Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 25, 2023

October inventory trends: strike vehicles, small SUVs, and electric vehicles

Pulling from retail advertised inventory data for the week of Oct 9-15, S&P Global Mobility delivers the following insights on the US market:

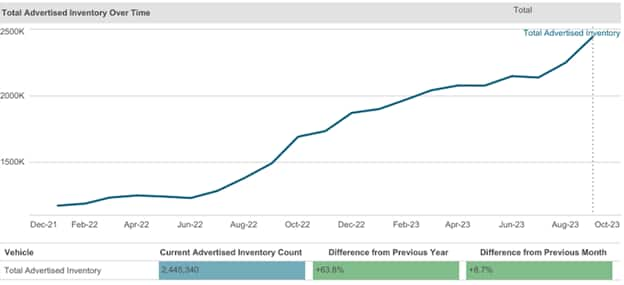

Overall industry inventories

New vehicle inventory listings have sharply accelerated in the past month; from slightly more than 2 million units as of Sept. 11, now approaching 2.5 million units - more than a 10% increase in a one-month span, and 64% higher than this period last year. The legacy Detroit brands matched the trend, with inventories jumping from about 995,000 to 1.08 million over the same span, an 8% jump.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

2023 vs 2024 model years

There still are more 2023 model vehicles in dealer advertised inventories than incoming 2024s; however, 2024 model year advertised inventory is now reaching the level of remaining 2023 model year units. And while we see the 2023 MY advertised inventory decreasing, the 2024 MY inventory is growing at a faster rate than the 2023 MY sell-down.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

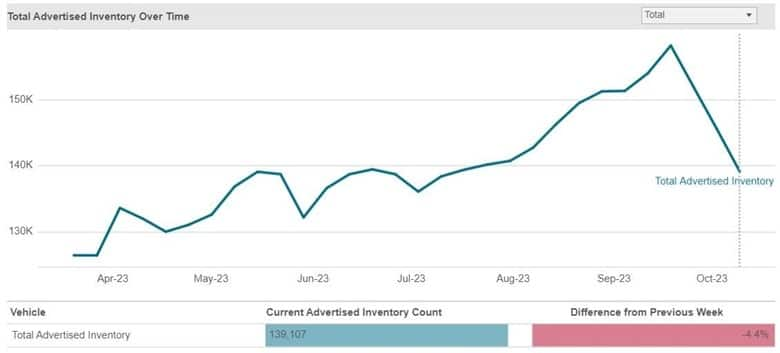

Strike vehicles

Retail advertised inventories of the vehicles affected since the beginning of the UAW strike — Ford Ranger, Ford Bronco, Ford Explorer, Lincoln Aviator, Chevrolet Colorado, GMC Canyon, Chevrolet Traverse, Buick Enclave, Jeep Wrangler, and Jeep Gladiator — have dropped from 160k to 141k since the week of September 18. It is uncertain if those vehicles' inventory situation could be worse, if not for dealers slowing their sales velocity in case of a long-term strike impact.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

However, once the strike vehicles are removed from the equation, the domestic manufacturers have been increasing retail advertised inventory for other vehicles at a sharp rate.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

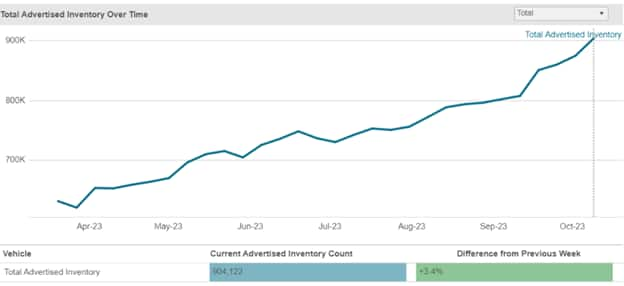

Compact Mainstream SUVs

The small SUV segment is once again turning into a dogfight, as overall retail advertised inventories continue to rise sharply.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

In looking at specific vehicles, the Nissan Rogue, Chevrolet Equinox, Hyundai Tucson, and Ford Escape have all seen inventories spike in the past month, while Toyota appears to have executed a summer sell-down of the RAV4, and the Jeep Wrangler has declined, likely due to the UAW strike. And while Honda CR-V inventory percentages climb, dealer advertised inventories remain well below one month's sales velocity.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

