Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 28, 2024

US automotive brand loyalty rates show positive shift

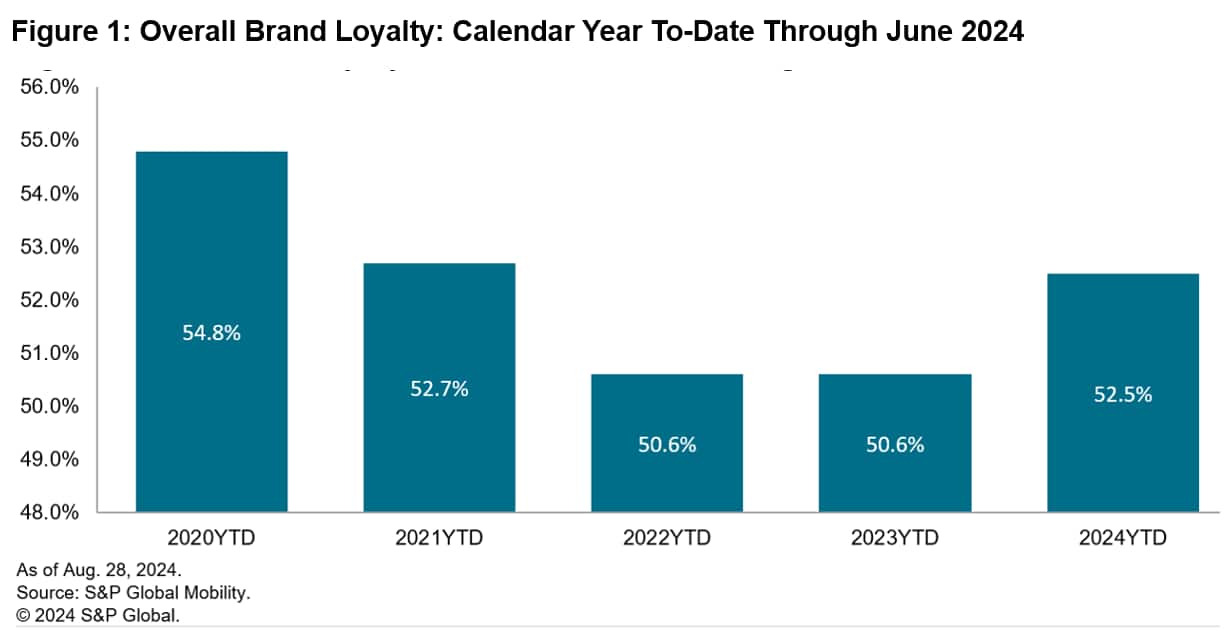

Industry brand loyalty rates trended upward in the first half of 2024 following several years of flat or declining values, according to a new S&P Global Mobility analysis of new vehicle registration data through the first half of the year.

The industry's brand loyalty rate through June stands at 52.5%, reflecting a 1.9 percentage-point improvement over the same period in 2023, marking the first year-over-year increase since 2020. The year-over-year increase in loyalty is a positive sign for the industry after several years of lower loyalty levels due to inventory shortages and post-pandemic recovery.

More than half of all brands in the industry saw a year-over-year increase of 1 percentage point or better. This group included both mainstream and luxury brands, which saw increases of 1.9 and 1.4 percentage points, respectively. Growing inventory levels and a strong pipeline of return-to- market households were the primary factors in loyalty gains for the first half of 2024.

"Last year we saw a big jump in the number of households returning to market for a new vehicle, but the inventory was lacking," said Vince Palomarez, associate director, loyalty product management at S&P Global Mobility. "This year, return-to-market volume remains consistent; however, inventory levels are up more than 40%, so households have more opportunity to remain loyal to their previous brand."

