Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 22, 2023

November inventory trends: Leftover ‘23s, an EV plateau, and hybrid hype

Retail advertised inventory data for the week of Nov. 6-12: S&P Global Mobility delivers the following insights regarding the US market.

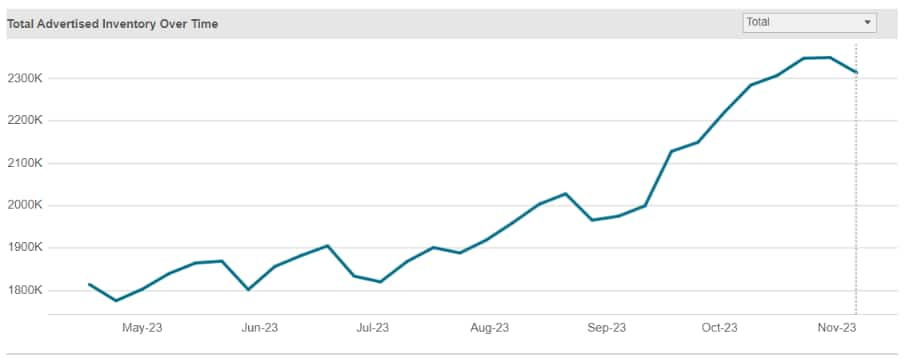

Overall industry inventories down from peak

New vehicle dealer inventory listings peaked in mid-October just shy of 2.5 million units, and have seen a slight decrease since then - from an end-of-October level of 2.35 million available dealer advertised units to about 2.3 million mid-November.

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

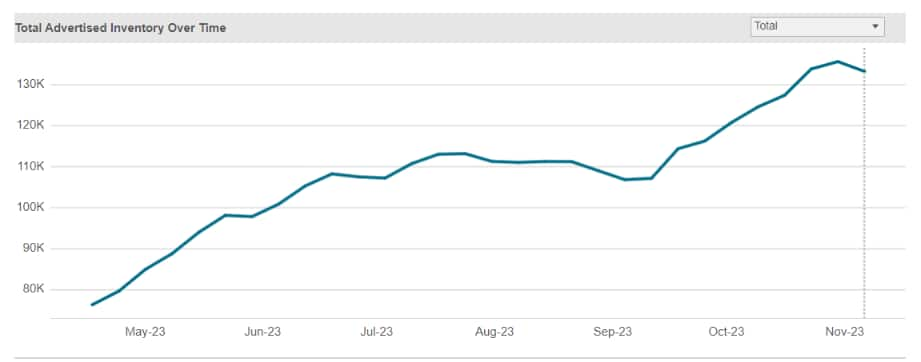

A BEV plateau?

Electric vehicle dealer advertised inventories (not including Tesla) also peaked the same week in October at 135,000 units, and have declined slightly since then. Most EVs have reached an inventory plateau and flattened off, except the Ford F-150 Lightning, which has grown sharply to 10,000 units. Ford reported total sales of about 2,000 Lightnings in August and September combined, but then accelerated to 3,712 units in October. The chart below shows industry-wide BEV retail advertised inventory (not counting Tesla).

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

Mustang Mach-E discounts

However, Ford's commitment to making the Mustang Mach-E a sales success has come at a price - or rather a price cut. More than half of Mach-E's retail advertised inventory is carrying a below-sticker offer. In Maryland and Virginia dealerships, Mach-E has an average discount of more than $5,000. Big discounts on the Mach-E can also be found in Mississippi, Oklahoma, Connecticut, Minnesota, and Kentucky. The chart below shows EV retail advertised inventories by nameplate.

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

Hybrids still revving hard

As consumers tap the brakes in their willingness to commit to the electric vehicle lifestyle, a hybrid-electric powertrain is being accepted as an acceptable halfway alternative. As of Nov. 12, there were 219k hybrids in dealer advertised inventories - a number that had been growing all summer to meet sales demand. About one-third of that total comes from the compact SUV segment, as seen in the chart below.

