Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Jul 25, 2023

July US auto inventory trends you should know

The impact of the July 4 weekend sales events, Ford Mach-E inventory numbers climbing past ICE SUVs, and the looming Compact SUV dogfight in the US market.

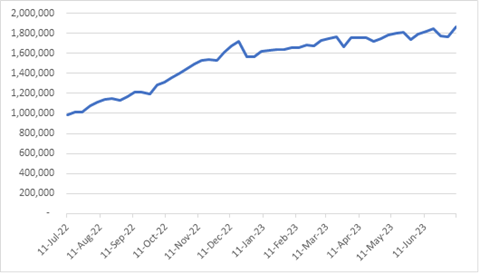

Dealer advertised inventories in the US took an expected dip following the July 4 weekend, but have quickly recovered, according to new analysis from S&P Global Mobility.

And while July 4 sales events received their typical promotions, the pattern for the long weekend was consistent to recent months-end in terms of sold inventory. The July 4 weekend also represented a trifecta of the end of the month, end of the quarter, and a holiday.

But while the long weekend took a chunk out of available advertised inventories - from 1.843 million in mid-June to 1.761 million on July 3, <span/>perhaps more notable is that available inventories almost immediately leaped ahead to 1.867 million by mid-July, surpassing the year-to-date highs seen in mid-June.

Total Industry Advertised Inventories

As of 16 July 2023

Source: S&P Global Mobility

© S&P Global Mobility

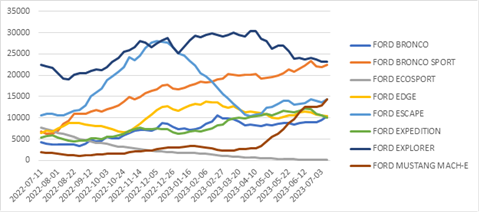

Ford Mach-E inventories climbing past ICE

SUVs

You can tell an automaker is serious about electric vehicles when advertised inventories climb to the equivalent level of its better-selling internal-combustion vehicles.

That is now happening with Ford SUVs, as inventories grow for the Ford Mustang Mach-E. In December, the Mach-E had the lowest advertised inventory count of any Ford SUV. As of early July, however, Ford dealers are now advertising more available Mach-E volume (14,363 units) than those of EcoSport, Bronco, Edge, and now, even Escape. Only the Explorer and Bronco Sport have more advertised units available.

Whether production is ramping up to meet anticipated demand, or whether there is sufficient demand to reduce inventories, remains to be seen. Year-to-date through June, Ford sold 14,040 units of the Mach-E, according to company reports, although inventories were constrained through the first quarter, and the sales pace has recently accelerated. By contrast, Ford has sold 64,839 Escapes over that period.

Ford SUV Advertised Inventories

As of 16 July 2023

Source: S&P Global Mobility

© S&P Global Mobility

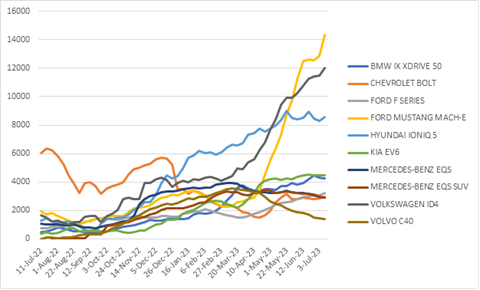

Non-Tesla EV inventories plateauing?

While Mach-E inventories are surging, most other EVs appear to be growing as well, but not at the same rate. Total advertised EV inventories reached 108,000 units in early July, up about 10,000 units from early June.

The other mainstream EV chasing volume is the Volkswagen ID.4; with about 12,000 units of advertised inventory (VW sold 6,690 units in 2Q 2023, but, again, with constrained inventories). The third-most advertised inventory is from the Hyundai Ioniq 5, although after an early-year surge of inventory through April, advertised stock appears to have flattened into a predictable wavelet pattern. The Kia EV6 shows a similar trend to the Hyundai - albeit at much lower volumes. The only EV showing a significant tapering of inventories is the Volvo C40.

Geographically, most of the industry EV inventory resides in the following DMAs: Los Angeles, San Francisco, New York City, Seattle, and Washington DC.

