Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 21, 2024

The Future of ICE Powertrain and Hybrid Powertrain Systems in North America

ICE powertrain remains relevant despite electrification. Automotive OEMs will innovate hybrid powertrain systems and legacy engine architectures to meet the demand for compliant and capable vehicles.

The internal combustion engine (ICE) has been the heart of America's auto industry for more than a century. Today, industry stakeholders are pushing to phase out ICE vehicles in favor of more environmentally friendly battery electric vehicles (BEVs).

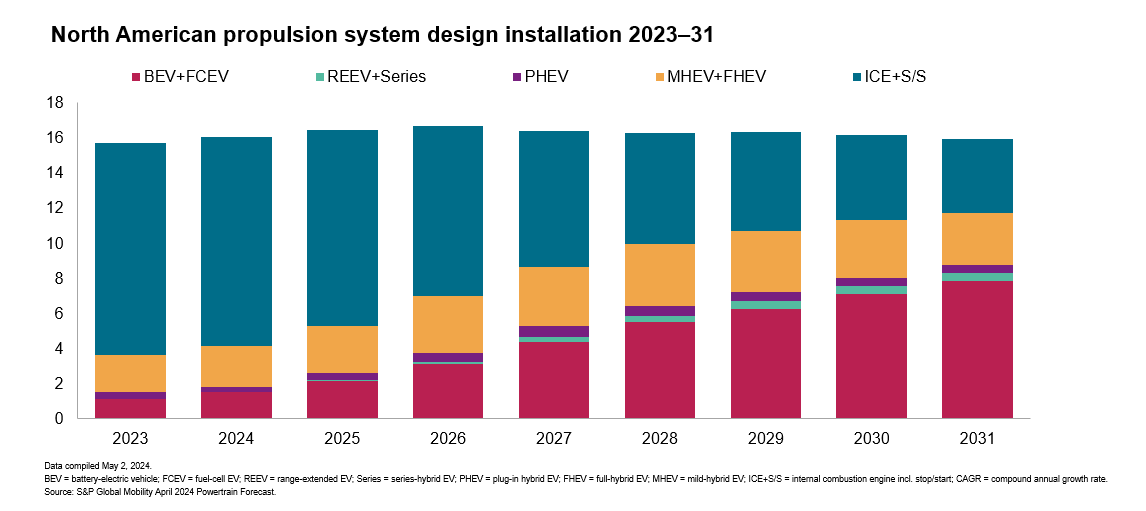

However, North America's road to electrification is not monolithic. While BEVs are natural frontrunners, hybrids — full, mild, and plug-ins — all play an essential role in bridging the gap between conventional ICE powertrain and fully electric vehicles.

During this transition automotive OEMs in North America will explore powertrain technologies, engine platforms, transmission designs, and other opportunities. What strategies can original equipment manufacturers (OEMs) adopt to balance investments across vehicle portfolios when navigating regulatory policies and electric vehicle incentives?

The Role of Hybrids in North America's Electrification Journey

As we edge closer to 2030, hybrid electric vehicle and BEV powertrain are likely to steer the future of the automotive industry in North America. Despite more rapid electrification in other regions, North America's production trails slightly, at just between 9% and 10% for BEVs and fuel cell vehicles. However, projections suggest a significant leap, with 44% of vehicles forecasted to be BEVs or fuel cell car models by the decade's end.

Why More Automakers Are Focusing on Hybrid Powertrain

Tightening regulatory policies demand automakers to achieve more significant reductions in carbon emissions. Fuel economy in automobiles and CO2 emissions standards are driving low-emission vehicle production. In the US electric car market, the National Highway Traffic Safety Administration targets 2% and 4% year-over-year improvements in fuel economy in automobiles, and the EPA aims for a nearly 50% reduction in fleet-wide emissions by 2032. These regulatory policies are powertrain-agnostic, allowing original equipment manufacturers to choose their path toward compliance, whether through BEVs, plug-ins, or other innovative technologies.

ICE vehicles with stop-start systems face increasing pressure but are not bowing out quietly. Adaptations and enhancements must take place to meet diverse consumer needs and regulatory demands. Hybridization allows engines to coexist with electric powertrain and provides automotive OEMs with a balanced approach.

The Impact of the US Inflation Reduction Act on EV Adoption

The US Inflation Reduction Act (IRA) is another critical policy influencing the battery electric vehicle (BEV) transition. The IRA set incentive eligibility rules across five key metrics: final vehicle assembly location, manufacturer's suggested retail price, buyer income, mineral sourcing and battery assembly location.

