the wheel and is, presumably, paying attention. Capacitive sensors like those of smartphone or touchscreen displays provide more intelligence but require hands-on engagement.

The only way to provide a true "hands-off" system — while still requiring the driver to keep eyes on the road, as opposed to their attention on something else — is eye-tracking cameras. Those are now built into a handful of models from a few makes but growing rapidly and with strong upside over the next decade. The resulting hands-off driving systems available today with driver monitoring systems are known as Super Cruise (General Motors), Autopilot (Tesla), BlueCruise (Ford) and various others.

European regulations will mandate the installation of these driver monitoring cameras in mid-2026. It's a stiff standard, but the only one that effectively guarantees that while a driver's hands may be off the wheel, their eyes are still on the road ahead — meaning they can retake control of the car in an emergency within a second or two, rather than the five to 15 seconds (or more) that's required if hands, eyes and mind are distracted by something else entirely.

The combination of Level 2 automated driving with driver monitoring pushes into Level 2+ and is the area of focus for nearly every automaker in the industry today. It includes a very capable form of sensing and automated control while ensuring the driver remains engaged and capable of supervising its operation. As important as any part of the design, it also maintains liability on the driver's side of the equation.

Then there's Level 3. This is autonomous driving by a vehicle without the driver needing to pay attention, but only in strictly limited circumstances. "Drivers are no longer required to supervise," Carlson explains. "Instead, the vehicle is responsible for all of the object detection, response, and actuation of appropriate control responses."

This is a huge leap, both technologically and legally. The significant difference is that liability for any crash caused by the Level 3 (or above) vehicle operating in autonomous mode shifts from the driver to the automaker, as the driver isn't required to be constantly engaged in the driving (or supervising) task. That means automakers will be exceptionally careful in taking this step, Carlson predicts. As such, S&P Global Mobility forecasts far less Level 3 penetration by 2035 compared with the pair of Level 2 tiers.

Because robo-taxis are limited to certain operating areas and conditions, they fall into what's called Level 4. Carlson expects considerably more services with potentially infinite expansions of those geofences. Fleet operators see a potential business model under which the added costs of Level 4 technology could be offset by greater uptime over a vehicle's lifetime. But automakers do not see sufficient willingness among consumers to pay an additional five figures for Level 4 functions in mass-produced vehicles over the next 10 years.

Where do we stand today?

Tesla's much-hyped Autopilot system to the contrary, Mercedes-Benz has been at the forefront most recently as the industry pushes into Level 3 and beyond. Its Drive Pilot system in Germany relieves the driver of having to pay attention while the car drives on limited access roads — at less than 60 kilometers per hour (36 mph). This low-speed operation is the opposite of the Level 2+ approach taken by GM and others, which started on limited-access highways only and is now expanding to certain divided secondary roads.

In Europe, regulatory updates are underway to boost the upper limit to 130 km/h (80 mph), recognizing that automated highway driving may save more lives through crashes averted than in lower-speed urban environments — but also enabling automakers to deliver more real-world value to potential buyers. Still, carmakers are taking it slowly and steadily. The rollout of autonomous driving features has proceeded more on traditional automaker schedules for developing new features, rather than in "tech time" where features are conceived, prototype, launched and revised on the fly.

But this tech industry influence is still the central theme of the movement toward the software-defined vehicle, one that utilizes over-the-air (OTA) updates to maintain and enhance functionality even after the point of sale.

MaaS robo-taxis, for now

The S&P Global Mobility forecast predicts fewer than 6% of light vehicles sold in 2035 will have any Level 4 functionality, as described by the SAE J3016 classification. Early Level 4 implementations in personally owned vehicles offer advanced parking functions, often with the support of infrastructure. But many technology providers remain focused on the long-term potential of scaling autonomous vehicles in fleets supporting MaaS business models.

There are positive examples of autonomous vehicles performing as well as humans in today's pilot programs in places like San Francisco and Phoenix in the US, and Beijing, Shanghai, and Guangzhou in mainland China. But these same vehicles can still be confounded by complex traffic scenarios the next minute or the next day, giving regulators and consumers alike reason to be cautious.

Mobility-as-a-Service (MaaS) and robo-taxis are nonetheless expected to lead the transition to an autonomous vehicle future, even with the relatively cautious growth ahead. There are growing numbers of small-scale deployments in certain cities around the world. But S&P Global Mobility forecasters do not expect that to become widespread and broadly accessible within the next decade.