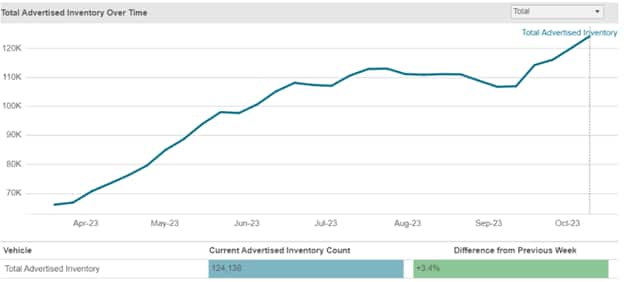

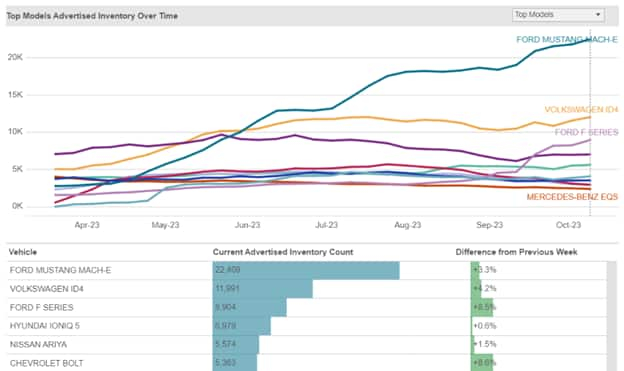

Electric vehicles

Inventories of EVs other than Teslas continue to rise, as continuing consumer concerns on affordability and charging network accessibility impact desirability. To ease the pressure on dealers, and increase consumer marketing exposure in a lower-pressure environment, some OEMs are increasing their EV sales to rental and corporate fleets.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

In looking at specific EV models, however, there are some concerning trends in terms of inventories vs. overall sales as reported by manufacturers (retail and fleet). Ford has nearly 22,500 units of the Mustang Mach-E in dealer advertised inventories; but total sales for the trailing three months amount to just 14,842 units (as reported by Ford). Same goes for the F-150 Lightning, which has nearly 9,000 units in inventory, but has sold just 3,500 units in the trailing three months (Ford recently cut a shift at the Rouge Electric Vehicle Center in response). Here are the inventory-to-sales equations for other key players in the EV market:

VW ID.4: 11,191 units in retail advertised inventory vs 10,707 in reported 3Q sales

Nissan Ariya: 5,574 in inventory vs 4,504 in 3Q sales

Hyundai Ioniq 5: 6,979 in inventory vs 11,665 in 3Q sales

Chevrolet Bolt EV and EUV: 5,363 in inventory (mostly Bolt EUV) vs 14,709 in 3Q sales. GM recently announced a production increase on these models.

An interesting side note: The Chevrolet Bolt EV and EUV siblings have been the best-selling non-Tesla EV nameplate in the industry for 13 consecutive months, while the Mustang Mach-E has been in the top 5 among all EVs (including Tesla) in 10 of the last 13 months, according to analysis of S&P Global Mobility total new light vehicle registration data through July 2023.

Source: S&P Global Mobility Retail Advertised Inventory data, week of Oct 9-15, 2023 ©2023 S&P Global Mobility

FOR MORE ON INVENTORY DATA AND MARKET INTELLIGENCE

ELECTRIC VEHICLES: TOO MANY TOYS ON THE SHELF

LIGHT VEHICLE SALES FORECASTING

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN '23

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

LOWER-CREDIT BUYERS PUSHED OUT OF NEW VEHICLES

AUTOMOTIVE LOYALTY RATES STALL DESPITE VOLUME INCREASES

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2foctober-inventory-trends-strike-vehicles-small-suvs-and-electr.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2foctober-inventory-trends-strike-vehicles-small-suvs-and-electr.html&text=October+inventory+trends%3a+strike+vehicles%2c+small+SUVs%2c+and+electric+vehicles++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2foctober-inventory-trends-strike-vehicles-small-suvs-and-electr.html","enabled":true},{"name":"email","url":"?subject=October inventory trends: strike vehicles, small SUVs, and electric vehicles | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2foctober-inventory-trends-strike-vehicles-small-suvs-and-electr.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=October+inventory+trends%3a+strike+vehicles%2c+small+SUVs%2c+and+electric+vehicles++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2foctober-inventory-trends-strike-vehicles-small-suvs-and-electr.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}