EV Inventories by Nameplate

As of 16 July 2023

Source: S&P Global Mobility

© S&P Global Mobility

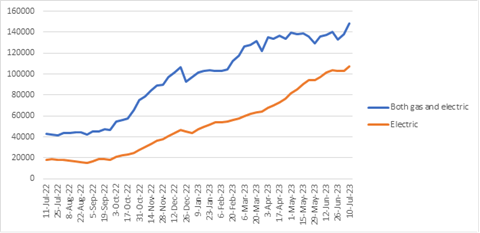

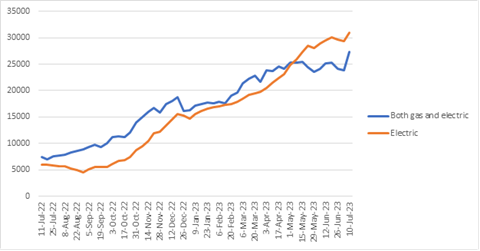

EV inventories passing Hybrids?

A true measure of EV penetration is comparing advertised inventory volumes against Hybrid Gas-Electric vehicles.

Nationally, even as inventories of all vehicles have grown, there has been a consistent gap of about 35,000 to 40,000 units of Hybrids compared to EVs - as of inventory levels on July 10 there were 148,761 Hybrids to 107,514 EVs. However, California saw a landmark event in May, as EV advertised inventories passed Hybrids, and have held steady: 30,914 EVs compared to 27,316 Hybrids as of July 10.

Early-July numbers show a sharp spike in growth of Hybrid inventories both nationally and in California - although whether that is a result of consumers choosing EVs over Hybrids, or an uptick in new Hybrid production to meet anticipated demand, has yet to be determined.

Hybrid Gas-Electric vs EV Advertised Inventories, National

As of 16 July 2023

Source: S&P Global Mobility

© S&P Global Mobility

Hybrid Gas-Electric vs EV Inventories, California

As of 16 July 2023

Source: S&P Global Mobility

© S&P Global Mobility

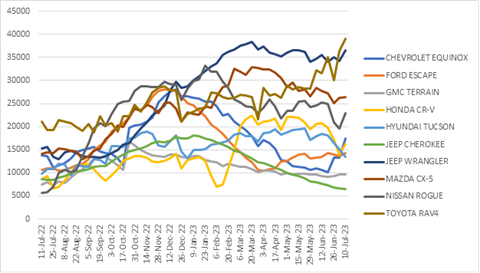

Toyota rejoins the Compact SUV fight

The most competitive segment in the industry involves mainstream Compact SUVs, and a dogfight looks to be emerging through the summer months as the traditional sales leader appears to have regained <span/>its inventory footing.

The Toyota RAV4 has been the best-selling passenger vehicle in the US since 2017. But pandemic-related supplier shortages crunched Toyota inventories, resulting in a 6.9% year-over-year sales decline for RAV4 through June.

As recently as April, Toyota had fewer RAV4s on the ground compared to Jeep Wrangler, Nissan Rogue, and Mazda CX-5. That tide is now turning, as RAV4 inventories have soared in late June and early July - just in time for the summer selling season - now reaching <span/>nearly 40,000 advertised units. Meanwhile, the RAV4's closest rival, the Honda CR-V, saw inventories dip sharply below 15,000 units in late June before seeing a slight jump in early July.

Compact SUV Inventories

As of 16 July 2023

Source: S&P Global Mobility

© S&P Global Mobility

NOTE: S&P Global Mobility calculates advertised inventories

both by total inventories - which includes some vehicles that have

already been sold but are still advertised by dealers - as well as

by available inventories that have not had their registrations

punched, which is a slightly lower number.

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN '23

AVERAGE VEHICLE AGE REACHES RECORD 12.5 YEARS

LOWER-CREDIT BUYERS PUSHED OUT OF NEW VEHICLES

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjuly-us-auto-inventory-trends-you-should-know.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjuly-us-auto-inventory-trends-you-should-know.html&text=July+US+auto+inventory+trends+you+should+know+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjuly-us-auto-inventory-trends-you-should-know.html","enabled":true},{"name":"email","url":"?subject=July US auto inventory trends you should know | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjuly-us-auto-inventory-trends-you-should-know.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=July+US+auto+inventory+trends+you+should+know+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fjuly-us-auto-inventory-trends-you-should-know.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}