Source: S&P Global Mobility Retail Advertised Inventory data,

week of Nov 6-12, 2023

Source: S&P Global Mobility Retail Advertised Inventory data,

week of Nov 6-12, 2023

©2023 S&P Global Mobility

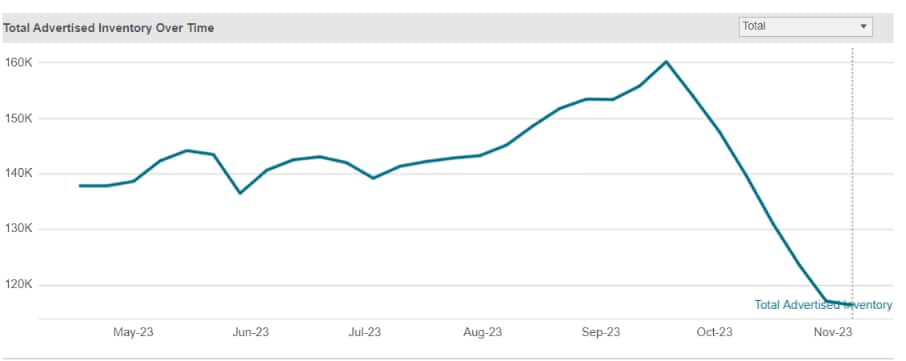

Strike vehicles strike back

In anticipation of the UAW strike action, GM, Ford, and Stellantis cranked up targeted plants so that combined volumes of the Ford Ranger, Ford Bronco, Ford Explorer, Lincoln Aviator, Chevrolet Colorado, GMC Canyon, Chevrolet Traverse, Buick Enclave, Jeep Wrangler, and Jeep Gladiator were at post-pandemic highs of about 160,000 units as of Sept. 18. Despite the strike lasting only six weeks at those plants before workers returned, sales have pushed inventories down to about 116,000 units. For example, pre-strike, the Jeep Wrangler had the second-most inventory of any compact SUV; as of Nov. 12, they had fallen to fourth-most inventory in the segment. Even if the assembly plants return to full production quickly, there is the infrastructure issue of getting units to dealerships. It appears volumes of strike vehicles have reached their bottom, as seen in the chart below.

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

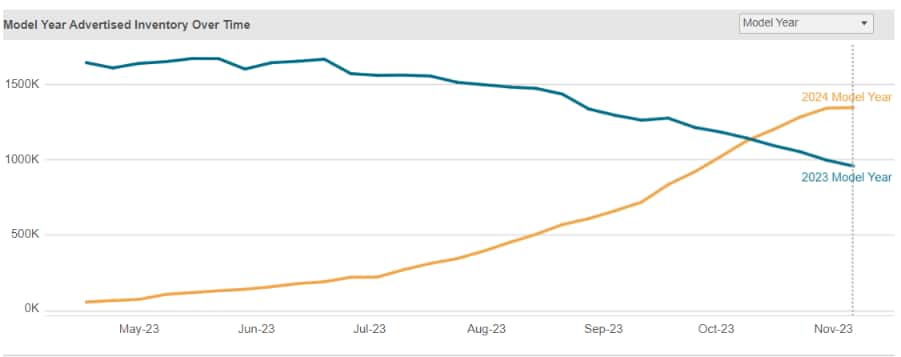

Selling down 2023s

As of mid-October, there were still more advertised dealer inventory of outgoing 2023 MY models than incoming 2024s, while the 2024 MY inventory was growing at a faster rate than the 2023 MY sell-down. But as of mid-November, that tide seems to have reversed; there are now fewer 2023s (about 955k) than 2024s (about 1.34 million).

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

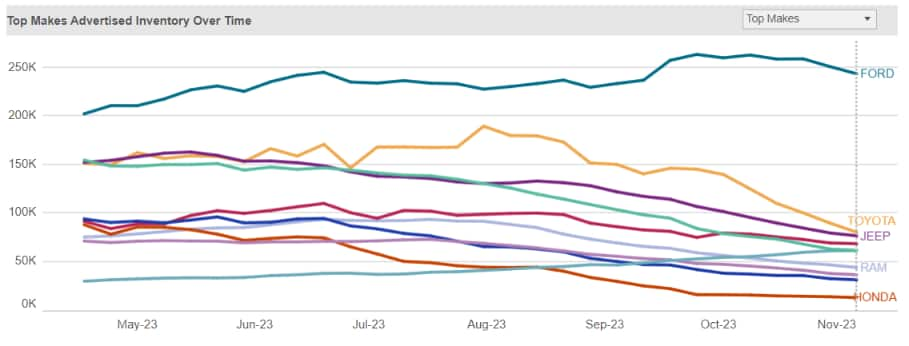

2023s and mainstream brands

So, who is managing the sell-down best? Many brands activated fall selldowns, but Ford is carrying the 2023 model year deeper into the year - especially for the best-selling F-Series pickup, which will have a 1Q 2024 rollout of the mid-cycle refresh 2024 model. Currently Ford has about 250k units of 2023 MY vehicles, of which 105k are the F-Series and Lightning. Ford also is carrying the 2023 model Explorer into 1Q 2024, which adds to the 2023 MY count as well. From Ford's level, it is a long way down to Toyota and Jeep in terms of leftover 2023s; removing the F-Series and Explorer, however, brings it much closer to the pack. The chart below shows 2023 model year retail advertised inventories by brand.

