Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 24, 2023

US auto sales progress again in July

New light vehicle sales in July are expected to sustain recent momentum.

S&P Global Mobility projects <span/>new US light vehicle sales volume in July 2023 to reach 1.33 million units, up 18% year over year. Expected July results represent a full calendar year worth of consecutive monthly sales growth (as measured in year-over-year unadjusted monthly volume comparisons), reflecting the recovery from the depths of the supply chain constraints realized through much of 2022. This volume would translate to an estimated sales pace of 16.1 million units (seasonally adjusted annual rate: <span/>SAAR).

"New light vehicle sales will continue to progress in July, reflecting the current trend of sustained demand levels to the fleet sector while retail sales continue to climb," said Chris Hopson, principal analyst at S&P Global Mobility. "From both an economic growth and auto demand perspective, the first half of 2023 has proven once again that one shouldn't doubt the spending capacity of US consumers."

Commensurate with the better-than-expected economic and auto sales data over the past six months, S&P Global Mobility has upgraded its calendar year 2023 US light vehicle sales forecast to 15.4 million units (up from 15.1 million in its previous forecast release).

The near-term outlook remains unclear as the new vehicle sales environment will be defined in the second half of the year by the dueling possibilities that auto consumers will be pressured by potential vehicle affordability issues (rising interest rates, credit tightening, still high vehicle prices) while at the same time, production advances could build back inventory more quickly than anticipated, setting up a scenario to alleviate some of the pricing pressures within the new vehicle market.

Although the July 4 weekend represented a trifecta of the end of the month, end of the quarter, and a holiday weekend, the sales pattern for the weekend was consistent to preceding <span/>months-end in terms of sold inventory.

"The long weekend took a chunk out of available advertised inventories - from 1.843 million in mid-June to 1.761 million on July 3," said Matt Trommer, associate director of Market Reporting at S&P Global Mobility. "Perhaps more notable is that available inventories in mid-July almost immediately rebounded to 1.867 million, surpassing the year-to-date highs seen in mid-June."

Various industry-specific risk factors remain prevalent in the outlook for the remainder of the 2023, including the potential for North American vehicle supply disruptions as union negotiations take shape.

"With some US manufacturers maintaining higher levels of inventory in relation to demand, North American production levels are expected to slow later this year, with the reduced volume effectively acting as risk mitigation for the high probability of a union strike," said Joe Langley, associate director, light vehicle production forecasting at S&P Global Mobility.

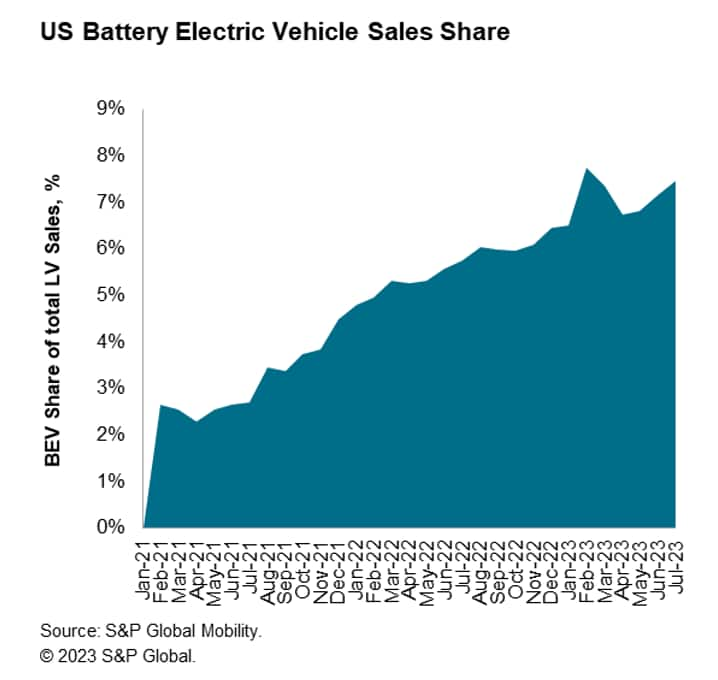

BEV share holding steady

Battery electric vehicle (BEV) share is expected to represent 7.6% of July sales, remaining on trend with the preceding months. Continued development of BEV sales remains a constant assumption for 2023 although some month-to-month volatility is expected as BEV pricing changes remain dynamic especially as aggressive BEV production expectations and new product introductions gain momentum in the second half of the year.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-progress-again-in-july.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-progress-again-in-july.html&text=US+auto+sales+progress+again+in+July+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-progress-again-in-july.html","enabled":true},{"name":"email","url":"?subject=US auto sales progress again in July | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-progress-again-in-july.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+auto+sales+progress+again+in+July+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-auto-sales-progress-again-in-july.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}