Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 27, 2023

November US auto sales stay the course; projection of 1.23 million units

Auto demand levels expected to continue tapering from 2Q results

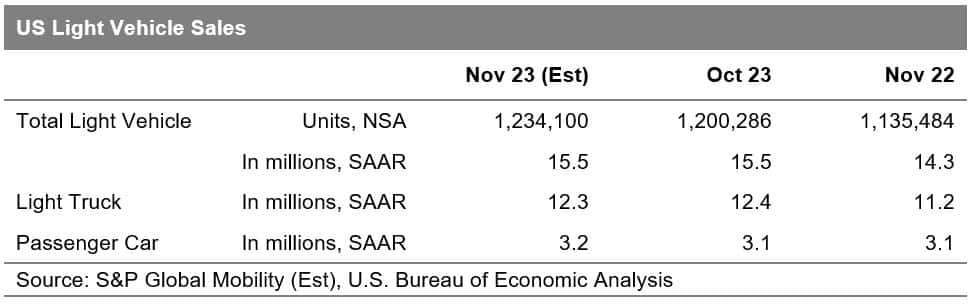

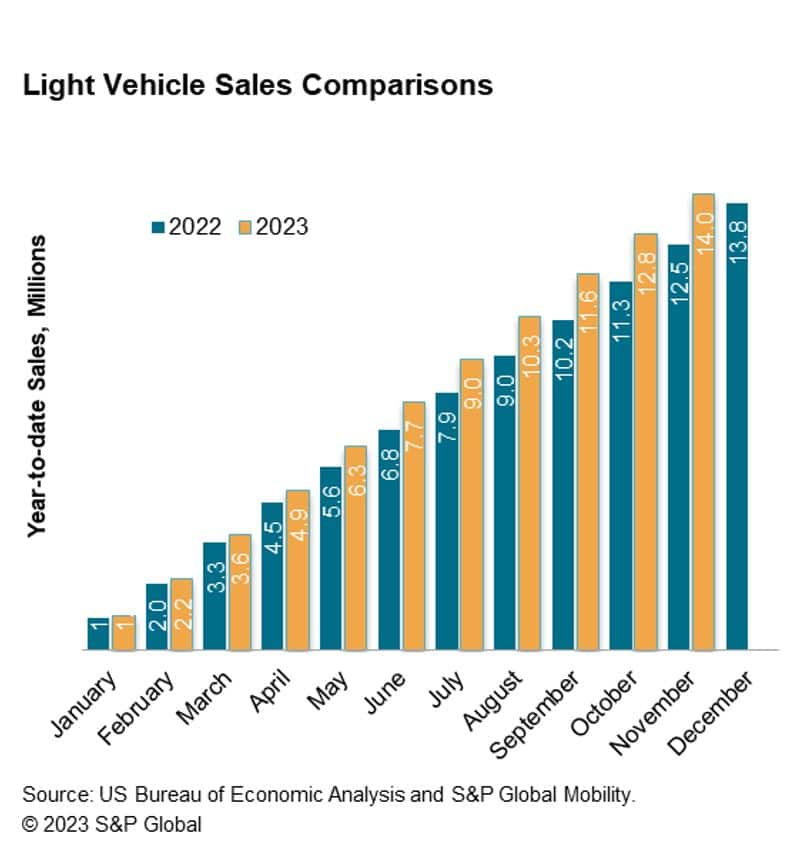

On an unadjusted volume level, November US light vehicle sales are expected to advance mildly from the strike impacted levels of October but remain absent of any momentum. S&P Global Mobility projects sales volume of 1.23 million units for November, which would translate to a seasonally adjusted sales rate (SAAR) of 15.5 million units for the month, even with the month-prior level.

"While the end of the UAW strikes provides some potential relief to those automakers impacted, the ever-present affordability concerns remain prevalent for the foreseeable future," reports Chris Hopson, principal analyst at S&P Global Mobility. "Over the course of the next few months, it's difficult to imagine auto sales getting a jump start from the current pace of demand, with the upshot being a bounce in early 2024 production creating a progression for inventory and incentive levels to develop come spring of 2024."