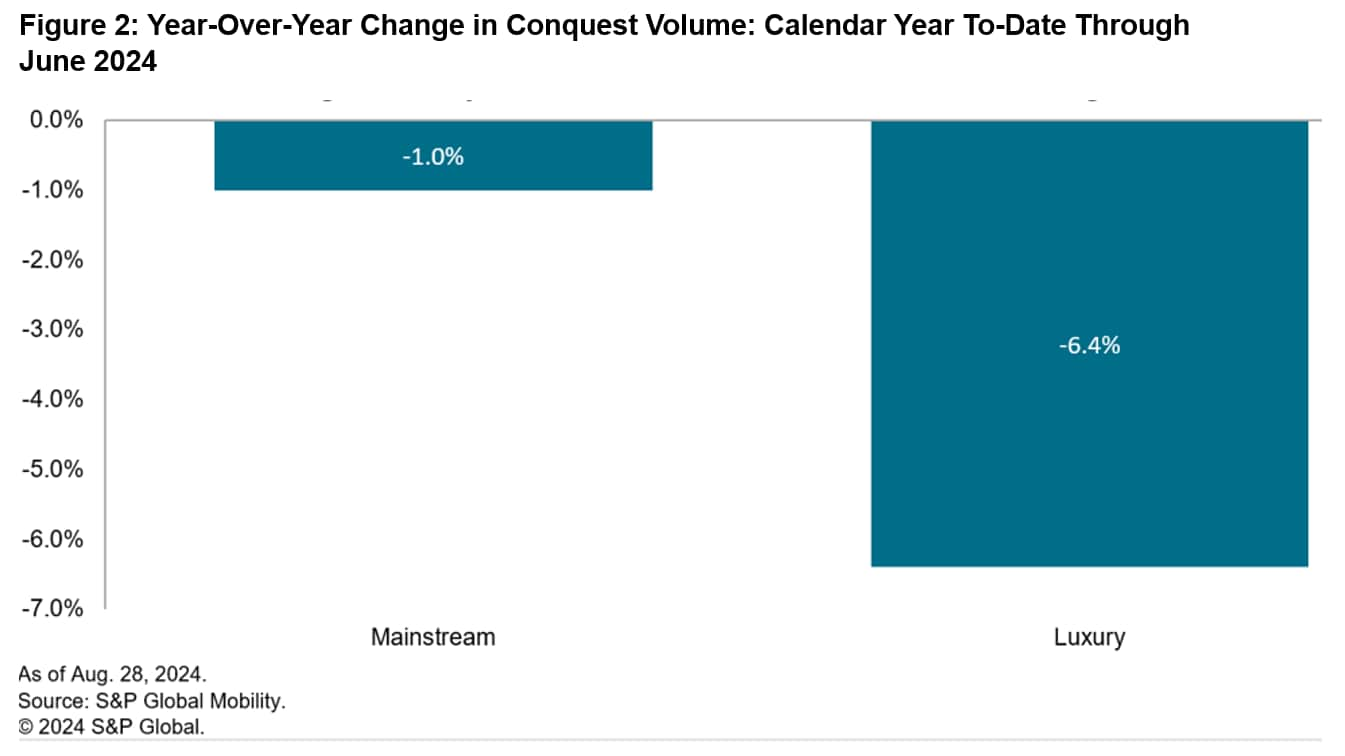

Conquest trends adversely affected

The increase in brand loyalty adversely affected conquest volume, as both sectors experienced year-over-year declines in the first half compared to the same period last year. The luxury brands, which experienced an 18% year-over-year increase for the first half of 2023, faced the largest decline, dropping 6.4% in the first half of 2024. Meanwhile, mainstream brands, while still declining year over year, saw conquest levels fall 1% vs. the first half of 2023.

"The positive jump in loyalty came at the expense of conquests," said Tom Libby, associate director for loyalty solutions and industry analysis at S&P Global Mobility. "Past years have shown that increases in both loyalty and conquests are possible if the pool of return-to-market rises as well. The first half of 2024 showed little-to-no change in return to market, so either loyalty or conquest were going to be affected."

Among individual brands, Tesla continues its run as the leader in brand loyalty with a rate of 67.8% for the first half of 2024. While all Tesla models retain more than 60% of their previous owners, the Model 3 remains the leader in the brand's lineup with a loyalty rate of 72.1%.

"Tesla has historically been a brand with strong loyal ties among their consumer base, despite a limited product portfolio," said Palomarez. "Changes in BEV prioritization among other OEMs, along with Tesla's directive to cut pricing when needed, has kept households from defecting."

Additional mid-year highlights:

- General Motors leads all multi-brand manufacturers in manufacturer loyalty for the first half of 2024, at 67.7%.

- Jaguar, Land Rover, and Lincoln are among the highest year-over-year gainers in brand loyalty, each improving rates by more than 6 percentage points.

- The Lincoln Nautilus is the current leader in model loyalty at 46.7%.

Get more details on our mid-year analysis by

watching our loyalty webinar. Webinar is available live

[August 29 at 1 pm ET] or on demand.

Watch loyalty trends webinar.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-automotive-brand-loyalty-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-automotive-brand-loyalty-rates.html&text=US+automotive+brand+loyalty+rates+show+positive+shift+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-automotive-brand-loyalty-rates.html","enabled":true},{"name":"email","url":"?subject=US automotive brand loyalty rates show positive shift | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-automotive-brand-loyalty-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+automotive+brand+loyalty+rates+show+positive+shift+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fus-automotive-brand-loyalty-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}