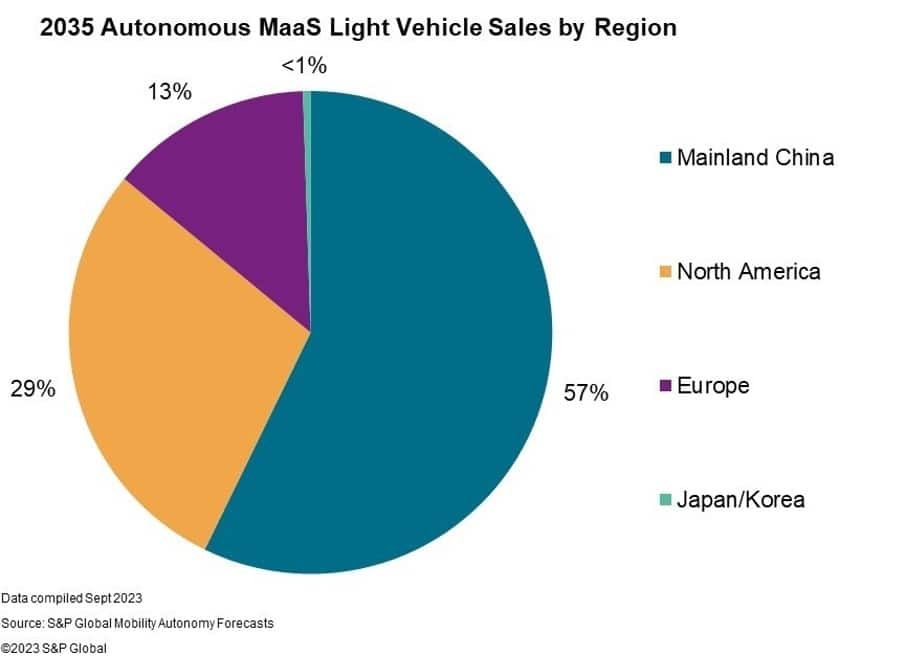

MaaS-equipped vehicles and robo-taxi applications are expected to represent less than 800,000 vehicles sold globally in 2035. Robo-taxis will be carefully geofenced for the foreseeable future — offering revenue service only within specific areas where they have already been extensively tested, Carlson predicts. But their high rate of utilization can be nonetheless effective at bringing new mobility options to some consumers and new revenue streams to automakers and mobility providers.

Owen Chen, senior principal analyst from S&P Global Mobility, explains that robo-taxi development and commercialization is a complex and multi-stage process, which can be summarized in three stages:

- Stage 1: Technical feasibility demonstrations confirm that robo-taxis can operate safely and reliably in the targeted conditions;

- Stage 2: The lengthy process of technology optimization, integration and refining vehicle design eventually brings scale to manufacturing and deployment;

- Stage 3: The efficient expansion will extend to many new locations and operating conditions, with profit on top of revenue from meaningful adoption by consumers.

"In 2023, many are working through Stage 1 while several are seeking scale in Stage 2, led by mainland China and the US," Chen said. "But the opportunity to restructure personal and shared mobility exists."

Nonetheless, challenges remain for successful and widespread deployment of Level 4 MaaS. In addition to a fragmented regulatory landscape and relatively low public trust that may hamper consumer acceptance and adoption, the cost of technology and the time needed for robust development and validation of hardware and software have quashed the optimism that defined much of the last decade.

The China factor

One major factor in the global race to develop driverless vehicles is mainland China. Autonomous driving tech was one priority of "Made in China 2025," a document issued by the Chinese Communist Party in August 2014 that set as a goal dominating the global provision, supply, and use of several advanced technologies. Those included not only autonomous vehicles but battery minerals, battery production and EVs.

Quite a few vehicles from Chinese makers are equipped with multiple sensors — more than would be required for today's ADAS technologies — and can be updated over-the-air with new and more advanced software. It is an integral part of their technology strategy, and it has taken root more quickly in China as new EV platforms are designed.

Consumers in China are also more familiar, have greater interest, and show more willingness to pay for these technologies compared with other markets including the US and Europe, according to the S&P Global Mobility Autonomy Consumer Survey conducted in March 2023. Survey respondents in China demonstrate the greatest interest in having these autonomous vehicle technologies in their next car purchase — 78% of respondents in China compared to 63% in the other seven markets surveyed (Brazil, Germany, India, Japan, Thailand, UK, US)

The sense among some Chinese makers, Carlson says, seems to be that if testing goes well, regulation that permits the rollout of Level 3 systems will arrive in due course. They want their cars on the road to be ready for that transition. And Chinese regulators give companies a certain amount of leeway to experiment and to test new technologies.

The US is unique in its tort bar, which demands the highest possible level of assurance that a new automotive feature is safe and effective. But do not assume that China is beta-testing its citizens; Chinese regulators will come down hard on a company if something bad happens and gets publicized — meaning there's similar oversight and pressure to ensure the systems work as planned.

"Level 3 is going to be the big hurdle, for all the driver-distraction issues inherent to its design," Carlson says. "While both mainland China and the US are racing to develop and deploy these systems, we forecast that China will be the volume leader in both Level 3 and Level 4."

"There's plenty of opportunity and growth ahead," says Carlson. "Significant volumes measured in the hundreds of thousands are quite likely to come before 2030 — but a future of shared mobility everywhere all the time remains an aspiration for the industry. Fortunately, many automated driving systems, especially in Level 2+ and Level 3, are coming soon. Those systems generally deliver on their value proposition to consumers at a more accessible price point."

--------------------------------------------------------------

Dive deeper into these mobility insights:

FOR MORE ON AUTONOMY FORECASTING

ADAS, AUTOMATION, AND AUTONOMY: OEM STRATEGIES

CONSUMER SENTIMENTS TOWARD AUTOMATED DRIVING

AUTONOMOUS DRIVING: ROBITAXI TECHNOLOGY, ECOSYSTEM & MARKET REVIEW WEBINAR

AUTO SAFETY SYSTEMS — CALIBRATION CHALLENGES AS VEHICLES AGE

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-waiting-for-autonomy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-waiting-for-autonomy.html&text=Fuel+for+Thought%3a+Waiting+for+Autonomy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-waiting-for-autonomy.html","enabled":true},{"name":"email","url":"?subject=Fuel for Thought: Waiting for Autonomy | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-waiting-for-autonomy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fuel+for+Thought%3a+Waiting+for+Autonomy+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2ffuel-for-thought-waiting-for-autonomy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}