New vehicle retail advertised inventory listings peaked in mid-October just shy of 2.5 million units and have seen a slight decrease since then - from an end-of-October level of 2.35 million units to about 2.3 million in mid-November.

"As of mid-October, there was still more advertised dealer inventory of outgoing 2023 model year models than incoming 2024s, and the 2024 model year inventory was growing at a faster rate than the 2023 model year sell-down," said Matt Trommer, associate director of Market Reporting at S&P Global Mobility. "But as of mid-November, that tide seems to have reversed; there are now fewer 2023s (about 955,000 units) than 2024s (about 1.34 million)."

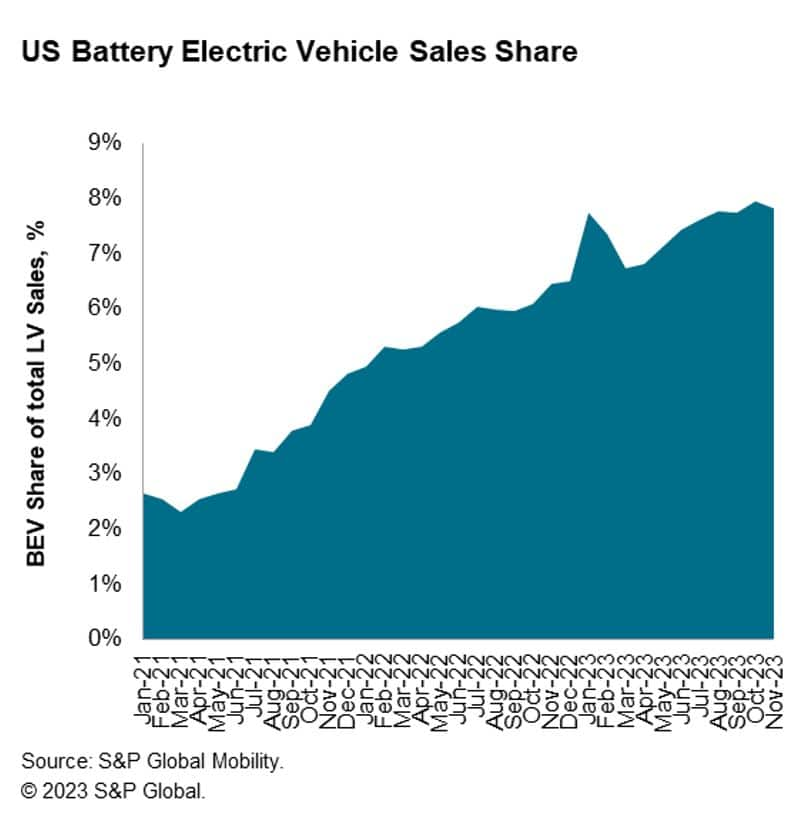

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. October 2023 BEV share is expected to reach 7.8%, similar to the month prior reading and pushing year-to-date BEV sales growth to an estimated 47%. BEV programs previously expected for stronger launches in Q4 2023 have been delayed to 2024, creating opportunity for BEV share advances beginning early next year.

Electric vehicle retail advertised inventories (not including Tesla) also peaked in mid-October at 135,000 units and have declined slightly since then. Most BEV nameplates have reached an inventory plateau and flattened off.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-us-auto-sales-stay-the-course.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-us-auto-sales-stay-the-course.html&text=November+US+auto+sales+stay+the+course%3b+projection+of+1.23+million+units+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-us-auto-sales-stay-the-course.html","enabled":true},{"name":"email","url":"?subject=November US auto sales stay the course; projection of 1.23 million units | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-us-auto-sales-stay-the-course.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=November+US+auto+sales+stay+the+course%3b+projection+of+1.23+million+units+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fnovember-us-auto-sales-stay-the-course.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}