To stimulate local production and consumer adoption, the Inflation Reduction Act offers vehicle buyers up to $7,500 in rebates if their electric vehicles are manufactured within North America. This electric vehicle incentive is part of a broader strategy to secure a domestic supply chain for critical components like batteries and essential minerals to ensure the region's competitiveness in the global electric vehicle market trends.

BEV Adoption Projections by Vehicle Segment

Projections for BEV Adoption

Across different body styles and market segments, traditional

cars, particularly sedans, are expected to see notable growth in

battery electric vehicles (BEVs). The most significant increase,

however, is projected to come from unibody light trucks and utility

vehicles. Over 63% of production in this segment is expected to

consist of BEVs or fuel cell vehicles by 2031.

Driven by increasing demand for capable vehicles, the transition to

BEVs will require enhancements in architecture and efficiency,

especially for full-size trucks, vans, and SUVs. Although diesel is

declining in relevance across most segments, its performance

characteristics remain highly valued, especially in high-torque

applications such as body-on-frame trucks, vans, and pickups.

Challenges and Opportunities in Heavy-Duty Vehicle Electrification

Adoption rates of battery electric vehicles (BEVs) currently vary significantly across the United States. California is leading among the Section 177 states due to the Advanced Clean Cars II regulations and its substantial market size. In a bold commitment, all new passenger cars, trucks, and SUVs sold in California must have zero emissions by 2035.

It's a different story for heavy-duty variants of pickups, vans, and SUVs (class 2B/3). They face electrification challenges, mainly due to the demanding performance and consumer expectations for these electric vehicle market trends. Despite the hurdles, advancements in range-extension technologies and hybrid systems will pave the way for electric options to become more viable.

Innovating Legacy Engine Architectures for a Greener Future

Outside the United States, Canada and Mexico are also witnessing shifts in their automotive sectors. Canada sees adaptations in plant operations and product offerings that align with electrification trends. Meanwhile, Mexico is experiencing a resurgence in post-pandemic vehicle production. Significant investments in BEV production and hybrid technologies mark a strong push toward electrification.

Strategic Investments in North America's Automotive Sector

Between Now and Full Electrification

Automotive OEMs are currently at a crossroads as the industry undergoes a period of intense innovation and competition. The cadence for new engine program launches is slowing. Instead, manufacturers are innovating on existing platforms. The goal is to develop further current architecture to support multiple powertrain configurations, such as internal combustion engines (ICE), hybrid, and plug-in hybrid.

The Future of ICE Powertrain in a Hybridized World

Implementing strategies like incremental improvements and hybridization helps extend the lifecycle of internal combustion engines (ICE). Furthermore, it updates these configurations and architectures to comply with the upcoming fuel economy and greenhouse gas regulations.

However, the industry is not devoid of emerging opportunities. The technological shift required to support a growing fleet of electric vehicles presents manufacturers with new market opportunities. There is an increasing need for advanced transmission systems, including dedicated hybrid transmissions (DHTs), reduction gear, and additional eAxle installations, which are crucial components for BEVs with electric motors.

The Importance of Hybrid Powertrain Systems

BEV powertrain may be the future, but the strategic use of hybrids and enhanced ICE vehicles will continue to play a crucial role in North America's automotive industry. As automotive OEMs balance investments across existing engine architectures and powertrain types to produce more capable and energy-efficient vehicles, their continued innovation in ICE powertrain and hybrid electric vehicle models will anchor the sector during this transition.

This article is part of a series featuring highlights from S&P Global Mobility's 2024 Solutions Webinar Series. The North America-focused Powertrain webinar occurred on May 9, 2024.

Register for additional webinar sessions.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpowertrain-and-investments-propel-Americas-electrification.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpowertrain-and-investments-propel-Americas-electrification.html&text=The+Future+of+ICE+Powertrain+and+Hybrid+Powertrain+Systems+in+North+America+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpowertrain-and-investments-propel-Americas-electrification.html","enabled":true},{"name":"email","url":"?subject=The Future of ICE Powertrain and Hybrid Powertrain Systems in North America | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpowertrain-and-investments-propel-Americas-electrification.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Future+of+ICE+Powertrain+and+Hybrid+Powertrain+Systems+in+North+America+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fpowertrain-and-investments-propel-Americas-electrification.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}