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

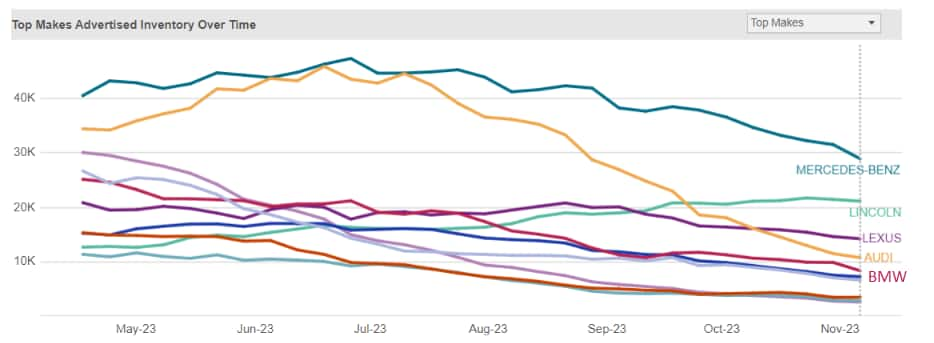

2023s and luxury brands

Most luxury brands have cleared out their 2023s, except for Mercedes-Benz - which is still awaiting the arrival of its re-engineered 2024 E-Class sedan. Although Mercedes' summer selldown dropped its dealer advertised inventories of 2023 MY vehicles from around 250k in May down to 116k presently, the 2023 E-Class ramped up dealer advertised inventories in September - levels which are still elevated because the refreshed 2024s are not yet in dealer stocks. The chart below shows retail advertised inventories by luxury brands.

Source: S&P Global Mobility Retail

Advertised Inventory data, week of Nov 6-12, 2023

©2023 S&P Global Mobility

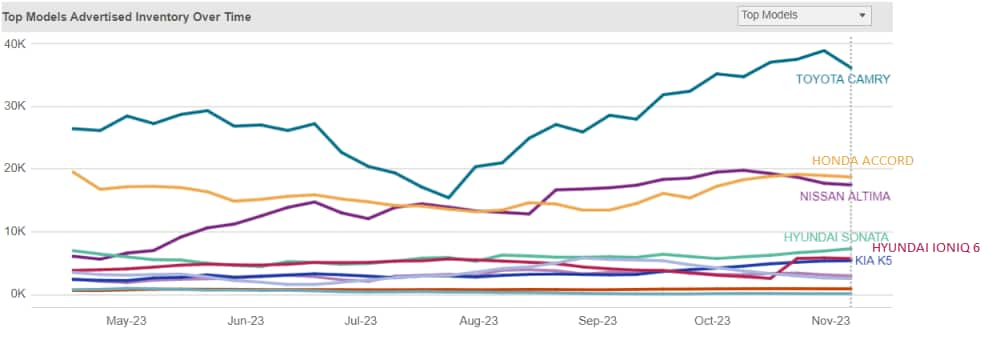

Remember midsize sedans? Toyota does.

With a short 2024 model year of the Toyota Camry before the 9th-generation redesign arrives as a 2025 model in spring, Toyota is cranking up the outgoing model. It was the best-selling passenger vehicle for 20-plus years, until the RAV4 compact SUV took its place in 2017 - but it's still near the top of the sales charts. But that hasn't stopped Toyota's desire to keep sedans in driveways. Dealer advertised inventories of Camry are currently double those of the sales runners-up competitors - the Nissan Altima and Honda Accord.

Source: S&P Global Mobility Retail Advertised Inventory data,

week of Nov 6-12, 2023

Source: S&P Global Mobility Retail Advertised Inventory data,

week of Nov 6-12, 2023

©2023 S&P Global Mobility

FOR MORE ON INVENTORY DATA AND MARKET INTELLIGENCE

LIGHT VEHICLE SALES FORECASTING

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-inventory-trends-leftover-23s-an-ev-plateau-and-hybri.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-inventory-trends-leftover-23s-an-ev-plateau-and-hybri.html&text=November+inventory+trends%3a+Leftover+%e2%80%9823s%2c+an+EV+plateau%2c+and+hybrid+hype++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-inventory-trends-leftover-23s-an-ev-plateau-and-hybri.html","enabled":true},{"name":"email","url":"?subject=November inventory trends: Leftover ‘23s, an EV plateau, and hybrid hype | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-inventory-trends-leftover-23s-an-ev-plateau-and-hybri.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=November+inventory+trends%3a+Leftover+%e2%80%9823s%2c+an+EV+plateau%2c+and+hybrid+hype++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-inventory-trends-leftover-23s-an-ev-plateau-and-hybri.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}